Procter & Gamble Sets Exchange Ratio for Its Stock in Sale of Beauty Business to Coty

September 28 2016 - 10:08AM

Dow Jones News

By Joshua Jamerson

Procter & Gamble Co. (PG) finalized the terms under which

its shareholders can essentially swap P&G shares for stock in

Coty Inc., as the consumer-products giant moves toward selling Coty

the speciality beauty business it built up a decade ago.

P&G is offering roughly 409.7 million shares of Galleria

Co., the wholly-owned subsidiary it created to facilitate the Coty

transaction, in exchange for P&G shares. The company will

transfer the assets and liabilities of most of its specialty beauty

brands business to Galleria, which will later merge with Coty.

P&G shareholders who tender their shares of P&G common

stock in the exchange offer will receive approximately 3.9033

shares of Galleria, which are equal to shares of Coty class A

common stock, subject to receipt of cash in lieu of fractional

shares, for each share of P&G stock exchanged.

The final exchange ratio details outlined Wednesday are part of

a complicated $13 billion deal P&G struck with Coty in July.

Procter & Gamble is giving up on brands like Wella shampoos,

Clairol hair dye and CoverGirl makeup, segments that distracted

from core areas and hurt its growth. The merger of Galleria and

Coty stock is expected to occur as promptly as practicable after

the exchange offer is complete, P&G has said.

The exchange offer will expire at midnight Eastern time on

Thursday.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

September 28, 2016 09:53 ET (13:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

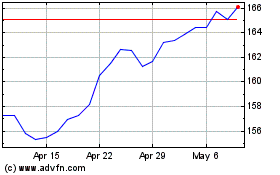

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

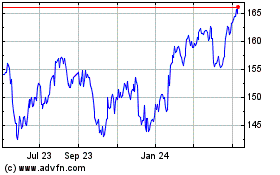

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024