Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

October 04 2016 - 4:19PM

Edgar (US Regulatory)

Greg Ebel & Al Monaco Filed by Spectra

Energy Corp Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Spectra Energy Corp (Commission File No. 001-33007)

Legal Disclaimer FORWARD-LOOKING

INFORMATION This communication includes certain forward looking statements and information (“FLI”) to provide Enbridge Inc. (“Enbridge”) and Spectra Energy Corp (“Spectra Energy”) shareholders and potential

investors with information about Enbridge, Spectra Energy and their respective subsidiaries and affiliates, including each company’s management’s respective assessment of Enbridge, Spectra Energy and their respective subsidiaries’

future plans and operations, which FLI may not be appropriate for other purposes. FLI is typically identified by words such as “anticipate”, “expect”, “project”, “estimate”, “forecast”,

“plan”, “intend”, “target”, “believe”, “likely” and similar words suggesting future outcomes or statements regarding an outlook. All statements other than statements of historical fact may

be FLI. In particular, this document contains FLI pertaining to, but not limited to, information with respect to the following: the combination transaction jointly announced by Enbridge and Spectra Energy on September 6, 2016 (the

“Transaction”); the combined company’s scale, financial flexibility and growth program; future business prospects and performance; annual cost, revenue and financing benefits; the expected ACFFO per share growth; annual dividend

growth and anticipated dividend increases; payout of distributable cash flow; financial strength and ability to fund capital program and compete for growth projects; run-rate and tax synergies; leadership and governance structure; and head office

and business center locations. Although we believe that the FLI is reasonable based on the information available today and processes used to prepare it, such statements are not guarantees of future performance and you are cautioned against placing

undue reliance on FLI. By its nature, FLI involves a variety of assumptions, which are based upon factors that may be difficult to predict and that may involve known and unknown risks and uncertainties and other factors which may cause actual

results, levels of activity and achievements to differ materially from those expressed or implied by these FLI, including, but not limited to, the following: the timing and completion of the transaction, including receipt of regulatory and

shareholder approvals and the satisfaction of other conditions precedent; interloper risk; the realization of anticipated benefits and synergies of the transaction and the timing thereof; the success of integration plans; the focus of management

time and attention on the transaction and other disruptions arising from the transaction; expected future ACFFO; estimated future dividends; financial strength and flexibility; debt and equity market conditions, including the ability to access

capital markets on favorable terms or at all; cost of debt and equity capital; potential changes in the Enbridge share price which may negatively impact the value of consideration offered to Spectra Energy shareholders; expected supply and demand

for crude oil, natural gas, natural gas liquids and renewable energy; prices of crude oil, natural gas, natural gas liquids and renewable energy; economic and competitive conditions; expected exchange rates; inflation; interest rates; tax rates and

changes; completion of growth projects; anticipated in-service dates; capital project funding; success of hedging activities; the ability of management of Enbridge, its subsidiaries and affiliates to execute key priorities, including those in

connection with the transaction; availability and price of labor and construction materials; operational performance and reliability; customer, shareholder, regulatory and other stakeholder approvals and support; regulatory and legislative decisions

and actions; public opinion; and weather. We caution that the foregoing list of factors is not exhaustive. Additional information about these and other assumptions, risks and uncertainties can be found in applicable filings with Canadian and U.S.

securities regulators, including any proxy statement, prospectus or registration statement to be filed in connection with the Transaction. Due to the interdependencies and correlation of these factors, as well as other factors, the impact of any one

assumption, risk or uncertainty on FLI cannot be determined with certainty. Except to the extent required by law, we assume no obligation to publicly update or revise any FLI, whether as a result of new information, future events or otherwise. All

FLI in this news release is expressly qualified in its entirety by these cautionary statements. Important Additional Information In connection with the proposed Transaction, Enbridge has filed with the Securities and Exchange Commission (the

“SEC”) a Registration Statement on Form F-4 that includes a preliminary proxy statement of Spectra Energy and a preliminary prospectus of Enbridge, as well as other relevant documents concerning the proposed Transaction. The proposed

Transaction involving Enbridge and Spectra Energy will be submitted to Spectra Energy’s stockholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a

solicitation of any vote or approval. STOCKHOLDERS OF SPECTRA ENERGY ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES FINAL AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC,

AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Spectra Energy stockholders will be able to obtain a free copy of the definitive proxy statement/prospectus, as well as other filings

containing information about Enbridge and Spectra Energy, without charge, at the SEC’s website (http://www.sec.gov). Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy

statement/prospectus can also be obtained, without charge, by directing a request to Enbridge, Investor Relations, 200, Fifth Avenue Place, 425 - 1st Street S.W., Calgary, Alberta, Canada T2P 3L8, (403) 266-7922, or to Spectra, Investor Relations,

5400 Westheimer Court, Houston, TX 77056-5310, (713) 627-5400. Participants in the Solicitation Enbridge, Spectra Energy, their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of

proxies in respect of the proposed Transaction. Information regarding Enbridge’s directors and executive officers is available in its Annual Report on Form 40-F for the year ended December 31, 2015, which was filed with the SEC on February 19,

2016, and its notice of annual meeting and management proxy circular for its 2016 annual meeting of common shareholders, which was furnished to the SEC under cover of a Form 6-K filed with the SEC on March 31, 2016. Information regarding Spectra

Energy’s directors and executive officers is available in Spectra Energy’s proxy statement for its 2016 annual meeting filed on Schedule 14A, which was filed with SEC on March 16, 2016. Other information regarding the participants in the

proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be

obtained as described in the preceding paragraph.

Highlights of Strategic Combination $165

Billion EV 10-12% 2018 – 2024 Global energy infrastructure leader Superior annual dividend growth expected Unparalleled secured growth program of $26 Billion Industry leading total return potential 96% Take-or-pay and equivalent or regulated

Stable and predictable cash flows Yield 4.6% Diversified assets and strong investment grade balance sheet $48 Billion in probability weighted development project pipeline + Notes:4.6% yield implied by the current share price and the 2017 increase.

Unless specified, all currency amounts in this document are in Canadian dollars.

President & CEO Al Monaco

Multiple Strategic Growth Platforms

Positioned for sustained demand-pull organic growth for the foreseeable future Positioned on a combined basis to compete with Canada’s leading midstream players on gas and NGL midstream infrastructure Positioned to provide integrated

gas/liquids midstream services across the hydrocarbon chain Highly predictable growing cash flows with significant further upside optionality Leading positions in all six platforms Enbridge Platforms for Growth Spectra Energy Platforms for Growth

Utilities deliver significant customer and shareholder benefits; Compelling platform for extension to electric utilities Spectra Energy U.S. presence and utility customer base enhances growth opportunities for Enbridge’s top-10 North American

position Canadian Midstream North American Liquids Pipelines North American Gas Pipelines Utilities Renewable Power U.S. Midstream

Shared Vision and Values Safety: #1

Priority

Shared Vision and Values Safety: #1

Priority Protecting the environment

Shared Vision and Values Safety: #1

Priority Protecting the environment Engaging and investing in communities

Shared Vision and Values Safety: #1

Priority Protecting the environment Engaging and investing in communities First choice of our customers

Shared Vision and Values Reliable

Business Model Solid Income Visible Growth Safety: #1 Priority Protecting the environment Engaging and investing in communities First choice of our customers Delivering value for our shareholders

Shared Vision and Values Safety: #1

Priority Protecting the environment Engaging and investing in communities First choice of our customers Delivering value for our shareholders Developing a diverse and talented team

Shared Vision and Values Safety: #1

Priority Protecting the environment Engaging and investing in communities First choice of our customers Delivering value for our shareholders Developing a diverse and talented team Positioning for the future

The Premier North American Energy

Infrastructure Asset Base Spanning Key Supply Basins and Demand Markets

Begin implementing integration actions

& continued integration planning 1Q17 Final Preparations for Day One Organization & remaining leadership decisions Sept 2016 4Q16 1Q17 2Q17 Illustrative Timeline to Transaction Closing Shareholder Votes Prepare proxy statement/prospectus

Mail proxy statement/ prospectus to Spectra Energy & Enbridge shareholders File final documents with securities commissions Prepare & submit required regulatory filings, incl. with Federal Trade Commission & Canadian Competition Bureau

Receipt of Regulatory approvals Respond to regulator information requests INTEGRATION TIMELINE Sept. 7 Joint Integration Team named Sept. 30 Integration Team Leads named Transaction Closing Shareholder Votes DAY ONE Announcement September 6

REGULATORY APPROVAL TIMELINE SHAREHOLDER APPROVAL TIMELINE 4Q16 Day One integration planning expands to broader group

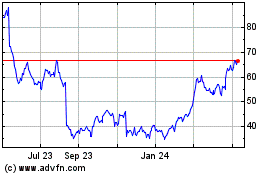

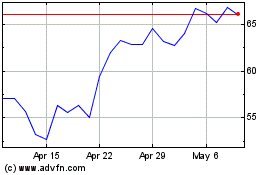

Sea (NYSE:SE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sea (NYSE:SE)

Historical Stock Chart

From Apr 2023 to Apr 2024