As filed with the Securities and Exchange Commission on September 21, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Chesapeake Utilities Corporation

(Exact name of registrant as specified

in its charter)

|

|

|

|

|

Delaware

|

|

51-0064146

|

|

(State or other jurisdiction of incorporation or

organization)

|

|

(I.R.S. Employer Identification No.)

|

909 Silver Lake Boulevard

Dover, Delaware 19904

(302) 734-6799

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Beth W. Cooper

Senior Vice President and Chief Financial Officer

Chesapeake Utilities Corporation

909 Silver Lake Boulevard

Dover, Delaware 19904

(302) 734-6799

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jeffrey E. Decker, Esq.

Baker & Hostetler LLP

2300 SunTrust Center

200 S. Orange Avenue

Orlando, Florida 32801

(407) 649-4000

Approximate date of commencement of proposed sale to the

public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered

on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

¨

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in

connection with dividend or interest reinvestment plans, check the following box.

x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering.

¨

If this

form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box.

x

If this form is a post-effective amendment to a registration

statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box.

¨

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

x

|

|

Accelerated filer

|

|

¨

|

|

Non-accelerated filer

|

|

¨

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

¨

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

|

Amount to be

registered(1)

|

|

Proposed

maximum

offering price

per unit(1)

|

|

Proposed

maximum

aggregate

offering price(1)

|

|

Amount of

registration fee(2)

|

|

Common Stock, par value per share $0.4867

|

|

—

|

|

—

|

|

$

|

|

$

|

|

Preferred Stock Purchase Rights(3)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

Total

|

|

—

|

|

—

|

|

$

|

|

$

|

|

|

|

|

|

(1)

|

The Registrant is registering an indeterminate number of shares of its common stock, par value $0.4867 per share (the “Common Stock”), as may from time to

time be offered in unspecified numbers and at indeterminate prices. In addition, pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the securities being registered hereunder includes such

indeterminate number of shares of Common Stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends, or similar transactions. In accordance with Rule 457(o) under the Securities

Act, the Registrant is required to specify only the maximum aggregate offering price for all classes of securities being registered.

|

|

(2)

|

Calculated in accordance with Rule 456(b) and 457(r) under the Securities Act.

|

|

(3)

|

The Registrant’s Common Stock currently includes certain preferred stock purchase rights (collectively, the “Rights”) issued pursuant to that certain

Rights Agreement, dated as of August 20, 1999 (filed on Exhibit 4.1 to the Current Report on Form 8-K dated August 24, 1999, File No. 001-11590), as amended on September 12, 2008 (filed on Exhibit 4.1 to the Current Report on Form 8-K dated

September 12, 2008, File No. 001-11590) (the “Rights Agreement”), between the Registrant and Computershare Trust Company, N.A., a federally chartered trust company, as successor rights agents. Until the occurrence of certain events

specified in the Rights Agreement, none of which have occurred, the Rights are not exercisable, are evidenced by the certificate for the Common Stock, and will be transferred along with and only with, and are not severable from, the Common

Stock. The value attributable to the Rights, if any, is reflected in the market price of the Common Stock. No separate consideration will be payable for the Rights.

|

PROSPECTUS

Chesapeake Utilities Corporation

Common Stock

We may offer, from time to time in one or more offerings, in amounts, at prices, and on terms that we will determine at the time of offering, shares of our common stock, par value per share $0.4867 (the

“Common Stock”). We will provide the specific terms of any offering of Common Stock in supplements to this prospectus. The prospectus supplements will also describe the specific manner in which we will offer these securities and

may also supplement, update, or amend information contained in this prospectus. You should read this prospectus, the applicable prospectus supplement, and any documents incorporated by reference into this prospectus carefully before you invest.

We may sell Common Stock on a continuous or delayed basis directly, through agents, dealers, or underwriters as designated from time to time,

or through a combination of these methods. If any agents, dealers, or underwriters are involved in the sale of any securities, the applicable prospectus supplement will set forth any applicable commissions or discounts. Our net proceeds

from the sale of securities also will be set forth in the applicable prospectus supplement.

Our Common Stock is listed on the New York Stock

Exchange under the symbol, “CPK.” The last reported sale price of our Common Stock on the New York Stock Exchange on September 20, 2016 was $62.18 per share.

Investing in our common stock involves risks. See “

Risk Factors

” on page 5.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE

SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is September 21, 2016.

We have not authorized any

dealer, salesman, or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus or any applicable supplement to this prospectus. You must not rely upon any

information or representation not contained or incorporated by reference in this prospectus or any applicable supplement to this prospectus as if we had authorized it. This prospectus and any applicable prospectus supplement do not constitute

an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate. Nor do this prospectus and any accompanying prospectus supplement constitute an offer to sell or the solicitation

of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus or any applicable prospectus

supplement is correct on any date after its date, even though this prospectus or a supplement is delivered or securities are sold on a later date.

TABLE OF CONTENTS

FORWARD-LOOKING INFORMATION

This prospectus and the applicable prospectus supplements include and incorporate by reference forward-looking statements within the

meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend such forward-looking statements to be covered by the safe harbor provisions for

forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identifiable by use of the words “believe,” “expect,” “intend,”

“anticipate,” “plan,” “estimate,” “project ” or similar expressions. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Actual results could

differ materially from those in forward-looking statements because of, among other reasons, the factors described under Item 1A “Risk Factors” in our Annual Report on Form 10-K and in the periodic reports that we file with the Securities

and Exchange Commission (the “SEC”), as well as the following:

|

|

•

|

|

state and federal legislative and regulatory initiatives (including deregulation) that affect cost and investment recovery, have an impact on rate

structures, and affect the speed at, and the degree to, which competition enters the electric and natural gas industries;

|

|

|

•

|

|

the outcomes of regulatory, tax, environmental, and legal matters, including whether pending matters are resolved within current estimates and whether

the costs associated with such matters are adequately covered by insurance or recovered in rates;

|

|

|

•

|

|

the weather and other natural phenomena, including the economic, operational, and other effects of hurricanes, ice storms, and other damaging weather

events;

|

|

|

•

|

|

industrial, commercial, and residential growth or contraction in our markets or service territories;

|

|

|

•

|

|

the timing and extent of changes in commodity prices and interest rates;

|

|

|

•

|

|

the capital-intensive nature of our regulated energy businesses;

|

|

|

•

|

|

the extent of success in connecting natural gas and electric supplies to transmission systems and in expanding natural gas and electric markets;

|

|

|

•

|

|

the results of financing efforts, including our ability to obtain financing on favorable terms, which can be affected by various factors, including

credit ratings and general economic conditions;

|

|

|

•

|

|

the ability to establish and maintain new key supply sources;

|

|

|

•

|

|

changes in environmental and other laws and regulations to which we are subject and environmental conditions of property that we now or may in the

future own or operate;

|

|

|

•

|

|

general economic conditions, including any potential effects arising from terrorist attacks and any hostilities or other external factors over which we

have no control;

|

|

|

•

|

|

conditions of the capital markets and equity markets during the periods covered by the forward-looking statements;

|

|

|

•

|

|

the ability to continue to hire, train, and retain appropriately qualified personnel;

|

|

|

•

|

|

the creditworthiness of counterparties with which we are engaged in transactions;

|

|

|

•

|

|

the effect of spot, forward, and future market prices on our various energy businesses;

|

|

|

•

|

|

the ability to construct facilities at or below estimated costs;

|

|

|

•

|

|

possible increased federal, state, and local regulation of the safety of our operations;

|

|

|

•

|

|

the ability to successfully execute, manage, and integrate merger, acquisition, or divestiture plans, regulatory or other limitations imposed as a

result of a merger, acquisition, or divestiture, and the success of the business following a merger, acquisition, or divestiture;

|

|

|

•

|

|

the inherent hazards and risks involved in our energy businesses;

|

1

|

|

•

|

|

risks related to cyber-attacks that could disrupt our business operations or result in failure of information technology systems;

|

|

|

•

|

|

the effect of competition on our businesses;

|

|

|

•

|

|

the impact on our cost and funding obligations under our pension and other postretirement benefit plans of potential downturns in the financial

markets, lower discount rates, and costs associated with the Patient Protection and Affordable Care Act;

|

|

|

•

|

|

the effect of accounting pronouncements issued periodically by accounting standard-setting bodies;

|

|

|

•

|

|

the timing of regulatory and other governmental approvals, authorizations, and permits; and

|

|

|

•

|

|

the loss of customers due to government-mandated sale of our utility distribution facilities.

|

In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might

occur to a different extent or at a different time than we have described. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. This prospectus only provides you with a general description of the

securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update, or change information

contained in this prospectus. You should read both this prospectus and the applicable prospectus supplement, together with additional information described under the headings “Where You Can Find More Information” and

“Incorporation of Certain Information by Reference.”

Unless otherwise indicated or unless the context requires

otherwise, all references in this prospectus to “we,” “us,” “our,” the “Company,” the “Registrant,” or “Chesapeake Utilities” mean Chesapeake Utilities Corporation and its

subsidiaries. When we refer to our “Certificate of Incorporation,” we mean Chesapeake Utilities Corporation’s Amended and Restated Certificate of Incorporation, and when we refer to our “Bylaws,” we mean Chesapeake

Utilities Corporation’s Amended and Restated Bylaws, as amended from time to time.

WHERE YOU

CAN FIND MORE INFORMATION

We file annual, quarterly, and special reports, proxy statements, and other information with the

SEC pursuant to the Exchange Act. Such filings are available to the public on the SEC’s website at http://www.sec.gov. You may also read and copy any document we file with the SEC at the SEC’s Public Reference Room at 100 F

Street, N.E., Washington, D.C. 20549. You may obtain copies of any document filed by us at prescribed rates by writing to the Public Reference Section of the SEC at that address. You may obtain information about the operation of the

SEC’s Public Reference Room by calling the SEC at 1-800-SEC-0330. You may inspect reports and other information that we file at the offices of the New York Stock Exchange, Inc., 20 Broad Street, New York, New York 10005. Information

about us, including our filings, is also available on our website at http://www.chpk.com; however, that information is not part of this prospectus or any accompanying prospectus supplement.

We have filed a registration statement, of which this prospectus is a part, and related exhibits with the SEC under the Securities

Act. That registration statement contains additional information about us and our Common Stock. You may inspect the registration statement and exhibits without charge at the SEC’s Public Reference Room or at the SEC’s website set

forth above, and you may obtain copies from the SEC at prescribed rates.

2

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information contained in documents we file with the SEC,

which means that we can disclose important information to you by referring to those documents. The information incorporated by reference is an important part of this prospectus. Any statement contained in a document that is incorporated by

reference in this prospectus is automatically updated and superseded if information contained in this prospectus, or information that we later file with the SEC, modifies or replaces that information. Any statement made in this prospectus or

any prospectus supplement concerning the contents of any contract, agreement, or other document is only a summary of the actual contract, agreement, or other document. If we have filed or incorporated by reference any contract, agreement, or

other document as an exhibit to the registration statement, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding a contract, agreement, or other document is qualified in its

entirety by reference to the actual document.

We incorporate by reference the following documents we filed, excluding any

information contained therein or attached as exhibits thereto which has been furnished to, but not filed with, the SEC:

(a) Our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed on February 29, 2016;

(b) Our definitive Proxy Statement on Schedule 14A filed on April 5, 2016;

(c) Our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2016, filed on May

5, 2016;

(d) Our Quarterly Report on Form 10-Q for the quarterly period ended June 30,

2016, filed on August 4, 2016;

(e) Our Current Report on Form 8-K dated May 4, 2016,

filed on May 10, 2016;

(f) Our Current Report on Form 8-K dated May 20, 2016, filed on

May 20, 2016;

(g) The description of our Rights contained in our Registration Statement

on Form 8-A filed on August 24, 1999, including any amendment or report filed for the purpose of updating the description; and

(h) The description of our Common Stock contained in our registration statements filed pursuant to Section 12 of the Exchange Act, including any amendment or report filed for the

purpose of updating the description.

Any documents we file pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act

after the date of this prospectus and prior to the termination of the offering of the securities to which this prospectus relates will automatically be deemed to be incorporated by reference in this prospectus and a part of this prospectus from the

date of filing such documents; provided, however, that we are not incorporating, in each case, any documents or information contained therein that has been furnished to, but not filed with, the SEC.

Any person to whom a copy of this prospectus is delivered may obtain without charge, upon written or oral request, a copy of the documents

incorporated by reference in this prospectus (other than exhibits, unless they are specifically incorporated by reference in any such documents). Requests for copies of documents should be directed to the Investor Relations Administrator,

Chesapeake Utilities Corporation, P.O. Box 615, Dover, Delaware 19903-0615, telephone numbers: (302) 734-6716 or toll-free (888) 742-5275. We also maintain a website that contains additional information about us at

http://www.chpk.com.

You should rely only on the information incorporated by reference or set forth in this prospectus or the

applicable prospectus supplement. We have not authorized anyone else to provide you with different information. We may only use this prospectus to sell securities if it is accompanied by a prospectus supplement. We are offering these

securities only in states where the offer is permitted.

You should not assume that the information in this prospectus or the

applicable prospectus supplement is accurate as of any date other than the dates on the front pages of these documents.

3

THE COMPANY

Chesapeake Utilities is a Delaware corporation formed in 1947. We are a diversified energy company engaged, through our operating

divisions and subsidiaries, in various energy and other businesses. We operate primarily on the Delmarva Peninsula and in Florida, Pennsylvania, and Ohio, providing natural gas distribution and transmission, natural gas supply, gathering and

processing, electric distribution, and propane distribution service. The core of our business is regulated energy services, which provides stable earnings through our utility operations. Our unregulated businesses provide opportunities to

achieve returns greater than those of a traditional utility.

We operate within two reportable segments: Regulated Energy and

Unregulated Energy. The Regulated Energy segment includes our natural gas distribution, natural gas transmission, and electric distribution operations. All operations in this segment are regulated, as to their rates and service, by the

Public Service Commission having jurisdiction in each state in which we operate or by the Federal Energy Regulatory Commission in the case of Eastern Shore Natural Gas Company, our wholly-owned natural gas transmission subsidiary. The

Unregulated Energy segment includes our propane distribution, propane wholesale marketing, natural gas marketing, and natural gas supply, gathering, and processing services, which are unregulated as to their rates and services. Also included in

this segment are other unregulated energy services, such as energy-related merchandise sales; heating, ventilation, and air conditioning, plumbing, and electrical services; and electricity and steam generation services from the combined heat and

power plant we recently placed into service in Nassau County, Florida.

The remainder of our operations is presented as

“Other businesses and eliminations,” which consists of unregulated subsidiaries that own real estate leased to Chesapeake Utilities, as well as certain corporate costs not allocated to other operations.

Our principal executive office is located at 909 Silver Lake Boulevard, Dover, Delaware 19904, and our telephone number is (302)

734-6799. Our website address is http://www.chpk.com. Information on our website does not constitute part of this prospectus.

4

RISK FACTORS

You should carefully consider the risks described in the documents incorporated by reference in this prospectus before making an

investment decision. These risks are not the only ones we face. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition, or results of

operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks and you may lose all or part of your

investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these

forward-looking statements as a result of certain factors, including the risks described in the documents incorporated herein by reference, which include (i) our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and (ii)

documents we file with the SEC after the date of this prospectus that are incorporated by reference into this prospectus.

5

USE OF PROCEEDS

Unless otherwise specified in a prospectus supplement, the net proceeds from the sale of our Common Stock will be added to our general

corporate funds and may be used for general corporate purposes including, but not limited to, financing of capital expenditures, repayment of short-term debt, financing acquisitions, investing in subsidiaries, and general working capital purposes.

6

DESCRIPTION OF CAPITAL STOCK

Our authorized capital stock consists of 25,000,000 shares of common stock, par value $0.4867 per share, and 2,000,000 shares of preferred

stock, par value $0.01 per share.

Common Stock

Stockholders are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders and are entitled to receive dividends when and as declared by the Board of Directors

out of funds legally available therefore for distribution to stockholders and to share ratably in the assets legally available for distribution to stockholders in the event of the liquidation or dissolution, whether voluntary or involuntary, of

Chesapeake Utilities. Stockholders do not have cumulative voting rights in the election of directors and have no preemptive, subscription, or conversion rights. Our Common Stock is not subject to redemption by us. Each outstanding

share of our Common Stock currently has associated with it one preferred stock purchase Right issued under our stockholder rights plan, which is summarized below.

The transfer agent and registrar for our common stock is Computershare Trust Company, N.A.

Preferred Stock

Shares of preferred stock may be issued by us from time to

time, by authorization of the Board of Directors and without the necessity of further action or authorization by our stockholders, in one or more series and with such voting powers, designations, preferences and relative, participating, optional or

other special rights and qualifications as the Board of Directors may, in its discretion, determine, including, but not limited to: (a) the distinctive designation of such series and the number of shares to constitute such series; (b) the dividend

rights, if any, for such series; (c) the voting power, if any, of shares of such series; (d) the terms and conditions (including price), if any, upon which shares of such stock may be converted into or exchanged for shares of stock of any other

class or any other series of the same class or any other securities or assets; (e) our right, if any, to redeem shares of such series and the terms and conditions of such redemption; (f) the retirement or sinking fund provisions, if any, of shares

of such series and the terms and provisions relative to the operation thereof; (g) the amount, if any, that the stockholders of such series shall be entitled to receive in case of a liquidation, dissolution, or winding up of Chesapeake Utilities;

(h) the limitations and restrictions, if any, upon the payment of dividends or the making of other distributions on, and upon the purchase, redemption, or other acquisition by us of, our Common Stock; and (i) the conditions or restrictions, if any,

upon the creation of indebtedness or upon the issuance of any additional stock of Chesapeake Utilities.

Certificate of

Incorporation Provisions Relating to a Change in Control

Under our Certificate of Incorporation, the affirmative vote of

not less than 75% of the total voting power of all outstanding shares of our capital stock is required to approve a merger or consolidation of Chesapeake Utilities with, or the sale of substantially all of our assets or business to, any other

corporation (other than a corporation 50% or more of the common stock of which is owned by us), if such corporation or its affiliates singly or in the aggregate own or control directly or indirectly 5% or more of the outstanding shares of our Common

Stock, unless the transaction is approved by our Board of Directors prior to the acquisition by such corporation or its affiliates of ownership or control of 5% or more of the outstanding shares of common stock. In addition, our Certificate of

Incorporation provides for a classified Board of Directors under which one-third of the members are elected annually for three-year terms. The supermajority voting requirement for certain mergers and consolidations and the classified Board of

Directors may have the effect of delaying, deferring, or preventing a change in control of us.

Stockholder Rights Plan

Our Board of Directors has adopted a stockholder rights plan (the “Rights Plan”) to protect against abusive or

coercive takeover tactics that are contrary to the best interests of our stockholders. To implement

7

the Rights Plan, the Board of Directors declared a dividend of one preferred stock purchase Right for each outstanding share of our Common Stock held of record on September 3, 1999, and directed

the issuance of a Right along with each share of our Common Stock issued thereafter for so long as provided for under the terms of the Rights Plan. Unless and until the Rights become exercisable, the Rights trade with our Common Stock and are

evidenced by the certificates for our Common Stock. The Rights will become exercisable and trade independently from our Common Stock upon either: (i) a public announcement that a person or entity has acquired beneficial ownership of 15% or

more of the outstanding our Common Stock, other than in a tender or exchange offer for all of the outstanding shares of our Common Stock at a price and on terms that a majority of the disinterested members of the Board of Directors determines to be

adequate and in our best interests and the best interests of our stockholders (an “Acquiring Person”) or (ii) ten days after the announcement or commencement of a tender or exchange offer that would result in a person or entity becoming an

Acquiring Person. Each Right, if it becomes exercisable, initially entitles the holder to purchase one-fiftieth of a share (a “Unit”) of our Series A Participating Cumulative Preferred Stock, par value $0.01 per share, at a price of

$70 per Unit, subject to anti-dilution adjustments. Upon a person or entity becoming an Acquiring Person, each Right (other than the Rights held by the Acquiring Person) will become exercisable to purchase a number of shares of our Common Stock

having a market value equal to two times the exercise price of the Right. If we are acquired in a merger or other business combination transaction by an Acquiring Person, each Right (other than the Rights held by the Acquiring Person) will

become exercisable to purchase a number of the acquiring company’s shares of common stock having a market value equal to two times the exercise price of the Right.

The Rights expire on August 20, 2019 unless they are redeemed earlier by us at the redemption price of $0.01 per Right. We may redeem the Rights at any time before they become exercisable and

thereafter only in limited circumstances.

Delaware Anti-Takeover Statute

We are subject to Section 203 of the Delaware General Corporation Law, which, subject to certain exceptions, prohibits a Delaware

corporation from engaging in any business combination with any interested stockholder for a period of three years following the date that such stockholder became an interested stockholder, unless: (i) the corporation’s board of directors

approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder, (ii) upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the

interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, or (iii) the business combination is approved by the board of directors and authorized at an annual or special

meeting of stockholders by the affirmative vote of the stockholders of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

8

PLAN OF DISTRIBUTION

We may sell securities offered pursuant to any applicable prospectus supplement to one or more underwriters for public offering and sale

by them or we may sell such securities to investors directly or through agents, some of which may be dealers. We may also sell the securities through a combination of these methods. The name of any underwriter or agent involved in the

offer and sale of such securities will be included in the applicable prospectus supplement.

The distribution of securities

offered pursuant to any applicable prospectus supplement may occur:

(a) at a fixed

price or prices, which may be changed;

(b) at market prices prevailing at the time of

sale;

(c) at prices related to prevailing market prices; or

(d) at negotiated prices.

From time to time, we may also authorize underwriters acting as our agents to offer and sell securities upon the terms and conditions set forth in an applicable prospectus supplement. Underwriters

may be deemed to have received compensation from us in the form of underwriting discounts or commissions in connection with the sale of securities offered pursuant to any applicable prospectus supplement. Underwriters may also receive

commissions from purchasers of securities for whom such underwriters may act as agent. Underwriters may sell securities offered pursuant to any applicable prospectus supplement to or through dealers. Such dealers may receive compensation

in the form of discounts, concessions from the underwriters, or commissions from the purchasers for whom such dealers may act as agent.

We may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus

supplement so indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including short sale transactions. If so, the third party may use

securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of common shares, and may use securities received from us in settlement of those derivatives to close out any related open

borrowings of common shares. The third party in such sale transactions will be an underwriter and, if not identified in this prospectus, will be identified in the applicable prospectus supplement or a post-effective amendment to this

registration statement.

We will describe in the applicable prospectus supplement any underwriting compensation we pay to

underwriters or agents in connection with any offering of securities. Likewise, we will also describe any discounts, concessions, or commissions allowed by underwriters to participating dealers in the applicable prospectus

supplement. Underwriters, dealers, and agents participating in the distribution of the securities may be deemed to be underwriters, and any discounts and commissions received by them and any profit realized by them on resale of the securities

may be deemed to be underwriting discounts and commissions. We may enter into agreements to indemnify underwriters, dealers, and agents against certain civil liabilities, including liabilities under the Securities Act, and to reimburse these

persons for certain expenses. We will describe any indemnification agreements in the applicable prospectus supplement.

During and after an offering through underwriters, the underwriters may purchase and sell the securities in the open market. These

transactions may include overallotment and stabilizing transactions and purchases to cover syndicate short positions created in connection with the offering. The underwriters also may impose a penalty bid, which means that selling concessions

allowed to syndicate members or other broker-dealers for the offered securities sold for their account may be reclaimed by the syndicate if the offered securities are repurchased by the syndicate in stabilizing or covering transactions. These

activities may stabilize, maintain or otherwise affect the market price of the offered securities, which may be higher than the price that might otherwise prevail in the open market. If commenced, the underwriters may discontinue these activities at

any time.

9

If indicated in the applicable prospectus supplement, we may authorize dealers acting as our

agents to solicit offers by certain institutions to purchase the securities from us at the public offering price set forth in such prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on the date or dates

stated in the prospectus supplement. Each delayed delivery contract will be for an amount not less than the respective amounts stated in the applicable prospectus supplement. Likewise, the aggregate principal amount of the securities sold

pursuant to delayed delivery contracts will not be less or more than the respective amounts stated in the applicable prospectus supplement. We may make delayed delivery contracts with various institutions, including commercial and savings

banks, insurance companies, pension funds, investment companies, educational and charitable institutions, and other institutions. Delayed delivery contracts will always be subject to our approval. Delayed delivery contracts will not be

subject to any conditions except the following:

(a) The purchase by an institution of

the securities covered by its delayed delivery contracts shall not at the time of delivery be prohibited under the laws of any jurisdiction in the United States to which such institution is subject; and

(b) If the securities are being sold to underwriters, we shall have sold to such underwriters the

total principal amount of the offered securities less the principal amount covered by the delayed delivery contracts.

Certain

of the underwriters or their affiliates may, but will not necessarily, be customers of, engage in transactions with or perform services for us or one or more of our subsidiaries in the ordinary course of our and/or their business. It is also

possible that certain of the underwriters or their affiliates may be affiliates of banking institutions or other financial services firms with which we or one or more of our subsidiaries has a pre-existing business relationship.

10

EXPERTS

The consolidated financial statements and management’s assessment of the effectiveness of internal control over financial reporting

(which is included in Management’s Report on Internal Control Over Financial Reporting) incorporated in this prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2015, have been so incorporated in reliance

on the report of Baker Tilly Virchow Krause, LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

11

LEGAL MATTERS

The validity of the Common Stock will be passed upon by Baker & Hostetler LLP, Orlando, Florida. Any underwriters, dealers, or

agents may also be advised about other legal matters relating to any offering of the securities made pursuant this prospectus by their own counsel, which will be named in the applicable prospectus supplement.

12

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and

Distribution.

The estimated expenses of issuance and distribution, other than underwriting discounts and commissions, to

be borne by the Company are as follows:

|

|

|

|

|

|

|

SEC registration fee

|

|

|

*

|

|

|

NYSE listing fee

|

|

|

**

|

|

|

Accounting fees and expenses

|

|

|

**

|

|

|

Legal fees and expenses (other than Blue Sky)

|

|

|

**

|

|

|

Blue Sky fees and expenses (including counsel fees)

|

|

|

**

|

|

|

Printing expenses

|

|

|

**

|

|

|

Transfer agent’s and registrar’s fees and expenses

|

|

|

**

|

|

|

Miscellaneous expenses

|

|

|

**

|

|

|

|

|

|

|

|

|

Total

|

|

|

**

|

|

|

|

|

|

|

|

|

*

|

Under Rules 456(b) and 457(r) under the Securities Act, the SEC registration fee will be paid at the time of any particular offering of securities under this

Registration Statement and is therefore not currently determinable.

|

|

**

|

These fees are calculated based on the amount of securities offered and/or the number of offerings and accordingly are not presently known and cannot be estimated at

this time.

|

Since an indeterminate amount of securities is covered by this registration statement, the expenses

in connection with the issuance and distribution of the securities are not currently determinable. The amounts shown are estimates of expenses payable by us in connection with the filing of this registration statement and one offering of

securities hereunder, but do not limit the amount of securities that may be offered.

Item 15. Indemnification of Directors and Officers.

Under the Company’s Bylaws, each person who was or is made a party or is threatened to be made a party to any

action, suit, or proceeding, whether civil, criminal, administrative, or investigative, by reason of the fact he is or was a director or officer of the Company, or is or was serving at the request of the Company as a director or officer of another

corporation or of a partnership, joint venture, trust, or other enterprise (including employee benefit plans), is entitled to indemnification and to be held harmless by the Company to the fullest extent permitted by the General Corporation Law of

the State of Delaware (the “DGCL”) against all expense, liabilities, and loss (including attorneys’ fees, judgments, fines, or penalties and amounts paid in settlement) reasonably incurred or suffered by such person in connection

therewith, including liabilities arising under the Securities Act. These indemnification rights include the right to be paid by the Company the expenses incurred in defending any action, suit, or proceeding in advance of its final disposition,

subject to the receipt by the Company of an undertaking by or on behalf of such person to repay all amounts so advanced if it is ultimately determined that such person is not entitled to be indemnified. These indemnification rights under the

Bylaws are not exclusive of any other indemnification right which any person may have or acquire under any law, bylaw, agreement, vote of stockholders, disinterested directors or otherwise.

Under Section 145 of the DGCL, a corporation may indemnify any person who was or is a party, or is threatened to be made a party, to any

action, suit, or proceeding by reason of the fact that he is or was a director or officer of such corporation if such person acted in good faith and in a manner he reasonably believed to be in and not opposed to the best interest of the corporation

and, with respect to a criminal action or proceeding, such person had no reasonable cause to believe that his conduct was unlawful, except that, in the case of any action or suit by or in the right of the corporation (such as a derivative action),

no indemnification is permitted if the person shall be adjudged liable to the corporation (other than indemnification for such expenses as a court shall determine such person is fairly and reasonably entitled).

II-1

Article Eleven of the Company’s Certificate of Incorporation provides that a director

of the Company shall not be personally liable to the Company or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (a) for breach of the director’s duty of loyalty to the Company or its

stockholders, (b) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (c) under Section 174 of the DGCL, or (d) for any transaction from which the director derived an improper personal

benefit.

The Company has in effect liability insurance policies covering certain claims against any director or officer of the

Company by reason of certain breaches of duty, neglect, error, misstatement, omission, or other act committed by such person in his capacity as director or officer.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, or persons controlling us pursuant to the foregoing provisions, we have been informed

that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act is therefore unenforceable.

Item 16. Exhibits.

A

list of exhibits filed herewith or incorporated by reference is contained in the Exhibit Index, which is incorporated herein by reference.

The agreements included as exhibits to this registration statement contain representations and warranties by each of the parties to the applicable agreement. These representations and warranties have

been made solely for the benefit of the other parties to the applicable agreement and:

|

|

•

|

|

should not in all instances be treated as categorical statements of fact, but rather as a way of allocating the risk to one of the parties if those

statements prove to be inaccurate;

|

|

|

•

|

|

may apply standards of materiality in a way that is different from what may be viewed as material to you or other investors; and

|

|

|

•

|

|

were made only as of the date of the applicable agreement or such other date or dates as may be specified in the agreement and are subject to more

recent developments.

|

Accordingly, these representations and warranties may not describe the actual state of

affairs as of the date they were made or at any other time. We acknowledge that, notwithstanding the inclusion of the foregoing cautionary statements, we are responsible for considering whether additional specific disclosures of material

information regarding material contractual provisions are required to make the statements in this registration statement not misleading. Additional information about us may be found elsewhere in this registration statement and our other public

filings, which are available without charge through the SEC’s website at http://www.sec.gov. See “Where You Can Find More Information.”

Item 17. Undertakings.

|

(a)

|

The undersigned Registrant hereby undertakes:

|

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC

|

II-2

|

|

pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of

Registration Fee” table in the effective registration statement; and

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such

information in the registration statement;

|

provided, however,

that paragraphs (a)(1)(i), (a)(1)(ii), and (a)(1)(iii) do not apply if the registration statement is on Form S-3 and the information

required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in

the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to

the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

|

|

(i)

|

Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was

deemed part of and included in the registration statement; and

|

|

|

(ii)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering

made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date

such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is

at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made

in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; and

|

(5) That, for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of the securities, in a primary offering

of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the

following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

(i)

|

Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

|

II-3

|

|

(ii)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

|

|

|

(iii)

|

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by

or on behalf of the undersigned Registrant; and

|

|

|

(iv)

|

Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

|

|

(b)

|

The undersigned Registrant undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report

pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling persons of the Registrant pursuant

to the foregoing provisions, or otherwise, the Registrant has been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a

claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer, or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer, or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of

appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

|

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly

caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Dover, State of Delaware, on September 21, 2016.

|

|

|

|

|

CHESAPEAKE UTILITIES CORPORATION

|

|

By:

|

|

/s/ Michael P.

McMasters

|

|

|

|

Michael P. McMasters

|

|

|

|

President and Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Michael P. McMasters and Beth W. Cooper, or either of them, as his or her true and lawful

attorneys-in-fact and agents, each with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this

registration statement, and to file same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and

authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as the person might or could do in person, hereby ratifying and confirming all that the

attorneys-in-fact and agents or any of them, or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

/s/ John R. Schimkaitis

|

|

|

|

/s/ Michael P. McMasters

|

|

John R. Schimkaitis, Chairman of the Board

|

|

|

|

Michael P. McMasters, President,

|

|

and Director

|

|

|

|

Chief Executive Officer and Director

|

|

Date: September 21, 2016

|

|

|

|

(Principal Executive Officer)

Date: September 21, 2016

|

|

/s/ Beth W. Cooper

|

|

|

|

|

|

Beth W. Cooper, Senior Vice President

|

|

|

|

/s/ Eugene H. Bayard, Esq.

|

|

and Chief Financial Officer

|

|

|

|

Eugene H. Bayard, Esq., Director

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

Date: September 21, 2016

|

|

Date: September 21, 2016

|

|

|

|

|

|

|

|

|

|

/s/ Thomas J. Bresnan

|

|

|

|

/s/ Dr. Ronald G. Forsythe, Jr.

|

|

Thomas J. Bresnan, Director

|

|

|

|

Dr. Ronald G. Forsythe, Jr., Director

|

|

Date: September 21, 2016

|

|

|

|

Date: September 21, 2016

|

|

|

|

|

|

/s/ Thomas P. Hill, Jr.

|

|

|

|

/s/ Dennis S. Hudson, III

|

|

Thomas P. Hill, Jr., Director

|

|

|

|

Dennis S. Hudson, III, Director

|

|

Date: September 21, 2016

|

|

|

|

Date: September 21, 2016

|

|

|

|

|

|

/s/ Paul L. Maddock, Jr.

|

|

|

|

/s/ Calvert A. Morgan, Jr.

|

|

Paul L. Maddock, Jr., Director

|

|

|

|

Calvert A. Morgan, Jr., Director

|

|

Date: September 21, 2016

|

|

|

|

Date: September 21, 2016

|

|

|

|

|

|

|

|

|

|

/s/ Dianna F. Morgan

|

|

|

|

|

|

Dianna F. Morgan, Director

|

|

|

|

|

|

Date: September 21, 2016

|

CHESAPEAKE UTILITIES CORPORATION

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

1.1

|

|

Form of Underwriting Agreement for Common Stock *

|

|

|

|

|

4.1

|

|

Amended and Restated Certificate of Incorporation of Chesapeake Utilities Corporation is incorporated herein by reference to Exhibit 3.1 of the Company’s Quarterly Report

on

Form 10-Q for the period ended June 30, 2010, File No. 001-11590.

|

|

|

|

|

4.2

|

|

Amended and Restated Bylaws of Chesapeake Utilities Corporation, effective December 4, 2012, are incorporated herein by reference to Exhibit 3 of the Company’s Current Report

on Form 8-K, filed December 7, 2012, File No. 001-11590.

|

|

|

|

|

4.3

|

|

First Amendment to the Amended and Restated Bylaws of Chesapeake Utilities Corporation, effective December 3, 2014, is incorporated herein by reference to Exhibit 3(ii) of the

Company’s Current Report on Form 8-K filed December 7, 2012, File No. 001-11590.

|

|

|

|

|

4.4

|

|

Rights Agreement, dated as of August 20, 1999, between Chesapeake Utilities Corporation and EquiServe Trust Company, N.A., as Rights Agent, including (i) the form of Certificate of

Voting Powers, Designations, Preferences and Rights of Series A Participating Cumulative Preferred Stock attached thereto as Exhibit A, (ii) the form of Rights Certificate attached thereto as Exhibit B, and (iii) the Summary of Rights to Purchase

Preferred Shares attached thereto as Exhibit C, is incorporated by reference to Exhibit 4.1 of the Company’s Current Report on Form 8-K dated August 24, 1999, File No. 001-11590.

|

|

|

|

|

4.5

|

|

First Amendment to Rights Agreement, dated as of September 12, 2008, between Chesapeake Utilities Corporation and Computershare Trust Company, N.A., as successor Rights Agent to

BankBoston, N.A. is incorporated by reference to Exhibit 4.1 of the Company’s Current Report on Form 8-K dated September 12, 2008, File No. 001-11590.

|

|

|

|

|

5.1

|

|

Opinion of Baker & Hostetler LLP **

|

|

|

|

|

23.1

|

|

Consent of Baker Tilly Virchow Krause, LLP **

|

|

|

|

|

23.2

|

|

Consent of Baker & Hostetler LLP (included in Exhibit 5.1) **

|

|

|

|

|

24.1

|

|

Power of Attorney (set forth on the signature page hereto) **

|

|

*

|

To be filed by amendment or as an exhibit to a document incorporated by reference into the registration statement.

|

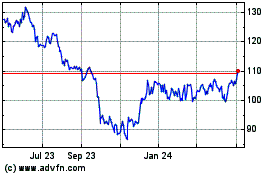

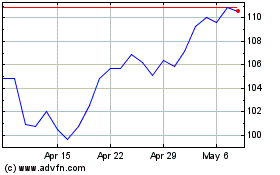

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

From Apr 2023 to Apr 2024