Nike Revenue and Profit Rise, Though Growth in a Key Indicator Slows--2nd Update

September 27 2016 - 7:54PM

Dow Jones News

By Sara Germano

Nike Inc. reported an 8% jump in quarterly sales Tuesday, but

slowing future demand for its sneakers and apparel fanned

investors' concerns about the sportswear maker's growth

prospects.

The company said world-wide futures orders -- a calculation of

the amount of goods scheduled for delivery within the next six

months -- rose 5% for the period ending January 2017, compared with

9% growth for the same period a year ago.

In the North American region, which comprises the lion's share

of Nike's business, futures orders rose just 1% in the fiscal first

quarter, compared with 14% growth in the year-ago period. Analysts

typically have monitored futures orders as a way to measure demand

for Nike's products.

Shares of Nike fell 2% in after-hours trading to $54.19, after

ending the 4 p.m. session at $55.34.

In a significant shift, Nike finance chief Andy Campion said

Tuesday the company will no longer report futures orders in its

quarterly earnings news releases. They will instead be discussed on

a conference call with analysts and reported in regulatory filings,

he said.

"Futures orders continue to be an important and valuable aspect

of our operating model. That said, the relationship between

reported futures and reported revenue in a given quarter has become

less correlated" as the company sells more items directly to

consumers, Mr. Campion said.

The move marks not only a shift in how Nike reports its results,

but a wider change in retail. Looking to replicate the success of

fast-fashion houses such as H&M and Zara, many manufacturers

are aiming to bring products to market more quickly, and sell those

products directly to consumers, instead of through wholesale

partners.

At its investor day last fall, Nike said it hoped to more than

double its annual direct-to-consumer sales to $16 billion by

2020.

Before Tuesday's earnings report, Nike had been contending with

a rapidly changing sporting-goods industry, including the

bankruptcy and liquidation of major retail partners, including The

Sports Authority Inc., among others.

Nike also has been facing increasing pressure from rivals Under

Armour Inc. and Adidas AG in its domestic market. Analysts have

noted both companies have grabbed market share from Nike, the

overall leader, in crucial categories such as basketball and casual

footwear.

Nike Chief Executive Mark Parker acknowledged the company has

faced stiffer competition from upstart competitors, as the athletic

look has influenced apparel and footwear styles.

While this summer featured two premier sports events in the

Olympic Games and the European soccer championship, "the look of

sport continues to influence everyday styles around the world. As a

result, new brands are entering into the athletic landscape," Mr.

Parker said.

Mr. Campion said North American sales should outpace futures

orders growth in the region for the balance of the year, as Nike

expects stronger sell-through to consumers.

In the first quarter, Nike's revenue was $9.06 billion as North

American sales grew 6.1% to $4.03 billion. Overall, Nike reported a

profit of $1.25 billion, or 73 cents a share, up from $1.18

billion, or 67 cents a share, a year earlier. Analysts had expected

per-share profit of 56 cents.

--Tess Stynes contributed to this article.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

September 27, 2016 19:39 ET (23:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

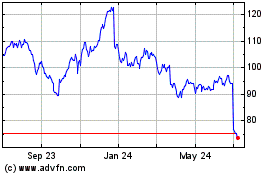

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

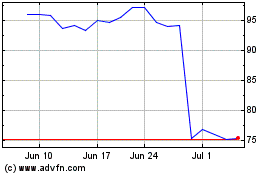

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024