ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The

second part, the accompanying prospectus, gives more general information, some of which may not apply to this offering. Before investing in our common stock, you should read in their entirety this prospectus supplement, the accompanying prospectus,

including the information under the caption “Where You Can Find More Information,” as well as the documents incorporated by reference. These documents contain information you should consider when making your investment decision. You should

rely only on the information contained or incorporated by reference into this prospectus supplement or the accompanying prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different or additional

information. If anyone provides you with different, additional or inconsistent information, you should not rely on it.

We are

not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this prospectus supplement and the accompanying prospectus is

accurate only as of their respective dates, or in the case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any sales of our

common stock. Our business, financial condition, results of operations and prospects may have changed since those dates.

References in this prospectus supplement to the “Company,” “Chesapeake,” “we,” “us” and

“our” refer to Chesapeake Utilities Corporation and its consolidated subsidiaries, unless the context indicates another meaning. Unless expressly incorporated by reference, information contained on or made available through our website is

not a part of this prospectus supplement. Capitalized terms used but not defined in this prospectus supplement shall have the meanings ascribed to them in the accompanying prospectus.

S-ii

SUMMARY

This summary highlights information contained elsewhere or incorporated by reference in this prospectus supplement or the accompanying

prospectus. Because this is a summary, it is not complete and does not contain all of the information that may be important to you. For a more complete understanding of us and this offering of our common stock, we encourage you to read in their

entirety this prospectus supplement, the accompanying prospectus, including the information under the caption “Where You Can Find More Information”, as well as the documents incorporated by reference. You should also read “Risk

Factors” beginning on page S- 8 of this prospectus supplement and the section captioned “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2015, which has been filed with the Securities and Exchange

Commission (“SEC”) and is incorporated by reference into this prospectus supplement, for more information about important risks that you should consider before making a decision to purchase any shares of common stock in this offering.

Our Business

Chesapeake Utilities Corporation is a Delaware corporation formed in 1947. We are a diversified energy company engaged, through our operating divisions and subsidiaries, in various energy and other

businesses. We operate primarily on the Delmarva Peninsula and in Florida, Pennsylvania and Ohio, largely providing natural gas distribution and transmission, natural gas supply, gathering and processing, electric distribution and propane

distribution service. The core of our business is regulated energy services, which provides stable earnings through our utility operations. Our unregulated businesses provide opportunities to achieve returns greater than those of a traditional

utility. The following charts present operating income by type of energy served and geographic area for the year ended December 31, 2015 and average investment by type of energy served and geographic area as of December 31, 2015.

S-1

Operating Income by Energy Served and Geographic Area

Average Investment by Energy Served and Geographic Area

|

|

|

|

|

|

|

We operate within two reportable segments: Regulated Energy and Unregulated Energy. The Regulated Energy

segment includes our natural gas distribution, natural gas transmission and electric distribution operations. All operations in this segment are regulated, as to their rates and service, by the public service commission (“PSC”) having

jurisdiction in each state in which we operate or by the Federal Energy Regulatory Commission (“FERC”) in the case of Eastern Shore Natural Gas Company (“Eastern Shore”). The Unregulated Energy segment includes our propane

distribution, propane wholesale marketing, natural gas marketing and natural gas supply, gathering and processing services, which are unregulated as to their rates and services. Also included in this segment are other unregulated energy services,

such as energy-related merchandise sales; heating, ventilation, and air conditioning, plumbing, and electrical services; and electricity and steam generation services from the combined heat and power (“CHP”) plant we recently placed into

service in Amelia Island, Florida.

S-2

The remainder of our operations is presented as “Other businesses and

eliminations,” which consists of unregulated subsidiaries that own real estate leased to Chesapeake Utilities, as well as certain corporate costs not allocated to other operations.

Regulated Energy

Regulated Energy is our largest segment and

consists of: (i) our natural gas distribution operations in Delaware, Maryland and Florida; (ii) our electric distribution operation in Florida; and (iii) our natural gas transmission operations on the Delmarva Peninsula and in Florida. Our natural

gas and electric distribution operations, which are local distribution utilities, generate revenues based on tariff rates approved by the PSC of each state in which we operate. The PSCs have also authorized our utilities to negotiate rates, based on

approved methodologies, with customers that have competitive alternatives. Some of our customers in Maryland are currently served with propane under PSC-approved tariff rates as we prepare to convert some of our underground propane distribution

system customers to natural gas. These customers are included in the Delmarva natural gas distribution operation.

Eastern

Shore, our interstate natural gas transmission subsidiary, bills its customers based upon FERC-approved tariff rates. Eastern Shore is also authorized by FERC to negotiate rates above or below FERC-approved tariff rates. Peninsula Pipeline, our

Florida intrastate pipeline subsidiary, is subject to regulation by the Florida PSC, and has negotiated contracts with third-party customers and with certain affiliates. Our rates are designed to provide the opportunity to generate revenues to

recover all prudently incurred costs and provide a return on rate base sufficient to pay interest on debt and a reasonable return for our stockholders. Rate base generally consists of the original cost of utility plant less accumulated depreciation

on utility plant in service, working capital and certain other assets and, depending upon the particular regulatory jurisdiction, may also include deferred income tax liabilities and other additions or deletions.

The natural gas commodity market for Chesapeake Utilities’ Florida division and FPU’s Indiantown division is deregulated.

Accordingly, marketers, rather than a traditional utility, sell natural gas to end-use customers in those jurisdictions. For all of our other local distribution utilities, we have fuel cost recovery mechanisms authorized by the PSCs that allow us to

periodically adjust fuel rates to reflect changes in the wholesale cost of natural gas and electricity and to ensure we recover all of the costs prudently incurred in purchasing natural gas and electricity for our customers.

Unregulated Energy

Our Unregulated Energy segment provides propane distribution, propane wholesale marketing, natural gas marketing, supply, gathering and processing and other unregulated energy-related services to

customers. Revenues generated from this segment are not subject to any federal, state or local pricing regulations. Our businesses in this segment typically complement our regulated businesses by offering propane as a fuel source where natural gas

is not readily available, or by providing natural gas marketing, supply, gathering and processing services to our customers. Through competitive pricing and supply management, these businesses provide the opportunity to generate returns greater than

those of a traditional utility.

Our propane distribution operations sell propane primarily to residential,

commercial/industrial and wholesale customers in Delaware, Maryland, Virginia and in southeastern Pennsylvania through Sharp and Sharpgas, and in Florida through FPU and Flo-gas. Many of our propane distribution customers are “bulk

delivery” customers. We make deliveries of propane to the bulk delivery customers as needed, based on the level of propane remaining in the tank located at the customer’s premises. We invoice and record revenues for our bulk delivery

service customers at the time of delivery, rather than upon customers’ actual usage, since the customers typically own the propane gas in the tanks on their premises. We also have underground propane distribution systems serving various

neighborhoods and communities. Such customers are billed

S-3

monthly based on actual consumption, which is measured by meters installed on their premises. In Florida, we also offer metered propane distribution service to residential and commercial

customers. The customers’ tanks are metered, and we read and bill the customers once a month.

Other Businesses

Other businesses consists primarily of other unregulated subsidiaries, including Skipjack and ESRE that own real

estate leased to affiliates; and certain unallocated corporate costs, which are not directly attributable to a specific business unit. Skipjack and ESRE own and lease office buildings in Delaware and Maryland to divisions and other subsidiaries of

Chesapeake Utilities.

Recent Developments

In June 2016, we commenced operations of our first CHP plant in Amelia Island, Florida, through our newest subsidiary, Eight Flags Energy. We anticipate that the CHP plant will yield significant

cost-savings for customers on Amelia Island, while also providing environmental benefits, such as reduced greenhouse gas emissions and lower water use than conventional utility power plants.

Corporate Information

Our principal executive office is

located at 909 Silver Lake Boulevard, Dover, Delaware 19904, and our telephone number is (302) 734-6799. Our website address is http://www.chpk.com. Information on our website does not constitute part of this prospectus.

S-4

THE OFFERING

|

Common stock offered

|

shares (plus an

additional shares if the underwriters exercise their option to purchase additional shares in full)

|

|

Shares to be outstanding after this offering

|

shares

(or shares outstanding if the underwriters exercise their option to purchase additional shares in full)(1)

|

|

Use of proceeds

|

We estimate that our net proceeds from this offering will be approximately $ million (or approximately

$ million if the underwriters exercise their option to purchase additional shares in full), after deducting the underwriting discounts and commissions and other offering expenses. We intend to use these

proceeds to pay down certain of our short-term revolving debt, which will increase our borrowing availability under these facilities for future capital needs.

|

|

Risk factors

|

Please read “Risk Factors” on page S-8 and the other information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus for a

discussion of factors you should carefully consider before deciding to invest in shares of our common stock.

|

|

Current indicated annualized dividends per share

|

$1.22(2)

|

|

Exchange Listing

|

Our common stock is traded on the New York Stock Exchange under the symbol “CPK”

|

|

Transfer Agent and Registrar

|

Computershare Trust Company, N.A.

|

|

(1)

|

The number of shares outstanding after the offering is based on approximately 15,336,799 shares outstanding as of September 7, 2016 and includes the shares to be sold

by us in this offering. The number of shares outstanding after the offering does not include the 831,183, 742,245 or 539,374 shares of our common stock reserved as of September 15, 2016 for issuance under the Retirement Savings Plan, Dividend

Reinvestment and Direct Stock Purchase Plan or the 2013 Stock and Incentive Compensation Plan, respectively.

|

|

(2)

|

Based upon our most recently declared quarterly dividend of $0.3050 per share of our common stock. Future dividends, if any, may be declared and paid at the discretion

of our board of directors and will depend on our future earnings, financial condition and other factors.

|

S-5

SUMMARIZED HISTORICAL FINANCIAL DATA

In the table below, we provide you with certain summary financial information. We have derived the income statement data for each of the

years in the three-year period ended December 31, 2015 and the balance sheet data as of December 31, 2014 and 2015 from our audited consolidated financial statements incorporated by reference in this prospectus supplement. We have derived the income

statement data for the six months ended June 30, 2015 and 2016 and the balance sheet data as of June 30, 2016 from our unaudited consolidated financial statements incorporated by reference in this prospectus supplement. The unaudited condensed

consolidated financial statements have been prepared on a basis consistent with the audited consolidated financial statements and, in the opinion of management, include all adjustments (including normal recurring accruals) necessary for a fair

presentation of such data. The results for the interim periods are not necessarily indicative of results for a full year. The financial information below is only a summary and should be read together with, and is qualified in its entirety by

reference to, the financial information incorporated by reference in the accompanying prospectus. See the information under the captions “Where You Can Find More Information” and “Incorporation of Certain Information by

Reference” in the accompanying prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended

|

|

|

Six Months Ended

|

|

|

|

|

December 31,

2013

|

|

|

December 31,

2014

|

|

|

December 31,

2015

|

|

|

June 30,

2015

|

|

|

June 30,

2016

|

|

|

($ in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

Income Statement Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regulated Energy

|

|

$

|

264,637

|

|

|

$

|

300,442

|

|

|

$

|

301,902

|

|

|

$

|

171,642

|

|

|

$

|

156,611

|

|

|

Unregulated Energy

|

|

|

166,723

|

|

|

|

184,961

|

|

|

|

162,108

|

|

|

|

91,121

|

|

|

|

92,027

|

|

|

Other businesses and eliminations

|

|

|

12,946

|

|

|

|

13,431

|

|

|

|

(4,766

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

$

|

444,306

|

|

|

$

|

498,834

|

|

|

$

|

459,244

|

|

|

$

|

262,763

|

|

|

$

|

248,638

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regulated Energy

|

|

$

|

50,084

|

|

|

$

|

50,451

|

|

|

$

|

60,985

|

|

|

$

|

35,788

|

|

|

$

|

39,545

|

|

|

Unregulated Energy

|

|

|

12,353

|

|

|

|

11,723

|

|

|

|

16,355

|

|

|

|

14,689

|

|

|

|

12,347

|

|

|

Other businesses and eliminations

|

|

|

297

|

|

|

|

105

|

|

|

|

418

|

|

|

|

201

|

|

|

|

230

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating income

|

|

$

|

62,734

|

|

|

$

|

62,279

|

|

|

$

|

77,758

|

|

|

$

|

50,678

|

|

|

$

|

52,122

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

32,787

|

|

|

$

|

36,092

|

|

|

$

|

41,140

|

|

|

$

|

27,403

|

|

|

$

|

28,396

|

|

|

Average common shares outstanding (basic)

|

|

|

14,430,962

|

|

|

|

14,551,308

|

|

|

|

15,094,423

|

|

|

|

14,922,094

|

|

|

|

15,300,931

|

|

|

Average common shares outstanding (diluted)

|

|

|

14,543,446

|

|

|

|

14,604,944

|

|

|

|

15,143,373

|

|

|

|

14,970,190

|

|

|

|

15,342,287

|

|

|

Basic earnings per share

|

|

$

|

2.27

|

|

|

$

|

2.48

|

|

|

$

|

2.73

|

|

|

$

|

1.84

|

|

|

$

|

1.86

|

|

|

Diluted earnings per share

|

|

$

|

2.26

|

|

|

$

|

2.47

|

|

|

$

|

2.72

|

|

|

$

|

1.83

|

|

|

$

|

1.85

|

|

|

|

|

|

|

|

|

|

Cash Flow Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per share

|

|

$

|

1.0133

|

|

|

$

|

1.0667

|

|

|

$

|

1.1325

|

|

|

$

|

0.5575

|

|

|

$

|

0.5925

|

|

|

Capital expenditures (Including acquisitions)

|

|

$

|

128,240

|

|

|

$

|

98,057

|

|

|

$

|

195,261

|

|

|

$

|

117,267

|

|

|

$

|

70,045

|

|

S-6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31,

|

|

|

At June 30,

|

|

|

|

|

2014

|

|

|

2015

|

|

|

2015

|

|

|

2016

|

|

|

($ in thousands)

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross property, plant and equipment

|

|

$

|

883,131

|

|

|

$

|

1,070,263

|

|

|

$

|

995,479

|

|

|

$

|

1,138,633

|

|

|

Net property, plant and equipment

|

|

$

|

689,762

|

|

|

$

|

854,950

|

|

|

$

|

790,449

|

|

|

|

908,807

|

|

|

Total assets

|

|

$

|

904,469

|

|

|

$

|

1,068,586

|

|

|

$

|

970,636

|

|

|

|

1,097,047

|

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

$

|

300,322

|

|

|

$

|

358,138

|

|

|

$

|

351,176

|

|

|

|

379,554

|

|

|

Long-term debt, net of current maturities

|

|

|

158,486

|

|

|

|

149,340

|

|

|

|

156,247

|

|

|

|

143,865

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

458,808

|

|

|

$

|

507,478

|

|

|

$

|

507,423

|

|

|

$

|

523,419

|

|

|

|

|

|

|

|

|

Current portion of long-term debt

|

|

$

|

9,109

|

|

|

$

|

9,151

|

|

|

$

|

9,127

|

|

|

$

|

12,075

|

|

|

Short-term borrowing

|

|

|

88,231

|

|

|

|

173,397

|

|

|

|

94,713

|

|

|

|

180,042

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization and short-term borrowing

|

|

$

|

556,148

|

|

|

$

|

690,026

|

|

|

$

|

611,263

|

|

|

$

|

715,536

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity as a % of total capitalization

|

|

|

65.46

|

%

|

|

|

70.57

|

%

|

|

|

69.21

|

%

|

|

|

72.51

|

%

|

|

Equity as a % of total capitalization and short-term borrowing

|

|

|

54.00

|

%

|

|

|

51.90

|

%

|

|

|

57.45

|

%

|

|

|

53.04

|

%

|

S-7

RISK FACTORS

An investment in our common stock involves risks. You should read carefully the risks and uncertainties described below and the

“Risk Factors” section in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which is incorporated by reference into this prospectus supplement and the accompanying prospectus, in addition to the other

information set forth or incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment an investment decision. Also, these risks are not the only ones we face. Additional risks not

presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition, or results of operations could be materially adversely affected by the materialization of any of these risks.

The trading price of our securities could decline due to the materialization of any of these risks and you may lose all or part of your investment.

Risks relating to the Company’s Common Stock

The market price of

the Company’s common stock may fluctuate significantly, which could negatively affect the Company and holders of its common stock.

Such fluctuations in price may occur from time to time as a result of many factors, including but not limited

to:

|

|

•

|

|

investors’ perceptions of the prospects of the Company and the energy and commodities markets;

|

|

|

•

|

|

investors’ perceptions of the Company’s and/or the industry’s risk and return characteristics relative to other investment alternatives;

|

|

|

•

|

|

differences between our actual financial and operating results and those expected by investors and analysts;

|

|

|

•

|

|

changes in analyst reports, recommendations or earnings estimates regarding the Company, other comparable companies or the industry generally, and the

Company’s ability to meet those estimates;

|

|

|

•

|

|

actual or anticipated fluctuations in quarterly financial and operating results;

|

|

|

•

|

|

volatility in the equity securities market; and

|

|

|

•

|

|

sales, or anticipated sales, of large blocks of the Company’s common stock.

|

The Company cannot predict the effect that issuances or sales of its common stock, including pursuant to this offering, may have on the

market price for its common stock. The issuance and sale of substantial amounts of common stock, including issuances and sales pursuant to this offering, could adversely affect the market price of the Company’s common stock.

S-8

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

This prospectus supplement and the accompanying prospectus include and incorporate by reference forward-looking statements

within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend such forward-looking statements to be covered by the safe harbor provisions

for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identifiable by use of the words “believe,” “expect,” “intend,”

“anticipate,” “plan,” “estimate,” “project ” or similar expressions. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Actual results could differ

materially from those in forward-looking statements because of, among other reasons, the factors described under “Risk Factors” in this prospectus and Item 1A “Risk Factors” in our Annual Report on Form 10-K and in the periodic

reports that we file with the SEC, as well as the following:

|

|

•

|

|

state and federal legislative and regulatory initiatives (including deregulation) that affect cost and investment recovery, have an impact on rate

structures, and affect the speed at, and the degree to, which competition enters the electric and natural gas industries;

|

|

|

•

|

|

the outcomes of regulatory, tax, environmental, and legal matters, including whether pending matters are resolved within current estimates and whether

the costs associated with such matters are adequately covered by insurance or recovered in rates;

|

|

|

•

|

|

the weather and other natural phenomena, including the economic, operational, and other effects of hurricanes, ice storms, and other damaging weather

events;

|

|

|

•

|

|

industrial, commercial, and residential growth or contraction in our markets or service territories;

|

|

|

•

|

|

the timing and extent of changes in commodity prices and interest rates;

|

|

|

•

|

|

the capital-intensive nature of our regulated energy businesses;

|

|

|

•

|

|

the extent of success in connecting natural gas and electric supplies to transmission systems and in expanding natural gas and electric markets;

|

|

|

•

|

|

the results of financing efforts, including our ability to obtain financing on favorable terms, which can be affected by various factors, including

credit ratings and general economic conditions;

|

|

|

•

|

|

the ability to establish and maintain new key supply sources;

|

|

|

•

|

|

changes in environmental and other laws and regulations to which we are subject and environmental conditions of property that we now or may in the

future own or operate;

|

|

|

•

|

|

general economic conditions, including any potential effects arising from terrorist attacks and any hostilities or other external factors over which we

have no control;

|

|

|

•

|

|

conditions of the capital markets and equity markets during the periods covered by the forward-looking statements;

|

|

|

•

|

|

the ability to continue to hire, train, and retain appropriately qualified personnel;

|

|

|

•

|

|

the creditworthiness of counterparties with which we are engaged in transactions;

|

|

|

•

|

|

the effect of spot, forward, and future market prices on our various energy businesses;

|

|

|

•

|

|

the ability to construct facilities at or below estimated costs;

|

|

|

•

|

|

possible increased federal, state, and local regulation of the safety of our operations;

|

|

|

•

|

|

the ability to successfully execute, manage, and integrate merger, acquisition, or divestiture plans, regulatory or other limitations imposed as a

result of a merger, acquisition, or divestiture, and the success of the business following a merger, acquisition, or divestiture;

|

S-9

|

|

•

|

|

the inherent hazards and risks involved in our energy businesses;

|

|

|

•

|

|

risks related to cyber-attacks that could disrupt our business operations or result in failure of information technology systems;

|

|

|

•

|

|

the effect of competition on our businesses;

|

|

|

•

|

|

the impact on our cost and funding obligations under our pension and other postretirement benefit plans of potential downturns in the financial

markets, lower discount rates, and costs associated with the Patient Protection and Affordable Care Act;

|

|

|

•

|

|

the effect of accounting pronouncements issued periodically by accounting standard-setting bodies;

|

|

|

•

|

|

the timing of regulatory and other governmental approvals, authorizations, and permits; and

|

|

|

•

|

|

the loss of customers due to government-mandated sale of our utility distribution facilities.

|

In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might

occur to a different extent or at a different time than we have described. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

S-10

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information contained in documents we file with the SEC,

which means that we can disclose important information to you by referring to those documents. The information incorporated by reference is an important part of this prospectus. Any statement contained in a document that is incorporated by

reference in this prospectus supplement or the accompanying prospectus is automatically updated and superseded if information contained in this prospectus supplement or the accompanying prospectus, or information that we later file with the SEC,

modifies or replaces that information. Any statement made in this prospectus supplement or the accompanying prospectus concerning the contents of any contract, agreement, or other document is only a summary of the actual contract, agreement, or

other document. If we have filed or incorporated by reference any contract, agreement, or other document as an exhibit to the registration statement, you should read the exhibit for a more complete understanding of the document or matter

involved. Each statement regarding a contract, agreement, or other document is qualified in its entirety by reference to the actual document.

We incorporate by reference the following documents we filed, excluding any information contained therein or attached as exhibits thereto which has been furnished to, but not filed with, the SEC:

|

|

(a)

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed on February 29, 2016;

|

|

|

(b)

|

Our definitive Proxy Statement on Schedule 14A filed on April 5, 2016;

|

|

|

(c)

|

Our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2016, filed on May 5, 2016;

|

|

|

(d)

|

Our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2016, filed on August 4, 2016;

|

|

|

(e)

|

Our Current Report on Form 8-K dated May 4, 2016, filed on May 10, 2016;

|

|

|

(f)

|

Our Current Report on Form 8-K dated May 20, 2016, filed on May 20, 2016;

|

|

|

(g)

|

The description of our Rights contained in our Registration Statement on Form 8-A filed on August 24, 1999, including any amendment or report filed for the purpose of

updating the description; and

|

|

|

(h)

|

The description of our Common Stock contained in our registration statements filed pursuant to Section 12 of the Exchange Act, including any amendment or report filed

for the purpose of updating the description.

|

Any documents we file pursuant to Sections 13(a), 13(c), 14, or

15(d) of the Exchange Act after the date of this prospectus supplement and prior to the termination of the offering of the securities to which this prospectus supplement and the accompanying prospectus relate will automatically be deemed to be

incorporated by reference in this prospectus supplement and the accompanying prospectus and a part of this prospectus supplement and the accompanying prospectus from the date of filing such documents; provided, however, that we are not

incorporating, in each case, any documents or information contained therein that has been furnished to, but not filed with, the SEC.

S-11

USE OF PROCEEDS

As a result of this offering, we will receive approximately

$ million in net proceeds from the sale of our common stock, after deducting an aggregate of approximately

$ in underwriting discounts and commissions and estimated offering expenses. If the underwriters’ option to purchase additional shares is exercised in full, we estimate that

our net proceeds will be approximately $ million.

We intend to use the net proceeds from this offering to pay down certain of our short-term revolving debt, which will increase our

borrowing availability under these facilities for future capital needs.

S-12

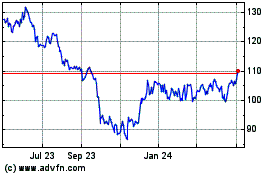

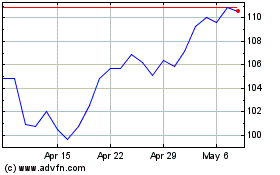

MARKET PRICE, DIVIDENDS AND DIVIDEND POLICY

Our common stock is listed on the New York Stock Exchange under the symbol “CPK”, as stated previously. The following table sets

forth the high and low closing prices of our common stock on the New York Stock Exchange and the cash dividends declared on our common stock for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period

|

|

High

|

|

|

Low

|

|

|

Dividends Per

Share

|

|

|

2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

42.91

|

|

|

$

|

37.78

|

|

|

$

|

0.2567

|

|

|

Second Quarter

|

|

$

|

47.75

|

|

|

$

|

39.97

|

|

|

$

|

0.2700

|

|

|

Third Quarter

|

|

$

|

48.33

|

|

|

$

|

39.96

|

|

|

$

|

0.2700

|

|

|

Fourth Quarter

|

|

$

|

52.60

|

|

|

$

|

41.36

|

|

|

$

|

0.2700

|

|

|

2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

51.70

|

|

|

$

|

45.57

|

|

|

$

|

0.2700

|

|

|

Second Quarter

|

|

$

|

55.59

|

|

|

$

|

45.54

|

|

|

$

|

0.2875

|

|

|

Third Quarter

|

|

$

|

55.45

|

|

|

$

|

46.62

|

|

|

$

|

0.2875

|

|

|

Fourth Quarter

|

|

$

|

60.31

|

|

|

$

|

50.03

|

|

|

$

|

0.2875

|

|

|

2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

66.37

|

|

|

$

|

53.54

|

|

|

$

|

0.2875

|

|

|

Second Quarter

|

|

$

|

66.18

|

|

|

$

|

57.20

|

|

|

$

|

0.3050

|

|

|

Third Quarter (Through September 16)

|

|

$

|

66.89

|

|

|

$

|

59.74

|

|

|

$

|

0.3050

|

|

On September 20, 2016, the last reported closing price of our common stock on the New York Stock

Exchange was $62.18 per share and on June 30, 2016, we had approximately 2,396 holders of record of our common stock.

We

have paid a quarterly cash dividend on our common stock for 55 consecutive years. We have typically paid dividends four times a year: January, April, July and October. Dividends are payable at the discretion of our board of directors. Future payment

of dividends, and the amount of these dividends, will depend upon future earnings, cash flow, financial requirements and other factors. We cannot assure you that we will pay a dividend at any time in the future or that we will maintain or raise the

level of dividends in the future. Our board of directors can elect at any time, and for an indefinite duration, not to declare dividends on our common stock.

On August 3, 2016, our board of directors declared a quarterly dividend of $0.3050 per share of our common stock. The dividend will be paid on October 5, 2016, to stockholders of record at the close of

business on September 15, 2016 (the “record date”).

S-13

CERTAIN MATERIAL UNITED STATES FEDERAL INCOME AND ESTATE TAX

CONSEQUENCES

FOR NON-U.S. HOLDERS

The following summary discusses certain material U.S. federal income and estate tax consequences to “non-U.S. holders” relating to the purchase, ownership and disposition of our common shares.

As used herein, a non-U.S. holder means a beneficial owner of our common shares that is not a “U.S. Person” (as defined below) or a partnership for U.S. federal income tax purposes. This summary is based upon the provisions of the U.S.

Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations, rulings and judicial decisions, all as in effect on the date hereof. Those authorities may be subject to change or differing interpretations at any time,

perhaps retroactively, so as to result in U.S. federal income tax consequences different from those discussed below. There can be no assurance that the Internal Revenue Service (the “IRS”) will agree with the statements herein and we have

not obtained, nor do we intend to obtain, a ruling from the IRS with respect to the U.S. federal income or estate tax consequences to a non-U.S. holder of the purchase, ownership or disposition of our common shares. A “U.S. Person” means a

beneficial owner of our common shares that is for U.S. federal income tax purposes:

|

|

•

|

|

an individual who is a citizen or a resident of the United States;

|

|

|

•

|

|

a corporation (or any entity treated as a corporation for U.S. federal income tax purposes) that is created or organized in or under the laws of the

United States, any State thereof or the District of Columbia;

|

|

|

•

|

|

an estate the income of which is subject to U.S. federal income taxation regardless of its source; or

|

|

|

•

|

|

a trust that (1) is subject to the primary supervision of a court within the United States and one or more U.S. persons have the authority to

control all substantial decisions of the trust or (2) was in existence on August 20, 1996, was treated as a U.S. domestic trust immediately prior to that date, and has validly elected to continue to be treated as a U.S. domestic trust.

|

This summary deals only with our common shares held as capital assets within the meaning of

section 1221 of the Code (generally, property held for investment). This summary does not address all of the U.S. federal income and estate tax consequences that may be relevant to a non-U.S. holder in light of such holder’s own particular

circumstances, nor does it deal with special situations, such as:

|

|

•

|

|

tax consequences to non-U.S. holders who may be subject to special tax treatment, such as holders of more than 5 percent of our outstanding common

shares, dealers in securities, banks, insurance companies, partnerships or other entities treated as pass-through entities for U.S. federal income tax purposes, certain former citizens or residents of the United States, “controlled foreign

corporations,” “passive foreign investment companies,” corporations that accumulate earnings to avoid U.S. federal income tax, tax-exempt entities, pension plans, common trust funds, certain trusts, hybrid entities, foreign

governments, international organizations and dealers or traders in securities that elect to use a mark-to-market method of accounting for their securities holdings;

|

|

|

•

|

|

tax consequences to persons holding our common shares as part of a hedging, integrated, constructive sale or conversion transaction or a straddle;

|

|

|

•

|

|

any gift tax consequences;

|

|

|

•

|

|

the Medicare tax imposed on certain investment income;

|

|

|

•

|

|

alternative minimum tax consequences, if any; or

|

|

|

•

|

|

any U.S. state, local or foreign tax consequences.

|

If a partnership (or other entity or arrangement treated as a partnership) holds our common shares, the tax treatment of a partner in the partnership generally will depend upon the status of the partner

and the status and activities of the partnership. Prospective investors that are partnerships (or entities treated as partnerships for U.S. federal income tax purposes) should consult their own tax advisers regarding the U.S. federal income and

estate tax considerations to them and their partners of holding our common shares.

S-14

THIS DISCUSSION IS FOR GENERAL PURPOSES ONLY. IF YOU ARE CONSIDERING THE PURCHASE OF OUR

COMMON SHARES, YOU SHOULD CONSULT YOUR OWN TAX ADVISERS CONCERNING THE U.S. FEDERAL AND ESTATE TAX CONSEQUENCES TO YOU IN LIGHT OF YOUR OWN PARTICULAR CIRCUMSTANCES, AS WELL AS ANY TAX CONSEQUENCES ARISING UNDER THE LAWS OF ANY OTHER TAXING

JURISDICTION, THE EFFECT OF ANY CHANGES IN APPLICABLE TAX LAW, AND YOUR ENTITLEMENT TO BENEFITS UNDER AN APPLICABLE INCOME TAX TREATY.

Dividends on Common Shares

If we make a distribution of cash or other

property (other than certain pro rata distributions of our common shares) in respect of our common shares, the distribution will be treated as a dividend to the extent it is paid from our current or accumulated earnings and profits (as determined

under U.S. federal income tax principles). If the amount of a distribution exceeds our current and accumulated earnings and profits, such excess first will be treated as a tax-free return of capital to the extent of the non-U.S. holder’s

adjusted tax basis in our common shares and thereafter will be treated as capital gain subject to the tax treatment described below in “—Sale or Other Disposition of Common Shares.”

Distributions treated as dividends on our common shares held by a non-U.S. holder generally will be subject to U.S. federal withholding

tax at a rate of 30 percent, or at a lower rate if provided by an applicable income tax treaty and the non-U.S. holder has provided the documentation required to claim benefits under such treaty to us or our agent. Generally, to claim the benefits

of an income tax treaty, a non-U.S. holder will be required to provide a properly executed IRS Form W-8BEN or Form W-8BEN-E (or appropriate substitute or successor form) certifying its entitlement to benefits under the treaty.

If, however, a dividend is effectively connected with the conduct of a trade or business in the United States by the non-U.S. holder (and,

if an applicable tax treaty so provides, is attributable to a permanent establishment or fixed base maintained by the non-U.S. holder in the United States), the dividend will not be subject to the 30 percent U.S. federal withholding tax (provided

the non-U.S. holder has provided the appropriate documentation, generally an IRS Form W-8ECI, to the withholding agent), but the non-U.S. holder generally will be subject to U.S. federal income tax in respect of the dividend on a net income

basis, and at graduated rates, in substantially the same manner as U.S. Persons. Dividends received by a non-U.S. holder that is a corporation for U.S. federal income tax purposes and which are effectively connected with the conduct of a U.S. trade

or business may also be subject to a branch profits tax at the rate of 30 percent (or a lower rate if provided by an applicable tax treaty).

A non-U.S. holder that is eligible for a reduced rate of U.S. federal withholding tax under an income tax treaty may obtain a refund or credit of any excess amounts withheld by timely filing an

appropriate claim for a refund together with the required information with the IRS.

Sale or Other Disposition of Common

Shares

Subject to the below discussions of backup withholding and FATCA, a non-U.S. holder generally will not be subject

to U.S. federal income or withholding tax on gain realized on the sale or other disposition of our common shares unless:

|

|

•

|

|

such non-U.S. holder is an individual who is present in the United States for 183 days or more in the taxable year of such sale or

disposition, and certain other conditions are met;

|

|

|

•

|

|

such gain is effectively connected with the conduct by the non-U.S. holder of a trade or business in the United States (and, if an applicable tax

treaty so provides, is attributable to a permanent establishment or a fixed base maintained by the non-U.S. holder in the United States); or

|

|

|

•

|

|

we are or have been a “U.S. real property holding corporation,” which we refer to as a “USRPHC,” under section 897 of the Code at

any time during the shorter of the five-year period ending on the date of disposition and the non-U.S. holder’s holding period for its shares of our common shares.

|

S-15

Gain realized by such non-U.S. holder described in the first bullet above will be subject to

a flat 30 percent tax (or such lower tax rate specified by an applicable income tax treaty), which may be offset by certain U.S. source capital losses.

Gain realized by a non-U.S. holder that is effectively connected with such non-U.S. holder’s conduct of a trade or business in the United States generally will be subject to U.S. federal income tax

on a net income basis, and at graduated rates, in substantially the same manner as a U.S. Person (except as provided by an applicable tax treaty). In addition, if such non-U.S. holder is a corporation for U.S. federal income tax purposes, it may

also be subject to a branch profits tax at the rate of 30 percent (or a lower rate if provided by an applicable tax treaty).

Generally, a corporation is a USRPHC if the fair market value of its United States real property interests equals or exceeds 50 percent of

the sum of the fair market value of its worldwide real property interests and its other assets used or held for use in a trade or business (all as determined for U.S. federal income tax purposes). Given the lack of clear guidance in this area, there

can be no assurances that we are not or will not become a USRPHC. If, however, we were a USRPHC during the applicable testing period, non-U.S. holders owning (directly or indirectly) more than 5 percent of our common shares will be subject to

different tax consequences and should consult their own tax advisers. U.S. federal income tax will not apply to gain realized on the sale or disposition of our common shares by a non-U.S. holder that owns (directly or indirectly) 5 percent or less

of our common shares so long as our common shares are “regularly traded on an established securities market” (such as the NYSE) as defined under applicable Treasury regulations. However, we can provide no assurance that our common shares

will remain regularly traded.

Information Reporting and Backup Withholding

Dividends and proceeds from the sale or other taxable disposition of our common shares are potentially subject to backup withholding at

the applicable rate (currently 28 percent). In general, backup withholding will not apply to dividends on, or proceeds from the disposition of, our common shares paid by us or our paying agents, in their capacities as such, to a non-U.S. holder if

the holder has provided the required certification (generally on Form W-8BEN or Form W-8BEN-E) that it is a non-U.S. holder and neither we nor our paying agent has actual knowledge (or reason to know) that the holder is a U.S. Person.

Generally, the amount of dividends on our common shares paid to a non-U.S. holder and the amount of any tax withheld from such dividends

must be reported annually to the IRS and to the non-U.S. holder. Copies of these information returns may be made available by the IRS to the tax authorities of the country in which the non-U.S. holder is a resident under the provisions of an

applicable tax treaty or agreement.

Backup withholding is not an additional tax. Any amounts withheld under the backup

withholding rules will be allowed as a refund or a credit against a non-U.S. holder’s U.S. federal income tax liability, provided the required information is furnished on a timely basis to the IRS.

Non-U.S. holders should consult their tax advisers regarding the application of the information reporting and backup withholding rules to

them.

FATCA

The Foreign Account Tax Compliance Act provisions of the Hiring Incentives to Restore Employment Act and Treasury regulations thereunder, commonly referred to as “FATCA”, generally, will impose

a U.S. federal withholding tax of 30 percent on certain types of payments, including payments of U.S. source interest or dividends and gross proceeds from the sale (including redemption) of certain securities producing such U.S. source interest or

dividends made to (i) “foreign financial institutions” unless they agree to collect and disclose to the IRS information regarding their direct and indirect U.S. account holders or (ii) certain “non-financial foreign

entities” unless they certify that they do not have any “substantial United States owners” (as defined in the Code) or furnish identifying information regarding each substantial United States owner (generally by providing an IRS Form

W-8BEN or Form W-8BEN-E). In

S-16

certain circumstances, the relevant foreign financial institution or non-financial foreign entity may qualify for an exemption from these rules, which exemption is typically evidenced by

providing appropriate documentation (such as an IRS Form W-8BEN or Form W-8BEN-E). In addition, an intergovernmental agreement between the United States and the jurisdiction of a foreign financial institution may modify the information reporting and

related rules under FATCA.

The withholding obligations described above generally will apply to payments of dividends on the

common shares, and to payments of gross proceeds from a sale or other disposition (including redemption) of the common shares occurring on or after January 1, 2019. Non-U.S. holders are urged to consult their tax advisers regarding FATCA and

the application of these requirements to their investment in the common shares.

U.S. Federal Estate Tax

Common shares owned or treated as owned by an individual who is not a citizen of and who is not domiciled in the United States (as

specifically defined for U.S. federal estate tax purposes) at the time of death will still be included in the individual’s gross estate for U.S. federal estate tax purposes and may be subject to U.S. federal estate tax unless an applicable

estate tax treaty provides otherwise.

S-17

UNDERWRITING

We have entered into an underwriting agreement, dated September , 2016, with the

underwriters named below with respect to the shares of common stock to be offered pursuant to this prospectus supplement. Subject to the terms and conditions contained in the underwriting agreement, we have agreed to sell and the underwriters, for

whom Wells Fargo Securities, LLC and RBC Capital Markets, LLC are acting as representatives, have agreed to purchase from us the number of shares of our common stock set forth opposite its name in the following table:

|

|

|

|

|

|

|

Name of Underwriter

|

|

Number

of Shares

|

|

|

Wells Fargo Securities, LLC

|

|

|

|

|

|

RBC Capital Markets, LLC

|

|

|

|

|

|

Janney Montgomery Scott LLC

|

|

|

|

|

|

Robert W. Baird & Co. Incorporated

|

|

|

|

|

|

J.J.B. Hilliard, W.L. Lyons, LLC

|

|

|

|

|

|

USCA Securities LLC

|

|

|

|

|

|

Ladenburg Thalmann & Co. Inc.

|

|

|

|

|

|

BB&T Capital Markets, a division of BB&T Securities, LLC

|

|

|

|

|

|

Total

|

|

|

|

|

Option to Purchase Additional Shares

We have granted to the underwriters a 30-day option, exercisable from the date of the underwriting agreement, to purchase on a pro-rata

basis up to additional shares of our common stock at the public offering price less the underwriting discounts and commissions.

We will be obligated to sell these shares of our common stock to the underwriters to the extent the option to purchase additional shares

is exercised.

Discounts and Commissions

The underwriters propose to offer the shares of our common stock initially at the public offering price on the cover page of this prospectus supplement and to certain dealers at that price less a

concession not in excess of $ per share. The underwriters may allow, and the dealers may reallow, a concession not to exceed

$ per share on sales to other dealers. After the public offering, the underwriters may change the public offering price and concessions to dealers.

The following table summarizes the compensation to be paid to the underwriters. The information assumes either no exercise or full

exercise by the underwriters of their option to purchase additional shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

Per

Share

|

|

|

Without

Option

|

|

|

With

Option

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions payable by us

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

The underwriting fee will be an amount equal to the offering price per share to the public of our common

stock, less the amount paid by the underwriters to us per share of common stock. The underwriters’ compensation was determined through arms’ length negotiations between the underwriters and us.

We estimate that the expenses payable by us in connection with this offering, other than the underwriting discounts and commissions

referred to above, will be approximately $ . Estimated expenses include SEC filing fees, New York Stock Exchange listing fees, printing, legal, accounting, transfer agent and

registrar fees, and other miscellaneous fees and expenses.

S-18

Lock-Up Arrangement

We and our directors and officers have agreed not to sell, transfer, pledge, offer or contract to sell, transfer or pledge, or file with

the SEC a registration statement under the Securities Act, relating to any additional shares of our common stock or securities convertible into or exchangeable or exercisable for any shares of our common stock without the prior written consent of

Wells Fargo Securities, LLC and RBC Capital Markets, LLC for a period of 60 days after the date of the underwriting agreement. These restrictions will not apply to shares issued pursuant to employee benefit plans or other employee, executive or

director compensation plans, pursuant to our Retirement Savings Plan, Dividend Reinvestment and Direct Stock Purchase Plan or the Chesapeake Utilities Corporation 2013 Stock and Incentive Compensation Plan.

Indemnity

We have agreed to indemnify the underwriters against certain liabilities arising out of this prospectus supplement, the accompanying

prospectus and certain other materials in connection with this offering.

Our Relationship with the Underwriters

The underwriters and their respective affiliates are full service financial institutions engaged in various activities,

which may include, among other activities, securities trading and underwriting, commercial and investment banking, financial advisory, corporate trust, investment management, investment research, principal investment, hedging, financing and

brokerage activities. In the ordinary course of their respective businesses, certain of the underwriters and/or their respective affiliates have in the past and may in the future provide us and our affiliates with commercial banking, investment

banking, financial advisory and other services for which they have and in the future will receive customary fees.

In

particular, affiliates of Wells Fargo Securities, LLC and RBC Capital Markets, LLC serve as lenders to the Company under its Credit Agreement dated October 8, 2015, as amended. None of the net proceeds of this offering will be used to repay any

amounts due to such affiliates under the credit agreement.

In the ordinary course of their various business activities, the

underwriters and certain of their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and

for the accounts of their customers, and such investment and securities activities may involve securities and/or instruments issued by us and our affiliates. If the underwriters or their respective affiliates have a lending relationship with us,

they routinely hedge their credit exposure to us consistent with their customary risk management policies. The underwriters and their respective affiliates may hedge such exposure by entering into transactions which consist of either the purchase of

credit default swaps or the creation of short positions in our securities or the securities of our affiliates, including potentially the common stock offered hereby. Any such short positions could adversely affect future trading prices of the common

stock offered hereby. The underwriters and certain of their respective affiliates may also communicate independent investment recommendations, market color or trading ideas and/or publish or express independent research views in respect of such

securities or instruments and may at any time hold, or recommend to customers that they acquire, long and/or short positions in such securities and instruments.

Stabilization

The underwriters may engage in over-allotment transactions,

stabilizing transactions and syndicate covering transactions in accordance with Regulation M under the Exchange Act.

|

|

•

|

|

Over-allotment involves sales by the underwriters of shares in excess of the number of shares the underwriters are obligated to purchase, which creates

syndicate short positions.

|

|

|

•

|

|

Stabilizing transactions permit bids to purchase shares of our common stock so long as the stabilizing bids do not exceed a specified maximum.

|

S-19

|

|

•

|

|

Syndicate covering transactions involve purchases of our common stock in the open market after the distribution has been completed to cover syndicate

short positions.

|

These stabilizing transactions and syndicate covering transactions may cause the price of

our common stock to be higher than the price that might otherwise exist in the open market. These transactions may be effected on the New York Stock Exchange or otherwise. Neither we nor any of the underwriters make any representation that the

underwriters will engage in any of the transactions described above. If commenced, these transactions may be discontinued at any time without notice. Neither we nor any of the underwriters make any representation or prediction as to the effect that

the transactions described above, if commenced, may have on the market price of our common stock.

S-20

NOTICE TO INVESTORS

Canada

The common stock may be sold only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as

defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant

Obligations. Any resale of the common stock must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if

this Prospectus Supplement or the accompanying Prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the

securities legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with

a legal advisor.

Pursuant to Section 3A.3 of National Instrument 33-105 Underwriting Conflicts (“NI 33-105”), the

Underwriters are not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this offering.

EXPERTS

The consolidated financial

statements and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control Over Financial Reporting) incorporated in this prospectus supplement by

reference to the Annual Report on Form 10-K for the year ended December 31, 2015, have been so incorporated in reliance on the report of Baker Tilly Virchow Krause, LLP, an independent registered public accounting firm, given on the authority of

said firm as experts in auditing and accounting.

S-21

LEGAL MATTERS

The validity of the issuance of common stock and certain other legal matters with respect to the offering of the common stock will be

passed upon for the Company by Baker & Hostetler LLP, Orlando, Florida. Certain legal matters will be passed upon for the underwriters by Hunton & Williams LLP, New York, New York.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly, and special reports, proxy statements, and other information with the SEC pursuant to the Exchange

Act. Such filings are available to the public from the SEC’s website at http://www.sec.gov. You may also read and copy any document we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549.

You may obtain copies of any document filed by us at prescribed rates by writing to the Public Reference Section of the SEC at that address. You may obtain information about the operation of the SEC’s Public Reference Room by calling the SEC at

1-800-SEC-0330.

You may inspect reports and other information that we file at the offices of the New York Stock Exchange, Inc., 20 Broad Street, New York, New York 10005. Information about us, including

our filings, is also available on our website at http://www.chpk.com; however, that information is not part of this prospectus supplement or the accompanying prospectus.

We have filed a registration statement, of which this prospectus supplement and accompanying prospectus are a part, and related exhibits with the SEC under the Securities Act. That registration

statement contains additional information about us and our common stock. You may inspect the registration statement and exhibits without charge at the SEC’s Public Reference Room or at the SEC’s website set forth above, and you may

obtain copies from the SEC at prescribed rates.

S-22

PROSPECTUS

Chesapeake Utilities Corporation

Common Stock

We may offer, from time to time in one or more offerings, in amounts, at prices, and on terms that we will determine at the time of offering, shares of our common stock, par value per share $0.4867 (the

“Common Stock”). We will provide the specific terms of any offering of Common Stock in supplements to this prospectus. The prospectus supplements will also describe the specific manner in which we will offer these securities and

may also supplement, update, or amend information contained in this prospectus. You should read this prospectus, the applicable prospectus supplement, and any documents incorporated by reference into this prospectus carefully before you invest.

We may sell Common Stock on a continuous or delayed basis directly, through agents, dealers, or underwriters as designated from time to time,

or through a combination of these methods. If any agents, dealers, or underwriters are involved in the sale of any securities, the applicable prospectus supplement will set forth any applicable commissions or discounts. Our net proceeds

from the sale of securities also will be set forth in the applicable prospectus supplement.

Our Common Stock is listed on the New York Stock

Exchange under the symbol, “CPK.” The last reported sale price of our Common Stock on the New York Stock Exchange on September 20, 2016 was $62.18 per share.

Investing in our common stock involves risks. See “

Risk Factors

” on page 5.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE

SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is September 21, 2016.

We have not authorized any

dealer, salesman, or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus or any applicable supplement to this prospectus. You must not rely upon any

information or representation not contained or incorporated by reference in this prospectus or any applicable supplement to this prospectus as if we had authorized it. This prospectus and any applicable prospectus supplement do not constitute

an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate. Nor do this prospectus and any accompanying prospectus supplement constitute an offer to sell or the solicitation

of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus or any applicable prospectus

supplement is correct on any date after its date, even though this prospectus or a supplement is delivered or securities are sold on a later date.

TABLE OF CONTENTS

FORWARD-LOOKING INFORMATION

This prospectus and the applicable prospectus supplements include and incorporate by reference forward-looking statements within the

meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend such forward-looking statements to be covered by the safe harbor provisions for

forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identifiable by use of the words “believe,” “expect,” “intend,”

“anticipate,” “plan,” “estimate,” “project ” or similar expressions. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Actual results could

differ materially from those in forward-looking statements because of, among other reasons, the factors described under Item 1A “Risk Factors” in our Annual Report on Form 10-K and in the periodic reports that we file with the Securities

and Exchange Commission (the “SEC”), as well as the following:

|

|

•

|

|

state and federal legislative and regulatory initiatives (including deregulation) that affect cost and investment recovery, have an impact on rate

structures, and affect the speed at, and the degree to, which competition enters the electric and natural gas industries;

|

|

|

•

|

|

the outcomes of regulatory, tax, environmental, and legal matters, including whether pending matters are resolved within current estimates and whether

the costs associated with such matters are adequately covered by insurance or recovered in rates;

|

|

|

•

|

|

the weather and other natural phenomena, including the economic, operational, and other effects of hurricanes, ice storms, and other damaging weather

events;

|

|

|

•

|

|

industrial, commercial, and residential growth or contraction in our markets or service territories;

|

|

|

•

|

|

the timing and extent of changes in commodity prices and interest rates;

|

|

|

•

|

|

the capital-intensive nature of our regulated energy businesses;

|

|

|

•

|

|

the extent of success in connecting natural gas and electric supplies to transmission systems and in expanding natural gas and electric markets;

|

|

|

•

|

|