Boston Scientific to Buy EndoChoice

September 27 2016 - 8:40AM

Dow Jones News

Medical-devices company Boston Scientific Corp. on Tuesday said

it agreed to buy EndoChoice Holdings Inc. for roughly $210 million,

expanding its endoscopy business as sales of some products have

slowed.

Boston Scientific said it would pay $8 a share in cash for

EndoChoice, a 90% premium to its closing price of $4.22 a share on

Monday.

Boston Scientific, based in Marlborough, Mass., has diversified

its product offerings in recent years to help pad softening sales

in some bread-and-butter areas, such as pacemakers and implanted

defibrillators. In July, the company raised its earnings outlook

amid better-than-expected revenue. In its endoscopy business, which

EndoChoice will become part of, sales rose 11% in the June quarter

to $361 million.

Georgia-based EndoChoice, which posted sales of $75 million in

the 12 months ended June 30, makes endoscopic imaging systems,

devices and infection-control products.

Boston Scientific said it expects to complete the acquisition in

the fourth quarter, and that the deal will be neutral to its

adjusted per-share earnings in 2017 and add to profits

thereafter.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

September 27, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

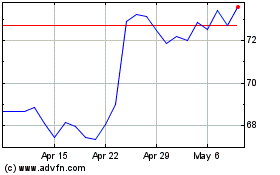

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boston Scientific (NYSE:BSX)

Historical Stock Chart

From Apr 2023 to Apr 2024