Amended Current Report Filing (8-k/a)

September 30 2016 - 4:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): September 21, 2016

PETROGRESS, INC.

(Exact name of registrant as specified in

its charter)

|

Florida

|

|

333-184459

|

|

27-2019626

|

(State or other jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1013 Centre Road, Suite 403-A, Wilmington,

DE 19805

(Address of principal executive offices)

(Zip Code)

(302) 428-1222

(Registrant’s telephone number, including

area code)

Copy of correspondence to:

Marc J. Ross, Esq.

James M. Turner, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, Fl. 32

New York, NY 10006

Tel: (212) 930-9700 Fax: (212) 930-9725

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

EXPLANATORY NOTE

This Amendment No.

1 on Form 8-K/A (this “Amendment”) is being filed to amend the Current Report on Form 8-K filed by Petrogress, Inc.

(the “Company”) with the Securities and Exchange Commission (the “Commission”) on September 27, 2016 (the

“Original 8-K”), where the Company stated that its Quarterly Reports filed on Form 10-Q for the periods ended March

31, 2016 and June 30, 2016 should not be relied upon for the reasons reported under Item 4.02.

The Company subsequently

determined that in addition to these financial statements, audited financial statement information filed on Form 8-K/A with the

Commission on May 13, 2016 in connection with a reverse merger should also not be relied upon for the same reasons. Item 4.02 below

has been revised to include this updated information.

This Amendment speaks

as of the filing date of the Original 8-K and does not reflect any events that may have occurred subsequent to such date.

Item 4.01 Changes in Registrant’s

Certifying Accountant.

On September 27, 2016,

the Board of Directors (the “Board”) of the Company approved the dismissal of David S. Friedkin CPA (“Friedkin”)

as the Registrant’s independent public accountant.

The Company engaged

Friedkin during the period from May 18, 2016 to September 27, 2016 (the “Engagement Period”). During the Engagement

Period, Friedkin did not issue reports on the Company’s consolidated financial statements.

During the

Company’s two most recent fiscal years ended December 31, 2015 and 2014, and through September 27, 2016, there were (i)

no disagreements (within the meaning of Item 304(a)(1)(iv) of Regulation S-K) with Friedkin on any matters of accounting

principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement(s), if not

resolved to the satisfaction of Friedkin, would have caused Friedkin to make reference to the subject matter of the

disagreement(s) in connection with its report on the consolidated financial statements of the Company, and (ii) no reportable

events of the type described in Item 304(a)(1)(v) of Regulation S-K.

The Company provided

Friedkin with a copy of this Form 8-K prior to its filing with the Commission and requested that Friedkin furnish it with a letter

addressed to the Commission stating that it agrees with the statements made above. A copy of Friedkin’s letter will be filed

as Exhibit 16.1 as an amendment to this Form 8-K.

Item 4.02 Non-Reliance on Previously

Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On February 29, 2016,

the Company entered into a Securities Exchange Agreement (the “Exchange Agreement”) with Petrogres Co. Ltd., a Marshall

Islands corporation (“Petrogres”), with Petrogres surviving as a wholly-owned subsidiary of the Company (the “Merger”).

Because the Merger was accounted for as a reverse merger and recapitalization, Petrogres was the acquirer for financial reporting

purposes and the Company was the acquired company.

On May 13, 2016, the

Company filed a Form 8-K/A to amend the Current Report on Form 8-K filed on March 3, 2016 in connection with the Exchange Agreement

to include: (i) the audited consolidated financial statements of Petrogres as of and for the years ended December 31, 2015 and

2014, together with the reports of Friedkin, as the independent public accountant of Petrogres, with respect thereto, and (ii)

the unaudited pro forma condensed combined financial statements of the Company as of and for the year ended December 31, 2015 (collectively,

the “Merger Financials”).

On May 18, 2016, the

Board appointed Friedkin as its new independent accountant. During the Engagement Period, Friedkin reviewed the Company’s

consolidated quarterly financial statements on Form 10-Q (the “Previously Issued Financial Statements”) as of and for

the periods ended March 31, 2016 and June 30, 2016.

On September 21, 2016,

the Company became aware that Friedkin, its then-current independent public accountant, had not been registered with the Public

Company Accounting Oversight Board (the “PCAOB”). Consequently, the Company’s Previously Issued Financial Statements

and Merger Financials were not reviewed by a registered public accounting firm in accordance with rules and regulations of the

Commission and thus are deemed substantially deficient and not timely filed. In addition, the Company’s Quarterly Reports

on Form 10-Q (the “Original Filings”) and the Merger Financials must be amended (i) to identify the reports as deficient;

(ii) to label the columns of the financial statements as “not reviewed” and (iii) to describe how the Registrant will

remedy the deficiency (collectively, the “Disclosures”).

As a result, the Board

determined that the Previously Issued Financial Statements as of and for the quarters ended March 31, 2016 and June 30, 2016 presented

in the Original Filings and the Merger Financials included in the Form 8-K/A previously filed by the Company with the Commission,

should not be relied upon. The Company will amend the Original Filings and the Merger Financials to include the Disclosures.

The Company will engage

a PCAOB-registered independent public accountant as required as soon as possible and will file subsequent amendments to the Original

Filings and the Merger Financials as soon as practicable thereafter to remove the Disclosures and to make any changes resulting

from the new auditor’s review to reflect compliance with Commission rules and regulations.

The Company’s

management and the Board have discussed the matters disclosed under this Item 4.02 with Friedkin.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit

number

|

|

Description

|

|

16.1

|

|

Letter from David S. Friedkin CPA to the U.S. Securities and Exchange Commission regarding statements included in this Form 8-K (to be filed by amendment).

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: September 30, 2016

|

|

PETROGRESS, INC.

|

|

|

|

|

|

By:

|

/s/

Christos P. Traios

|

|

|

Name:

|

Christos P. Traios

|

|

|

Title:

|

Chief Executive Officer

|

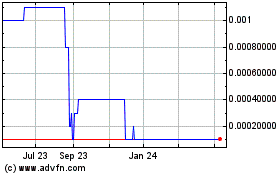

Petrogress (CE) (USOTC:PGAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

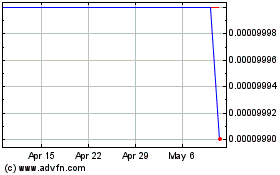

Petrogress (CE) (USOTC:PGAS)

Historical Stock Chart

From Apr 2023 to Apr 2024