Current Report Filing (8-k)

September 23 2016 - 4:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest

event reported)

September 20, 2016

|

DATARAM CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

Nevada

|

001-08266

|

22-18314-09

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

777 Alexander Road, Suite 100, Princeton, NJ

|

08540

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area

code:

(609) 799-0071

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing

On September 14, 2016,

Dataram Corporation (the “Company”) filed a Quarterly Report on Form 10-Q (the “10-Q”) for the fiscal quarter

ended July 31, 2016 with the Securities and Exchange Commission (“SEC”). The 10-Q reported total stockholders’

equity for the three months ended July 31, 2016 of approximately $2.4 million. This was less than the NASDAQ Stock Market LLC (“NASDAQ”)

stockholder equity requirement of $2.5 million as defined by Rule 5550(b)(1).

As previously reported

in the Company’s Current Report on Form 8-K filed with the SEC on August 5, 2016, the Company closed the sale of 3,699 shares

of its newly designated 0% Series D Convertible Preferred Stock (the “Preferred Shares”) to accredited investors for

gross proceeds to the Company of $503,000 (the “Series D Financing”) on August 4, 2016. Each Preferred Share was sold

at a per share purchase price of $136.00 and converts into 100 shares of common stock, subject to adjustment for dividends and

stock splits.

As a result of the gross

proceeds received from the Series D Financing, the Company believes it is in compliance with NASDAQ’s continued listing requirements,

including Rule 5550(b)(1).

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATARAM CORPORATION

|

|

|

|

|

|

|

|

Dated: September 23, 2016

|

|

|

|

|

|

/s/ David A. Moylan

|

|

|

|

|

|

|

|

David A. Moylan

|

|

|

|

|

|

|

|

Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

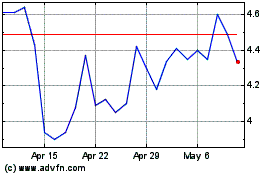

US Gold (NASDAQ:USAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Gold (NASDAQ:USAU)

Historical Stock Chart

From Apr 2023 to Apr 2024