By Eyk Henning, Dana Mattioli and Dana Cimilluca

Qualcomm Inc. is in talks to acquire NXP Semiconductors NV, a

deal that would likely be valued at over $30 billion and represent

the latest merger in a rapidly consolidating semiconductor

industry.

A deal could be struck in the next two to three months,

according to people familiar with the matter. As always, it is

possible there won't be one, and some of the people said Qualcomm

is also exploring other deal options.

NXP, which is based in the Netherlands and trades on Nasdaq, had

a roughly $28 billion market value midday Thursday. With a typical

premium, a takeover could value the company at more than $30

billion, making it one of the largest in another strong year for

mergers and acquisitions.

Qualcomm, which is based in San Diego, has a market value of $93

billion.

Chip companies have been eagerly seeking acquisitions that can

help them gain scale and cut costs as they cope with slower growth

and rising competition. Semiconductor M&A hit an all-time high

in 2015, as companies such as Intel Corp. and Avago Technologies

Ltd. made big acquisition moves. NXP itself acquired Freescale

Semiconductor Ltd. in an $11.8 billion deal.

There have been more than $75 billion of chip deals this year,

helping make technology the busiest sector for M&A -- with more

than $463 billion of deals, according to Dealogic.

Just a couple months ago, Japan's SoftBank agreed to buy

U.K.-based microprocessor designer ARM Holdings PLC in a $32

billion deal.

China has also added momentum. The country is putting $24

billion toward an effort to bulk up and develop its semiconductor

industry.

A deal with NXP would radically reshape Qualcomm, a company that

rose to prominence by supplying wireless chips but has endured

challenges in recent years that include a slowdown in smartphone

growth.

Qualcomm has an unusual business model. While it derives most

revenues from designing and selling chips, the company earns more

than half its profits from licensing its wireless patents to nearly

all makers of mobile phones.

That has helped Qualcomm generate outsize profits for most of

its history. The company held $31 billion in cash and securities on

its balance sheet at the end of June, almost all of it held

offshore -- another incentive to buy a foreign company like

NXP.

Buying the Dutch company would expand Qualcomm's chip business

from dozens of major product lines to hundreds spanning many

industries outside mobile devices. It would instantly become the

No. 1 supplier of chips used in cars, one of the hottest target

markets for semiconductor makers hoping to benefit as automobiles

add greater computing power and self-driving models develop.

The possibility of a Qualcomm-NXP tie-up has been

long-speculated given the complementary nature of the companies and

the ability of such a move to significantly boost earnings.

Indeed, on Thursday, Sanford C. Bernstein analysts put out a

note on the possibility.

"Many investors at least believe they would like to see the

company do something more strategic," they wrote of Qualcomm. NXP's

large size makes it potentially attractive to Qualcomm, they wrote,

as do the company's exposure to the automotive, security and

mobile-payments industries.

The deal could add 30% to Qualcomm's earnings before any cost

savings, they reckon.

They also noted the deal would face "considerable

integration/execution risks."

If a deal were to be struck, it would be the largest in

Qualcomm's history, and would come after activist investor Jana

Partners LLC exited its investment in the company earlier this

year. Last year, Jana pressed the company to consider splitting its

chip unit from its patent business. Qualcomm evaluated a split but

ultimately decided against it.

A deal would greatly expand Qualcomm's head count, which stood

at about 33,000 as of September 2015. NXP has about 45,000

employees, according to public filings.

Based in Eindhoven in the Netherlands, NXP makes chips not for

personal computers or smartphones, but for automotive systems,

identification cards and transit cards. In 2015, NXP reported $6.1

billion in revenue and $1.5 billion in profit.

NXP was founded more than 60 years ago as Philips

Semiconductors, a division of Royal Philips NV, before it was sold

to a private-equity consortium in 2006 and renamed. It became a

public company in 2010 and the private-equity firms have since sold

their stakes.

The Freescale acquisition vaulted NXP to the No. 1 supplier of

chips used in cars. NXP has also been heavily involved with a

short-range wireless technology called near-field communications,

which has been incorporated into some smartphones for purposes such

as mobile payments, a growing field. The iPhone 6 and much-hailed

Apple Pay service also use NXP's chipsets.

----Don Clark and Stu Woo contributed to this article.

Write to Eyk Henning at eyk.henning@wsj.com, Dana Mattioli at

dana.mattioli@wsj.com and Dana Cimilluca at

dana.cimilluca@wsj.com

(END) Dow Jones Newswires

September 29, 2016 14:29 ET (18:29 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

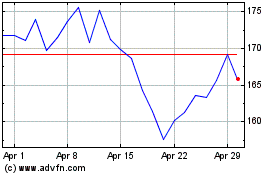

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024