Chesapeake Energy Gets Subpoena Seeking Accounting Information

September 29 2016 - 3:09PM

Dow Jones News

By Erin Ailworth

Chesapeake Energy Corp. said Thursday that it has received a

subpoena from the U.S. Department of Justice requesting information

on the company's accounting for oil and gas properties.

The Oklahoma City-based company disclosed the Justice Department

scrutiny of its accounting as part of a filing with the U.S.

Securities and Exchange Commission in which it announced an $850

million debt offering.

Chesapeake shares, which hit a low Thursday of $6.06, fell 7.6%

to $6.24 in afternoon trading in New York.

Gordon Pennoyer, a spokesman for Chesapeake, declined to discuss

the subpoenas, referring all questions to the filing. A Justice

Department spokesperson declined to comment Thursday.

Chesapeake previously had disclosed that it has received

subpoenas asking for documents, information, and testimony in

connection with possible violations of antitrust laws relating to

how Chesapeake purchases and leases oil and gas rights. Its royalty

payment practices also have been the subject of federal and state

subpoenas.

The Thursday filing stated that Chesapeake has "engaged in

discussions" with the Justice Department, U.S. Postal Service, and

state agency representatives, and continues "to respond to such

subpoenas and demands."

Previous scrutiny of Chesapeake by federal investigators led the

Justice Department in March to indict the company's former chief

executive, Aubrey McClendon, on one count of conspiring to rig the

price of oil and gas leases.

Mr. McClendon -- a pioneering figure in oil and gas exploration

who helped launch a renaissance in U.S. energy production -- died

the next day, after his natural gas-fueled Chevy Tahoe crashed into

a bridge abutment and caught fire. The Justice Department dropped

its charge in the wake of Mr. McClendon's death.

Chesapeake has said it was cooperating with the price-rigging

probe and that it didn't expect to face criminal prosecutions or

fines related to the matter.

The company has struggled in recent years as it tries to

complete a corporate overhaul amid the worst downturn in crude

prices in a generation. Activist investors, including billionaire

Carl Icahn, led a shareholder revolt in 2012 that ultimately forced

out Mr. McClendon.

Earlier this month, Mr. Icahn sold more than half his stake in

Chesapeake, citing tax planning reasons. In a statement on the

move, Mr. Icahn praised Chesapeake's current CEO, whom he helped to

install.

"We believe that over the last few years Doug Lawler and his

team have done an admirable job, especially in light of the

circumstances," Mr. Icahn said in a posting on his website.

After Mr. Icahn reduced his stake, two Chesapeake directors with

ties to the billionaire resigned from the energy-producer's board

on Monday.

Write to Erin Ailworth at Erin.Ailworth@wsj.com

(END) Dow Jones Newswires

September 29, 2016 14:54 ET (18:54 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

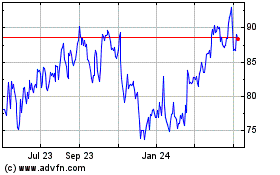

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

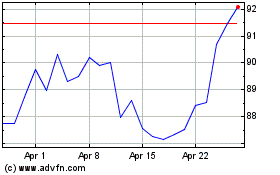

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024