Current Report Filing (8-k)

September 30 2016 - 4:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 30, 2016

BEAZER HOMES USA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

DELAWARE

|

|

001-12822

|

|

58-2086934

|

|

(State or other jurisdiction of

Company or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1000 Abernathy Road, Suite 260

Atlanta, Georgia 30328

(Address of principal executive offices)

(770) 829-3700

(Registrant’s telephone number, including area code)

None

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On September 30, 2016, Beazer Homes

USA, Inc. (the “Company”) issued and sold an additional $100 million aggregate principal amount of its 8.750% Senior Notes due 2022 (the “Additional Notes”) at an issue price of 104.25% (plus accrued interest from

September 21, 2016) through a private placement to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and outside the United States pursuant to Regulation S under

the Securities Act.

The Additional Notes were initially sold pursuant to a purchase agreement, dated September 27, 2016, among the

Company, the wholly-owned subsidiaries named as guarantors therein (the “Guarantors”) and Credit Suisse Securities (USA) LLC, as representative of the initial purchasers named therein (the “Initial Purchasers”). The proceeds from

the offering were used to fund the redemption of all of the Company’s outstanding 9.125% Senior Notes due 2019 (the “2019 Notes”).

The Additional Notes were issued as additional notes under that certain Indenture, dated September 21, 2016 (the “Base Indenture”),

as supplemented by that certain First Supplemental Indenture (the “First Supplemental Indenture” and, together with the Base Indenture, the “Indenture”). The terms of the Additional Notes, other than their issue date and issue

price, will be identical to the terms of, and the Additional Notes will be an additional issuance of, the $400,000,000 principal amount of our 8.750% Senior Notes due 2022 issued pursuant the Base Indenture (the “Original Notes”), as

described in the Company’s Current Report on Form 8-K filed on September 22, 2016. The Additional Notes will trade interchangeably with the Original Notes.

In connection with the issuance of the Additional Notes, the Company and the Guarantors entered

into a Registration Rights Agreement, dated as of September 30, 2016 (the “Registration Rights Agreement”), with the representative of the Initial Purchasers. The Registration Rights Agreement requires the Company to register under

the Securities Act the issuance, in exchange for the privately-placed Additional Notes, of 8.750% Senior Notes due 2022 (the “Exchange Notes”) having substantially identical terms to the Additional Notes and to complete the exchange or, if

the exchange cannot be effected, to file and keep effective a shelf registration statement for resale of the privately-placed Additional Notes. Failure of the Company to comply with the registration and exchange requirements in the Registration

Rights Agreement within the specified time period would require the Company to pay as liquidated damages additional interest on the privately-placed Additional Notes until the failure to comply is cured.

The foregoing descriptions of the Base Indenture, First Supplemental Indenture, the Additional Notes and the Registration Rights Agreement are

qualified in their entirety to the forms of the Base Indenture, First Supplemental Indenture, the Additional Notes and the Registration Rights Agreement filed herewith as Exhibit 4.1 of the Company’s Form 8-K filed on September 22, 2016 and

Exhibits 4.1, 4.2 and 4.3 to this Current Report on Form 8-K, respectively, and incorporated in this Item 1.01 by reference.

|

Item 1.02.

|

Termination of a Material Definitive Agreement

|

On September 30, 2016, the Company

irrevocably deposited with U.S. Bank National Association, trustee for the 2019 Notes, sufficient funds to fund the redemption of the 2019 Notes remaining outstanding. As a result, the Company and the guarantors under the 2019 Notes have been

released from their respective obligations under the 2019 Notes and the indenture governing the 2019 Notes pursuant to the satisfaction and discharge provisions thereunder.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth above under Item 1.01 is hereby incorporated by reference into this Item 2.03.

On September 30, 2016, the Company issued a press release announcing

the completion of the refinancing transaction. A copy of this release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

4.1

|

|

First Supplemental Indenture, dated as of September 30, 2016, between the Company, the Guarantors and U.S. Bank National Association, as trustee

|

|

|

|

|

4.2

|

|

Form of 8.750% Senior Note due 2022 (incorporated by reference to Exhibit 4.2 of the Company’s Current Report on Form 8-K filed on September 22, 2016)

|

|

|

|

|

4.3

|

|

Registration Rights Agreement, dated as of September 30, 2016, between the Company, the Guarantors and Credit Suisse Securities (USA) LLC, as representative of the Initial Purchasers

|

|

|

|

|

99.1

|

|

Press release dated September 30, 2016

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

Date: September 30, 2016

|

|

|

|

|

BEAZER HOMES USA, INC.

|

|

|

|

|

By:

|

|

/s/ Kenneth F. Khoury

|

|

|

|

Kenneth F. Khoury

|

|

|

|

Executive Vice President, Chief Administrative Officer and General Counsel

|

EXHIBIT INDEX

|

|

|

|

|

4.1

|

|

First Supplemental Indenture, dated as of September 30, 2016, between the Company, the Guarantors and U.S. Bank National Association, as trustee

|

|

|

|

|

4.2

|

|

Form of 8.750% Senior Note due 2022 (incorporated by reference to Exhibit 4.2 of the Company’s Current Report on Form 8-K filed on September 22, 2016)

|

|

|

|

|

4.3

|

|

Registration Rights Agreement, dated as of September 30, 2016, between the Company, the Guarantors and Credit Suisse Securities (USA) LLC, as representative of the Initial Purchasers

|

|

|

|

|

99.1

|

|

Press release dated September 30, 2016

|

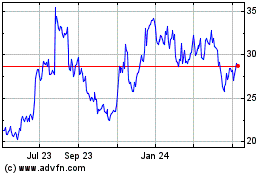

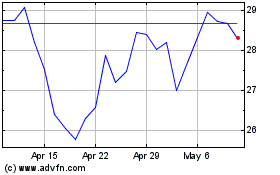

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Apr 2023 to Apr 2024