Current Report Filing (8-k)

September 30 2016 - 4:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT

REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): September 29, 2016

Commercial Metals Company

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

1-4304

|

|

75-0725338

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

6565 N. MacArthur Blvd.

Irving, Texas

|

|

75039

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(214) 689-4300

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers.

|

On September 29, 2016, Commercial Metals Company (the “

Company

”) announced that the Company and John Elmore,

Senior Vice President of the Company and President of CMC International, mutually agreed that Mr. Elmore would separate from his position as an officer of the Company and have his employment with the Company terminate, effective

September 29, 2016 (the “

Separation Date

”).

In connection with his departure, the Company and

Mr. Elmore entered into a Separation Agreement (the “

Agreement

”) on September 29, 2016. Except as provided in the Agreement, the Agreement supersedes (a) the Terms and Conditions of Employment, dated

May 29, 2012, between Mr. Elmore and the Company, and (b) the Commercial Metals Company Executive Employment Continuity Agreement, dated as of July 2, 2012, between Mr. Elmore and the Company. Under the Agreement,

Mr. Elmore has agreed to comply with certain (i) non-competition and (ii) non-solicitation obligations from the Separation Date through the periods ending March 29, 2018 and September 29, 2018, respectively. In addition,

Mr. Elmore has agreed to certain ongoing cooperation obligations contained in the Agreement.

In consideration for

Mr. Elmore’s release and waiver of claims and agreement to comply with the non-competition and non-solicitation obligations referenced in the Agreement, the Company agreed, among other things, to provide Mr. Elmore: (i) a lump

sum payment in the gross amount of $1,160,000, which is equivalent to two years annual base salary; (ii) Mr. Elmore’s fiscal year 2016 annual performance bonus based on the formulaic calculation in the Company’s 2016 Annual

Performance Bonus Program, as approved by the Company’s Compensation Committee; and (iii) vesting of all previously unvested employer contributions to Mr. Elmore’s account in the Commercial Metals Companies 2005 Benefits

Restoration Plan, as amended and restated. Also in consideration for Mr. Elmore’s release and waiver of claims and agreement to comply with the obligations referenced in the Agreement, the Company agreed to (A) accelerate the vesting

of 60,793 outstanding time-vested restricted stock units and (B) issue a number of shares of Company common stock equal to the number of performance stock units (“

PSUs

”) granted on October 22, 2013 and the prorated

portion of PSUs granted on each of October 27, 2014 and October 26, 2015, in each case in the event the Company achieves all of the applicable performance vesting criteria and subject to the other terms and conditions set forth in the

Agreement. As additional consideration, the Company will pay up to a maximum of $67,500 for certain outplacement career consulting services for Mr. Elmore for up to twelve (12) months.

The foregoing summary of the Agreement does not purport to be complete and is qualified in its entirety by the full text of the Agreement

itself, a copy of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

10.1

|

Separation Agreement, dated as of September 29, 2016, by and between Commercial Metals Company and John C. Elmore

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMERCIAL METALS COMPANY

|

|

|

|

|

|

|

Date: September 30, 2016

|

|

|

|

By:

|

|

/s/ Paul K. Kirkpatrick

|

|

|

|

|

|

Name:

|

|

Paul K. Kirkpatrick

|

|

|

|

|

|

Title:

|

|

Vice President, General Counsel and Corporate Secretary

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

|

10.1

|

|

Separation Agreement, dated as of September 29, 2016, by and between Commercial Metals Company and John C. Elmore

|

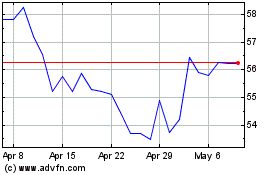

Commercial Metals (NYSE:CMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Commercial Metals (NYSE:CMC)

Historical Stock Chart

From Apr 2023 to Apr 2024