Salesforce Battles Microsoft, LinkedIn -- WSJ

September 30 2016 - 3:03AM

Dow Jones News

By Rachael King

Salesforce.com Inc. said it would press regulators in the U.S.

and Europe to block Microsoft Corp.'s $26.2 billion acquisition of

LinkedIn Corp., arguing the deal would hurt competition by giving

its business-software rival too much control over the

social-networking company's vast pool of data.

Salesforce's public broadside against the deal on Thursday came

three months after it lost a bidding war for LinkedIn to Microsoft.

Both companies' interest in LinkedIn centers on data generated by

its members, who typically maintain career résumés on the site.

LinkedIn claims 450 million members in more than 200 countries,

including 106 million monthly active uses.

Burke Norton, Salesforce's chief legal officer, said owning

LinkedIn would give Microsoft an unfair competitive advantage

because it could block rivals' access to the data on its

membership. He said the deal also raises "data privacy issues" that

Salesforce thinks U.S. and European Union authorities should

scrutinize.

"Microsoft's proposed acquisition of LinkedIn threatens the

future of innovation and competition," Mr. Norton said in a

statement.

Microsoft responded by pointing out that the deal had already

passed regulatory muster in some countries, and that it is

Salesforce, not Microsoft, that dominates the market for software

that handles customer relationship management, or CRM -- a market

in which LinkedIn's data may help Microsoft compete against

Salesforce.

"Salesforce may not be aware, but the deal has already been

cleared to close in the United States, Canada, and Brazil," said

Brad Smith, Microsoft's chief legal officer. "We're committed to

continuing to work to bring price competition to a CRM market in

which Salesforce is the dominant participant charging customers

higher prices today."

Antitrust issues arising from the acquisition of immense data

sets have been raised in technology mergers in both the EU and the

U.S., but no merger has been derailed on those grounds, according

to Michael Carrier, a professor at Rutgers Law School who

specializes in antitrust issues. European regulators examined the

competitive and privacy implications of Google's acquisition of

DoubleClick and Facebook Inc.'s purchase of WhatsApp. The EU

regulators ultimately approved them.

The European Union antitrust watchdog signaled Thursday that big

data will continue to play a role in assessing merger deals. In a

speech, the EU's competition chief, Margrethe Vestager, said she

would "keep a close eye on how companies use that data."

The EU's review of Microsoft's purchase of LinkedIn likely will

focus on whether the professional network's data "has a very long

durability or might constitute a barrier for others," Ms. Vestager

told Bloomberg after the merger was announced.

Salesforce's argument could work against it if the company were

to acquire the social network Twitter Inc., as The Wall Street

Journal and others have reported it is trying to do. Moreover,

Salesforce's contention that Microsoft might deny competitors

access to LinkedIn's data would have applied equally to Salesforce

if it had been successful in its effort to acquire the network.

People familiar with the matter noted that no outside entity

currently has unlimited access to LinkedIn trove of data.

LinkedIn's data is potentially valuable because large data sets

are critical to the development of artificial intelligence, a

technology that both Microsoft and Salesforce have said they are

counting on to drive growth.

Salesforce hasn't filed a formal complaint against Microsoft in

connection with its purchase of LinkedIn, according to people

familiar with the matter. However, the company filled out a

questionnaire sent by the European Commission, which solicits

information from companies potentially affected by mergers and

acquisitions as part of its normal preregistration process.

Microsoft hasn't yet registered the deal with EU authorities.

Nonetheless, Salesforce's announcement of its intention to fight

the deal is an unusually proactive and public stance so early in

the acquisition process. Generally, competitors hold their

opposition until a merger has been registered with regulators.

"We intend to work closely with regulators, lawmakers and other

stakeholders to make the case that this merger is anticompetitive,"

Mr. Norton said.

Salesforce tried to outbid Microsoft for LinkedIn, according to

people familiar with the effort. However, Salesforce continued to

submit bids after Microsoft and LinkedIn entered into an exclusive

deal, according to those people and regulatory filings.

Chief Executive Marc Benioff later sent an email to LinkedIn CEO

Jeff Weiner and LinkedIn Chairman Reid Hoffman after reading a July

1 regulatory filing that detailed events leading up to the deal.

Mr. Benioff wrote in the email that he would have offered a "much

higher" price had LinkedIn continued talks with him after its call

for final offers, according to a July 22 company filing.

--Jay Greene, Natalia Drozdiak and Deepa Seetharaman contributed

to this article.

Write to Rachael King at rachael.king@wsj.com

(END) Dow Jones Newswires

September 30, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

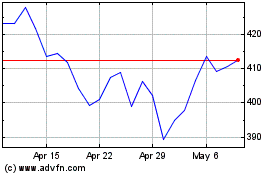

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024