Not even Steven Spielberg is immune to Chinese moves into

Hollywood.

Hollywood's highest-grossing director is teaming up with Jack

Ma's Alibaba Group Holding Ltd. in a partnership that will help Mr.

Spielberg's Amblin Partners produce, finance and distribute movies,

the companies said Sunday.

Amblin and the e-commerce company's movie business, Alibaba

Pictures Group Ltd., said their alliance will help Mr. Spielberg's

company distribute its movies in China, while Alibaba, in turn,

will rely on Amblin to become a bigger part of Hollywood's

production and distribution scene.

Alibaba Pictures will take a minority equity stake in Amblin and

gain a seat on its board. The companies didn't disclose financial

terms of the deal.

The partnership is the first in China for Amblin, formerly

DreamWorks Studios, which will also gain access to Alibaba's large

trove of data on Chinese consumers, an Alibaba spokeswoman

said.

To celebrate the alliance, Mr. Ma and Mr. Spielberg held a

conversation on a hotel-ballroom stage in Beijing on Sunday, during

which they said the two companies will promote values shared by

both the East and the West.

"We can do co-productions between our company and your company,

and we can bring more of China to America, and more of America to

China," Mr. Spielberg said.

Mr. Ma, executive chairman and founder of Alibaba Group, said:

"I don't see any human-value difference between West and East. The

only difference is the West can tell the story better than

Chinese."

The Amblin-Alibaba tie-up comes as China's already large

appetite for getting into blockbuster action—from movie producing

to cinema ownership—continues to grow, and Hollywood is eager for

greater access to the hard-to-navigate Chinese market.

Chinese box-office sales are No. 2 in the world, behind the

U.S., and Chinese investors have poured money into film ventures

from the U.S. to Europe.

Leading the way is Chinese conglomerate Dalian Wanda Group—owned

by Wang Jianlin, the only Chinese entrepreneur richer than Mr. Ma.

Wanda has purchased U.S. theater chain AMC Entertainment Holdings

Inc. and production company Legendary Entertainment, and is in the

process of buying Dick Clark Productions.

Alibaba Pictures has amped up its investments in the past year,

partially bankrolling "Star Trek Beyond," which pulled in more than

$20 million in its first week of Chinese release in September, and

"Mission: Impossible-Rogue Nation," starring Tom Cruise.

Distribution partnerships with Chinese firms have become

increasingly important for Hollywood studios, since they have

little control over how a movie is marketed or released in China.

Sony Corp.'s Sony Pictures Entertainment Inc. signed a deal with

Wanda last month to market Sony movies across Wanda's vast

holdings, and several Hollywood executives who have left studio

jobs have secured production deals backed by Chinese investors.

DreamWorks re-formed as Amblin Partners last year after

receiving more than $800 million in equity and debt and signing a

distribution deal with Comcast Corp.'s Universal Pictures. The fund

infusion—led by Participant Media, India's Reliance Entertainment,

Entertainment One and Mr. Spielberg himself—gave the struggling

company new life after years of box-office disappointments and low

output.

The first movie released under the Universal agreement, "The

Girl on the Train," opened at No. 1 at the box office this weekend.

Mr. Spielberg said at the time of the fundraising that he planned

to resurrect some of his beloved franchises and produce sequels to

the 2015 blockbuster "Jurassic World."

Any revival of Mr. Spielberg's previous blockbusters would open

in a global market that's increasingly reliant on Chinese

moviegoers. The Chinese box office is expected to be No. 1 in the

world in the next few years.

The Chinese market is also emerging as a place to make up for

lost ground if a movie fares poorly in the U.S. Summer releases

"Warcraft" and "Now You See Me 2" both had disappointing attendance

in North America, for example, but were hits in China, though

studios collect a smaller portion of box-office revenue from

Chinese cinemas. DreamWorks' own "Need for Speed" was one of the

first titles to alert Hollywood to this new lopsided trend when it

collected $66 million in China and $43 million in North America in

2014.

Mr. Spielberg's "The BFG," which opens in China on Friday, will

hope for a similar dynamic. The adaptation of the beloved Roald

Dahl children's book underperformed in North America, collecting a

paltry $55.4 million against a $140 million production budget. The

Walt Disney Co. release has collected an additional $120 million

from overseas markets so far.

At the end of Sunday's event, a promotional image for "The BFG"

was flashed on the ballroom's large screen.

Jeff Small, president and co-CEO of Amblin, said at the event

that, in mapping out its strategy for a larger China presence, his

company realized it wanted a partner that could serve as a guide

and which had a "deep bond with and knowledge of Chinese

people."

Alibaba Pictures has access to reams of information on Chinese

consumers. It runs an online ticketing platform, and its parent

runs China's biggest e-commerce platforms, with 500 million

users.

Net losses at Alibaba Pictures, which is publicly traded in Hong

Kong, have added up. The firm reported nearly 466 million yuan ($70

million) in net losses for the six months ended in June, up from

about 152 million yuan in the first half of 2015. It said an

increase in marketing expenses related to its online

movie-ticketing platform was a primary factor. Content-acquisition

costs and production spending also have kept the company from

turning a profit in the past.

One shared prospect for Alibaba Pictures and Amblin is the

developing field of virtual reality. Mr. Spielberg called virtual

reality "the latest and maybe the greatest" kind of format for

entertainment content in the future. Mr. Ma said mobile phones and

the Internet of Things will allow movies to be found in cinemas and

"all kinds of channels." He said: "My job is using technology to

support and empower these guys."

Write to Alyssa Abkowitz at alyssa.abkowitz@wsj.com and Erich

Schwartzel at erich.schwartzel@wsj.com

(END) Dow Jones Newswires

October 09, 2016 21:35 ET (01:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

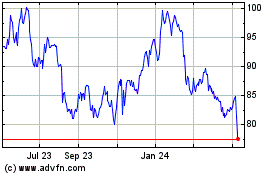

Sony (NYSE:SONY)

Historical Stock Chart

From Mar 2024 to Apr 2024

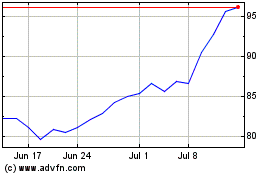

Sony (NYSE:SONY)

Historical Stock Chart

From Apr 2023 to Apr 2024