Compass Minerals Completes Acquisition of Leading Brazilian Specialty Plant Nutrition Company

October 03 2016 - 4:10PM

Business Wire

Compass Minerals (NYSE: CMP) today announced it has completed

the purchase of all remaining interest in Produquímica Indústria e

Comércio S.A. (Produquímica), one of Brazil’s leading manufacturers

and distributors of specialty plant nutrients. As previously

disclosed, the acquisition is expected to add $0.12 to $0.15 to

earnings per share in 2016, excluding any purchase accounting

adjustments.

“With this acquisition complete, Compass Minerals has delivered

on a key component of our growth strategy. We have expanded the

geographic scope of our operations into one of the world’s most

important agriculture markets, broadened our portfolio of specialty

plant nutrition products, and reduced our dependency on winter

weather,” said Fran Malecha, Compass Minerals president and CEO. “I

am delighted to officially welcome all of the employees and

associates of Produquímica to Compass Minerals and look forward to

the growth we can achieve as one company.”

Compass Minerals purchased 35 percent of Produquímica in

December 2015. Total consideration for the remainder of

Produquímica was approximately $465 million (based on a Brazilian

Real-to-US$ exchange rate of R$3.25/US$1.00). This includes the

purchase of equity valued at $328 million based on Produquímica’s

estimated 2016 earnings, subject to customary, post-closing

adjustments, and the assumption of approximately $137 million of

net debt. The company expects to retire a portion of Produquímica’s

debt during the fourth quarter of 2016.

Based in São Paulo, Brazil, Produquímica generated approximately

R$1.2 billion in net revenue and R$198 million in EBITDA* as of the

12 months ending June 30, 2016. Produquímica operates two primary

businesses – agricultural productivity and chemical solutions. The

agricultural productivity division manufactures and distributes a

broad offering of specialty plant nutrition solution-based

products. These include micronutrients, controlled release

fertilizers, and other specialty supplements used in direct soil

and foliar applications, as well as through irrigation systems and

for seed treatment. Produquímica also manufactures and markets

specialty chemicals, primarily for the water treatment industry and

for use in other industrial processes in Brazil. Both businesses

are supported by robust research and development capabilities and a

strong technical sales force, which have helped fuel Produquímica’s

revenue and earnings growth. For the period from 2011 to 2015,

Produquímica’s net sales and EBITDA* grew at 16 percent and 19

percent compounded annual growth rates, respectively.

Additional details regarding the transaction can be found in a

Form 8-K the company filed today with the U.S. Securities and

Exchange Commission.

*Earnings before interest, taxes, depreciation and

amortization.

About Compass Minerals

Compass Minerals is a leading provider of essential minerals

that solve nature’s challenges, including salt for winter roadway

safety and other consumer, industrial and agricultural uses, and

specialty plant nutrition minerals that improve the quality and

yield of crops. Named one of Forbes’ 100 Most Trustworthy Companies

in America in 2016 and 2015, Compass Minerals’ mission is to be the

best essential minerals company by delivering where and when it

matters. The company produces its minerals at locations throughout

the U.S. and Canada and in the U.K. For more information about

Compass Minerals and its products, please visit

www.compassminerals.com.

This press release may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including without limitation statements about the expected

additions to earnings per share and the timing and amount of debt

retirement. The company uses words such as “may,” “would,” “could,”

“should,” “will,” “likely,” “expect,” “anticipate,” “believe,”

“intend,” “plan,” “forecast,” “outlook,” “project,” “estimate” and

similar expressions suggesting future outcomes or events to

identify forward-looking statements or forward-looking information.

These statements are based on the company’s current expectations

and involve risks and uncertainties that could cause the company’s

actual results to differ materially. The differences could be

caused by a number of factors, including foreign exchange rates,

the risk that the acquisition of Produquímica could disrupt the

plans and operations of the company, Produquímica or both, and the

risk that the company may not realize the expected financial and

other benefits from the acquisition. For further information on

risks and uncertainties that may affect the company’s business, see

the “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of the

company’s Annual Report on Form 10-K for the year ended December

31, 2015, and its Quarterly Reports on Form 10-Q for the quarters

ended March 31, 2016 and June 30, 2016, filed with the SEC. The

company undertakes no obligation to update any forward-looking

statements made in this press release to reflect future events or

developments. Because it is not possible to predict or identify all

such factors, this list cannot be considered a complete set of all

potential risks or uncertainties.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161003006418/en/

Compass MineralsInvestor ContactTheresa L. Womble,

+1-913-344-9362Director of Investor

Relationswomblet@compassminerals.comorMedia ContactTara

Hart, +1-913-344-9319Manager of Corporate

AffairsMediaRelations@compassminerals.com

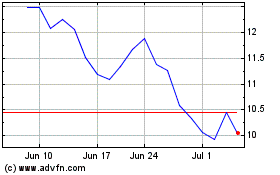

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

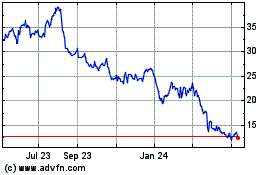

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Apr 2023 to Apr 2024