Cheniere Energy to Acquire Holding Company

September 30 2016 - 9:40AM

Dow Jones News

Natural-gas exporter Cheniere Energy Inc. on Friday said it made

an all-stock offer to fully merge with Cheniere Energy Partners LP

Holdings LLC, valuing the company that owns and operates its assets

at $5.07 billion.

Cheniere, which already holds an 80.1% stake in Cheniere Energy

Partners, offered 0.5049 Cheniere shares for each share of Cheniere

Energy Partners, representing a value of $21.90 per share of

Cheniere Energy Partners, or a 3% premium over its Thursday closing

price.

Cheniere Chief Executive Jack Fusco said the deal would allow

investors in Cheniere Energy Partners the opportunity "to

participate in the future success of the entire Cheniere

complex."

Last month, Cheniere posted a second-quarter loss as its ramp-up

in production of liquefied natural gas faces a world-wide glut that

is depressing prices. Surging natural-gas supplies in North America

and slowing demand from traditional buyers in Asia have pushed down

LNG spot prices and made it more difficult for suppliers to sign

fixed-price contracts needed to secure financing for export

projects.

In premarket trading, Cheniere rose 1.2% to $43.89, while

Cheniere Energy Partners jumped 13% to $23.95.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

September 30, 2016 09:25 ET (13:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

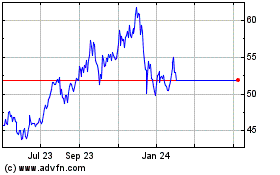

Cheniere Energy Partners (AMEX:CQP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cheniere Energy Partners (AMEX:CQP)

Historical Stock Chart

From Apr 2023 to Apr 2024