SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

|

Filed

by the Registrant

☒

|

|

|

Filed by a Party other

than the Registrant ☐

|

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under Rule 14a-12

|

WESTERN

DIGITAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement, if other than Registrant)

|

Payment

of Filing Fee (Check the appropriate box):

|

|

|

|

☒

|

No

fee required.

|

|

|

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

(1)

|

Title of each class of

securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form

or Schedule and the date of its filing.

|

|

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Date

Filed:

|

Explanatory

Note

: As part of its regular, ongoing engagement with stockholders, Western Digital Corporation

(“Western Digital”) is planning to have a number of meetings with stockholders. The attached Proxy Statement Summary

is intended to facilitate discussions at those meetings and presents information regarding Western Digital’s business, performance,

executive compensation programs and governance practices taken from Western Digital’s 2016 Proxy Statement.

1 ©2016 Western Digital Corporation or affiliates. All rights reserved. Fall Shareholder Update September 2016

2 ©2016 Western Digital Corporation or affiliates. All rights reserved. Forward - Looking Statements This presentation contains forward - looking statements that involve risks and uncertainties, including, but not limited to, statements regarding our product and technology positioning, the anticipated benefits of our new technologies, executing on our integrated strategic plans and realizing our strategic imperatives. Forward - looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved, if at all. Forward - looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward - looking statements. Additional key risks and uncertainties include the impact of continued uncertainty and volatility in global economic conditions; actions by competitors; difficulties associated with go - to - market capabilities and transitioning into 3D NAND; business conditions; growth in our markets; and pricing trends and fluctuations in average selling prices. More information about the other risks and uncertainties that could affect our business are listed in our filings with the Securities and Exchange Commission (the “SEC”) and available on the SEC’s website at www.sec.gov , including our most recently filed periodic report, to which your attention is directed. We do not undertake any obligation to publicly update or revise any forward - looking statement, whether as a result of new information, future developments or otherwise, except as otherwise required by law.

3 R 94 G 96 B 152 R 60 G 130 B 193 R 45 G 96 B 143 R 212 G 83 B 79 R 237 G 146 B 80 R 244 G 198 B 107 • Rich base of technologies with 10,000+ patents and applications • Diverse product portfolio that allows us to offer comprehensive storage solutions Client Devices Western Digital is a Leading Storage Solutions Company We develop, manufacture and provide comprehensive d ata storage s olutions … ©2016 Western Digital Corporation or affiliates. All rights reserved. 30% 22% 48% Americas Europe, Middle East and Africa Asia Geographic Revenue Breakdown … across a wide array of markets. … to global, sophisticated customers 1 … 1 Representative customers Client Solutions Datacenter Devices Datacenter Solutions

4 Industry Trends Informed Strategic Goals ©2016 Western Digital Corporation or affiliates. All rights reserved. Several years ago, we anticipated meaningful industry shifts that would impact the HDD business and our management team established 5 strategic pillars to position WDC for the future • Create optimal product mix for both client and enterprise customers while managing declining HDD demand • Establish technology leadership (e.g., Helium) in the HDD industry • Organize effectively to address market trends and WDC strategy • Enhance core capabilities (e.g., Go - To - Market) needed to succeed • Access fast - growing mobility segments (e.g., Smartphones, tablets) • Establish best - in - class product portfolio to address several retail customer segment needs • Develop storage solutions and platforms for small and medium businesses • Build on WDC’s eSSD capabilities and establish cSSD capabilities • Leverage WDC’s GTM capabilities and relationships with legacy enterprise and client customers to manage HDD - to - SSD transition HGST Acquisition New BU investment (Data Center Systems BU) and multiple acquisitions (e.g., Virident , Skyera ) Company - wide transformation initiatives SanDisk Acquisition Our Board and management team have set thoughtful strategic growth objectives, and management’s consistent execution of these objectives has positioned us to deliver long - term value to our shareholders - Significantly Expanded Total Addressable Market (TAM ) by 2020 (From ~$24B in 2016 to $75B+ in 2020) SanDisk Acquisition & other partnerships

5 R 94 G 96 B 152 R 60 G 130 B 193 R 45 G 96 B 143 R 212 G 83 B 79 R 237 G 146 B 80 R 244 G 198 B 107 Key Benefits and Impact of SanDisk Acquisition Server - side flash storage HW & SW SanDisk Acquisition was Major Step in Long - Term Goal of Creating a Global Storage Solutions Company ©2016 Western Digital Corporation or affiliates. All rights reserved. Storage Device Storage Controller Processing Applications Software 2008 - 2012 2013 - 2015 2016 JDA: Ent. SSDs HDD / Ent. SSDs Ent. SSDs, enhanced controller Flash arrays Advanced Caching Object Storage Software • The SanDisk transaction is a result of a multiple year long strategic review • Key part of a single, intertwined strategy to achieve market leadership in storage and memory driven by ‒ Product d iversification ‒ Vertical integration x Doubles addressable market x Achieves immediate scale and margin expansion x Creates a highly scaled diversified leader x Captive NAND supply enables technology, operational and financial advantages x Creates robust portfolio with strong up - the - stack positioning Our management team has a strong track record of value creation through strategic M&A and industry leading partnerships

6 R 94 G 96 B 152 R 60 G 130 B 193 R 45 G 96 B 143 R 212 G 83 B 79 R 237 G 146 B 80 R 244 G 198 B 107 NAND Technology • 3D NAND technology transition • Competitive market Progress Toward our Long - term Goals in 2016 ©2016 Western Digital Corporation or affiliates. All rights reserved. We entered 2016 facing macro - economic headwinds, shifting industry trends, major regulatory hurdles, and meaningful integration risks, but we continue to successfully navigate these challenges and are well positioned to create value for our shareholders SanDisk and HGST Acquisitions • $15.59 billion acquisition of leading NAND player SanDisk announced in October 2015 • China imposed hold separate condition on 2012 acquisition of HGST • Simultaneous major integrations of SanDisk and WD/HGST subsidiaries Financial • Leveraged balance sheet • Expired licensing and royalty agreement with Samsung Evolving Industry Trends • Shift in storage technologies and decline in PC sales • Storage moving from the client to the cloud • Disaggregation of the enterprise datacenter x Achieved shareholder approval of SanDisk acquisition x Negotiated lift of China’s hold separate condition in October 2015 x Completed successful financing of SanDisk acquisition in challenging debt market and closed deal in May 2016 x New leadership team in place with strong product roadmap x On target to achieve synergy targets from both integrations x SanDisk acquisition provides hedge against replacement of HDDs in client enterprise markets x Leadership position in capacity enterprise HDDs and enterprise SSDs enables cloud storage participation x Well positioned for current supply/demand environment x Managed transition of 16 - year joint venture with Toshiba for development and manufacturing of NAND x Current 15nm 2D technology remains industry’s cost leader x Announced next generation 3D NAND technology, BiCS3, with 64 layers of vertical storage capability x Pilot production of 64 layer 3D (BiCS3) has commenced x Paid off $3 billion bridge loan x Favorably repriced $3 billion Term Loan B; $750 million prepayment x On target to achieve 1.5x gross leverage ratio in 3 - 5 years to provide strategic flexibility for determining capital allocation x Structural optimization underway

7 R 94 G 96 B 152 R 60 G 130 B 193 R 45 G 96 B 143 R 212 G 83 B 79 R 237 G 146 B 80 R 244 G 198 B 107 The Storage Market is Robust ©2016 Western Digital Corporation or affiliates. All rights reserved. Datacenter Solutions USD billion +51 % X% CAGR Source: WDC Estimates Client Devices Datacenter Devices Client Solutions +12% +10% +15% +8 % - 7% +14 % - 2% - 4% 0% ▪ Notebook/ desktop HDD ▪ Consumer electronics HDD ▪ Client SSD ▪ Embedded, components ▪ Branded HDD ▪ Branded flash ▪ Removable products ▪ Enterprise HDD ▪ Enterprise SSD ▪ Datacenter devices ▪ Related software and solutions Approximately $75B TAM in Core Business, Incremental $26B TAM in Datacenter Solutions Est. by FY 2020 FY20 $26B FY16 $5B Flash HDD $12B FY16 $14B $6B $8B FY20 $23B $11B FY16 $33B $35B $44B $9B FY20 $20B $13B $3B $8B $5B FY16 < $5B FY20 $7B < $3B

8 Acute Focus on Our Integration Plan to Realize Value ©2016 Western Digital Corporation or affiliates. All rights reserved. Our management team is laser - focused on integration efforts during this strategic and organizational transformation period WDC - SanDisk Integration Sources of value • Product roadmap rationalization • G&A consolidation • Procurement savings • Vertical integration Annualized Run - rate Savings ~$500M by 18 months, post - close ~$1.1B by CY20 WD - HGST Integration Sources of value • Product roadmap rationalization • Site consolidation • G&A consolidation • Procurement savings Annualized Run - rate Savings OpEx | ~$450M by end of CY17 − ~2/3 by end of CY16 COGS | ~$350M by end of CY17 − ~1/2 by end of CY16

9 A Management Team Focused on Creating Value ©2016 Western Digital Corporation or affiliates. All rights reserved. On account of the magnitude of the SanDisk and HGST integrations, the Compensation Committee believes it i s critically important to incentivize our management team to remain highly focused on integration efforts and retain key employees during this process □ A Multi - Year Strategic Evolution • Our Board and management team developed a multi - year strategy to form a global storage solutions company, drive growth, and create long - term value for our shareholders □ Execution of our Strategy • Our management team has been executing on this strategy – acquiring HGST in 2012 and SanDisk in 2016, and forming a joint venture with Unis in 2015 □ Continuing Focus on Successful Integration • The Board approved expanded roles and promotions for key management team members that showed exceptional leadership in creating and executing on this transformation and which will position our leadership team to most effectively drive growth and long - term value creation: • Mark P. Long: Promoted to Chief Financial Officer, in addition to his role as EVP and Chief Strategy Officer • Michael D. Cordano: Promoted to President and Chief Operating Officer • Michael C. Ray: Promoted to EVP and Chief Legal Officer and Secretary • Jacqueline M. DeMaria : Promoted to EVP and Chief Human Resources Officer • Steven G. Campbell: Promoted to EVP and Chief Technology Officer • Our management team is laser - focused on successfully executing its integration plan, and the Compensation Committee believes it is important to establish incentive opportunities that drive timely, focused action toward this goal

10 Performance - Based Executive Compensation Program ©2016 Western Digital Corporation or affiliates. All rights reserved. Base Salary Long - Term Incentive 2 (LTI) Short - Term Incentive (STI) [CATEGORY NAME] [VALUE] [CATEGORY NAME] Target [VALUE] [CATEGORY NAME] 3 [VALUE] Key Elements 1 • Provides incentive to drive near - term financial goals that support long - term objectives • Measured semi - annually to ensure goals reflect the impact of rapidly evolving industry - related externalities • Competitive with market and industry norms • Reflects individual experience and future contributions Performance Link Fixed compensation Adjusted earnings per share [CATEGORY NAME] [VALUE] [CATEGORY NAME] Target [VALUE] [CATEGORY NAME] 3 [VALUE] CEO Pay N EO Pay • PSUs — 50% ‒ Provides strong alignment with company performance ‒ Measures performance over two years, which represents a long - term performance period in the context of our rapidly evolving industry • Options — 25% ‒ Provides alignment with shareholders and long - term stock price ‒ Vests over 4 years • RSUs — 25% ‒ Provides alignment with shareholders and retention value ‒ Vests over 3 years (4 years starting in FY 2017) • Operating i ncome • Revenue • Relative TSR hurdle • Total available market modifier Stock price increase Stock price 1 Based on 2016 compensation 2 Based on 2016 CEO compensation; Long - Term Incentive program percentages based on grant - date fair value of awards 3 Based on 2016 targeted total direct compensation; figure reflects midpoint of Long - Term Incentive program grant guidelines

11 Key 2016 Compensation Committee Decisions ©2016 Western Digital Corporation or affiliates. All rights reserved. Milligan (CEO) No Change No Change • Annual LTI Award (PSUs, RSUs, Stock Options) Cordano (President & COO) + $25,000 (+ 3.6%) + 15% • Annual LTI Award (PSUs, RSUs, Stock Options ) • Integration PSUs Leonetti (Former CFO) No Change No Change • Annual LTI Award (PSUs, RSUs, Stock Options) • Integration PSUs Long (CFO & CSO) + $ 25,000 (+ 5%) + 15% • Transaction - related PSUs • Integration PSUs Murphy (EVP) No Change No Change • Annual LTI Award (PSUs, RSUs, Stock Options) • Integration PSUs Ray (CLO & Secretary) + $ 25,000 (+ 5%) + 10% • Annual LTI Award (PSUs, RSUs, Stock Options) • Integration PSUs ▪ No change in base salary or target bonus ▪ No Integration PSU award Compensation Elements ▪ Modest increase in salary and STI in connection with promotion ▪ No increase in STI or LTI awards ▪ As a result of departure, all Integration PSUs will be forfeited ▪ Modest increase in salary and STI in connection with promotion ▪ Transaction - related PSUs granted in lieu of FY 2016 LTI awards ▪ Limited Integration PSU award ▪ No increase in STI or LTI awards ▪ As a result of departure, all Integration PSUs will be forfeited ▪ Modest increase in salary and STI in connection with promotion Base Salary STI Target 1 LTI Equity Awards 2 1 Based on percentage of base salary; represents increase in percentage of base salary compared to FY 2015 2 Integration PSU refers to the Integration - focused LTI award that was awarded in March 2016 Notes 2

12 R 94 G 96 B 152 R 60 G 130 B 193 R 45 G 96 B 143 R 212 G 83 B 79 R 237 G 146 B 80 R 244 G 198 B 107 Establishing Direct Incentives to Drive Integration ©2016 Western Digital Corporation or affiliates. All rights reserved. 1 st Perf. Period — Synergies Goal Tranche #1 Vesting (50%) 2 nd Performance Period — Cumulative Synergies Goal Tranche #2 Vesting (50%) October 2015 March 2016 December 2016 December 2017 March 2018 March 2019 Primary Metrics Expense Reduction Cost Savings Rationale • Provide objective measures of company’s ability to integrate WD and HGST subsidiaries and realize synergies of HGST acquisition • Focus management on reducing costs and maximizing value creation Performance and Vesting Periods □ One - time, broad - based plan designed to motivate senior leaders and key employees during integration period □ Linked to objective performance metrics □ Vesting contingent upon achievement of integration goals over a multi - year period and service - based requirement □ Vesting extends through fiscal year 2019, providing long - term incentive Integration PSU Structure

13 Compensation Program Changes for Fiscal 2017 ©2016 Western Digital Corporation or affiliates. All rights reserved. 2017 executive compensation program changes reflect greater focus on long - term performance - based compensation and continued commitment to competitive pay □ Long - Term Incentive Awards • Extended RSU’s vesting schedule to 4 - year ratable vesting from 3 years • For Fiscal 2017, Compensation Committee eliminated RSUs from CEO LTI equity mix □ Salary • Compensation Committee approved certain base salary and bonus target increases for executives based on composite market data and our pay positioning strategy • CEO base salary was increased on account of his total direct compensation being below our peer group median; prior to increase, his base salary had not been increased since 2013

14 R 94 G 96 B 152 R 60 G 130 B 193 R 45 G 96 B 143 R 212 G 83 B 79 R 237 G 146 B 80 R 244 G 198 B 107 Board Overview ©2016 Western Digital Corporation or affiliates. All rights reserved. 33% Diverse 89% Independent Board Composition is Uniquely Suited to Execute Business Strategy x Technology x Mergers & Acquisitions x Sales & Marketing x Senior Executive Leadership x Corporate Strategy x International Business x Finance & Accounting x Public Company Boards Director Refreshment to Reflect Evolving Needs of our Business Complementary Director Skills Independent & Balanced Board Martin Cole Independent Director Joined in 2014 Paula Price Independent Director Joined in 2014 Sanjay Mehrotra Independent Director Joined in 2016 Selection Rationale As the former President & CEO of SanDisk, Director Mehrotra brings unparalleled understanding of SanDisk’s business and operations Selection Rationale Director Price has extensive experience in growing and managing a global business and overseeing the successful integration of major M&A transactions Selection Rationale Director Cole has significant experience in executive leadership of global operations and technology solutions

15 R 94 G 96 B 152 R 60 G 130 B 193 R 45 G 96 B 143 R 212 G 83 B 79 R 237 G 146 B 80 R 244 G 198 B 107 Best Practices in Compensation and Governance ©2016 Western Digital Corporation or affiliates. All rights reserved. x Annual director elections x Majority vote standard x Strong independent Board leadership and oversight, which includes an independent Chairman and a Lead Independent Director with a clearly defined role x D irector retirement policy x Commitment to Board refreshment and diversity x Board risk oversight x Robust succession planning for directors and senior management x Annual third - party facilitated Board and committee self - evaluations x Code of conduct for directors, officers and employees x Cap maximum payout levels under performance - based and incentive awards x Compensation Committee has discretion to reduce incentive award payouts x Strict executive stock ownership guidelines (5x base salary for CEO) x Maintain a clawback policy x Provide limited and modest perquisites x No tax gross - up payments in connection with severance or change in control x No automatic vesting of equity on change in control x No hedging or short - sale transactions by executive officers or directors x No dividends paid on awards that have not vested Governance Compensation

16 ©2016 Western Digital Corporation or affiliates. All rights reserved.

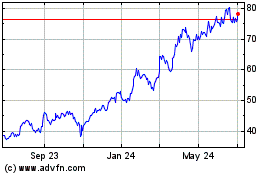

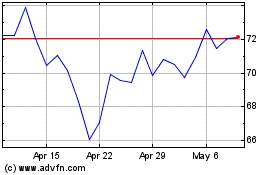

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024