Pfizer Scraps Plan to Break Up Company -- WSJ

September 27 2016 - 3:03AM

Dow Jones News

By Jonathan D. Rockoff and Austen Hufford

Pfizer Inc. said Monday it would remain a single company,

deciding not to split into one business focused on patent-protected

drugs and another on cash-rich older products.

The decision means the New York City-based drug company would

remain one of the industry's largest. It projects at least $51

billion in revenue this year from a growing portfolio of cancer

drugs and vaccines as well as a pipeline with copies of expensive

big-molecule drugs.

Pfizer spent at least $600 million preparing for a potential

split, a spokeswoman said. Chief Executive Ian Read said staying

whole was "the best structure," though the company would "preserve

our option to split our businesses should factors materially change

at some point in the future."

Shares of Pfizer fell 1.7% in trading on the New York Stock

Exchange Monday morning.

Mr. Read had been considering a breakup for years as a way to

reduce the big pharmaceutical company's complexity while rewarding

shareholders with the windfall from a split into two stocks. Toward

that goal, Pfizer shed its animal-health business and created two

internal organizations.

Many on Wall Street thought the odds of a companywide breakup

rose after Pfizer agreed late last year to a $150 billion deal for

Allergan PLC. But Pfizer walked away from the tie-up when the Obama

administration moved earlier this year t o deter such tax-lowering

inversion deals.

Meanwhile, the stocks of innovative pharmaceutical companies

rose amid new-drug approvals, while shares in generic- and

specialty-drug companies fell amid questions about their abilities

to grow.

The varying performances suggested hiving off a separate

business focused on off-patent drugs might not generate the level

of market returns that had once been expected, while denying the

new-drugs company all the cash generated by the older

medicines.

That cash funds the company's new sources of growth, according

to Citi Research, including the drug-development work of the

company's laboratories and deals such as the recently announced

agreement to buy Medivation Inc. and its prostate-cancer drug

Xtandi for $14 billion.

Pfizer said in a news release announcing the decision that a

supposed "valuation gap" between the company's market cap and the

value of its individual units has closed over time.

"We believe that by operating two separate and autonomous units

within Pfizer we are already accessing many of the potential

benefits of a split -- sharper focus, increased accountability, and

a greater sense of urgency -- while also retaining the operational

strength, efficiency and financial flexibility of operating as a

single company," Mr. Read said.

Pfizer's new-drugs business had $26.8 billion in sales last year

from the Prevnar pneumonia vaccine, Ibrance breast-cancer treatment

and other patent-protected medicines whose sales are

increasing.

Meantime, the company's older-drugs business notched $22.1

billion in sales mostly from products that have lost patent

protection and therefore are losing sales, such as

cholesterol-lowering drug Lipitor and menopausal drug Premarin.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

September 27, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

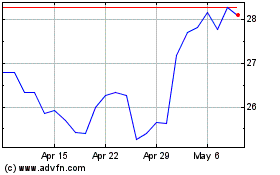

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024