Filed Pursuant to Rule 424(b)(2)

Registration No. 333-187399

PROSPECTUS SUPPLEMENT

(To Prospectus dated November 6, 2013)

11,000,000 Shares

Nordic American Tankers Limited

COMMON SHARES

Nordic

American Tankers Limited is offering for sale 11,000,000 of its common shares.

Our common shares are listed on the

New York Stock Exchange, or the NYSE, under the symbol “NAT.” On September 23, 2016, the closing price of our common shares on the New York Stock Exchange was $10.85 per share.

At our request, the underwriters have reserved for sale an aggregate of 534,000 common shares to all of the members of our board of

directors, certain members of our management, and all of our advisors at the public offering price listed in the table below. The 534,000 common shares include approximately 100,000 common shares to be purchased by our Chairman and Chief Executive

Officer and 400,000 common shares to be purchased by the Company’s Vice Chairman. The shares sold to these individuals will be subject to the lock-up agreements set forth herein.

Investing in our common shares involves a high degree of risk. See the sections entitled “

Risk Factors

” on page S-8 of this prospectus supplement and in our Annual Report on Form 20-F for the fiscal year ended December 31, 2015, which is incorporated herein by reference.

We have granted the underwriters a 30-day option to purchase up to 1,650,000 additional shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per

Share

|

|

|

Total

|

|

|

Public Offering Price

|

|

|

$10.00

|

|

|

|

$110,000,000

|

|

|

Underwriting

Discount

(1)

|

|

|

$0.50

|

|

|

|

$5,233,000

|

|

|

Proceeds

(1)

|

|

|

$9.50

|

|

|

|

$104,767,000

|

|

|

(1)

|

The 534,000 common shares sold to members of our board of directors, members of our management, and our advisors will be sold at the public offering price. The underwriters will not receive any

underwriting discount on the sale of such shares.

|

Neither the Securities and Exchange Commission nor any

state securities commission has approved or disapproved these common shares or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus or determined if this prospectus supplement is truthful or complete. Any

representation to the contrary is a criminal offense.

The underwriters are offering the common stock as set forth

under the section of this prospectus supplement entitled “Underwriting.” The underwriters expect to deliver the shares to purchasers on or about September 30, 2016.

|

|

|

|

|

|

|

MORGAN STANLEY

|

|

DNB Markets

|

|

SEB

|

|

Bookrunning Manager

|

|

Co-Manager

|

|

Co-Manager

|

September 27, 2016

Nordic Zenith

Nordic Freedom

TABLE OF CONTENTS

S-i

IMPORTANT NOTICE ABOUT INFORMATION IN THIS

PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is the prospectus supplement, which

describes the specific terms of this offering and also adds to and updates information contained in the accompanying base prospectus and the documents incorporated by reference into this prospectus supplement and the base prospectus. The second

part, the base prospectus, gives more general information about securities we may offer from time to time, some of which does not apply to this offering. Generally, when we refer only to the prospectus, we are referring to both parts combined, and

when we refer to the accompanying prospectus, we are referring to the base prospectus.

If the description of

this offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained in or incorporated by reference in this prospectus supplement, the

accompanying prospectus and any free writing prospectus relating to this offering. We have not, and the underwriters have not, authorized anyone to provide you with information that is different. If anyone provides you with different or inconsistent

information, you should not rely on it. We are offering to sell, and seeking offers to buy, common shares only in jurisdictions where offers and sales are permitted. The information contained in or incorporated by reference in this prospectus is

accurate only as of the date such information was issued, regardless of the time of delivery of this prospectus or any sale of our common shares.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Matters discussed in this prospectus supplement, the accompanying prospectus and the documents that we have filed with

the Commission that are incorporated by reference in this prospectus supplement may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order

to encourage companies to provide prospective information about their business. Forward-looking statements include, but are not limited to, statements concerning plans, objectives, goals, strategies, future events or performance, underlying

assumptions and other statements, which are other than statements of historical facts.

We desire to

take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor legislation. This prospectus supplement and any other written or oral

statements made by us or on our behalf may include forward-looking statements, which reflect our current views with respect to future events and financial performance, and are not intended to give any assurance as to future results. When used in

this document, the words “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “target,” “project,” “likely,”

“may,” “could” and similar expressions, terms, or phrases may identify forward-looking statements.

The forward-looking statements are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, our management’s examination of historical operating trends, data

contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. We undertake no obligation to update any forward-looking statement, whether as a

result of new information, future events or otherwise.

Important factors that, in our view, could cause

actual results to differ materially from those discussed in the forward-looking statements include the strength of world economies and currencies, general market conditions, including fluctuations in charter rates and vessel values, changes in

demand in the tanker market, as a result of changes in the petroleum production levels set by the Organization of the Petroleum Exporting Countries, or

S-ii

OPEC, and worldwide oil consumption and storage, changes in our operating expenses, including bunker prices, drydocking and insurance costs, the market for our vessels, availability of financing

and refinancing, changes in governmental rules and regulations or actions taken by regulatory authorities, potential liability from pending or future litigation, general domestic and international political conditions, potential disruption of

shipping routes due to accidents or political events, vessel breakdowns and instances of off-hire, failure on the part of a seller to complete a sale of a vessel to us and other important factors, including those under the heading “Risk

Factors” in this prospectus supplement, in the accompanying prospectus and in our annual report on Form 20-F for the year ended December 31, 2015, as well as those described from time to time in the reports filed by us with the Securities

and Exchange Commission, or the SEC.

This prospectus supplement may contain assumptions, expectations,

projections, intentions and beliefs about future events. These statements are intended as forward-looking statements. We may also from time to time make forward-looking statements in our periodic reports that we will file with the Commission, in

other information sent to our security holders, and in other written materials. We caution that assumptions, expectations, projections, intentions and beliefs about future events may and often do vary from actual results and the differences can be

material.

We undertake no obligation to publicly update or revise any forward-looking statement contained in

this prospectus supplement, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus supplement

might not occur, and our actual results could differ materially from those anticipated in these forward-looking statements.

Common shares may be offered or sold in Bermuda only in compliance with the provisions of the Investment Business Act of 2003 and the Exchange Control Act 1972, and related regulations of Bermuda which regulate the sale of

securities in Bermuda. In addition, specific permission is required from the Bermuda Monetary Authority, or the BMA, pursuant to the provisions of the Exchange Control Act 1972 and related regulations, for all issuances and transfers of securities

of Bermuda companies, other than in cases where the BMA has granted a general permission. The BMA, in its policy dated June 1, 2005, provides that where any equity securities, including our common shares, of a Bermuda company are listed on an

appointed stock exchange, general permission is given for the issue and subsequent transfer of any securities of a company from and/or to a non-resident, for as long as any equities securities of such company remain so listed. The New York Stock

Exchange is an appointed stock exchange under Bermuda law. Approvals or permissions given by the Bermuda Monetary Authority do not constitute a guarantee by the Bermuda Monetary Authority as to our performance or our creditworthiness.

Accordingly, in granting such permission, the BMA accepts no responsibility for our financial soundness or the correctness of any of the statements made or expressed in this prospectus or any prospectus supplement. Neither this prospectus nor any

prospectus supplement needs to be filed with the Registrar of Companies in Bermuda in accordance with Part III of the Companies Act 1981 of Bermuda pursuant to provisions incorporated therein following the enactment of the Companies Amendment Act

2013. Such provisions state that a prospectus in respect of the offer of shares in a Bermuda company whose equities are listed on an appointed stock exchange under Bermuda law does not need to be filed in Bermuda, so long as the company in question

complies with the requirements of such appointed stock exchange in relation thereto.

S-iii

PROSPECTUS SUPPLEMENT SUMMARY

This section summarizes some of the information that is contained or incorporated by reference in

this prospectus supplement and the accompanying prospectus. As an investor or prospective investor, you should review carefully the entire prospectus supplement and the accompanying prospectus, any free writing prospectus that may be provided to you

in connection with this offering of our common shares and the information incorporated by reference in this prospectus supplement and the accompanying prospectus, including the sections entitled “Risk Factors” included on page S-7 of this

prospectus supplement and in our Annual Report on Form 20-F for the fiscal year ended December 31, 2015.

In this prospectus supplement, “we,” “us,” “our,” “the Company” and “NAT” all refer to Nordic American Tankers Limited and all of its subsidiaries. “Nordic American Tankers

Limited” refers only to Nordic American Tankers Limited and not its subsidiaries. Terms used in this prospectus supplement will have the meanings described in the accompanying prospectus, unless otherwise specified. The common shares offered by

this prospectus supplement include the related preferred share purchase rights. Unless otherwise indicated, all information in this prospectus supplement assumes that the underwriters’ option to purchase up to 1,650,000 additional shares is not

exercised.

Our Company

Nordic American Tankers Limited was formed on June 12, 1995 under the laws of the Islands of Bermuda. We maintain

our principal offices at the LOM Building, 27 Reid Street, Hamilton HM 11, Bermuda. Our telephone number at such address is (441) 292-7202. We were formed for the purpose of acquiring and chartering double-hull tankers. We are an international

tanker company with a fleet of 30 Suezmax tankers, one of which is to be delivered in the first quarter of 2017. The 29 vessels we operate average approximately 156,000 deadweight tonnes, or dwt, each.

As of the date of this prospectus supplement, we have chartered all of our operating vessels on spot market related

arrangements or on time charters.

Our Fleet

Our current fleet consists of 30 Suezmax crude oil tankers, including one newbuilding to be delivered in January 2017.

All of our vessels are employed on spot market related arrangements or on time charters. The vessels are homogenous and interchangeable as they have approximately the same freight capacity and ability to transport the same type of cargo. The

vessels we operate average approximately 156,000 deadweight tonnes, or dwt, each.

|

|

|

|

|

|

|

|

|

Vessel

|

|

Yard (1)

|

|

Built

|

|

Delivered to NAT

|

|

Nordic Harrier

|

|

Samsung

|

|

1997

|

|

August 1997

|

|

Nordic Hawk

|

|

Samsung

|

|

1997

|

|

October 1997

|

|

Nordic Hunter

|

|

Samsung

|

|

1997

|

|

December 1997

|

|

Nordic Voyager

|

|

Dalian New

|

|

1997

|

|

November 2004

|

|

Nordic Fighter

|

|

Hyundai

|

|

1998

|

|

March 2005

|

|

Nordic Freedom

|

|

Daewoo

|

|

2005

|

|

March 2005

|

|

Nordic Discovery

|

|

Hyundai

|

|

1998

|

|

August 2005

|

|

Nordic Saturn

|

|

Daewoo

|

|

1998

|

|

November 2005

|

|

Nordic Jupiter

|

|

Daewoo

|

|

1998

|

|

April 2006

|

|

Nordic Moon

|

|

Samsung

|

|

2002

|

|

November 2006

|

|

Nordic Apollo

|

|

Samsung

|

|

2003

|

|

November 2006

|

|

Nordic Cosmos

|

|

Samsung

|

|

2003

|

|

December 2006

|

|

Nordic Sprite

|

|

Samsung

|

|

1999

|

|

February 2009

|

|

Nordic Grace

|

|

Hyundai

|

|

2002

|

|

July

2009

|

S-1

|

|

|

|

|

|

|

|

|

Vessel

|

|

Yard (1)

|

|

Built

|

|

Delivered to NAT

|

|

Nordic Mistral

|

|

Hyundai

|

|

2002

|

|

November 2009

|

|

Nordic Passat

|

|

Hyundai

|

|

2002

|

|

March 2010

|

|

Nordic Vega

|

|

Bohai

|

|

2010

|

|

December 2010

|

|

Nordic Breeze

|

|

Samsung

|

|

2011

|

|

August 2011

|

|

Nordic Aurora

|

|

Samsung

|

|

1999

|

|

September 2011

|

|

Nordic Zenith

|

|

Samsung

|

|

2011

|

|

November 2011

|

|

Nordic Sprinter

|

|

Hyundai

|

|

2005

|

|

July 2014

|

|

Nordic Skier

|

|

Hyundai

|

|

2005

|

|

August 2014

|

|

Nordic Light

|

|

Samsung

|

|

2010

|

|

September 2015

|

|

Nordic Cross

|

|

Samsung

|

|

2010

|

|

October 2015

|

|

Nordic Luna

|

|

Universal

|

|

2004

|

|

May 2016

|

|

Nordic Castor

|

|

Universal

|

|

2004

|

|

June 2016

|

|

Nordic Sirius

|

|

Universal

|

|

2000

|

|

June 2016

|

|

Nordic Pollux

|

|

Universal

|

|

2003

|

|

July 2016

|

|

Nordic Star

|

|

Sungdong

|

|

2016

|

|

September 2016

|

|

Nordic

Space

(2)

|

|

Sungdong

|

|

2017

|

|

January 2017

|

|

(1)

|

As used in this prospectus supplement, “Samsung” refers to Samsung Heavy Industries Co., Ltd, “Dalian” refers to Dalian Shipbuilding Industry Co. Ltd., “Hyundai”

refers to Hyundai Heavy Industries Co., Ltd., “Daewoo” refers to Daewoo Shipbuilding and Marine Engineering S.A., “Bohai” refers to Bohai Shipbuilding Heavy Industry Co., Ltd., and “Universal” refers to Universal

Shipbuilding Corporation.

|

|

(2)

|

Vessel under construction.

|

The technical

management of our vessels is handled by third-party companies under the supervision and instruction of our management subsidiary, Scandic American Shipping Ltd.

As of the date of this prospectus supplement, the ship management firm V.Ships Norway AS provides the technical

management and operation for 17 of the Company’s vessels. The ship management firms Columbia Shipmanagement Ltd, Cyprus and Hellespont Ship Management GmbH & Co KG, Germany provide the same services for seven and five of the

Company’s vessels, respectively.

Recent and Other Developments

Based on the rates achieved in the third quarter, we expect earnings per share and dividend per share in the third

quarter of 2016 to be lower than in the second quarter of 2016.

The daily rates as reported by shipbrokers

or by analysts may vary significantly from the actual rates we achieve in the market. As a matter of policy we do not attempt to predict future spot rates.

On August 31, 2016, the Company paid a cash dividend of $0.25 per share to shareholders of record as of August 17,

2016.

We anticipate declaring a dividend in respect of the third quarter 2016 in mid-October 2016. The

shares sold in this offering will receive that dividend.

During May, June and July of 2016, the Company took

delivery of four Japanese-built Suezmax sister vessels, the

Nordic Luna

, the

Nordic Castor,

the

Nordic Sirius

and the

Nordic Pollux

. The Company paid an aggregate purchase price of $106.0 million for the four vessels.

S-2

In the third quarter of 2016, the arbitration matter with Gulf

Navigation Holding PJSC was settled. In addition to the amount received, we have made reversal of other related accruals, which will have a positive impact on our profit & loss accounts of approximately $5.3 million in total in the third quarter

of 2016.

Between August 17, 2016 and August 22, 2016, the Company’s Chairman and Chief Executive

Officer purchased approximately 210,000 of our common shares for an aggregate purchase price of $2.3 million.

On September 8, 2016, the Company announced that it had taken delivery of the newbuild Suezmax vessel

Nordic

Star

.

S-3

The Offering

|

Common shares offered by this prospectus supplement

|

11,000,000 common shares (or 12,650,000 common shares, assuming full exercise of the underwriters’ option to purchase additional shares).

|

|

|

At our request, the underwriters have reserved for sale an aggregate of 534,000 common shares to all of the members of our Board, certain members of our management, and all of our advisors at the

public offering price. The 534,000 common shares include 100,000 common shares to be purchased by our Chairman and Chief Executive Officer and 400,000 common shares to be purchased by our Vice Chairman. The underwriters will not receive any proceeds

from the common shares sold to these individuals.

|

|

Common shares to be outstanding immediately after this offering

|

100,319,666 common shares (or 101,969,666 common shares, assuming full exercise of the underwriters’ option to purchase additional shares).

|

|

Rights Plan

|

Each common share offered hereby is being offered with one preferred share purchase right to purchase one one-thousandth of a share of the Company’s Series A Participating Preferred Stock at an exercise price of

$115.00, subject to adjustment. See “Description of Capital Stock—Stockholders Rights Plan” in the accompanying prospectus.

|

|

Use of Proceeds

|

We estimate that the net proceeds from this offering, after deducting underwriting discounts and commissions and estimated expenses relating to this offering, will be approximately $104.3 million, assuming no exercise

underwriters’ option to purchase additional shares, or $120.0 million, assuming the underwriters’ full exercise of the option to purchase additional shares. We intend to use the net proceeds of this offering primarily to finance the

expansion of our fleet and for general corporate purposes. We refer you to the section entitled “Use of Proceeds.”

|

|

New York Stock Exchange Symbol

|

“NAT”

|

|

Risk Factors

|

Investing in our common shares involves risks. You should carefully consider the risks discussed under the caption “Risk Factors” in this prospectus supplement, the accompanying prospectus and in our Annual Report

on Form 20-F for the fiscal year ended December 31, 2015, which is incorporated by reference in this prospectus supplement, and under the caption “Risk Factors” or any similar caption in the documents that we subsequently file with the

Securities and Exchange Commission, or the Commission, that are incorporated or deemed to be incorporated by reference in this prospectus supplement and the accompanying prospectus, and in any free writing prospectus that we may be provided in

connection with this offering of our common shares pursuant to this prospectus supplement and the accompanying prospectus.

|

|

Conflicts of Interest

|

An affiliate of DNB Markets, Inc. and Skandinaviska Enskilda Banken AB (publ), underwriters in this offering, are each deemed to have received at least 5% of the net offering proceeds of this offering in connection with the

repayment of our revolving credit facility. See “Use of Proceeds.” Therefore, the offering will be conducted in accordance with FINRA Rule 5121. In accordance with that rule, no “qualified independent underwriter” is required,

because a bona fide public market exists in the shares, as that term is defined in the rule.

|

S-4

The number of shares to be outstanding after this offering is based on

89,319,666 common shares issued and outstanding as of the date of this prospectus supplement and excludes (i) 1,664,450 common shares that may be issued under our Dividend Reinvestment and Direct Stock Purchase Plan; and (ii) the

underwriters’ option to purchase up to 1,650,000 additional shares. See “Underwriting.”

We

currently have an authorized share capital amount of 180,000,000 common shares, par value $0.01 per share.

S-5

Summary Financial Information

The following table provides our summary consolidated financial data and other data as of the dates and for the periods

shown. Our summary consolidated statements of operations data and other financial data for the years ended December 31, 2013, 2014 and 2015, are derived from our audited consolidated financial statements set forth in our Annual Report on Form

20-F for the fiscal year ended December 31, 2015, as incorporated by reference herein. Our summary consolidated statements of operations data and other financial data for the six months ended June 30, 2016 and 2015 and our selected balance

sheet data at June 30, 2016 are derived from our unaudited consolidated condensed financial statements set forth in our Report on Form 6-K filed on September 26, 2016 and incorporated by reference herein, and, in the opinion of management, include

all adjustments (consisting of only normal recurring adjustments) necessary for a fair statement thereof. Our interim results are not necessarily indicative of our results for the entire year or for any future periods.

The summary consolidated financial data and other data set forth below should be read in conjunction with, and are

qualified in their entirety by reference to, our audited consolidated and unaudited consolidated condensed financial statements, including the related notes thereto, and “Item 5. Operating and Financial Review and Prospects” included in

our Annual Report on Form 20-F for the fiscal year ended December 31, 2015, which is incorporated by reference herein.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended,

|

|

|

Year ended December 31,

|

|

|

|

|

June 30,

2016

|

|

|

June 30,

2015

|

|

|

2015

|

|

|

2014

(adjusted)

1

|

|

|

2013

|

|

|

|

|

All figures in thousands of USD except share data

|

|

|

SELECTED CONSOLIDATED FINANCIAL DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voyage Revenues

|

|

|

195,316

|

|

|

|

229,295

|

|

|

|

445,738

|

|

|

|

351,049

|

|

|

|

243,657

|

|

|

Voyage Expenses

|

|

|

(56,930

|

)

|

|

|

(86,271

|

)

|

|

|

(158,656

|

)

|

|

|

(199,430

|

)

|

|

|

(173,410

|

)

|

|

Vessel Operating Expense

|

|

|

(36,931

|

)

|

|

|

(33,029

|

)

|

|

|

(66,589

|

)

|

|

|

(62,500

|

)

|

|

|

(64,924

|

)

|

|

General and Administrative Expenses

|

|

|

(7,218

|

)

|

|

|

(4,906

|

)

|

|

|

(9,790

|

)

|

|

|

(14,863

|

)

|

|

|

(19,555

|

)

|

|

Depreciation Expenses

|

|

|

(43,073

|

)

|

|

|

(40,468

|

)

|

|

|

(82,610

|

)

|

|

|

(80,531

|

)

|

|

|

(74,375

|

)

|

|

Loss on Contract

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(5,000

|

)

|

|

Fees for Provided Services

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,500

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Operating Income (Loss)

|

|

|

51,164

|

|

|

|

64,621

|

|

|

|

128,093

|

|

|

|

(4,775

|

)

|

|

|

(93,608

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Income

|

|

|

64

|

|

|

|

73

|

|

|

|

114

|

|

|

|

181

|

|

|

|

146

|

|

|

Interest Expense

|

|

|

(4,951

|

)

|

|

|

(5,400

|

)

|

|

|

(10,855

|

)

|

|

|

(12,244

|

)

|

|

|

(11,518

|

)

|

|

Equity (Loss) Income

(

1

)

|

|

|

(3,944

|

)

|

|

|

(635

|

)

|

|

|

(2,462

|

)

|

|

|

1,559

|

|

|

|

40

|

|

|

Other Financial Income (Expense)

|

|

|

(62

|

)

|

|

|

(17

|

)

|

|

|

(263

|

)

|

|

|

2,113

|

|

|

|

(477

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss)

|

|

|

42,270

|

|

|

|

58,642

|

|

|

|

114,627

|

|

|

|

(13,166

|

)

|

|

|

(105,417

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings (Loss) per share

|

|

|

0.47

|

|

|

|

0.66

|

|

|

|

1.29

|

|

|

|

(0.15

|

)

|

|

|

(1.64

|

)

|

|

Diluted Earnings (Loss) per share

|

|

|

0.47

|

|

|

|

0.66

|

|

|

|

1.29

|

|

|

|

(0.15

|

)

|

|

|

(1.64

|

)

|

|

Cash Dividends Declared per share

|

|

|

0.86

|

|

|

|

0.60

|

|

|

|

1.38

|

|

|

|

0.63

|

|

|

|

0.64

|

|

|

Basic Weighted Average Shares Outstanding

|

|

|

89,313,615

|

|

|

|

89,182,001

|

|

|

|

89,182,001

|

|

|

|

85,401,179

|

|

|

|

64,101,923

|

|

|

Diluted Weighted Average Shares Outstanding

|

|

|

89,313,615

|

|

|

|

89,182,001

|

|

|

|

89,182,001

|

|

|

|

85,401,179

|

|

|

|

64,101,923

|

|

|

Other financial data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash Provided by (Used in) operating activities

|

|

|

104,478

|

|

|

|

94,110

|

|

|

|

174,391

|

|

|

|

57,479

|

|

|

|

(47,265

|

)

|

|

Cash Dividends paid

|

|

|

76,815

|

|

|

|

53,509

|

|

|

|

123,071

|

|

|

|

54,069

|

|

|

|

41,756

|

|

S-6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended,

|

|

|

Year ended December 31,

|

|

|

|

|

June 30,

2016

|

|

|

June 30,

2015

|

|

|

2015

|

|

|

2014

(adjusted)

1

|

|

|

2013

|

|

|

|

|

All figures in thousands of USD except share data

|

|

|

Selected Balance Sheet Data (at period end):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

29,519

|

|

|

|

105,508

|

|

|

|

29,889

|

|

|

|

100,736

|

|

|

|

65,675

|

|

|

Total assets

(1)

(2)

|

|

|

1,262,869

|

|

|

|

1,177,830

|

|

|

|

1,239,194

|

|

|

|

1,173,628

|

|

|

|

1,132,977

|

|

|

Total long-term

debt

(2)(3)

|

|

|

380,213

|

|

|

|

248,282

|

|

|

|

324,568

|

|

|

|

247,768

|

|

|

|

246,540

|

|

|

Common stock

|

|

|

893

|

|

|

|

892

|

|

|

|

892

|

|

|

|

892

|

|

|

|

754

|

|

|

Total shareholders’ equity

|

|

|

846,529

|

|

|

|

894,384

|

|

|

|

880,721

|

|

|

|

888,911

|

|

|

|

854,984

|

|

|

(1)

|

Adjustments were based on the change of accounting of investment from available-for-sale to equity method investment, Please see note 4 in our Annual Report on Form 20-F for the fiscal year ended

December 31, 2015.

|

|

(2)

|

We have adopted ASU 2015-03

, Interest – Imputation of Interest (Subtopic 835-30) – Simplifying the Presentation of Debt Issuance Costs

, which required debt issuance costs to a

recognized debt liability to be presented in the Balance Sheets as a direct deduction from the debt liability rather than an asset. This has been applied retrospectively to the comparative balance sheet data as of December 31, 2015, 2014 and 2013.

The application reduces Total long-term debt from 330,000 to 324,568, 250,000 to 247,768 and 250,000 to 246,540 as of December 31, 2015, 2014 and 2013, respectively. Total assets are reduced from 1,244,626 to 1,239,194, 1,175,860 to 1,173,628 and

1,136,437 to 1,132,977 as of December 31, 2015, 2014 and 2013, respectively.

|

|

(3)

|

Outstanding amounts on our Credit Facility were 385,000 and 250,000, as per June 30, 2016 and June 30, 2015, respectively, 330,000, 250,000 and 250,000 as per December 31, 2015, December 31, 2014

and December 31, 2013, respectively.

|

S-7

RISK FACTORS

Investing in our common shares involves risks. You should carefully consider the risks set forth below and discussed

under the caption “Risk Factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2015, which is incorporated by reference in this prospectus supplement and the accompanying prospectus, and under the caption

“Risk Factors” or any similar caption in the documents that we subsequently file with the Commission that are incorporated or deemed to be incorporated by reference in this prospectus supplement and the accompanying prospectus, and in any

free writing prospectus that you may be provided in connection with this offering of our common shares pursuant to this prospectus supplement and the accompanying prospectus.

We may use the net proceeds of this offering for purposes with which you do not agree.

We intend to use the net proceeds from this offering primarily to finance the expansion of our fleet and for general

corporate purposes. To the extent that we are not able to purchase vessels on terms that are acceptable to us or at all, we may use the net proceeds for other purposes with which you do not agree. Please see “Use of Proceeds.”

We have antitakeover protections which could prevent a change in our control.

We have antitakeover protections which could prevent a change in our control. For example, on February 13, 2007, our

Board of Directors, or our Board, adopted a shareholders rights agreement and declared a dividend of one preferred share purchase right to purchase one one-thousandth of a share of our Series A Participating Preferred Stock for each outstanding

common share, par value $0.01 per share. The dividend was payable on February 27, 2007 to shareholders of record on that date. Each right entitles the registered holder to purchase from us one one-thousandth of a share of Series A Participating

Preferred Stock at an exercise price of $115.00, subject to adjustment. We can redeem the rights at any time prior to a public announcement that a person has acquired ownership of 15% or more of the Company’s common shares. This shareholders

rights plan was designed to enable us to protect shareholder interests in the event that an unsolicited attempt is made for a business combination with, or a takeover of, the Company. Our shareholders rights plan is not intended to deter offers that

our Board determines are in the best interests of our shareholders.

S-8

USE OF PROCEEDS

We estimate that the net proceeds from this offering, after deducting underwriting discounts and commissions and

estimated expenses relating to this offering, will be approximately $104.3 million, assuming no exercise underwriters’ option to purchase additional shares, or $120.0 million, assuming the underwriters’ full exercise of the

option to purchase additional shares. We intend to use the net proceeds of this offering primarily to finance the expansion of our fleet and for general corporate purposes. Immediately following the offering, we may use the proceeds of this

offering to repay borrowings under our revolving credit facility pending application towards other uses.

We

cannot assure you that we will use the proceeds of this offering to finance the acquisition of vessels and we may use the net proceeds for general corporate purposes. See “Risk Factors—We may use the net proceeds of this offering for

purposes with which you do not agree.”

S-9

CAPITALIZATION

The following table sets forth our capitalization as of June 30, 2016 on a historical basis and on an as adjusted basis

to give effect to:

|

|

•

|

|

the payment on August 31, 2016 of a dividend of $0.25 per common share, or $22.3 million in the aggregate, in respect of the second quarter of 2016; and

|

|

|

•

|

|

the delivery of

Nordic Pollux

and

Nordic Star

at which time $62.0 million in aggregate was drawn on the revolving credit facility.

|

and on a further adjusted basis to give effect to this offering and the use of net proceeds therefrom.

You should read the adjusted capitalization table information below in connection with “Use of Proceeds” and

our financial statements and related notes appearing elsewhere or incorporated by reference in this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

2016

|

|

|

Dollars in thousands

|

|

Actual

|

|

|

As

Adjusted

|

|

|

As Further

Adjusted

|

|

|

Debt:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit

Facility

(1)

|

|

|

380,213

|

|

|

|

442,213

|

|

|

|

442,213

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total debt

|

|

|

380,213

|

|

|

|

442,213

|

|

|

|

442,213

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock, $0.01 par value, outstanding actual (89,319,666 shares), as

adjusted (89,319,666 shares) and as further adjusted

(100,319,666 shares)

(2)

|

|

|

893

|

|

|

|

893

|

|

|

|

1,003

|

|

|

Additional paid-in

capital

(2)(3)

|

|

|

114,938

|

|

|

|

114,938

|

|

|

|

219,145

|

|

|

Contributed Surplus

|

|

|

731,575

|

|

|

|

709,249

|

|

|

|

709,249

|

|

|

Accumulated other Comprehensive Income

|

|

|

(877

|

)

|

|

|

(877

|

)

|

|

|

(877

|

)

|

|

Retained deficit

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders’ equity

|

|

|

846,529

|

|

|

|

824,203

|

|

|

|

928,520

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

|

1,226,742

|

|

|

|

1,266,416

|

|

|

|

1,370,733

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

The undrawn amount of our revolving credit facility was $53.0 million as of June 30, 2016, on an as adjusted basis. We may borrow amounts under our revolving credit facility to finance future

vessel acquisitions up to the lesser market value and the purchase price of the new vessels and, subject to certain limitations, for general corporate purposes. Immediately following the offering, we may use the proceeds of this offering to

repay borrowings under our revolving credit facility pending application towards other uses. Credit Facility consists of outstanding amounts on our revolving credit facility less unamortized deferred financing cost. Outstanding amounts under

our revolving credit facility were $447.0 million as of September 26, 2016.

|

|

(2)

|

Common shares and Additional paid-in capital excludes (i) 1,664,450 common shares that may be issued under our Dividend Reinvestment and Direct Stock Purchase Plan; and (ii) the underwriters’

option to purchase up to 1,650,000 additional shares.

|

|

(3)

|

Additional paid-in capital, as further adjusted, includes estimated fees and expenses of approximately $450,000 relating to this offering.

|

S-10

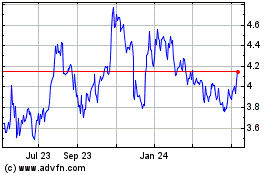

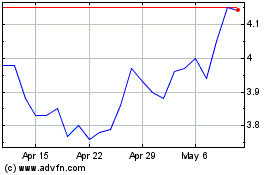

SHARE HISTORY AND MARKETS

Since November 16, 2004, the primary trading market for our common shares has been the NYSE, on which our shares

are listed under the symbol “NAT.” You should carefully review the high and low prices of our common shares in the tables for the months, quarters and years indicated under the heading “Share History and Markets” in our Annual

Report on Form 20-F for the fiscal year ended December 31, 2015.

The following table below sets forth the

high and low market prices for each of the periods indicated for shares of our common shares as reported by the NYSE:

|

|

|

|

|

|

|

|

|

|

|

|

|

NYSE

HIGH

|

|

|

NYSE

LOW

|

|

|

For the quarter ended:

|

|

|

|

|

|

|

|

|

|

March 31, 2016

|

|

$

|

15.57

|

|

|

$

|

9.94

|

|

|

June 30, 2016

|

|

$

|

16.18

|

|

|

$

|

13.14

|

|

The high and low market prices for our common shares by month since March 2016 have been

as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

NYSE

HIGH

|

|

|

NYSE

LOW

|

|

|

For the month:

|

|

|

|

|

|

|

|

|

|

March 2016

|

|

$

|

14.82

|

|

|

$

|

12.81

|

|

|

April 2016

|

|

$

|

15.42

|

|

|

$

|

13.65

|

|

|

May 2016

|

|

$

|

16.18

|

|

|

$

|

13.14

|

|

|

June 2016

|

|

$

|

16.07

|

|

|

$

|

13.55

|

|

|

July 2016

|

|

$

|

14.41

|

|

|

$

|

11.68

|

|

|

August 2016

|

|

$

|

12.52

|

|

|

$

|

10.00

|

|

|

September 2016*

|

|

$

|

11.11

|

|

|

$

|

10.04

|

|

|

*

|

As of September 23, 2016.

|

S-11

DIVIDEND POLICY

Our policy is to declare quarterly dividends to shareholders as decided by the Board. The dividend to shareholders

could be higher than the operating cash flow or the dividend to shareholders could be lower than the operating cash flow after reserves as the Board may from time to time determine are required, taking into account contingent liabilities, the terms

of our revolving credit facility, our other cash needs and the requirements of Bermuda law.

Total dividends

distributed in 2015 were $123.1 million or $1.38 per share. The quarterly dividend payments per share in 2015, 2014, 2013, 2012 and 2011 have been as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period

|

|

2016

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

1st Quarter

|

|

$

|

0.43

|

|

|

$

|

0.22

|

|

|

$

|

0.12

|

|

|

$

|

0.16

|

|

|

$

|

0.30

|

|

|

$

|

0.25

|

|

|

2nd Quarter

|

|

|

0.43

|

|

|

|

0.38

|

|

|

|

0.23

|

|

|

|

0.16

|

|

|

|

0.30

|

|

|

|

0.30

|

|

|

3rd Quarter

|

|

|

0.25

|

|

|

|

0.40

|

|

|

|

0.28

|

*

|

|

|

0.16

|

|

|

|

0.30

|

|

|

|

0.30

|

|

|

4th Quarter

|

|

|

|

|

|

|

0.38

|

|

|

|

0.14

|

|

|

|

0.16

|

|

|

|

0.30

|

|

|

|

0.30

|

|

|

Total

|

|

$

|

1.11

|

|

|

$

|

1.38

|

|

|

$

|

0.77

|

|

|

$

|

0.64

|

|

|

$

|

1.20

|

|

|

$

|

1.15

|

|

|

*

|

Includes $0.16 per share distributed as dividend-in-kind.

|

S-12

TAX CONSIDERATIONS

Please see the section titled “Additional Information—Taxation” in our Annual Report on Form 20-F for the

fiscal year ended December 31, 2015.

S-13

CERTAIN ERISA CONSIDERATIONS

The following discussion is a summary of certain considerations associated with the purchase of our

common stock by (i) employee benefit plans that are subject to Title I of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), (ii) plans, individual retirement accounts and other arrangements that are

subject to Section 4975 of the Internal Revenue Code of 1986, as amended (the “Code”), (iii) entities whose underlying assets are considered to include “plan assets” of such plans, accounts and arrangements (each such

plan and entity, an “ERISA Plan”) and (iv) plans that are subject to provisions under any other federal, state, local, non-U.S. or other laws or regulations that are substantially similar to such provisions of ERISA or the Code

(collectively, “Similar Laws”) and entities whose underlying assets are considered to include “plan assets” of such plans (each such plan and entity, an “Other Plan”).

Section 406 of ERISA and Section 4975 of the Code prohibit ERISA Plans from engaging in specified transactions

involving “plan assets” with persons or entities who are “parties in interest,” within the meaning of ERISA, or “disqualified persons,” within the meaning of Section 4975 of the Code, unless an exemption is

available. A party in interest or disqualified person who engages in a non-exempt prohibited transaction may be subject to excise taxes and other penalties and liabilities under ERISA and the Code. In addition, the fiduciary of the ERISA Plan that

engages in such a non-exempt prohibited transaction may be subject to penalties and liabilities under ERISA and the Code.

Because of the nature of our business as an operating company and the fact that we have no U.S. affiliates or U.S. operations, it is not likely that we would be considered a party in interest or a disqualified person with respect to

any ERISA Plan or that our assets would be considered to be “plan assets” of any such ERISA Plan. However, a prohibited transaction within the meaning of ERISA and the Code may result if our common stock is acquired by an ERISA Plan to

which an underwriter is a party in interest and such acquisition is not entitled to an applicable exemption, of which there are many.

Governmental plans, certain church plans and foreign plans, while not subject to the fiduciary responsibility or

prohibited transaction provisions of Title I of ERISA or Section 4975 of the Code, may nevertheless be subject to Similar Laws. Fiduciaries of any such plans should consult with their counsel before purchasing our common shares.

The foregoing discussion is general in nature and is not intended to be all-inclusive. Due to the complexity of these

rules and the penalties that may be imposed upon persons involved in non-exempt prohibited transactions, it is particularly important that fiduciaries, or other persons considering purchasing our common shares on behalf of, or with the assets of,

any ERISA Plan, or any Other Plan, consult with their counsel regarding the matters described herein.

S-14

UNDERWRITING (CONFLICTS OF INTEREST)

Under the terms and subject to the conditions in an underwriting agreement dated the date of this

prospectus supplement, the underwriters named below, for whom Morgan Stanley & Co. LLC is acting as representative, have severally agreed to purchase, and we have agreed to sell to them, severally, the number of common shares indicated below:

|

|

|

|

|

|

|

Name

|

|

Number of

Shares

|

|

|

Morgan Stanley & Co. LLC

|

|

|

9,350,000

|

|

|

DNB Markets, Inc.

|

|

|

825,000

|

|

|

Skandinaviska Enskilda Banken AB (publ)

|

|

|

825,000

|

|

|

|

|

|

|

|

|

Total:

|

|

|

11,000,000

|

|

|

|

|

|

|

|

The underwriting agreement provides that the obligations of the several underwriters to

pay for and accept delivery of the common shares offered by this prospectus supplement are subject to the approval of certain legal matters by their counsel and to certain other conditions. The underwriters are obligated to take and pay for all

of the common shares offered by this prospectus supplement if any such common shares are taken. However, the underwriters are not required to take or pay for the common shares covered by the underwriters’ option to purchase additional

shares described below.

After the initial offering of the common shares, the offering price and other

selling terms may from time to time be varied by the representative.

We have granted to the underwriters an

option, exercisable for 30 days from the date of this prospectus supplement, to purchase up to 1,650,000 additional common shares at the price set forth in the next paragraph. To the extent the option is exercised, each underwriter will become

obligated, subject to certain conditions, to purchase approximately the same percentage of the additional common shares as the number listed next to the underwriter’s name in the preceding table bears to the total number of common shares listed

next to the names of all underwriters in the preceding table.

The following table shows the per common share

and total public offering price, underwriting discounts and commissions, and proceeds before expenses to us. These amounts are shown assuming both no exercise and full exercise of the underwriters’ option to purchase up to an additional

1,650,000 common shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per

Share

|

|

|

Total

|

|

|

|

|

|

No Exercise

|

|

|

Full Exercise

|

|

|

Public offering price

|

|

$

|

10.00

|

|

|

$

|

110,000,000

|

|

|

$

|

126,500,000

|

|

|

Underwriting discounts and commissions to be paid by us

(1)

|

|

$

|

0.50

|

|

|

$

|

5,233,000

|

|

|

$

|

6,058,000

|

|

|

Proceeds, before expenses, to

us

(1)

|

|

$

|

9.50

|

|

|

$

|

104,767,000

|

|

|

$

|

120,442,000

|

|

|

(1)

|

The 534,000 common shares sold to members of our board of directors, members of our management, and our advisors will be sold at the public offering price. The underwriters will not receive any

underwriting discount on the sale of such shares.

|

At our request, the underwriters have

reserved for sale an aggregate of 534,000 common shares to all of the members of our board of directors, certain members of our management, and all of our advisors at the public offering price. The 534,000 common shares include approximately 100,000

common shares to be purchased by our Chairman and Chief Executive Officer and 400,000 common shares to be purchased by the Company’s Vice Chairman. The shares sold to these individuals will be subject to the lock-up agreements discussed below.

The underwriters will not receive any proceeds from the common shares sold to these individuals.

The

estimated offering expenses payable by us, exclusive of the underwriting discounts and commissions, are approximately $450,000.

Our common shares are listed on the New York Stock Exchange under the trading symbol “NAT”.

S-15

We and each of the directors and members of senior management of NAT and

the Manager listed under the caption “Directors and Senior Management” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2015 have agreed that, subject to specified exceptions, without the prior written consent of

Morgan Stanley & Co. LLC on behalf of the underwriters, we and they will not, during the period ending 60 days after the date of this prospectus supplement (the “restricted period”):

|

|

•

|

|

directly or indirectly, issue, offer, sell, agree to issue, offer or sell, solicit offers to purchase, grant any call option, warrant or other right to purchase, purchase any put option or any

other right to sell, pledge, borrow or otherwise dispose of any common shares or any securities convertible into or exercisable or exchangeable for common shares or make any announcement of any of the foregoing;

|

|

|

•

|

|

establish or increase any “put equivalent position” or liquidate or decrease any “call equivalent position” (in each case within the meaning of Section 16 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder) with respect to any common shares or any securities convertible into or exercisable or exchangeable for common shares; or

|

|

|

•

|

|

enter into any swap, derivative or other transaction or arrangement that transfers to another, in whole or in part, any economic consequence of ownership of any common shares or any securities

convertible into or exercisable or exchangeable for common shares;

|

whether any such transaction described

above is to be settled by delivery of common stock or such other securities, in cash or otherwise. In addition, we and each such person agrees that, without the prior written consent of Morgan Stanley & Co. LLC on behalf of the

underwriters, we or such other person will not, during the restricted period, make any demand for, or exercise any right with respect to, the registration of any common shares or any security convertible into or exercisable or exchangeable for

common stock.

The restrictions described in the immediately preceding paragraph to do not apply to:

|

|

•

|

|

the sale of shares to the underwriters; or

|

|

|

•

|

|

the issuance by the Company of common shares upon the grant and exercise of options under, or the issuance and sale of shares pursuant to, employee stock option plans in effect on the date hereof,

as described in the this prospectus supplement or the accompanying prospectus.

|

With respect to

such officers and directors, the restrictions described above do not apply (a) to bona fide gifts, provided the recipient thereof agrees in writing to be bound by the restrictions described above, (b) on death, by will or intestacy, (c) to

dispositions to an immediate family member or to any trust, partnership or other entity for the direct or indirect benefit of such officer or director and/or immediate family member, provided that such immediate family member, trust, partnership or

other entity agrees in writing to be bound by the restrictions described above, or (d) pursuant to a court order or settlement agreement approved by a court of competent jurisdiction.

Morgan Stanley & Co. LLC, in its sole discretion, may release the common shares and other securities subject to the

lock-up agreements described above in whole or in part at any time.

In order to facilitate the offering of

common shares, the underwriters may engage in transactions that stabilize, maintain or otherwise affect the price of the common shares. Specifically, the underwriters may sell more common shares than they are obligated to purchase under the

underwriting agreement, creating a short position. A short sale is covered if the short position is no greater than the number of common shares available for purchase by the underwriters under the option to purchase additional shares. The

underwriters can close out a covered short sale by exercising the option to purchase additional shares or purchasing common shares in the open market. In determining the source of common shares to close out a covered short sale, the

underwriters will consider, among other things, the open market price of common shares compared to the price available under the option to purchase additional shares. The underwriters may also sell common shares in excess of the option to

purchase additional shares, creating a naked short position. The underwriters must close out any naked short

S-16

position by purchasing common shares in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the

price of the common shares in the open market after pricing that could adversely affect investors who purchase in this offering. As an additional means of facilitating this offering, the underwriters may bid for, and purchase, common shares in

the open market to stabilize the price of the common shares. These activities may raise or maintain the market price of the common shares above independent market levels or prevent or retard a decline in the market price of the common shares.

The underwriters are not required to engage in these activities and may end any of these activities at any time.

We and the underwriters have agreed to indemnify each other against certain liabilities, including liabilities under the Securities Act.

A prospectus supplement in electronic format may be made available on websites maintained by one or more underwriters,

or selling group members, if any, participating in this offering. The representative may agree to allocate a number of common shares to underwriters for sale to their online brokerage account holders. Internet distributions will be

allocated by the representative to underwriters that may make Internet distributions on the same basis as other allocations.

Morgan Stanley & Co. LLC (1585 Broadway, New York, New York), DNB Markets Inc., (200 Park Avenue, New York, New York) and Skandinaviska Enskilda Banken AB (publ) (Filipstad Brygge 1, N-0252 Oslo, Norway) and their respective

affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging.

financing and brokerage activities. Certain of the underwriters and their respective affiliates have, from time to time, performed, and may in the future perform, various financial advisory and investment banking services for us, for which they

received or will receive customary fees and expenses.

In addition, in the ordinary course of their various

business activities, the underwriters and their respective affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for

their own account and for the accounts of their customers and may at any time hold long and short positions in such securities and instruments. Such investment and securities activities may involve our securities and instruments. The

underwriters and their respective affiliates may also make investment recommendations or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire,

long or short positions in such securities and instruments.

Skandinaviska Enskilda Banken AB (publ)

(“SEB”) is not a U.S. registered broker-dealer and, therefore, intends to participate in the offering outside of the United States and, to the extent that the offering by SEB is within the United States, it will offer to and place common

shares with investors through SEB Securities Inc., an affiliated U.S. broker-dealer. The activities of SEB in the United States will be effected only to the extent permitted by Rule 15a-6 under the Exchange Act.

An affiliate of DNB Markets, Inc. and SEB, underwriters in this offering, are each deemed to have received at least 5%

of the net offering proceeds of this offering in connection with the repayment of our revolving credit facility. See “Use of Proceeds.” Therefore, the offering will be conducted in accordance with FINRA Rule 5121. In accordance with that

rule, no “qualified independent underwriter” is required, because a bona fide public market exists in the shares, as that term is defined in the rule. DNB Markets, Inc. and SEB Securities Inc. will not confirm sales of the securities to

any account over which they exercise discretionary authority without the prior written approval of the customer.

S-17

Selling Restrictions

Canada

The common shares may be sold only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited

investors, as defined in National Instrument 45-106

Prospectus Exemptions

or subsection 73.3(1) of the

Securities Act

(Ontario), and are permitted clients, as defined in National Instrument 31-103

Registration Requirements,

Exemptions and Ongoing Registrant Obligations

. Any resale of the common shares must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for

rescission or damages if this prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities

legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with a legal

advisor.

Pursuant to section 3A.3 (or, in the case of securities issued or guaranteed by the government of a

non-Canadian jurisdiction, section 3A.4) of National Instrument 33-105

Underwriting Conflicts

(“NI 33-105”), the underwriters are not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts

of interest in connection with this offering.

European Economic Area

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a

“Relevant Member State”) an offer to the public of any shares of our common stock may not be made in that Relevant Member State, except that an offer to the public in that Relevant Member State of any shares of our common stock may be made

at any time under the following exemptions under the Prospectus Directive, if they have been implemented in that Relevant Member State:

|

(a)

|

to any legal entity which is a qualified investor as defined in the Prospectus Directive;

|

|

(b)

|

to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined

in the Prospectus Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the representatives for any such offer; or

|

|

(c)

|

in any other circumstances falling within Article 3(2) of the Prospectus Directive, provided that no such offer of shares of our common stock shall result in a requirement for the publication by us

or any underwriter of a prospectus pursuant to Article 3 of the Prospectus Directive.

|

For the

purposes of this provision, the expression an “offer to the public” in relation to any shares of our common stock in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of

the offer and any shares of our common stock to be offered so as to enable an investor to decide to purchase any shares of our common stock, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that

Member State, the expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant

implementing measure in the Relevant Member State, and the expression “2010 PD Amending Directive” means Directive 2010/73/EU.

United Kingdom

Each underwriter has represented and agreed that:

|

(a)

|

it has only communicated or caused to be communicated and will only communicate or cause to

be communicated an invitation or inducement to engage in investment activity (within the meaning of

|

S-18

|

|

Section 21 of the Financial Services and Markets Act 2000 (“FSMA”) received by it in connection with the issue or sale of the common shares of our common stock in circumstances in

which Section 21(1) of the FSMA does not apply to us; and

|

|

(b)

|

it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the common shares of our common stock in, from or otherwise involving

the United Kingdom.

|

Japan

No registration pursuant to Article 4, paragraph 1 of the Financial Instruments and Exchange Law of Japan (Law No. 25 of

1948, as amended) (the “FIEL”) has been made or will be made with respect to the solicitation of the application for the acquisition of the common shares.

Accordingly, the common shares have not been, directly or indirectly, offered or sold and will not be, directly or

indirectly, offered or sold in Japan or to, or for the benefit of, any resident of Japan (which term as used herein means any person resident in Japan, including any corporation or other entity organized under the laws of Japan) or to others for

re-offering or re-sale, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan except pursuant to an exemption from the registration requirements, and otherwise in compliance with, the FIEL and the other applicable laws

and regulations of Japan.

S-18

EXPENSES

The following are the estimated expenses of the issuance and distribution of the securities being registered under the

registration statement of which this prospectus supplement forms a part, all of which will be paid by us.

|

|

|

|

|

|

|

SEC registration fee

|

|

$

|

68,200

|

*

|

|

Printing and engraving expenses

|

|

$

|

200,000

|

|

|

Legal fees and expenses

|

|

$

|

150,000

|

|

|

Accounting fees and expenses

|

|

$

|

50,000

|

|

|

Miscellaneous

|

|

$

|

50,000

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

450,000

|

|

LEGAL MATTERS

The validity of the securities offered hereby will be passed upon for us by

Seward & Kissel LLP, New York, New York with respect to matters of United States law and by MJM Limited, Hamilton, Bermuda, with respect to matters of Bermuda law. The underwriters will be represented by Simpson Thacher & Bartlett LLP,

New York, New York.

EXPERTS

The consolidated financial statements of Nordic American Tankers Limited and subsidiaries as of and for the year ended

December 31, 2015, and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2015, have been incorporated by reference herein and in the registration statement in reliance upon