Will Yahoo's Data Breach Derail Verizon Deal?

September 22 2016 - 8:19PM

Dow Jones News

By Vipal Monga and Ryan Knutson

Is a security breach that exposed 500 million consumer accounts

a "material adverse change" to an internet company's business?

That is a question that would determine whether the breach

disclosed Thursday by Yahoo Inc. could affect the company's pending

$4.8 billion sale of its core business to Verizon Communications

Inc.

Many merger agreements contain provisions allowing buyers to

withdraw from the deal if the value of the transaction has been

hurt by a significant development. In the case of the Verizon-Yahoo

deal, such a change is defined as one that would "reasonably be

expected to have a material adverse effect on the business, assets,

properties, results of operation or financial condition of the

Business, taken as a whole."

The breach, which Yahoo blamed on a state-sponsored hacker,

occurred two years ago but was discovered after the merger deal.

Verizon said it learned of the problem this week and was reviewing

the situation.

Shares of Yahoo were little changed Thursday, rising 1 cent to

$44.15, suggesting investors aren't worried the revelation would

derail the deal.

Stephen S. Wu, a lawyer at the Silicon Valley Law Group,

reviewed the purchase agreement and said it is clear that Yahoo

effectively promised that no security breaches had taken place and

that no breaches would have occurred by the deal's closing, which

is expected in the first quarter of 2017.

That gives Verizon leverage to potentially renegotiate the deal

or even walk away, Mr. Wu said. The difficulty for Verizon is

determining what exactly is a materially adverse effect, and

whether it is enough to extinguish Verizon's interest in Yahoo.

There isn't a clear definition.

"It's vague," Mr. Wu said. "This is an agreement written in a

way that there's a judgment call that needs to be made."

It is rare for companies to trigger material-adverse-change

clauses because courts have resisted their use, said Lisa Stark, a

partner at K&L Gates LLP. "It's a very high standard," she

said. "It has to be a very substantial event. It can't just be a

hiccup."

In 2007, Hexion Specialty Chemicals agreed to acquire Huntsman

Corp. in a $6.5 billion deal. But Huntsman's earnings fell after

the deal was signed and Hexion and its private-equity owner sued to

get out of the deal. The Delaware court sided with Huntsman, ruling

that Huntsman's weak earnings were a short-term problem.

The two sides ultimately agreed to settle, with Hexion walking

away after it paid to settle with Huntsman.

In 2001, a Delaware judge ruled that Tyson Foods Inc. improperly

broke off a $3.2 billion deal with meatpacker IBP Inc. after Tyson

argued IBP had misled it about its earnings potential.

Although there is little history of successful use of the

clauses, one lawyer said companies continue to put them into deal

contracts, because it gives buyers a way to begin difficult

conversations if they get cold feet after signing an agreement. "It

gives somebody leverage to renegotiate a deal without necessarily

going to court," said Andrew Herman, a partner at Kirkland &

Ellis LLP. "It sets up that conversation."

Write to Vipal Monga at vipal.monga@wsj.com and Ryan Knutson at

ryan.knutson@wsj.com

(END) Dow Jones Newswires

September 22, 2016 20:04 ET (00:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

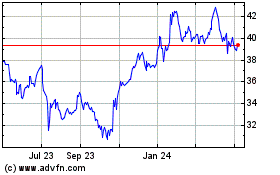

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

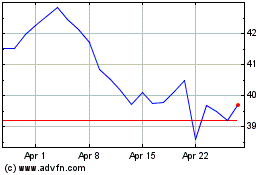

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024