Glencore's Congo Connection Adds Another Source of Unease

September 29 2016 - 7:04PM

Dow Jones News

By Scott Patterson

A Justice Department investigation into a Glencore PLC business

partner in the Democratic Republic of Congo could pose a another

headache for the Swiss mining-and-trading company, which has been

struggling with volatile commodity prices and concerns about its

debt.

The Justice Department on Thursday announced a settlement with

New York hedge-fund firm Och-Ziff Capital Management Group LLC in

which the company agreed to pay $426 million in criminal and civil

penalties and a unit pleaded guilty to criminal charges related to

its activities in Africa.

A separate Securities and Exchange Commission civil sanction

against Och-Ziff said the firm entered a series of deals from 2007

to 2011 in which it paid bribes through middlemen to government

officials in several African countries.

In its investigation, the Justice Department found that

Och-Ziff's business partner in the Congo paid more than $100

million in bribes to Congolese officials, including President

Joseph Kabila, in exchange for access to some of the nation's best

mineral assets.

The partner is Israeli mining tycoon Dan Gertler, according to

the settlement and people familiar with the matter.

A representative of Mr. Gertler declined to comment about the

Justice Department's investigation. A Glencore spokesman declined

to comment.

In a response to a 2014 report by corruption watchdog Global

Witness about its ties to Mr. Gertler, Glencore said all

transactions with Mr. Gertler's companies "have been conducted on

arm's-length terms and all public disclosure requirements

applicable to us have been complied with." All transactions with

Mr. Gertler and his companies "were entirely proper," it said.

"These revelations about Gertler raise doubts about his other

relationships" in Congo, said Leigh Baldwin, author of the Global

Witness report on Glencore.

Glencore linked up with Mr. Gertler about a decade ago. In 2007,

Glencore invested in Nikanor PLC, a Congo-focused mining company

partly owned by Mr. Gertler. Nikanor had gone public in London the

previous year and owned coveted copper assets in the impoverished

country's southeast.

Nikanor then sought to merge with Katanga Mining, a

copper-mining outfit with assets nearby. Arthur Ditto, Katanga's

chief executive at the time, said in an interview this year that he

resisted the deal, because he didn't think Katanga's assets had

been fully developed.

Mr. Ditto said Congolese government officials pressured him to

complete a deal with Nikanor and that the officials threatened to

revoke his mining license if he didn't comply. "I couldn't take it

as an idle threat," he said.

Nikanor and Katanga merged in early 2008, creating Katanga

Mining, one of Congo's largest copper-mining operations. After a

series of transactions, Glencore and Mr. Gertler emerged as its two

largest shareholders.

Katanga Mining has struggled to turn a profit. Last September,

amid a plan to sell assets and pare back debt, Glencore said it

planned to shut down Katanga for 18 months and spend nearly $1

billion to upgrade its operations. A landslide at one of its mines

this year killed seven workers.

Glencore and Mr. Gertler are also partners in another big

copper-mining business near Katanga Mining in Congo, Mutanda

Mining.

Allegations of impropriety have long dogged Glencore and its

founder, Marc Rich, a brash commodities trader whose trading of oil

with Iran while it held U.S. hostages in 1980 led U.S. authorities

to charge him with tax evasion. He fled to Switzerland in 1983 and

was later pardoned by President Bill Clinton in 2001. He died in

2013.

Mr. Gertler, the son of an Israeli diamond baron, has been a

lightning rod for anticorruption groups, who say he has used his

access to top government Congolese officials to gain control of

mineral assets at steep discounts.

He got his start in Congo as a diamond merchant toward the end

of the country's long civil war in the 1990s. He befriended the

country's ruler, Laurent Kabila, and Mr. Kabila's son Joseph, who

took over the country after his father's assassination in 2001.

He became one of the country's most influential, and

controversial, mining executives.

A due-diligence firm engaged by Och-Ziff to conduct a background

check on Mr. Gertler found that he "is happy to use his political

influence against those with whom he is in dispute...[and] keeps

what can only be described as unsavory business associates,"

according to the Justice Department's settlement.

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

September 29, 2016 18:49 ET (22:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

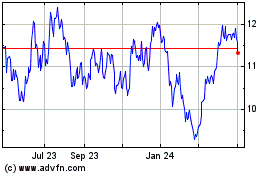

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

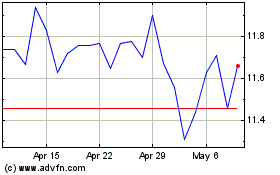

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Apr 2023 to Apr 2024