MBIA Insurance Corporation Announces Agreement to Sell Subsidiary

September 29 2016 - 6:30AM

Business Wire

MBIA Insurance Corporation (MBIA Corp.) today announced that its

wholly owned subsidiary, MBIA UK (Holdings) Limited (MBIA UK

Holdings), has entered into an agreement to sell MBIA UK Insurance

Limited (MBIA UK) to Assured Guaranty Corp. (Assured), a subsidiary

of Assured Guaranty Ltd. (NYSE: AGO). The purchase price consists

of the transfer to MBIA UK Holdings of notes issued by Zohar II

2005-1 CLO (Zohar II Notes) with an aggregate outstanding principal

amount of approximately $347 million (Assured Zohar II Notes) and a

cash payment by MBIA UK Holdings to Assured of $23 million. The

transaction is subject to certain closing conditions including the

receipt of regulatory approvals from the Prudential Regulation

Authority of the United Kingdom, the New York State Department of

Financial Services (NYSDFS) and the Maryland Insurance

Administration. The sale of MBIA UK, effectively in exchange for

the Assured Zohar II Notes, is part of MBIA Corp.’s strategy to

address the maturity of the Zohar II Notes on January 20, 2017,

which had approximately $772 million of gross par outstanding as of

June 30, 2016. MBIA Corp. does not currently expect that the Zohar

II CLO will have sufficient cash flow to repay all of the Zohar II

Notes at maturity. There is no assurance that the transaction will

be completed or that MBIA Corp.’s strategies will be successful.

The transaction is scheduled to close in early January of 2017.

Anthony McKiernan, Chief Financial Officer and President of MBIA

Insurance Corp., noted, “As we have previously stated, the sale of

MBIA UK is one of the elements of our plan to enable MBIA Corp. to

address its insurance obligations regarding the Zohar II Notes. The

acquisition of the Assured Zohar II Notes reduces MBIA Corp.’s

liability under its Zohar II policy and may facilitate our ability

to address the remaining Zohar II Notes on or before their

maturity.” He added, “While the sale of MBIA UK, if completed, will

be an important and meaningful accomplishment, MBIA Corp. still has

substantially more to do.”

MBIA Corp. is in the process of exploring a variety of

additional strategies to address its obligations with respect to

the Zohar II Notes. These strategies may involve the restructuring

or repurchase of certain Zohar II Notes that may require

substantial third party financing, which MBIA Corp. is seeking to

arrange. Its ability to do so, however, is constrained and there is

no assurance that it will be able to secure a financing on

acceptable terms. If, notwithstanding the transaction announced

today, MBIA Corp. is unable to successfully implement its

strategies for restructuring or otherwise satisfying its

obligations under the Zohar II Notes, it does not expect to have a

sufficient amount of liquid assets to pay all claims in respect to

the Zohar II Notes at maturity (irrespective of whether the sale of

MBIA UK is completed). MBIA Corp. anticipates that the approval by

the NYSDFS of the sale of MBIA UK, if granted, would be based on

(among other things) the NYSDFS concluding that MBIA Corp. will

successfully execute its strategies to meet and/or restructure its

obligations on the Zohar II Notes in a manner acceptable to the

NYSDFS.

MBIA Corp. believes that if the NYSDFS concludes at any time

that MBIA Corp. will not be able to restructure or otherwise

satisfy its obligations under the Zohar II Notes on terms

satisfactory to the NYSDFS, while maintaining sufficient assets to

readily pay other policyholder claims, the NYSDFS would likely put

MBIA Corp. into a rehabilitation or liquidation proceeding under

Article 74 of the New York Insurance Law and/or take such other

actions as the NYSDFS may deem necessary to protect the interests

of MBIA Corp.’s policyholders. The determination to commence such a

proceeding or take other such actions is within the exclusive

control of the NYSDFS. The NYSDFS enjoys broad discretion in this

regard, and any determination they may make would not be limited to

consideration of the matters described above. No assurance is given

as to what action, if any, the NYSDFS may take.

Barclays Capital is acting as financial advisor, and Debevoise

& Plimpton LLP is acting as legal advisor, on the sale of MBIA

UK.

Forward-Looking Statements

The information contained in this press release should be read

in conjunction with our filings made with the Securities and

Exchange Commission. This release includes statements that are not

historical or current facts and are “forward-looking statements”

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. The words “believe,”

“anticipate,” “project,” “plan,” “expect,” “estimate,” “intend,”

“will likely result,” “looking forward” or “will continue,” and

similar expressions identify forward-looking statements. These

statements are subject to certain risks and uncertainties that

could cause actual results to differ materially from historical

earnings and those presently anticipated or projected, including,

among other risks and uncertainties, the possibility that the

Company will experience increased credit losses or impairments on

public finance obligations we insure issued by state, local and

territorial governments and finance authorities that are

experiencing fiscal stress, the possibility that MBIA Corp. will

have inadequate liquidity to pay claims as a result of increased

losses on certain structured finance transactions, in particular

residential mortgage-backed securities transactions that include a

substantial number of ineligible mortgage loans, or a delay or

failure in collecting expected recoveries, the possibility that

loss reserve estimates are not adequate to cover potential claims,

a disruption in the cash flow from our subsidiaries or an inability

to access capital and our exposure to significant fluctuations in

liquidity and asset values within the global credit markets as a

result of collateral posting requirements, our ability to fully

implement our strategic plan, including our ability to maintain

high stable ratings for National and generate investor demand for

our financial guarantees, deterioration in the economic environment

and financial markets in the United States or abroad, and adverse

developments in European sovereign credit performance, real estate

market performance, credit spreads, interest rates and foreign

currency levels, the effects of governmental regulation, including

insurance laws, securities laws, tax laws, legal precedents and

accounting rules; and uncertainties that have not been identified

at this time. These and other factors that could affect financial

performance or could cause actual results to differ materially from

estimates contained in or underlying the Company’s forward-looking

statements are discussed under the “Risk Factors” section in MBIA

Inc.’s most recent Annual Report on Form 10-K and Quarterly Report

on Form 10-Q, which may be updated or amended in the Company’s

subsequent filings with the Securities and Exchange Commission. The

Company cautions readers not to place undue reliance on any such

forward-looking statements, which speak only to their respective

dates. The Company undertakes no obligation to publicly correct or

update any forward-looking statement if it later becomes aware that

such result is not likely to be achieved.

MBIA Insurance Corporation is a wholly owned subsidiary of MBIA

Inc., which is headquartered in Purchase, New York. MBIA Inc. is a

holding company whose subsidiaries provide financial guarantee

insurance for the public and structured finance markets. Please

visit MBIA's website at www.mbia.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160929005391/en/

For MBIA Insurance CorporationGreg Diamond, 914-765-3190Investor

and Media Relationsgreg.diamond@mbia.com

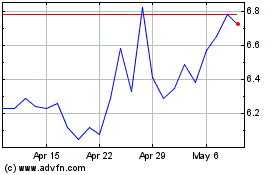

MBIA (NYSE:MBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

MBIA (NYSE:MBI)

Historical Stock Chart

From Apr 2023 to Apr 2024