Current Report Filing (8-k)

September 27 2016 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 26, 2016

|

INDOOR HARVEST CORP.

|

|

(Exact name of registrant as specified in its charter)

|

|

Texas

|

|

333-194326

|

|

45-5577364

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

5300 East Freeway Suite A

Houston, Texas

|

|

77020

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

713-410-7903

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

On September 26, 2016 (the “Closing Date”), Indoor Harvest Corp (the “Company”, “we”, “us”, “our”) entered into a Promissory Note and Warrant Purchase Agreement with Chuck Rifici Holdings, Inc, (the “Buyer”) a Canadian Corporation. The note consisted of $225,500 in aggregate principal amount including $204,000 actual payment of purchase price (the “Purchase Price”) plus a 10% original issue discount (the “Principal Amount”). The Warrant Purchase Agreement consisted of an aggregate total of 250,000 common stock warrants to purchase common stock for $0.30 for a period of 12 months, to the Buyer, in accordance with and in reliance upon the exemption from securities registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and/or Regulation S of the Securities Act of 1933, as amended for the above issuances to non US citizens or residents.

Convertible Note

On the Closing Date, the Company issued Notes of aggregate $225,500 in face value, which will, by their principal terms,

|

|

·

|

Carry an interest (the “Interest”) on the unpaid principal amount at the rate of 8% per annum. Interest all commence accruing on the date that the Note is fully funded and shall be computed on the basis of a 365-day year and the actual number of days elapsed;

|

|

|

|

|

|

|

·

|

Mature on March 23, 2017 and may be prepaid in whole or in part except otherwise explicitly set forth in the Note. If the Borrower exercises its right to prepay or repay the Note, the Borrower shall make payment to the Holder of an amount in cash (the “Optional Prepayment Amount”) equal to the sum of 115% multiplied by the Principal Amount plus accrued and unpaid interest on the Principal Amount to the Optional Prepayment Date plus Default Interest, if any; and

|

|

|

|

|

|

|

·

|

Upon an Event of Default, the per share conversion price into which any Principal Amount and interest under this Note shall be convertible into shares of Common Stock, at the option of the holder, hereunder (the “Conversion Price”) shall be equal to 65% multiplied by the lowest sales price of the Common Stock in a public market during the ten (10) consecutive Trading Day period immediately preceding the Trading Day that the Company receives a Notice of Conversion.

|

Important Notice regarding the Notes

The Notes have been included as exhibits to this Current Report on Form 8-K to provide investors and security holders with information regarding their terms. They are not intended to provide any other financial information about the Company. The representations, warranties and covenants contained in the Notes were made only for purposes of those agreements and as of specific dates; were solely for the benefit of the parties to the Notes; may be subject to limitations agreed upon by the parties, including being qualified by disclosures made for the purposes of allocating contractual risk between the parties to the Notes instead of establishing these matters as facts; and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any description thereof as characterizations of the actual state of facts or condition of the Company. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Notes, which subsequent information may or may not be fully reflected in public disclosures by the Company.

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

On March 22, 2016 (the “Closing Date”), Indoor Harvest Corp (the “Company”, “we”, “us”, “our”) entered into a securities purchase agreement (the “Securities Purchase Agreement”) with Firstfire Global Opportunities Fund, LLC, a Delaware limited liability Company and Rockwell Capital Partners Inc, a Delaware corporation, (the “Buyers”) relating to the issuance and sale (the “Offering”) of (i) notes (the “Notes”) of $272,500 in aggregate principal amount including $250,000 actual payment of purchase price (the “Purchase Price”) plus a 9% original issue discount (the “Principal Amount”), and an aggregate total of 50,000 shares of common stock of the Company, par value per share $0.001 (the “Common Stock”), to the Buyers, in accordance with and in reliance upon the exemption from securities registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and/or Rule 506 of Regulation D as promulgated by the United States Securities and Exchange Commission under the Securities Act.

On September 23, 2016, the maturity date under the Notes, the then aggregate outstanding principal amount of $406,069 came due under the Notes and the Company was unable to make the required payments. As a result, the Company is in default under the Notes. The Company received notices from the Buyers providing formal notice that an Event of Default, as defined in the Notes, had occurred. Pursuant to the Notices, the Holders demand payment of the Note’s principal amount at the Mandatory Default Amount, which is defined as 145% of the outstanding principal amount of the Note, in addition to the payment of all other amounts, costs, expenses and liquidated damages due in respect of this Note. On September 27, 2016, the Company made a cash payment of $203,441 to Rockwell Capital Partners Inc to satisfy the principal and interest of the Rockwell note. No common stock conversions took place under the Rockwell note.

FirstFire Global Opportunities Fund, LLC issued a notice of conversion of the shares described in Item 3.02 below, and, to the extent that the Event of Default remains uncured, interest on the principal amount that remains outstanding equal to 15% per annum. On September 26, 2016, the Company received a notice of conversion of FirstFire of $33,000 of the amount due under its Note, calculated pursuant to this provision. As of the date of this Current Report, the Company believes the Mandatory Default Amount due to FirstFire to be $170,351. Further, amounts due under the FirstFire Note may be converted at the election of the Holder into shares of the Company’s common stock at 45% multiplied by the lowest sales price of the Common Stock in a public market during the ten (10) consecutive Trading Day period immediately preceding the Trading Day that the Company receives a Notice of Conversion.

Item 3.02 Unregistered Sales of Equity Securities

Pursuant to the terms of the Securities Purchase Agreements dated March 22, 2016 between the Company and FirstFire Global Opportunities Fund, LLC, the Company has authorized the issuance an aggregate amount of 383,721 shares of the Company’s common stock, par value $0.001 (“Common Stock”), to the Holders on September 26, 2016 related to the failure to repay the Notes within six months of their issuance.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the date indicated.

|

|

INDOOR HARVEST CORP.

|

|

|

|

|

|

|

Date: September 27, 2016

|

By:

|

/s/ Chad Sykes

|

|

|

|

|

Chad Sykes

|

|

|

|

|

Chief Executive Officer and Director

|

|

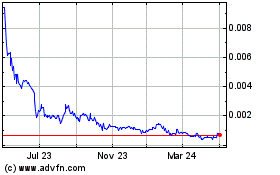

Indoor Harvest (PK) (USOTC:INQD)

Historical Stock Chart

From Mar 2024 to Apr 2024

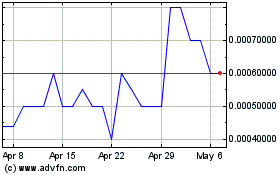

Indoor Harvest (PK) (USOTC:INQD)

Historical Stock Chart

From Apr 2023 to Apr 2024