Oil Tumbles on OPEC Skepticism

September 23 2016 - 3:20PM

Dow Jones News

Oil futures sank Friday on more skepticism that the world's

largest exporters are about to start cooperating and ease a supply

glut that has dragged down prices for two years.

Crude fell sharply just before noon after Bloomberg News

reported Saudi Arabia doesn't expect the Organization of the

Petroleum Exporting Countries to reach an agreement when it meets

later this month in Algeria's capital. The comments echo those made

last weekend by the group's secretary-general to Algeria's state

news agency APS that the meeting is informal and not for

"decision-making."

Traders "are reacting with disappointment and disgust," said

Donald Morton, senior vice president at Herbert J. Sims Co., who

runs an energy-trading desk.

U.S. crude for November delivery dropped $1.84, or 4%, to $44.48

a barrel on the New York Mercantile Exchange.

The losses erased two days of gains and a small, but positive

start to Friday's trade that had come as traders became more

optimistic about a deal. A Reuters report Friday morning said the

Saudi Arabian government is ready to cut its own oil output if the

Iranian government freezes its production levels.

But Saudi Arabian and Iranian oil officials also have clashed

this week over production limits while meeting at the OPEC

headquarters in Vienna, The Wall Street Journal reported later

Friday morning. Saudi Arabia and Iran couldn't agree on what

statistics should be used to determine oil output levels for a

potential "freeze"—the term used to describe a joint effort by big

producers to limit their petroleum output at the current pace or

lower.

Short bursts of optimism have often been broken by widespread

skepticism from analysts and traders about OPEC's ability to strike

a deal. Heavyweights including Saudi Arabia, Iran and Iraq have

longstanding political rivalries and have been stuck in a fierce

competition to undercut each other and sell more oil.

"Even an agreement to freeze would not be bullish either, given

how high current production levels are. The only bullish case would

be a credible and significant supply cut, which as it stands right

now is extremely unlikely," said Tamas Varga, an analyst at PVM Oil

Associates.

At 11 million barrels a day, Russian production levels are now

at their highest since the collapse of the Soviet Union, according

to Commerzbank commodities researchers. "The supply of crude oil

remains ample, in other words," the bank's analysts added in a note

Thursday.

Prices have often been bolstered by blasts of rhetoric from

major OPEC producers since late August when they broached the idea

of informal talks and better cooperation. Saudi Arabia and Russia

this month signed an oil-cooperation agreement. OPEC oil chief

Mohammed Barkindo last weekend said that if agreed by all parties,

an emergency meeting could be called later this year to solidify a

policy. Venezuelan President Nicolá s Maduro also has said OPEC and

non-OPEC members were close to a deal.

"There's a chance of success," said Robert Minter, investment

strategist at Aberdeen Asset Management, which had $402.8 billion

in assets under management at the end of June. "It would at least

show that they can once again act together and achieve a

consensus."

A senior OPEC official was quoted by The Wall Street Journal as

saying that OPEC has to keep the chatter going, "to make sure

prices don't fall to a certain level or rise to a certain level

they don't like, and recently we have seen a lot of that."

Summer Said and Benoit Faucon contributed to this article.

Write to Timothy Puko at tim.puko@wsj.com and Mike Bird at

Mike.Bird@wsj.com

(END) Dow Jones Newswires

September 23, 2016 15:05 ET (19:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

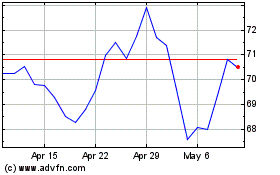

Service (NYSE:SCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

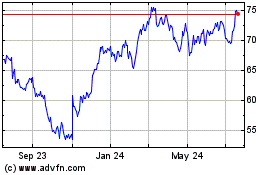

Service (NYSE:SCI)

Historical Stock Chart

From Apr 2023 to Apr 2024