UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF SEPTEMBER 2016

COMMISSION FILE NUMBER

000-51576

ORIGIN AGRITECH LIMITED

(Translation of registrant's name into English)

No. 21 Sheng Ming Yuan Road, Changping

District, Beijing 102206

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes

¨

No

x

If "Yes" is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-________.

Entry into Material Agreement –

Sale of Assets

General

On September 26, 2016,

Origin Agritech Limited, a British Virgin Islands company (“Origin Agritech”), entered into a Master Transaction Agreement

(“Transaction Agreement”), along with its controlled companies Beijing Origin Seed Limited (“Beijing Origin”),

Denong Zhengcheng Seed Limited (“Denong”), Changchun Origin Seed Technology Development Limited, (“Changchun

Origin”), Linze Origin Seed Limited (“Linze Origin”), each of Beijing Origin, Denong, Changchun Origin and Linze

Origin being a company incorporated under the Laws of the PRC and Beijing Shihui Agricultural Development Co., Limited, a company

incorporated under the Laws of the PRC (“Buyer”), for the purpose of selling its commercial seed production and distribution

assets and certain other assets in the PRC.

Origin

Agritech received a proposal from the Buyer on May 20, 2016, which was amended on July 16, 2016, for the purchase of the aforementioned

subsidiaries and assets.

The Buyer is a company controlled by Mr. Gengrui Han, brother of

the Dr. Han, Chairman of the Board of Origin Agritech, and Zhengzhou Advanced Industrial Investment Fund Partnership Enterprise

(Limited Partnership). In response to the initial letter on May 27, 2016, the Board of Directors formed a special committee consisting

of three independent directors, Mr. David W. Bullock, Mr. Min Tang and Mr. Michael Walter Trimble, with Mr. Bullock as its chairman

(“Special Committee), to (A) consider and evaluate the Buyer’s proposal and determine whether it is in the best interest

of the shareholders of the Origin Agritech, (B) negotiate on behalf of the Board of Directors the terms of the transactions contemplated

by the Buyer’s proposal, and (C) consider other alternative proposals or competing offers and make recommendations to the

Board of Directors. The Special Committee retained Duff & Phelps as its independent financial advisor. The transaction was

negotiated by the Special Committee and the Buyer, and the final terms for the Transaction Agreement and related agreements were

agreed upon during September 2016. The Transaction Agreement and the transaction was approved by the Special Committee and the

Board of Directors on September 26, 2016.

The overall transaction

will be conducted in two steps. The first step will be the sale of the equity held by Beijing Origin of each of the Denong, Changchun

Origin and Linze Origin companies, and the second step will be the sale of a company holding the Zhengzhou Branch Assets and the

office building in Beijing. Beijing Origin will also orchestrate with the parties that own minor percentages of Changchun Origin,

not now owned by Beijing Origin, to purchase their ownership equity amounts so that the Buyer acquires from Beijing Origin all

of the equity of Changchun Origin in the first step of the transaction. The second step requires Beijing Origin to effect a restructuring

to form a company to own the current office building located in Beijing, PRC and certain other assets (together the “Zhengzhou

Branch Assets”), which company will be sold to the Buyer so as to transfer the building and assets to the Buyer. By separate

agreement the Buyer will enter into license arrangements to pay Beijing Origin a royalty for the present and future seed portfolio

and a technology access fee for the research and development effort that Beijing Origin will provide going forward in the areas

of product discovery and development, hybrid registration, trait integration and intellectual property protection.

Objective of the Proposed Transaction

The objective of the transaction,

taken together, is to sell to the Buyer the corn seed production and distribution assets, the Beijing office building and generally

the business of commercial corn seed production and sales now operated by Origin Agritech in the PRC through Beijing Origin. Origin

Agritech will retain the current seed breeding and biotech operations located in the PRC, including the businesses of Beijing Origin

State Harvest Biotechnology Limited (“Origin Biotechnology”), Henan Origin Cotton Technology Development Limited (“Henan

Origin”) and the joint venture company of Xinjiang Originbo Seed Limited (“Xinjiang Origin”). The retained companies

cover the biotech research facilities, which include modern laboratories, extensive field testing networks and off-season winter

nursery in Hainan, so as to be able to expand and pursue germplasm and trait licensing opportunities, and the seed intellectual

property assets of the company. Through the retained ownership of Xinjiang Origin, the company will maintain its “Green Pass”

status, providing the company with the competitive advantage of introducing new hybrid varieties to the Chinese market under an

expedited government approval process. Origin Agritech will also retain the management persons and staff operating the biotech

research and plant breeding activities, who will continue to be located in the PRC. The transaction is designed to further orient

Origin Agritech becoming a multi-national seed development company, capitalizing on its biotechnology assets and skills and to

allow the company to focus on strategic partnerships both within China and around the globe. The future focus of Origin Agritech

will be expansion into the United States and other markets through licensing its biotech traits and seed germplasm characteristics

and continuing to develop both genetically and non-genetically modified corn and other seeds.

We believe that the Buyer

will be a strong strategic partner, which has a proven track record in seed production and distribution to farmers, suppliers and

agriculture-related enterprises in the PRC. The Buyer, we believe will position the commercial seed production and sales business

for long-term success in the PRC, including in their product range the Beijing Biotechnology and Beijing Origin seeds, while allowing

Origin to focus on growing its biotech portfolio and emerging product pipeline.

The net proceeds from

the transaction will strengthen the balance sheet and enable the Origin Agritech to focus on biotechnology trait and seed germplasm

research and development.

Sale Terms

At the first closing,

the Buyer will pay to Beijing Origin RMB 200 million (approximately US$30,000,000), for the 98.58% equity ownership interest in

Denong, 100% equity ownership interest Changchun Origin and 100% equity ownership interest in Linze Origin (together the “VIE

Subsidiaries”). The first closing is conditioned (among other things) on Beijing Origin acquiring the current minority percentage

ownership of Changchun Origin that is held by a third party, so as to deliver to the Buyer 100% of the equity ownership of Changchun

Origin. The minority interest of Denong will continue to be held by two third parties and will not be sold to the Buyer. At the

second closing, the Buyer will pay to Beijing Origin RMB 190 million (approximately US$28,500,000) and the RMB10 million (approximately

US$1,500,000) deposit will be released for the 100% ownership interest in an entity formed by Beijing Origin as part of its reorganization

to hold the Zhengzhou Branch Assets. The total consideration to be paid to Beijing Origin will be RMB 400 million (approximately

US$60,000,000).

The Buyer will assume

the outstanding liabilities of the VIE Subsidiaries and the Zhengzhou Branch Assets, except for certain outstanding bank loans.

The current bank loans aggregating RMB 90 million (approximately US$ 13,500,000) will be transferred to Beijing Origin, subject

to the approval and agreement of the bank lenders. If the bank loans cannot be transferred, then the purchase price will be reduced

for the outstanding amount due, but any guarantees provided by Dr. Han Gengchen will be terminated without liability to Beijing

Origin or Dr. Han.

Beijing Origin has agreed

to use its reasonable best efforts (i) to complete the restructuring of the company so as to be able to complete the second closing,

to acquire the portion of Changchun Origin that it does not own, and to transfer certain assets, the Linze Branch Assets, to Linze

Origin. Additionally, all intercompany accounts between Beijing Origin and its retained affiliates, on the one hand, and the VIE

Subsidiaries, on the other hand, regardless of any due dates, existing prior to the first closing will be paid in full before or

at the first closing. The Buyer and Beijing Origin will negotiate separate license agreements regarding the Buyer’s continued

use of the trademarks and trade names owned by Beijing Origin and licensing designated seeds developed by Beijing Origin or Beijing

Biotechnology. Origin Agritech and Beijing Origin are jointly responsible for all transfer, documentary, sales, use, stamp, recording,

value added, registration, conveyancing taxes and fees in connection with the sale of the various types of assets to the Buyer.

Beijing Origin has agreed

that for ten years after the closing, without the written consent of the Buyer, it and its affiliated entities will not directly

conduct any business in the distribution of crop seeds in the PRC, except for the distribution of crop seeds in Xinjiang province

by Xinjiang Origin. This limitation will not prohibit Origin Agritech, Beijing Origin or Beijing Biotechnology from conducting

the businesses of crop seed licensing, transgenic materials licensing, transgenic traits licensing or other activities related

to its intellectual property in the PRC. This non-competition provision will terminate if more than 50% of the equity interest

or assets of Origin Agritech are acquired by an independent third party during the restrictive period.

To be able to complete

the transaction, Beijing Origin will be required to obtain waivers of a right of first refusal to purchase the Denong shares being

sold to the Buyer held by Leshan Agricultural Science Institute and Sichuan Neijiang Agricultural Science Institute, each of whom

currently own a small percentage of the shares of Denong.

As a deposit against the

purchase price and for partial payment of specified termination fees, the Buyer will deposit with Beijing Origin the sum of RMB10

million (approximately US$1,500,000) at the time of the signing of the Transaction Agreement.

Shareholder Approval

Origin Agritech requires

shareholder approval under the governing corporate law of the British Virgin Islands to complete the transaction because it represents

the sale of a significant part of its currently held total assets. Origin Agritech has agreed with the Buyer to hold a shareholder

meeting as soon as practicable for the purpose of obtaining shareholder approval and adoption of the Transaction Agreement and

the other transactions contemplated to complete the sale of assets. It is estimated that the shareholder approval will be obtained

during the first calendar quarter of 2017, which will require Origin Agritech to have filed its Form 20-F annual report for fiscal

year 2016 and a proxy statement explaining the transaction and the financial and business consequences of the transaction with

the United States Securities and Exchange Commission and to have held the shareholder meeting in accordance with the laws of the

British Virgin Islands and its Memorandum of Association.

Representations and Warranties; Indemnification

Beijing Origin is making

certain limited representations and warranties to the Buyer, including those about (i) the corporate existence and power of the

Beijing Origin and each of the VIE Subsidiaries to enter into the various transactions, (ii) the corporate authorization of the

various Origin parties to enter into the various transactions, (iii) having required or obtaining all government authorizations

so as to be able to consummate the transactions contemplated by the Transaction Agreement, (iv) the transactions not contravening

any other agreements of Beijing Origin or the VIE Subsidiaries that would result in a loss of the benefits that the Buyer is purchasing,

and (v) the registered capital of the VIE Subsidiaries having been fully paid up and the stated ownership by Beijing Origin is

as disclosed. Origin Agritech and Beijing Origin are not providing any indemnification for their representations and warranties.

The

Buyer is giving to Beijing Origin similar corporate representations as Beijing Origin is giving to it. Additionally, the Buyer

is representing that it has the immediately available funds to pay the total purchase price, there is no litigation that would

affect its ability to consummate the acquisitions, and it is the only party owing a finder’s fee in respect of the transaction,

which is payable to

Go & Company (HK) Limited.

Closing Actions

The Transaction Agreement

provides for typical conditions to closing, including the continuance of the businesses of the VIE Subsidiaries prior to their

sale, there being no governmental prohibition to the transactions being consummated and having all approvals for the sale transaction,

there being no breaches of representations and warranties that have not been waived, and obtaining shareholder approval of the

Transaction Agreement and the transactions contemplated thereby.

Additionally, prior to

consummation of the transaction under the Transaction Agreement, Origin Agritech and Beijing Origin have committed to undertake

a number of deal specific actions. Beijing Origin is obligated to use its reasonable efforts to restructure its operations to be

able to sell the Zhengzhou Branch Assets to the Buyer and to enter into an agreement to acquire the Changchun Origin shares that

it does not currently own. Beijing Origin also must transfer certain identified assets to Linze Origin prior to the sale of that

VIE Subsidiary. Origin Agritech is committed to holding a meeting of its shareholders to approve the Transaction Agreement and

related transactions and in connection with that meeting to cause the Board of Directors to recommend to the shareholders their

approval of the transactions contemplated by the Transaction Agreement. Except as permitted by the terms of the Transaction Agreement,

Origin Agritech and its subsidiaries are prohibited, directly or indirectly, by its actions or those of its representatives, (i)

to solicit, initiate or knowingly take any action to facilitate or encourage the submission to it of a competing proposal to acquire

the company or the assets being sold under the Transaction Agreement, (ii) to enter into negotiations or furnish information for

a competing proposal, or (iii) to fail to make, withdraw or modify in a manner adverse to the Buyer the Origin Agritech Board of

Director recommendation to the shareholders to approve the Transaction Agreement.

Notwithstanding the obligation

limiting its actions with respect to a competing proposal to that of the Transaction Agreement, so long as they are consistent

with the fiduciary duties under British Virgin Islands law, the Board of Directors of Origin Agritech may engage in negotiations

or discussions with third parties that are expected to lead to a superior transaction to that if the Transaction Agreement, all

of which information is also provided to the Buyer. The Board of Directors of Origin Agritech also may also make a recommendation

against approval of the transactions with the Buyer and terminate the Transaction Agreement under the same fiduciary standard.

The parties to the Transaction

Agreement have committed to the typical mutual agreements such as consulting with one another about public announcements, making

governmental and other filings to be able to consummate the transaction, and using their reasonable best efforts to take all necessary

actions to achieve the objectives of the transaction.

Termination and Break Up Fees

Concurrently with the

execution and delivery of the Transaction Agreement, the Buyer will pay to Beijing Origin the cash amount of RMB 10 million (approximately

US$1,500,000), which is a portion of the purchase price and also the Termination Fee in favor of Beijing Origin.

If the Transaction Agreement

is terminated by Beijing Origin by reason of a breach of a representation, warranty or covenant by the Buyer, then the deposit

will be retained by Beijing Origin, and the Buyer will pay an additional sum of RMB 5 million (approximately US$750,000) to Beijing

Origin. If the Transaction Agreement is terminated because (i) Origin Agritech accepts a superior offer for the company or the

assets, (ii) the Board of Directors of Origin Agritech recommends that its shareholder approve a different transaction, (iii) Beijing

Origin breaches its representations, warranties or covenants, or (iv) a competing proposal to that of the Transaction Agreement

is announced and within 12 months the competing proposal is consummated, then the deposit amount will be returned to the Buyer,

and Beijing Origin will pay to the Buyer an additional sum of RMB 10 million (approximately US$1,500,000).

If the Transaction Agreement

is terminated by mutual agreement of the parties or by reason of the transactions not being completed by June 29, 2017, a governmental

authority has acted to prohibit the transactions, or Origin Agritech fails to obtain the required shareholder approval, then the

parties will terminate the agreement without penalty to any party.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

ORIGIN AGRITECH LIMITED

|

|

|

|

|

|

|

|

By

|

/S/ William S. Neibur

|

|

|

|

|

|

|

|

Name: William S. Neibur

|

|

|

|

Title: President and CEO

|

|

|

|

|

|

|

Date: September 27, 2016

EXHIBITS

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

99.1

|

|

Press release announcing the sale of designated assets, dated September 27, 2016

|

|

|

|

|

|

99.2

|

|

Form of Master Transaction Agreement, dated September 26, 2016, relating to the sale of corn seed commercial production and distribution assets

|

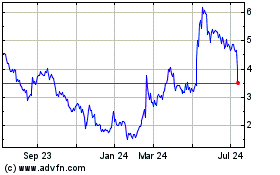

Origin Agritech (NASDAQ:SEED)

Historical Stock Chart

From Mar 2024 to Apr 2024

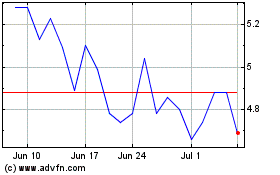

Origin Agritech (NASDAQ:SEED)

Historical Stock Chart

From Apr 2023 to Apr 2024