Hanjin Sale Is Possible, Court Says

September 28 2016 - 6:00AM

Dow Jones News

SEOUL—The South Korean bankruptcy court handling the insolvency

proceedings of Hanjin Shipping Co. said Wednesday a sale of the

troubled company is possible.

"The sale of Hanjin is one of the options we're considering. If

we conclude that it's the best way to rehabilitate the company,

we'll do so," Choi Ung-young, a judge and a spokesman for the Seoul

Central District Court, said.

Mr. Choi said the court will make a decision soon, as the value

of Hanjin's ships and its business network could deteriorate with

the passage of time.

Maersk Line, the world's largest container operator and a unit

of Danish conglomerate A.P. Mø ller-Mæ rsk, has indicated it plans

to buy smaller competitors in the future, fanning market

speculation that Hanjin could be an acquisition target.

Hanjin Shipping, the country's biggest operator and the world's

seventh largest in terms of capacity, filed for bankruptcy

protection last month and is under court order to sell its own

ships and returning chartered ships to their owners.

The company has a total of 97 container ships. Of that total, 60

were chartered and 37 owned by Hanjin.

Hanjin's Korean peer Hyundai Merchant Marine Co. will be the

first to look at Hanjin's 37 container vessels. Government

officials have said they would back Hyundai in buying Hanjin

assets, provided such a move would help it stay competitive.

Hyundai Merchant, which is itself in the midst of a creditor-led

restructuring program, said it is exploring all possibilities with

Hanjin but nothing has been decided.

Shares of Hanjin have risen 40% in the past week after Maersk

Chief Executive Sø ren Skou said acquisitions are "the preferred

option" of Maersk investment, instead of building new vessels.

Hanjin officials and Mr. Choi, the court judge, said Wednesday

they haven't been approached by Maersk over a possible takeover of

the company.

Analysts said Maersk would be more interested in buying Hanjin's

vessels rather than the entire company.

Seoul's maritime minister, Kim Young-suk, said Tuesday he

believes Hanjin's corporate value as a going concern is higher than

if it liquidated, although the company's fate is up to the

court.

Write to In-Soo Nam at In-Soo.Nam@wsj.com

(END) Dow Jones Newswires

September 28, 2016 05:45 ET (09:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

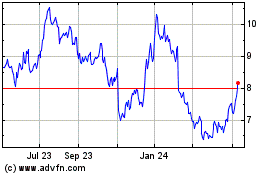

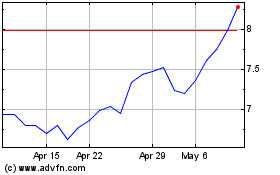

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Apr 2023 to Apr 2024