Current Report Filing (8-k)

September 28 2016 - 4:56PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 28, 2016

Compass Minerals International, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-31921

|

|

36-3972986

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer of

Identification Number)

|

|

|

|

|

|

|

|

9900 West 109

th

Street, Suite 100

Overland Park, KS 66210

|

|

66210

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(913) 344-9200

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240. 13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On September 28, 2016, Compass Minerals International, Inc. (the “Company”) incurred a new $450 million Incremental Tranche A-1 Term Loan (the “Tranche A-1 Term Loan”) with certain lenders pursuant to an amendment to the Credit Agreement, dated April 20, 2016 (the “Credit Agreement”), among the Company, Compass Minerals Canada Corp. and Compass Minerals UK Limited, JPMorgan Chase Bank, N.A., as administrative agent, and the lenders party thereto. Immediately prior to the incurrence of the Tranche A-1 Term Loan, the Credit Agreement was amended with the consent of the requisite lenders to, among other things, permit up to $450 million of incremental loans to be incurred pursuant to the “dollar-based” incremental loans basket under the Credit Agreement.

Proceeds of the Tranche A-1 Term Loan are expected to be used to fund the acquisition of the remaining issued and outstanding capital stock of Produquímica Indústria e Comércio S.A. not currently owned by the Company, and such acquisition is expected to close in early October 2016, subject to the satisfaction or waiver of customary closing conditions, including regulatory approvals. The Tranche A-1 Term Loan is subject to the same security, covenants and maturity date (July 1, 2021) as the Company’s existing term loan under the Credit Agreement. The interest rate of the Tranche A-1 Term Loan is LIBOR plus 2.00%.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the Incremental Amendment, dated September 28, 2016, a copy of which is attached as Exhibit 10.1 and which is incorporated herein by reference.

This Current Report on Form 8-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation statements about the expected acquisition of the remaining Produquímica capital stock and the timing of the closing date. The company uses words such as “may,” “would,” “could,” “should,” “will,” “likely,” “expect,” “anticipate,” “believe,” “intend,” “plan,” “forecast,” “outlook,” “project,” “estimate” and similar expressions suggesting future outcomes or events to identify forward-looking statements or forward-looking information. These statements are based on the Company’s current expectations and involve risks and uncertainties that could cause the Company’s actual results to differ materially. The differences could be caused by a number of factors, including the risk that regulatory approvals required for the acquisition are not obtained. For further information on risks and uncertainties that may affect the company’s business, see the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the company’s Annual Report on Form 10-K for the year ended December 31, 2015 and its Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016 and June 30, 2016 filed with the SEC. The Company undertakes no obligation to update any forward-looking statements made in this Current Report on Form 8-K to reflect future events or developments. Because it is not possible to predict or identify all such factors, this list cannot be considered a complete set of all potential risks or uncertainties.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information contained in Item 1.01 is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

The information contained in Item 1.01 is incorporated by reference herein. On September 28, 2016, the Company issued a press release regarding the Tranche A-1 Term Loan, a copy of which is attached hereto as Exhibit 99.1.

The information contained in this Item 7.01 and Exhibit 99.1 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

10.1

|

|

Incremental Amendment, dated September 28, 2016, to the Credit Agreement, dated April 20, 2016, among Compass Minerals International, Inc., Compass Minerals Canada Corp. and Compass Minerals UK Limited, JPMorgan Chase Bank, N.A., as administrative agent, and the lenders party thereto.

|

|

99.1

|

|

Press Release issued by Compass Minerals International, Inc. on September 28, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

COMPASS MINERALS INTERNATIONAL, INC.

|

|

Date: September 28, 2016

|

By:

|

/s/ Matthew J. Foulston

|

|

|

|

Name: Matthew J. Foulston

|

|

|

|

Title: Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

10.1

|

|

Incremental Amendment, dated September 28, 2016, to the Credit Agreement, dated April 20, 2016, among Compass Minerals International, Inc., Compass Minerals Canada Corp. and Compass Minerals UK Limited, JPMorgan Chase Bank, N.A., as administrative agent, and the lenders party thereto.

|

|

99.1

|

|

Press Release issued by Compass Minerals International, Inc. on September 28, 2016.

|

|

|

|

|

|

|

|

|

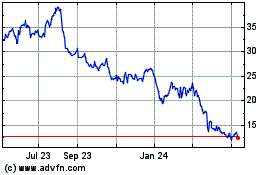

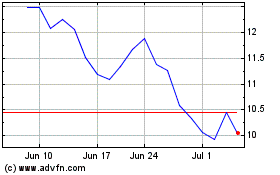

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Compass Minerals (NYSE:CMP)

Historical Stock Chart

From Apr 2023 to Apr 2024