Merrill Lynch to End Commission-Based Options for Retirement Savers

October 06 2016 - 5:30PM

Dow Jones News

Retirement savers who work with Merrill Lynch will no longer be

able to pay their broker a commission, the latest example of how

new rules on retirement accounts are roiling the wealth-management

industry.

The Bank of America Corp. brokerage unit told its more than

14,000 brokers on Thursday that after April 10 investors who want a

retirement account at Merrill will need to pay a fee based on a

percentage of their assets, instead of having the option of being

charged for each transaction made in their account.

Merrill is making the change to comply with the Obama

administration's so-called fiduciary rule requiring brokers to put

the interests of retirement savers ahead of their own. The rule is

expected to affect less than 10% of Merrill's $2 trillion in client

assets, Bank of America Chief Financial Officer Paul Donofrio told

analysts in April.

"We believe these decisions best position us to meet the

responsibilities required by the fiduciary rule," a Merrill

spokeswoman said.

Merrill investors in nonretirement accounts won't be affected by

the changes.

Merrill is the first brokerage to take the step of eliminating a

commission-based account option for retirement investors who want

to work with a broker. St. Louis-based brokerage Edward Jones and

independent broker-dealer LPL Financial Holdings Inc. are the only

other major brokerages to detail their postretirement rule business

plans, with both still offering some sort of commission-based

option to retirement savers.

Merrill's approach to compliance could serve as a template for

its biggest rivals, such as Morgan Stanley and Wells Fargo &

Co.'s brokerage arm, according to Alois Pirker, a research director

at Boston consulting firm Aite Group. That is because those firms,

including Merrill, have more high-net-worth clients who may already

work with a broker through a fee-based account.

"This requires that clients engage with the firm fully," Mr.

Pirker said. "If the client isn't willing to do that, they will

need to look for different options."

The rule is expected to affect about $3 trillion of client

assets in the U.S., according to researcher Morningstar Inc.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

October 06, 2016 17:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

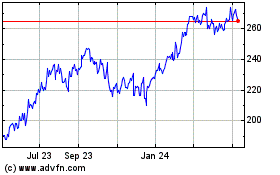

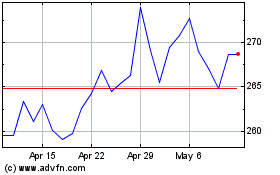

LPL Financial (NASDAQ:LPLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

LPL Financial (NASDAQ:LPLA)

Historical Stock Chart

From Apr 2023 to Apr 2024