Current Report Filing (8-k)

October 03 2016 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported):

September 29, 2016

|

Lucas Energy, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

001-32508

|

|

20-2660243

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

450 Gears Road, Suite 860, Houston, Texas

|

|

77067

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code (713) 528-1881

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 Entry into a Material Definitive

Agreement.

Pursuant to a Letter Agreement

entered into at Lucas Energy, Inc.’s (the “

Company’s

”) August 25, 2016 closing of the acquisition

of certain oil and gas properties located in Texas and Oklahoma, the Company and RAD2 Minerals, Ltd. (“

RAD2

”),

one of the sellers, which is owned and controlled by Richard N. Azar II, who was appointed as our Chairman on August 26, 2016,

RAD2 agreed to accept full liability for any and all deficiencies between the “

Agreed Assets Value

” set forth

in the purchase agreement relating to the acquisition, as described in greater detail in the Current Report on Form 8-K filed with

the Securities and Exchange Commission on August 31, 2016, of $80,697,710, and the mutually agreed upon value of the assets delivered

at closing by the sellers, up to an aggregate of $1,030,941 (as applicable, the “

Deficiency

”). In connection

therewith, RAD2 agreed to establish an escrow account within three business days of the closing and place into escrow 288,779 shares

of common stock, within 15 business days from the date of the closing. The escrowed shares are to be held in escrow pending (a)

RAD2’s transfer of assets to the Company following the closing, equal to at least the value of the Deficiency (as valued

in the reasonable determination of the Company); or (b) another mutually agreeable solution to the Deficiency ((a) or (b) as applicable,

the “

Make-Whole

”). The Letter Agreement provided that in the event the Make-Whole occurs on or prior to October

31, 2016 (45 business days from the date of closing)(the “

Make-Whole Deadline

”), the escrowed shares are to

be released to RAD2, and in the event the Make-Whole does not occur prior to the Make-Whole Deadline, the escrowed shares (or such

portion thereof that equals the Deficiency, in the reasonable determination of the Company) are to be released to the Company for

cancellation as consideration for the Deficiency.

On September 29, 2016,

we and RAD2 entered into another letter agreement, extending the Make-Whole Deadline to November 15, 2016. A copy of the letter

agreement is filed herewith as

Exhibit 10.1

.

On September 30, 2016,

we entered into a second amendment dated September 29, 2016 (the “

Amendment

”) to the stock purchase agreement

(the “

Stock Purchase Agreement

”) that we had entered into with an accredited institutional investor on April

6, 2016. The Amendment extends the time in which we are required under the Stock Purchase Agreement to file a resale registration

statement with the Securities and Exchange Commission (the “

SEC

”) until 5 business days after our registration

statement on Form S-3/A (File No. 333-211066) is declared effective by the SEC.

The foregoing summary of the terms of the Amendment is subject to, and qualified in its entirety by, such

document attached hereto as

Exhibit 10.2

, which is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 29, 2016,

and effective October 3, 2016, Anthony C. Schnur, the Chief Executive Officer and member of the Board of Directors of the Company,

resigned from the positions of Interim Chief Financial Officer, Secretary and Treasurer of the Company and also as Principal Financial

Officer of the Company.

Paul Pinkston, who was

appointed as Chief Accounting Officer of the Company on August 26, 2016, was appointed as the Principal Financial Officer, Treasurer

and Secretary of the Company to fill the vacancies created by Mr. Schnur’s resignation from those positions. Mr. Pinkston’s

biographical information is described in greater detail in the Current Report on Form 8-K filed with the Securities and Exchange

Commission on August 31, 2016.

The Company has no current

plans to fill the vacancy in the position of Chief Financial Officer.

Mr. Schnur continues to

serve as Chief Executive Officer and a member of the Board of Directors of the Company.

Also on September 29, 2016,

the Board of Directors formed a Related Party Transaction Committee, tasked with reviewing and approving, related party transactions,

on behalf of the Board of Directors. The Company’s independent directors, Messrs. J. Fred Hofheinz, Fred S. Zeidman, Alan

W. Dreeben and Robert D. Tips, were appointed as members of the committee, which does not have a formal charter.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

Change in Fiscal Year

As reported in the Company’s

Current Report on Form 8-K, filed with the Securities and Exchange Commission on August 31, 2016, effective on August 26, 2016,

the Board of Directors of the Company approved a change in the Company’s fiscal year from March 31

st

to December

31

st

. On September 29, 2016, after discussions among the Company’s Board of Directors and independent auditors,

the Company’s Board of Directors changed the Company’s fiscal year back to March 31

st

. The Company does

not anticipate filing any transition reports in connection with the changes in fiscal year described above.

Item 9.01 Financial Statements and Exhibits.

Exhibit

No.

|

|

Description

|

|

10.1

|

|

Letter Agreement dated September 29, 2016, by and between Lucas Energy, Inc. and RAD2 Minerals, Ltd.

|

|

10.2

|

|

Second Amendment to Stock Purchase Agreement dated September 29, 2016

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

LUCAS ENERGY, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Anthony C. Schnur

|

|

|

|

Name: Anthony C. Schnur

|

|

|

|

Title: Chief Executive Officer

|

Date: October 3, 2016

EXHIBIT INDEX

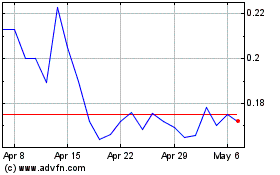

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Apr 2023 to Apr 2024