Bass Pro Shops to Acquire Cabela's

October 03 2016 - 10:00AM

Dow Jones News

Bass Pro Shops reached a deal to acquire Cabela's Inc. for about

$4.5 billion in cash, combining two of the biggest sellers of

outdoor-sports equipment and apparel.

Cabela's shareholders will receive $65.50 a share, a 19% premium

to Friday's close, in a deal the companies say will combine

complementary product lines and domestic geographic markets. The

companies valued the deal at $5.5 billion; company-provided deal

values often include debt and other items.

Shares of Cabela's, up 18% this year, rose about 15% to $63.00

in recent premarket trading.

The move comes as the sporting goods industry has been

struggling with tepid sales. Cabelas in December had said that it

was reviewing its strategic options, including a possible sale, as

the outdoor-sports retailer was under pressure from activist

investor Elliot Management Corp. Reuters in April had reported that

Bass Pro Shops was preparing an offer for Cabelas.

Privately owned Bass Pro Shops also said it will begin a

multiyear partnership with a unit of Capital One Financial Corp.

for a Cabela's co-branded credit card. The companies said their

customer-loyalty programs will remain unchanged.

The deal, which is expected to close in the first half of next

year, includes Cabela's 85 specialty retail stores, primarily in

the western U.S. and Canada and Bass Pro Shops' 99 stores and

Tracker Marine Centers located primarily in the eastern part of the

U.S. and Canada.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

October 03, 2016 09:45 ET (13:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

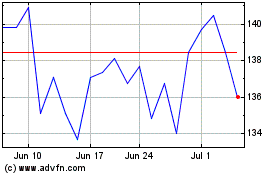

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

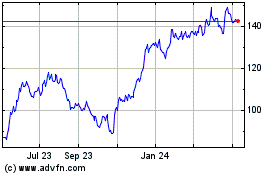

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024