As filed with the Securities and Exchange Commission on September 23, 2016

Registration No. 333-

Registration No. 333-

Registration No. 333-

Registration No. 333-

Registration No. 333-

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

|

|

|

|

|

|

|

|

|

|

|

Duke Energy

Corporation

|

|

Duke Energy

Carolinas, LLC

|

|

Duke Energy

Florida, LLC

|

|

Duke Energy

Indiana, LLC

|

|

Duke Energy

Ohio, Inc.

|

|

Duke Energy

Progress, LLC

|

|

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

North Carolina

|

|

Florida

|

|

Indiana

|

|

Ohio

|

|

North Carolina

|

|

(State or other jurisdiction of incorporation or organization)

|

20-2777218

|

|

56-0205520

|

|

59-0247770

|

|

35-0594457

|

|

31-0240030

|

|

56-0165465

|

|

(I.R.S. Employer Identification Number)

|

550 South Tryon Street Charlotte, NC 28202 (704) 382-3853

|

|

526 South Church Street Charlotte, NC 28202 (704) 382-3853

|

|

229 First Avenue North St. Petersburg, FL 33701 (704) 382-3853

|

|

1000 East Main Street Plainfield, IN 46168 (704) 382-3853

|

|

139 East Fourth Street Cincinnati, OH 45202 (704) 382-3853

|

|

410 South Wilmington Street Raleigh, NC 27601 (704) 382-3853

|

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

|

Stephen G. De May

Senior Vice President, Tax and Treasurer

Duke Energy Corporation

550 South Tryon Street

Charlotte, North Carolina 28202

(704) 382-3853

(Name, address, including zip code, and telephone numbers, including area code, of agent for service)

Please send copies of all notices, orders and communications to:

Robert T. Lucas III, Esq.

Deputy General Counsel and Assistant Corporate Secretary

Duke Energy Corporation

550 South Tryon Street

Charlotte, North Carolina 28202

(704) 382-3853

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement as determined by market conditions and other factors.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, check the following box.

o

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act

of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon

filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

ý

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

See the

definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

Duke Energy Corporation

|

|

Large accelerated filer

|

|

ý

|

|

Accelerated filer

|

|

o

|

|

|

|

Non-accelerated filer

|

|

o

|

|

Smaller reporting company

|

|

o

|

|

Duke Energy Carolinas, LLC

|

|

Large accelerated filer

|

|

o

|

|

Accelerated filer

|

|

o

|

|

|

|

Non-accelerated filer

|

|

ý

|

|

Smaller reporting company

|

|

o

|

|

Duke Energy Florida, LLC

|

|

Large accelerated filer

|

|

o

|

|

Accelerated filer

|

|

o

|

|

|

|

Non-accelerated filer

|

|

ý

|

|

Smaller reporting company

|

|

o

|

|

Duke Energy Indiana, LLC

|

|

Large accelerated filer

|

|

o

|

|

Accelerated filer

|

|

o

|

|

|

|

Non-accelerated filer

|

|

ý

|

|

Smaller reporting company

|

|

o

|

|

Duke Energy Ohio, Inc.

|

|

Large accelerated filer

|

|

o

|

|

Accelerated filer

|

|

o

|

|

|

|

Non-accelerated filer

|

|

ý

|

|

Smaller reporting company

|

|

o

|

|

Duke Energy Progress, LLC

|

|

Large accelerated filer

|

|

o

|

|

Accelerated filer

|

|

o

|

|

|

|

Non-accelerated filer

|

|

ý

|

|

Smaller reporting company

|

|

o

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of Securities

to be registered

|

|

Amount to be

registered

|

|

Proposed maximum

offering price per

|

|

Proposed maximum

aggregate offering

|

|

Amount of

registration fee(1)

|

|

|

|

Common Stock of Duke Energy Corporation, par value $0.001 per share

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities of Duke Energy Corporation

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities of Duke Energy Carolinas, LLC

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities of Duke Energy Florida, LLC

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities of Duke Energy Indiana, LLC

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities of Duke Energy Ohio, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

Debt Securities of Duke Energy Progress, LLC

|

|

|

|

|

|

|

|

|

|

|

|

Total(1)

|

|

|

|

|

|

|

|

$0

|

|

|

-

(1)

-

An

indeterminate number or amount of the securities of each identified class is being registered as may from time to time be sold at unspecified prices.

Separate consideration may or may not be received for securities that are issuable on exercise, conversion or exchange of other securities. The securities registered also include such indeterminate

amounts and numbers of common stock and debt securities as may be issued upon conversion of or exchange for debt securities that provide for conversion or exchange, or pursuant to the anti-dilution

provisions of any such debt securities. Pursuant to Rule 416 under the Securities Act, the shares being registered hereunder include such indeterminate number of shares of common stock as may

be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions. The registrants are relying on Rule 456(b) and

Rule 457(r) under the Securities Act to defer payment of all of the registration fee.

Table of Contents

Explanatory Note

This registration statement contains six (6) separate prospectuses:

1. The

first prospectus relates to the offering by Duke Energy Corporation of its common stock, par value $0.001 per share, and of its debt securities.

2. The

second prospectus relates to the offering by Duke Energy Carolinas, LLC, a direct, wholly owned subsidiary of Duke Energy Corporation, of its debt securities,

including first and refunding mortgage bonds, senior notes and subordinated notes.

3. The

third prospectus relates to the offering by Duke Energy Florida, LLC, an indirect, wholly owned subsidiary of Duke Energy Corporation, of its debt securities,

including first mortgage bonds and unsecured debt securities.

4. The

fourth prospectus relates to the offering by Duke Energy Indiana, LLC, an indirect, wholly owned subsidiary of Duke Energy Corporation, of its debt securities,

including first mortgage bonds and unsecured debt securities.

5. The

fifth prospectus relates to the offering by Duke Energy Ohio, Inc., an indirect, wholly owned subsidiary of Duke Energy Corporation, of its debt securities,

including first mortgage bonds and unsecured debt securities.

6. The

sixth prospectus relates to the offering by Duke Energy Progress, LLC, an indirect, wholly owned subsidiary of Duke Energy Corporation, of its debt securities,

including first mortgage bonds and unsecured debt securities

Information

contained herein relating to each registrant is filed separately by such registrant on its own behalf. No registrant makes any representation as to information relating to any other

registrant or securities issued by any other registrant.

Table of Contents

Prospectus

Duke Energy Corporation

Common Stock

Debt Securities

From time to time, we may offer the securities described in the prospectus separately or together in any combination, in one or more classes or

series, in amounts, at prices and on terms that we will determine at the time of the offering.

We

will provide specific terms of these offerings and securities in supplements to this prospectus. You should read carefully this prospectus, the information incorporated by reference

in this prospectus and any prospectus supplement before you invest. This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

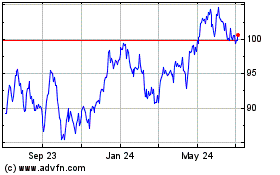

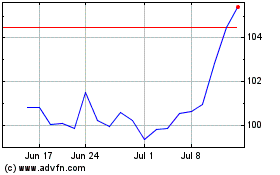

Our

common stock is listed on the New York Stock Exchange, or NYSE, under the trading symbol "DUK."

Investing in our securities involves risks. You should carefully consider the information in the section entitled "Risk Factors" contained

in our periodic reports filed with the Securities and Exchange Commission and incorporated by reference into this prospectus before you invest in any of our securities.

We may offer and sell the securities directly, through agents we select from time to time or to or through underwriters or dealers we select. If we use any

agents, underwriters or dealers to sell the securities, we will name them and describe their compensation in a prospectus supplement. The price to the public of those securities and the net proceeds

we expect to receive from that sale will also be set forth in a prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this

prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is September 23, 2016.

Table of Contents

Table of Contents

Prospectus

REFERENCES TO ADDITIONAL INFORMATION

This prospectus incorporates important business and financial information about us from other documents that are not included in or

delivered with this prospectus. This information is available for you to review at the Securities and Exchange Commission's, or SEC's, public reference room located at 100 F Street, N.E.,

Room 1580, Washington, DC 20549, and through the SEC's website,

www.sec.gov.

You can also obtain those documents incorporated by reference in

this prospectus by requesting them in writing or by telephone from us at the following address and telephone number:

Investor

Relations Department

Duke Energy Corporation

P.O. Box 1005

Charlotte, North Carolina 28201

(704) 382-3853 or (800) 488-3853 (toll-free)

See

"Where You Can Find More Information" in this prospectus.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that Duke Energy filed with the SEC utilizing a "shelf" registration process. Under

the shelf registration process, we are registering an unspecified amount of our common stock and debt securities, and may issue any of such securities in one or more offerings.

This

prospectus provides general descriptions of the securities we may offer. Each time securities are sold, a prospectus supplement will provide specific information about the terms of

that offering. The prospectus supplement may also add, update or change information contained in this prospectus. The registration statement filed with the SEC includes exhibits that provide more

details about the matters discussed in this prospectus. You should read this prospectus, the related exhibits filed with the SEC and any prospectus supplement, together with the additional information

described under the caption "Where You Can Find More Information."

Unless

we have indicated otherwise, or the context otherwise requires, references in this prospectus to "Duke Energy," "we," "us" and "our" or similar terms are to Duke Energy

Corporation and its subsidiaries.

i

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference in this prospectus include forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933 as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on our management's

beliefs and assumptions and can often by identified by terms and phrases that include "anticipate," "believe," "intend," "estimate," "expect," "continue," "should," "could," "may," "plan," "project,"

"predict," "will," "potential," "forecast," "target," "guidance," "outlook," or other similar terminology. Various factors may cause actual results to be materially different than the suggested

outcomes within forward-looking statements; accordingly, there is no assurance that such results will be realized.

In

light of these risks, uncertainties and assumptions, the events described in the forward-looking statements included or incorporated by reference in this prospectus might not occur or

might occur to a different extent or at a different time than described. Forward-looking statements speak only as of the date they are made and we expressly disclaim an obligation to publicly update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

ii

Table of Contents

THE COMPANY

Duke Energy, together with its subsidiaries, is a diversified energy company with operations in three primary business segments:

Regulated Utilities, Commercial Portfolio, and International Energy. Through these businesses, we supply, deliver and process energy for customers in the United States and selected international

markets.

Duke

Energy's Regulated Utilities segment consists of regulated generation and electric and gas transmission and distribution systems. The segment's generation portfolio includes a

balanced mix of energy resources having different operating characteristics and fuel sources. In our regulated electric operations, we serve approximately 7.4 million retail electric customers

in six states in the Southeast and Midwest regions of the United States and we own 50,170 megawatts of generating capacity serving an area of approximately 95,000 square miles with an estimated

population of 24 million people. Regulated Utilities also serves 525,000 retail natural gas customers in southwestern Ohio and northern Kentucky.

Electricity is also sold wholesale to incorporated municipalities, electric cooperative utilities and other load-serving entities.

Duke

Energy's Commercial Portfolio segment builds, develops and operates wind and solar renewable generation and storage and energy transmission projects throughout the United States.

The portfolio includes nonregulated renewable energy, electric transmission, natural gas infrastructure and energy storage businesses.

Duke

Energy's International Energy segment operates and manages power generation facilities and engages in sales and marketing of electric power, natural gas, and natural gas liquids

outside the United States. Its activities principally target power generation in Latin America. Additionally, International Energy owns a 25 percent interest in National Methanol Company

("NMC"), a large regional producer of methyl tertiary butyl ether (a gasoline additive), located in Saudi Arabia. International Energy's ownership interest will decrease to 17.5 percent upon

the successful startup of NMC's polyacetal production facility, which is expected to occur in early 2017. In February 2016, we announced that we had initiated a process to divest our International

Energy business segment, excluding the equity method investment in NMC. We are actively marketing the business. Non-binding offers have been received and are being evaluated. There is no assurance

that this process will result in a transaction and the timing for execution of a potential transaction is uncertain.

We

are a Delaware corporation. The address of our principal executive offices is 550 South Tryon Street, Charlotte, North Carolina 28202-1803 and our telephone number is

(704) 382-3853. Our common stock is listed and trades on the New York Stock Exchange under the symbol "DUK".

The

foregoing information about Duke Energy is only a general summary and is not intended to be comprehensive. For additional information about Duke Energy, you should refer to the

information described under the caption "Where You Can Find More Information."

RISK FACTORS

Investing in our securities involves risks. Before purchasing any securities we offer, you should carefully consider the risk factors

that are incorporated by reference herein from the section captioned "Risk Factors" in our Form 10-K for the year ended December 31, 2015, together with all of the other information

included in this prospectus and any prospectus supplement and any other information that we have incorporated by reference, including filings made with the SEC subsequent to the date hereof. Any of

these risks, as well as other risks and uncertainties, could harm our financial condition, results of operations or cash flows.

1

Table of Contents

USE OF PROCEEDS

Unless otherwise set forth in a prospectus supplement, we intend to use the net proceeds of any offering of securities sold by us for

general corporate purposes, which may include acquisitions, repayment of debt, capital expenditures and working capital. When a particular series of securities is offered, the prospectus supplement

relating to that offering will set forth our intended use of the net proceeds received from the sale of those securities. The net proceeds may be invested temporarily in short-term marketable

securities or applied to repay short-term debt until they are used for their stated purpose.

RATIO OF EARNINGS TO FIXED CHARGES

The ratios of earnings to fixed charges have been calculated using the Securities and Exchange Commission guidelines.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

|

Six Months

Ended

June 30, 2016

|

|

|

|

2015

|

|

2014

|

|

2013

|

|

2012(a)

|

|

2011

|

|

|

Earnings as defined for the fixed charges calculation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax income from continuing operations(b)

|

|

$

|

1,630

|

|

$

|

4,053

|

|

$

|

3,998

|

|

$

|

3,657

|

|

$

|

2,068

|

|

$

|

1,975

|

|

|

Fixed charges

|

|

|

1,071

|

|

|

1,859

|

|

|

1,871

|

|

|

1,886

|

|

|

1,510

|

|

|

1,057

|

|

|

Distributed income of equity investees

|

|

|

18

|

|

|

104

|

|

|

136

|

|

|

109

|

|

|

151

|

|

|

149

|

|

|

Deduct:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred dividend requirements of subsidiaries

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

3

|

|

|

—

|

|

|

Interest capitalized

|

|

|

8

|

|

|

18

|

|

|

7

|

|

|

8

|

|

|

30

|

|

|

46

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total earnings:

|

|

$

|

2,711

|

|

$

|

5,998

|

|

$

|

5,998

|

|

$

|

5,664

|

|

$

|

3,696

|

|

$

|

3,135

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed charges:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on debt, including capitalized portions

|

|

$

|

1,039

|

|

$

|

1,733

|

|

$

|

1,733

|

|

$

|

1,760

|

|

$

|

1,420

|

|

$

|

1,026

|

|

|

Estimate of interest within rental expense

|

|

|

32

|

|

|

126

|

|

|

138

|

|

|

126

|

|

|

87

|

|

|

31

|

|

|

Preferred dividend requirements

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

3

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total fixed charges

|

|

$

|

1,071

|

|

$

|

1,859

|

|

$

|

1,871

|

|

$

|

1,886

|

|

$

|

1,510

|

|

$

|

1,057

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratio of earnings to fixed charges

|

|

|

2.5

|

|

|

3.2

|

|

|

3.2

|

|

|

3.0

|

|

|

2.4

|

|

|

3.0

|

|

|

Ratio of earnings to fixed charges and Preferred dividends combined(c)

|

|

|

2.5

|

|

|

3.2

|

|

|

3.2

|

|

|

3.0

|

|

|

2.4

|

|

|

3.0

|

|

-

(a)

-

Includes

the results of Progress Energy, Inc. beginning on July 2, 2012.

-

(b)

-

Excludes

amounts attributable to noncontrolling interests and income or loss from equity investees.

-

(c)

-

For

the periods presented, Duke Energy Corporation had no preferred stock outstanding

DESCRIPTION OF CAPITAL STOCK

The following summary of our capital stock is subject in all respects to the applicable provisions of the Delaware General Corporation

Law, or the DGCL, and our amended and restated certificate of incorporation. The following discussion is a summary of our amended and restated certificate of incorporation and by-laws and is qualified

in its entirety by reference to those documents.

2

Table of Contents

General

Our total number of authorized shares of capital stock consists of 2 billion shares of common stock, par value $0.001 per share,

and 44 million shares of preferred stock, par value $0.001 per share.

Common Stock

Except as otherwise required by law and subject to the rights of the holders of any class or series of preferred stock, with respect to

all matters upon which shareholders are entitled to vote or to which shareholders are entitled to give consent, the holders of any outstanding shares of common stock vote together as a class, and

every holder of common stock is entitled to cast one vote in person or by proxy for each share of common stock standing in such holder's name on our books. We do not have a classified board of

directors nor do we permit cumulative voting.

Holders

of common stock are not entitled to any preemptive rights to subscribe for additional shares of common stock nor are they liable to further capital calls or to assessments by us.

Subject

to applicable law and the rights, if any, of the holders of any class or series of preferred stock having a preference over the rights to participate with the common stock with

respect to the payment of dividends, holders of our common stock are entitled to receive dividends or other distributions as declared by our board of directors at its discretion.

The

board of directors may create a class or series of preferred stock with dividends the rate of which is calculated by reference to, and payment of which is concurrent with, dividends

on shares of common stock.

Preferred Stock

Our board of directors has the full authority permitted by law, at any time and from time to time, to divide the authorized and

unissued shares of preferred stock into one or more classes or series and, with respect to each such class or series, to determine by resolution or resolutions the number of shares constituting such

class or series and the designation of such class or series, the voting powers, if any, of the shares of such class or series, and the preferences and relative, participating, optional or other

special rights, if any, and any qualifications, limitations or restrictions thereof, of the shares of any such class or series of preferred stock to the full extent now or as may in the future be

permitted by the law of the State of Delaware. The powers, preferences and relative, participating, optional and other special rights of each class or series of preferred stock and the qualifications,

limitations or restrictions thereof, if any, may differ from those of any and all other classes or series at any time outstanding. Except as otherwise required by law, as provided in the certificate

of incorporation or as determined by our board of directors, holders of preferred stock will not have any voting rights and will not be entitled to any notice of shareholder meetings.

Provisions that Have or May Have the Effect of Delaying or Prohibiting a Change in Control

Under our certificate of incorporation, the board of directors has the full authority permitted by Delaware law to determine the voting

rights, if any, and designations, preferences, limitations and special rights of any class or any series of any class of the preferred stock.

The

certificate of incorporation also provides that a director may be removed from office with or without cause. However, subject to applicable law, any director elected by the holders

of any series of

preferred stock may be removed without cause only by the holders of a majority of the shares of such series of preferred stock.

Our

certificate of incorporation requires an affirmative vote of the holders of at least 80% of the combined voting power of the then outstanding shares of stock of all our classes

entitled to vote

3

Table of Contents

generally

in the election of directors, voting together as a single class, to amend, alter or repeal provisions in the certificate of incorporation which relate to the number of directors and

vacancies and newly created directorships.

Our

certificate of incorporation provides that certain actions required or permitted to be taken at an annual or special meeting of shareholders may be effected without a meeting by

written consent of the holders of our common stock, but only if such action is taken in accordance with our certificate of incorporation, our by-laws and applicable law.

Our

by-laws provide that, except as expressly required by the certificate of incorporation or by applicable law, and subject to the rights of the holders of any series of preferred

stock, special meetings of the shareholders or of any series entitled to vote may be called for any purpose or purposes only by the Chairman of the board of directors or by the board of directors. In

addition, special meetings of the shareholders or of any class or series entitled to vote may also be called by our Secretary upon the written request by the holders of record at the time such request

is delivered representing at least fifteen percent (15%) of the outstanding shares of our common stock.

The

provisions of our certificate of incorporation and by-laws conferring on our board of directors the full authority to issue preferred stock, the restrictions on removing directors

elected by holders of preferred stock, the supermajority voting requirements relating to the amendment, alteration or repeal of the provisions governing the number of directors and filling of

vacancies and newly created directorships, and the requirement that shareholders act at a meeting unless all shareholders agree in writing, in certain instances could have the effect of delaying,

deferring or preventing a change in control or the removal of existing management.

DESCRIPTION OF DEBT SECURITIES

Duke Energy will issue the debt securities, whether senior or subordinated, in one or more series under its Indenture, dated as of

June 3, 2008, as supplemented from time to time. Unless otherwise specified in the applicable prospectus supplement, the trustee under the Indenture, or the Indenture Trustee, will be The Bank

of New York Mellon Trust Company, N.A. A copy of the Indenture is an exhibit to the registration statement, of which this prospectus is a part.

Duke

Energy conducts its business through subsidiaries. Accordingly, its ability to meet its obligations under the debt securities is dependent on the earnings and cash flows of those

subsidiaries and the ability of those subsidiaries to pay dividends or to advance or repay funds to Duke Energy. In addition, the rights that Duke Energy and its creditors would have to participate in

the assets of any such subsidiary upon the subsidiary's liquidation or recapitalization will be subject to the prior claims of the subsidiary's creditors. Certain subsidiaries of Duke Energy have

incurred substantial amounts of debt in the operations and expansion of their businesses, and Duke Energy anticipates that certain of its subsidiaries will do so in the future.

Holders

of debt securities will generally have a junior position to claims of creditors of our subsidiaries, including trade creditors, debt holders, secured creditors, taxing

authorities, guarantee holders and any holders of preferred stock. In addition to trade debt, certain of our operating subsidiaries have ongoing corporate debt programs used to finance their business

activities. Unless otherwise specified in a prospectus supplement, the Indenture will not limit the amount of indebtedness or preferred stock issuable by our subsidiaries.

The

following description of the debt securities is only a summary and is not intended to be comprehensive. For additional information you should refer to the Indenture.

4

Table of Contents

General

The Indenture does not limit the amount of debt securities that Duke Energy may issue under it. Duke Energy may issue debt securities

from time to time under the Indenture in one or more series by entering into supplemental indentures or by its board of directors or a duly authorized committee authorizing the issuance.

The

debt securities of a series need not be issued at the same time, bear interest at the same rate or mature on the same date.

Provisions Applicable to Particular Series

The prospectus supplement for a particular series of debt securities being offered will disclose the specific terms related to the

offering, including the price or prices at which the debt securities to be offered will be issued. Those terms may include some or all of the following:

-

•

-

the title of the series;

-

•

-

the total principal amount of the debt securities of the series;

-

•

-

the date or dates on which principal is payable or the method for determining the date or dates, and any right that Duke Energy has to

change the date on which principal is payable;

-

•

-

the interest rate or rates, if any, or the method for determining the rate or rates, and the date or dates from which interest will

accrue;

-

•

-

any interest payment dates and the regular record date for the interest payable on each interest payment date, if any;

-

•

-

whether Duke Energy may extend the interest payment periods and, if so, the terms of the extension;

-

•

-

the place or places where payments will be made;

-

•

-

whether Duke Energy has the option to redeem the debt securities and, if so, the terms of its redemption option;

-

•

-

any obligation that Duke Energy has to redeem the debt securities through a sinking fund or to purchase the debt securities through a

purchase fund or at the option of the holder;

-

•

-

whether the provisions described under "Satisfaction and Discharge; Defeasance and Covenant Defeasance" will not apply to the debt

securities;

-

•

-

the currency in which payments will be made if other than U.S. dollars, and the manner of determining the equivalent of those amounts

in U.S. dollars;

-

•

-

if payments may be made, at Duke Energy's election or at the holder's election, in a currency other than that in which the debt

securities are stated to be payable, then the currency in which those payments may be made, the terms and conditions of the election and the manner of determining those amounts;

-

•

-

the portion of the principal payable upon acceleration of maturity, if other than the entire principal;

-

•

-

whether the debt securities will be issuable as global securities and, if so, the securities depositary;

-

•

-

any changes in the events of default or covenants with respect to the debt securities;

-

•

-

any index or formula used for determining principal, premium or interest;

5

Table of Contents

-

•

-

the terms of the subordination of any series of subordinated debt;

-

•

-

if the principal payable on the maturity date will not be determinable on one or more dates prior to the maturity date, the amount

which will be deemed to be such principal amount or the manner of determining it;

-

•

-

the person to whom any interest shall be payable if other than the person in whose name the debt security is registered on the regular

record date for such interest payment; and

-

•

-

any other terms.

Unless

Duke Energy states otherwise in the applicable prospectus supplement, Duke Energy will issue the debt securities only in fully registered form without coupons, and there will be

no service charge for any registration of transfer or exchange of the debt securities. Duke Energy may, however, require payment to cover any tax or other governmental charge payable in connection

with any transfer or exchange (excluding certain exchanges not constituting a transfer as set forth in the Indenture). Subject to the terms of the Indenture and the limitations applicable to global

securities, transfers and exchanges of the debt securities may be made at The Bank of New York Mellon Trust Company, N.A., 101 Barclay Street, New York, New York 10286 or at any other office

maintained by Duke Energy for such purpose.

The

debt securities will be issuable in denominations of $1,000 and any integral multiples of $1,000, unless Duke Energy states otherwise in the applicable prospectus supplement. Duke

Energy may at any time deliver executed debt securities to the Indenture Trustee for authentication, and the Indenture Trustee shall authenticate such debt securities upon the written request of Duke

Energy and satisfaction of certain other conditions set forth in the Indenture.

Duke

Energy may offer and sell the debt securities, including original issue discount debt securities, at a substantial discount below their principal amount. The applicable prospectus

supplement will describe special United States federal income tax and any other considerations applicable to those securities. In addition, the applicable prospectus supplement may describe certain

special United States federal income tax or other considerations, if any, applicable to any debt securities that are denominated in a currency other than U.S. dollars.

Global Securities

We may issue some or all of the Debt Securities as book-entry securities. Any such book-entry securities will be represented by one or

more fully registered global certificates. We will register each global security with or on behalf of a securities depositary identified in the applicable prospectus supplement. Each global security

will be deposited with the securities depositary or its nominee or a custodian for the securities depositary.

As

long as the securities depositary or its nominee is the registered holder of a global security representing Debt Securities, that person will be considered the sole owner and holder

of the global security and the securities it represents for all purposes. Except in limited circumstances, owners of beneficial interests in a global

security:

-

•

-

may not have the global security or any Debt Securities registered in their names;

-

•

-

may not receive or be entitled to receive physical delivery of certificated Debt Securities in exchange for the global security; and

-

•

-

will not be considered the owners or holders of the global security or any Debt Securities for any purposes under the applicable

securities or the related mortgage or indenture.

We

will make all payments of principal and any premium and interest on a global security to the securities depositary or its nominee as the holder of the global security. The laws of

some jurisdictions

6

Table of Contents

require

that certain purchasers of securities take physical delivery of securities in definitive form. These laws may impair the ability to transfer beneficial interests in a global security.

Ownership

of beneficial interests in a global security will be limited to institutions having accounts with the securities depositary or its nominee, which are called "participants" in

this discussion, and to persons that hold beneficial interests through participants. When a global security representing Debt Securities is issued, the securities depositary will credit on its

book-entry, registration and transfer system the principal amounts of Debt Securities the global security represents to the accounts of its participants. Ownership of beneficial interests in a global

security will be shown only on, and the transfer of those ownership interests will be effected only through, records maintained by:

-

•

-

the securities depositary, with respect to participants' interests; and

-

•

-

any participant, with respect to interests the participant holds on behalf of other persons.

Payments

participants make to owners of beneficial interests held through those participants will be the responsibility of those participants. The securities depositary may from time to

time adopt various policies and procedures governing payments, transfers, exchanges and other matters relating to beneficial interests in a global security. None of the following will have any

responsibility or liability for any aspect of the securities depositary's or any participant's records relating to beneficial interests in a global security representing Debt Securities, for payments

made on account of those beneficial interests or for maintaining, supervising or reviewing any records relating to those beneficial interests:

-

•

-

Duke Energy Corporation;

-

•

-

the applicable trustee; or

-

•

-

any agent of either of them.

Redemption

Provisions relating to the redemption of debt securities will be set forth in the applicable prospectus supplement. Unless Duke Energy

states otherwise in the applicable prospectus supplement, Duke Energy may redeem debt securities only upon notice mailed at least thirty (30), but not more than sixty (60) days before the date

fixed for redemption. Unless Duke Energy states otherwise in the applicable prospectus supplement, that notice may state that the redemption will

be conditional upon the Indenture Trustee, or the applicable paying agent, receiving sufficient funds to pay the principal, premium and interest on those debt securities on the date fixed for

redemption and that if the Indenture Trustee or the applicable paying agent does not receive those funds, the redemption notice will not apply, and Duke Energy will not be required to redeem those

debt securities. If less than all the debt securities of a series are to be redeemed, the particular debt securities to be redeemed shall be selected by the Indenture Trustee by such method as the

Indenture Trustee shall deem fair and appropriate.

Duke

Energy will not be required to:

-

•

-

issue, register the transfer of, or exchange any debt securities of a series during the fifteen (15) day period before the date

the notice is mailed identifying the debt securities of that series that have been selected for redemption; or

-

•

-

register the transfer of or exchange any debt security of that series selected for redemption except the unredeemed portion of a debt

security being partially redeemed.

Consolidation, Merger, Conveyance or Transfer

The Indenture provides that Duke Energy may consolidate or merge with or into, or convey or transfer all or substantially all of its

properties and assets to, another corporation or other entity. Any

7

Table of Contents

successor

must, however, assume Duke Energy's obligations under the Indenture and the debt securities issued under it, and Duke Energy must deliver to the Indenture Trustee a statement by certain of

its officers and an opinion of counsel that affirm compliance with all conditions in the Indenture relating

to the transaction. When those conditions are satisfied, the successor will succeed to and be substituted for Duke Energy under the Indenture, and Duke Energy will be relieved of its obligations under

the Indenture and the debt securities.

Modification; Waiver

Duke Energy may modify the Indenture with the consent of the holders of a majority in principal amount of the outstanding debt

securities of all series of debt securities that are affected by the modification, voting as one class. The consent of the holder of each outstanding debt security affected is, however, required

to:

-

•

-

change the maturity date of the principal or any installment of principal or interest on that debt security;

-

•

-

reduce the principal amount, the interest rate or any premium payable upon redemption of that debt security;

-

•

-

reduce the amount of principal due and payable upon acceleration of maturity;

-

•

-

change the currency of payment of principal, premium or interest on that debt security;

-

•

-

impair the right to institute suit to enforce any such payment on or after the maturity date or redemption date;

-

•

-

reduce the percentage in principal amount of debt securities of any series required to modify the Indenture, waive compliance with

certain restrictive provisions of the Indenture or waive certain defaults; or

-

•

-

with certain exceptions, modify the provisions of the Indenture governing modifications of the Indenture or governing waiver of

covenants or past defaults.

In

addition, Duke Energy may modify the Indenture for certain other purposes, without the consent of any holders of debt securities.

Unless

Duke Energy states otherwise in the applicable prospectus supplement, the holders of a majority in principal amount of the outstanding debt securities of any series may waive, for

that series, Duke Energy's compliance with certain restrictive provisions of the Indenture. The holders of a majority in principal amount of the outstanding debt securities of all series under the

Indenture with respect to which a default has occurred and is continuing, voting as one class, may waive that default for all those series, except a default in the payment of principal or any premium

or interest on any debt security or a default with respect to a covenant or provision which cannot be modified without the consent of the holder of each outstanding debt security of the series

affected.

Events of Default

The following are events of default under the Indenture with respect to any series of debt securities, unless Duke Energy states

otherwise in the applicable prospectus supplement:

-

•

-

failure to pay principal of or any premium on any debt security of that series when due;

-

•

-

failure to pay when due any interest on any debt security of that series that continues for sixty (60) days; for this purpose,

the date on which interest is due is the date on which Duke Energy is required to make payment following any deferral of interest payments by it under the terms of debt securities that permit such

deferrals;

8

Table of Contents

-

•

-

failure to make any sinking fund payment when required for any debt security of that series that continues for sixty (60) days;

-

•

-

failure to perform any other covenant in the Indenture (other than a covenant expressly included solely for the benefit of other

series) that continues for ninety (90) days after the Indenture Trustee or the holders of at least 33% of the outstanding debt securities of that series give Duke Energy and, if such notice is

given by the holders, the Indenture Trustee written notice of the default; and

-

•

-

certain bankruptcy, insolvency or reorganization events with respect to Duke Energy.

In

the case of the fourth event of default listed above, the Indenture Trustee may extend the grace period. In addition, if holders of a particular series have given a notice of default,

then holders of at least the same percentage of debt securities of that series, together with the Indenture Trustee, may also extend the grace period. The grace period will be automatically extended

if Duke Energy has initiated and is diligently pursuing corrective action within the original grace period.

Duke

Energy may establish additional events of default for a particular series and, if established, any such events of default will be described in the applicable prospectus supplement.

If

an event of default with respect to debt securities of a series occurs and is continuing, then the Indenture Trustee or the holders of at least 33% in principal amount of the

outstanding debt securities of that series may declare the principal amount of all debt securities of that series to be immediately due and payable. However, that event of default will be considered

waived at any time after the declaration, but before a judgment or decree for payment of the money due has been obtained if:

-

•

-

Duke Energy has paid or deposited with the Indenture Trustee all overdue interest, the principal and any premium due otherwise than by

the declaration and any interest on such amounts, and any interest on overdue interest, to the extent legally permitted, in each case with respect to that series, and all amounts due to the Indenture

Trustee; and

-

•

-

all events of default with respect to that series, other than the nonpayment of the principal that became due solely by virtue of the

declaration, have been cured or waived.

The

Indenture Trustee is under no obligation to exercise any of its rights or powers at the request or direction of any holders of debt securities unless those holders have offered the

Indenture Trustee security or indemnity against the costs, expenses and liabilities which it might incur as a result. The holders of a majority in principal amount of the outstanding debt securities

of any series have, with certain exceptions, the right to direct the time, method and place of conducting any proceedings for any remedy available to the Indenture Trustee or the exercise of any power

of the Indenture Trustee with respect to those debt securities. The Indenture Trustee may withhold notice of any default, except a default in the payment of principal or interest, or in the payment of

any sinking or purchase fund installment, from the holders of any series if the Indenture Trustee in good faith considers it in the interest of the holders to do so.

The

holder of any debt security will have an absolute and unconditional right to receive payment of the principal, any premium and, within certain limitations, any interest on that debt

security on its maturity date or redemption date and to enforce those payments.

Duke

Energy is required to furnish each year to the Indenture Trustee a statement by certain of its officers to the effect that it is not in default under the Indenture or, if there has

been a default, specifying the default and its status.

9

Table of Contents

Payments; Paying Agent

The paying agent will pay the principal of any debt securities only if those debt securities are surrendered to it. The paying agent

will pay interest on debt securities issued as global securities by wire transfer to the holder of those global securities. Unless Duke Energy states otherwise in the applicable prospectus supplement,

the paying agent will pay interest on debt securities that are not in global form at its office or, at Duke Energy's option:

-

•

-

by wire transfer to an account at a banking institution in the United States that is designated in writing to the Indenture Trustee at

least sixteen (16) days prior to the date of payment by the person entitled to that interest; or

-

•

-

by check mailed to the address of the person entitled to that interest as that address appears in the security register for those debt

securities.

Unless

Duke Energy states otherwise in the applicable prospectus supplement, the Indenture Trustee will act as paying agent for that series of debt securities, and the principal

corporate trust office of the Indenture Trustee will be the office through which the paying agent acts. Duke Energy may, however, change or add paying agents or approve a change in the office through

which a paying agent acts.

Any

money that Duke Energy has paid to the Indenture Trustee or a paying agent for principal, any premium or interest on any debt securities which remains unclaimed at the end of two

years after that principal, premium or interest has become due will be repaid to Duke Energy at its request. After repayment to Duke Energy, holders should look only to Duke Energy for those payments.

Satisfaction and Discharge, Defeasance and Covenant Defeasance

Upon the written request of Duke Energy, the Indenture shall be satisfied and discharged (except as to certain surviving rights and

obligations specified in the Indenture) when:

-

•

-

either all debt securities have been delivered to the Indenture Trustee for cancellation or all debt securities not delivered to the

Indenture Trustee for cancellation are due and payable within one year (at maturity or due to redemption) and Duke Energy has deposited with the Indenture Trustee money or government obligations

sufficient to pay and discharge such debt securities to the applicable maturity or redemption date (including principal, any premium and interest thereon);

-

•

-

Duke Energy has paid or caused to be paid all other sums payable under the Indenture by Duke Energy; and

-

•

-

Duke Energy has delivered to the Indenture Trustee an officers' certificate and an opinion of counsel stating that all conditions

precedent relating to the satisfaction and discharge of the Indenture have been complied with.

The

Indenture provides that Duke Energy may be:

-

•

-

discharged from its obligations, with certain limited exceptions, with respect to any series of debt securities, as described in the

Indenture, such a discharge being called a "defeasance" in this prospectus; and

-

•

-

released from its obligations under certain restrictive covenants especially established with respect to any series of debt

securities, as described in the Indenture, such a release being called a "covenant defeasance" in this prospectus.

Duke

Energy must satisfy certain conditions to effect a defeasance or covenant defeasance. Those conditions include the irrevocable deposit with the Indenture Trustee, in trust, of money

or government

10

Table of Contents

obligations

which through their scheduled payments of principal and interest would provide sufficient money to pay the principal and any premium and interest on those debt securities on the maturity

dates of those payments or upon redemption.

Following

a defeasance, payment of the debt securities defeased may not be accelerated because of an event of default under the Indenture. Following a covenant defeasance, the payment of

debt securities may not be accelerated by reference to the covenants from which Duke Energy has been released. A defeasance may occur after a covenant defeasance.

Under

current United States federal income tax laws, a defeasance would be treated as an exchange of the relevant debt securities in which holders of those debt securities might

recognize gain or loss. In addition, the amount, timing and character of amounts that holders would thereafter be required to include in income might be different from that which would be includible

in the absence of that defeasance. Duke Energy urges investors to consult their own tax advisors as to the specific consequences of a defeasance, including the applicability and effect of tax laws

other than United States federal income tax laws.

Under

current United States federal income tax law, unless accompanied by other changes in the terms of the debt securities, a covenant defeasance should not be treated as a taxable

exchange.

Concerning the Indenture Trustee

The Bank of New York Mellon Trust Company, N.A., or BNYM, is the Indenture Trustee. Duke Energy and certain of its affiliates maintain

deposit accounts and banking relationships with BNYM or its affiliates. BNYM or its affiliates also serve as trustee or agent under other indentures and agreements pursuant to which securities of Duke

Energy and of certain of its affiliates are outstanding.

The

Indenture Trustee will perform only those duties that are specifically set forth in the Indenture unless an event of default under the Indenture occurs and is continuing. In case an

event of default occurs and is continuing, the Indenture Trustee will exercise the same degree of care as a prudent individual would exercise in the conduct of his or her own affairs.

Upon

any application by Duke Energy to the Indenture Trustee to take any action under any provision of the Indenture, Duke Energy is required to furnish to the Indenture Trustee such

certificates and opinions as may be required under the Trust Indenture Act of 1939, as amended.

PLAN OF DISTRIBUTION

We may sell securities to one or more underwriters or dealers for public offering and sale by them, or we may sell the securities to

investors directly or through agents. The prospectus supplement relating to the securities being offered will set forth the terms of the offering and the method of distribution and will identify any

firms acting as underwriters, dealers or agents in connection with the offering, including:

-

•

-

the name or names of any underwriters;

-

•

-

the purchase price of the securities and the proceeds to us from the sale;

-

•

-

any underwriting discounts and other items constituting underwriters' compensation;

-

•

-

any public offering price;

-

•

-

any discounts or concessions allowed or reallowed or paid to dealers; and

-

•

-

any securities exchange or market on which the securities may be listed.

Only

those underwriters identified in the prospectus supplement are deemed to be underwriters in connection with the securities offered in the prospectus supplement.

11

Table of Contents

We may distribute the securities from time to time in one or more transactions at a fixed price or prices, which may be changed, or at prices determined as the

prospectus supplement specifies. We may sell securities through forward contracts or similar arrangements. In connection with the sale of securities, underwriters, dealers or agents may be deemed to

have received compensation from us in the form of underwriting discounts or commissions and also may receive commissions from securities purchasers for whom they may act as agent. Underwriters may

sell the securities to or through dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters or commissions from the purchasers for

whom they may act as agent.

We

may sell the securities directly or through agents we designate from time to time. Any agent involved in the offer or sale of the securities covered by this prospectus will be named

in a prospectus supplement relating to such securities. Commissions payable by us to agents will be set forth in a prospectus supplement relating to the securities being offered. Unless otherwise

indicated in a prospectus supplement, any such agents will be acting on a best-efforts basis for the period of their appointment.

Some

of the underwriters, dealers or agents and some of their affiliates who participate in the securities distribution may engage in other transactions with, and perform other services

for, us and our subsidiaries or affiliates in the ordinary course of business.

Any

underwriting or other compensation which we pay to underwriters or agents in connection with the securities offering, and any discounts, concessions or commissions which underwriters

allow to dealers, will be set forth in the applicable prospectus supplement. Underwriters, dealers and agents participating in the securities distribution may be deemed to be underwriters, and any

discounts and commissions they receive and any profit they realize on the resale of the securities may be deemed to be underwriting discounts and commissions under the Securities Act of 1933, as

amended. Underwriters, and their controlling persons, and agents may be entitled, under agreements we enter into with them, to indemnification against certain civil liabilities, including liabilities

under the Securities Act of 1933, as amended.

EXPERTS

The consolidated financial statements incorporated in this prospectus by reference from Duke Energy Corporation's Annual Report on

Form 10-K, and the effectiveness of Duke Energy Corporation's internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered

public accounting firm, as stated in their report, which is incorporated herein by reference. Such consolidated financial statements have been so incorporated in reliance upon the report of such firm

given upon their authority as experts in accounting and auditing.

VALIDITY OF THE SECURITIES

Robert T. Lucas III, Esq., who is our Deputy General Counsel and Assistant Corporate Secretary, and/or counsel named in the applicable

prospectus supplement, will issue an opinion about the validity of the securities we are offering in the applicable prospectus supplement. Counsel named in the applicable prospectus supplement will

pass upon certain legal matters on behalf of any underwriters.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and, in accordance therewith, file

annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission, or the SEC. Such reports and other information can be inspected and copied at

the SEC's Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may also obtain copies of these documents at prescribed rates from the Public Reference

Section of the SEC at its Washington, D.C. address. Please call the

12

Table of Contents

SEC

at 1-800-SEC-0330 for further information. Our filings with the SEC, as well as additional information about us, are also available to the public through Duke Energy's website at

http://www.duke-energy.com

and are made available as soon as reasonably practicable after such material is filed with or furnished to the SEC. The

information on our website is not a part of this prospectus. Our filings are also available to the public through the SEC website at

http://www.sec.gov

.

The

SEC allows us to "incorporate by reference" into this prospectus the information we file with them, which means that we can disclose important information to you by referring you to

those documents. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this

information. This prospectus incorporates by reference the documents incorporated in the prospectus at the time the registration statement became effective and all later documents filed with the SEC,

in all cases as updated and superseded by later filings with the SEC. Duke Energy incorporates by reference the documents listed below and any future documents filed by Duke Energy Corporation with

the SEC under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, until the offering is completed.

-

•

-

Annual Report on Form 10-K for the year ended December 31, 2015, including the portions of our definitive proxy

statement filed on Schedule 14A on March 24, 2016 that are incorporated by reference therein;

-

•

-

Amendment No. 1 to Annual Report on Form 10-K for the year ended December 31, 2015;

-

•

-

Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2016, and June 30, 2016; and

-

•

-

Current Reports on Form 8-K filed on January 4, 2016, January 6, 2016, February 18, 2016 (solely with

respect to Item 5.02), February 29, 2016, March 7, 2016, April 1, 2016, April 12, 2016, May 10, 2016, June 10, 2016, August 12, 2016, and

August 25, 2016.

We

will provide without charge a copy of these filings, other than any exhibits unless the exhibits are specifically incorporated by reference into this prospectus. You may request a

copy by writing us at the following address or telephoning one of the following numbers:

Investor

Relations Department

Duke Energy Corporation

P.O. Box 1005

Charlotte, North Carolina 28201

(704) 382-3853 or (800) 488-3853 (toll-free)

You

should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized any other person to provide you with different information. If

anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell the securities described in this prospectus in any state where the offer

or sale is not permitted. You should assume that the information contained in the prospectus is accurate only as of its date. Our business, financial condition, results of operations and prospects may

have changed since that date.

13

Table of Contents

Prospectus

Duke Energy Carolinas, LLC

First and Refunding Mortgage Bonds

Senior Notes

Subordinated Notes

From time to time, we may offer the securities described in the prospectus separately or together in any combination, in one or more classes or

series, in amounts, at prices and on terms that we will determine at the time of the offering.

We

will provide specific terms of these offerings and securities in supplements to this prospectus. You should read carefully this prospectus, the information incorporated by reference

in this prospectus and any prospectus supplement before you invest. This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Investing in our securities involves risks. You should carefully consider the information in the section entitled "Risk Factors" contained in our

periodic reports filed with the Securities and Exchange Commission and incorporated by reference into this prospectus before you invest in any of our securities.

We may offer and sell the securities directly, through agents we select from time to time or to or through underwriters or dealers we select. If

we use any agents, underwriters or dealers to sell the securities, we will name them and describe their compensation in a prospectus supplement. The price to the public of those securities and the net

proceeds we expect to receive from that sale will also be set forth in a prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this

prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is September 23, 2016.

Table of Contents

TABLE OF CONTENTS

Prospectus

REFERENCES TO ADDITIONAL INFORMATION

This prospectus incorporates important business and financial information about us from other documents that are not included in or

delivered with this prospectus. This information is available for you to review at the Securities and Exchange Commission's, or SEC's, public reference room located at 100 F Street, N.E.,

Room 1580, Washington, DC 20549, and through the SEC's website,

www.sec.gov.

You can also obtain those documents incorporated by reference in

this prospectus by requesting them in writing or by telephone from the company at the following address and telephone number:

Investor

Relations Department

Duke Energy Carolinas, LLC

P.O. Box 1005

Charlotte, North Carolina 28201

(704) 382-3853 or (800) 488-3853 (toll free)

See

"Where You Can Find More Information" in this prospectus.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that Duke Energy Carolinas filed with the SEC utilizing a "shelf" registration

process. Under the shelf registration process, we are registering an unspecified amount of First and Refunding Mortgage Bonds, Senior Notes, and Subordinated Notes, and may issue any of such

securities in one or more offerings.

This

prospectus provides general descriptions of the securities Duke Energy Carolinas may offer. Each time securities are sold, a prospectus supplement will provide specific information

about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. The registration statement filed with the SEC includes exhibits

that provide more details about the matters discussed in this prospectus. You should read this prospectus, the related exhibits filed with the SEC and any prospectus supplement, together with the

additional information described under the caption "Where You Can Find More Information."

Unless

we have indicated otherwise, or the context otherwise requires, references in this prospectus to "Duke Energy Carolinas," "we," "us" and "our" or similar terms are to Duke Energy

Carolinas, LLC and its subsidiaries.

i

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference in this prospectus include forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on our management's

beliefs and assumptions and can often be identified by terms and phrases that include "anticipate," "believe," "intend," "estimate," "expect," "continue," "should," "could," "may," "plan," "project,"

"predict," "will," "potential," "forecast," "target," "guidance," "outlook," or other similar terminology. Various factors may cause actual results to be materially different than the suggested

outcomes within forward-looking statements; accordingly, there is no assurance that such results will be realized.

In

light of these risks, uncertainties and assumptions, the events described in the forward-looking statements included or incorporated by reference in this prospectus might not occur or

might occur to a different extent or at a different time than described. Forward-looking statements speak only as of the date they are made and we expressly disclaim an obligation to publicly update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

ii

Table of Contents

THE COMPANY

Duke Energy Carolinas, a wholly owned subsidiary of Duke Energy Corporation, generates, transmits, distributes, and sells electricity

in portions of North Carolina and South Carolina. Its service area covers approximately 24,000 square miles. Duke Energy Carolinas supplies electric service to approximately 2.5 million

residential, commercial and industrial customers. As of December 31, 2015, our asset portfolio included approximately 19,645 megawatts of generation capacity, 103,100 miles of distribution

lines, and 13,100 miles of transmission lines.

We

are a North Carolina limited liability company. The address of our principal executive offices is 526 South Church Street, Charlotte, North Carolina 28202-1803. Our telephone number

is (704) 382-3853.

The

foregoing information about Duke Energy Carolinas is only a general summary and is not intended to be comprehensive. For additional information about Duke Energy Carolinas, you

should refer to the information described under the caption "Where You Can Find More Information."

RISK FACTORS

Investing in our securities involves risks. Before purchasing any securities we offer, you should carefully consider the risk factors

in our Annual Report on Form 10-K for the year ended December 31, 2015, which has been filed with the SEC and is incorporated by reference in this prospectus, together with all of the

other information included in this prospectus and any prospectus supplement and any other information that we have incorporated by reference, including filings made with the SEC subsequent to the date

hereof. Any of these risks, as well as other risks and uncertainties, could harm our financial condition, results of operations or cash flows.

USE OF PROCEEDS

Unless stated otherwise in the applicable prospectus supplement, we intend to use the net proceeds from the sale of any offered

securities:

-

•

-

to redeem or purchase from time to time presently outstanding securities when we anticipate those transactions will result in an

overall cost savings;

-

•

-

to repay maturing securities;

-

•

-

to finance our ongoing construction program; or

-

•

-

for general company purposes.

1

Table of Contents

RATIO OF EARNINGS TO FIXED CHARGES