Moody’s Analytics Launches the RiskBench™ Platform for Benchmarking and Analyzing Commercial Credit Risk

September 22 2016 - 7:45AM

Business Wire

Moody’s Analytics, a leading provider of credit analytics and

data, today announced the launch of the RiskBench™ platform, an

innovative solution for benchmarking and analyzing credit

portfolios. Credit market participants can use the RiskBench

platform to improve monitoring of portfolio risk, to evaluate

market expansion opportunities, and to estimate expected credit

losses.

“The RiskBench platform offers users a competitive advantage in

managing portfolio credit risk. Customers can benchmark their

performance in industry and regional markets using Moody’s

Analytics proprietary data and analytics, and can fill in gaps in

their credit scoring where borrower data are incomplete,” said

Mehna Raissi, Senior Director, Enterprise Risk Solutions, Moody’s

Analytics.

The RiskBench platform’s visual and interactive dashboards were

developed with QLIK® Sense, enabling users to monitor and benchmark

the performance and characteristics of loan portfolios against

relevant peers. Risk professionals can also use the platform to

model impairment provisions required under the IFRS 9 and CECL

accounting standards, and to analyze portions of their loan

portfolios where they lack granular data. The RiskBench platform

uses the Moody’s Analytics Credit Research Database (CRD™), a

proprietary database of private firm financial statements and

defaults, to provide insight into the credit quality of private

companies in the US and Europe.

“With the credit environment becoming increasingly dynamic and

interconnected across markets and asset classes, opportunities

abound for firms to better leverage next generation platforms and

global credit data and analytics within a coherent framework,” said

Cubillas Ding, Director of Risk at research and advisory firm

Celent, which focuses on identifying market trends, innovation and

best practices in financial services technology.

In forthcoming versions of the RiskBench platform, Moody’s

Analytics will expand coverage to include commercial real estate,

retail asset classes, and additional geographies.

Learn more about the Moody’s Analytics RiskBench platform.

Please join Moody’s Analytics and Qlik for an in-depth webinar

on benchmarking and analyzing credit risk, “Exposing actionable

insights in Credit Risk Management” on September 27, 2016.

About Moody’s Analytics

Moody’s Analytics helps capital markets and risk management

professionals worldwide respond to an evolving marketplace with

confidence. The company offers unique tools and best practices for

measuring and managing risk through expertise and experience in

credit analysis, economic research and financial risk management.

By providing leading-edge software, advisory services, and

research, including the proprietary analysis of Moody’s Investors

Service, Moody’s Analytics integrates and customizes its offerings

to address specific business challenges. Moody's Analytics is a

subsidiary of Moody's Corporation (NYSE:MCO), which reported

revenue of $3.5 billion in 2015, employs approximately 10,800

people worldwide and maintains a presence in 36 countries. Further

information is available at www.moodysanalytics.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160922005263/en/

Moody’s AnalyticsKATERINA SOUMILOVA, 001-212-553-1177Assistant

Vice PresidentCorporate

Communicationskaterina.soumilova@moodys.comorKERSTIN VOELKEL,

0044-20-7772-5207Assistant Vice PresidentCommunications

Strategistkerstin.voelkel@moodys.com

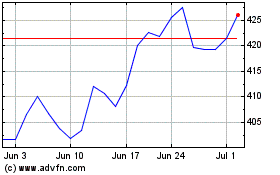

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024