Current Report Filing (8-k)

September 21 2016 - 1:27PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 20, 2016

THE FEMALE HEALTH COMPANY

(Exact name of registrant as specified in its charter)

Wisconsin

(State or other jurisdiction of incorporation)

|

|

|

|

|

1-13602

|

|

39-1144397

|

|

(Commission File Number)

|

|

(I.R.S. Employer I.D. Number)

|

|

|

|

|

515 North State Street

Suite 2225

Chicago,

Illinois

|

|

60654

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

312-595-9123

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (

see

General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders

|

On September 20, 2016, The

Female Health Company (the “Company”) convened and then adjourned a special meeting of shareholders (the “Special Meeting”) to consider matters relating to the proposed merger transaction with Aspen Park Pharmaceuticals, Inc. A

total of 29,052,667 shares of the Company’s common stock were eligible to vote at the Special Meeting, and 22,488,197 shares of common stock, or 77.4% of the shares eligible to vote, were present or represented by proxy at the Special Meeting,

representing a quorum.

The only matter submitted to a vote of shareholders at the Special Meeting was a proposal regarding adjournment of

the meeting and the voting results for this proposal are set forth below.

Proposal 6. Approval of Adjournment of the Special Meeting

The shareholders voted to approve the adjournment of the Special Meeting, if necessary or advisable, for further solicitation of proxies to approve the

proposals at the Special Meeting.

|

|

|

|

|

|

|

|

|

Votes For

|

|

Votes Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

17,414,474

|

|

4,894,003

|

|

179,520

|

|

—

|

Five other proposals were not submitted to a vote at the Special Meeting. Instead, the Special Meeting was

adjourned to September 22, 2016, to provide the Company with additional time to solicit proxies to approve these proposals. Approval of Proposals 1, 2 and 3 requires the affirmative vote of the holders of at least two-thirds of the outstanding

shares, which is 19,368,445 shares. Approval of Proposal 4 requires the affirmative vote of a majority of the votes cast. Approval of Proposal 5 requires that the votes cast in favor of the proposal exceed the votes cast against the proposal. Below

is the current voting on these five proposals based on the report provided to the Company at 8:20 a.m., Central Time, on September 21, 2016 by Broadridge, the Company’s tabulator for the Special Meeting:

Proposal 1. To Adopt the Reincorporation Plan of Merger

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

|

Votes Against

|

|

|

Abstentions

|

|

|

Broker Non-Votes

|

|

Total Shares Voted

|

|

|

18,633,202

|

|

|

|

4,066,078

|

|

|

|

102,484

|

|

|

—

|

|

% of Voted

|

|

|

81.71

|

%

|

|

|

17.83

|

%

|

|

|

0.44

|

%

|

|

—

|

|

% of Outstanding

|

|

|

64.13

|

%

|

|

|

13.99

|

%

|

|

|

0.35

|

%

|

|

—

|

Proposal 2. Increase Number of Authorized Shares of Common and Preferred Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

|

Votes Against

|

|

|

Abstentions

|

|

|

Broker Non-Votes

|

|

Total Shares Voted

|

|

|

17,839,808

|

|

|

|

4,880,219

|

|

|

|

81,737

|

|

|

—

|

|

% of Voted

|

|

|

78.23

|

%

|

|

|

21.40

|

%

|

|

|

0.35

|

%

|

|

—

|

|

% of Outstanding

|

|

|

61.40

|

%

|

|

|

16.79

|

%

|

|

|

0.28

|

%

|

|

—

|

2

Proposal 3. Change Vote Required by Stockholders to Approve Certain Matters

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

|

Votes Against

|

|

|

Abstentions

|

|

|

Broker Non-Votes

|

|

Total Shares Voted

|

|

|

18,378,781

|

|

|

|

4,306,319

|

|

|

|

116,664

|

|

|

—

|

|

% of Voted

|

|

|

80.60

|

%

|

|

|

18.88

|

%

|

|

|

0.51

|

%

|

|

—

|

|

% of Outstanding

|

|

|

63.26

|

%

|

|

|

14.82

|

%

|

|

|

0.40

|

%

|

|

—

|

Proposal 4. Approve the Issuance of Common Stock Pursuant to the Merger

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

|

Votes Against

|

|

|

Abstentions

|

|

|

Broker Non-Votes

|

|

Total Shares Voted

|

|

|

17,886,399

|

|

|

|

4,804,992

|

|

|

|

110,373

|

|

|

—

|

|

% of Voted

|

|

|

78.44

|

%

|

|

|

21.07

|

%

|

|

|

0.48

|

%

|

|

—

|

|

% of Outstanding

|

|

|

61.56

|

%

|

|

|

16.53

|

%

|

|

|

0.37

|

%

|

|

—

|

Proposal 5. Approve, By a Non-Binding Advisory Vote, Executive Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes For

|

|

|

Votes Against

|

|

|

Abstentions

|

|

|

Broker Non-Votes

|

|

Total Shares Voted

|

|

|

17,660,418

|

|

|

|

4,989,618

|

|

|

|

151,728

|

|

|

—

|

|

% of Voted

|

|

|

77.45

|

%

|

|

|

21.88

|

%

|

|

|

0.66

|

%

|

|

—

|

|

% of Outstanding

|

|

|

60.78

|

%

|

|

|

17.17

|

%

|

|

|

0.52

|

%

|

|

—

|

On September 20, 2016, the Company issued a press release announcing the adjournment of the Special

Meeting and related matters, which is attached as Exhibit 99.1 and incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

The following exhibit is filed herewith:

Exhibit 99.1 – Press Release, dated September 20, 2016.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

THE FEMALE HEALTH COMPANY

|

|

|

|

|

|

|

Date: September 21, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BY

|

|

/s/ Michele Greco

|

|

|

|

|

|

|

|

Michele Greco, Executive Vice President and

Chief Financial Officer

|

4

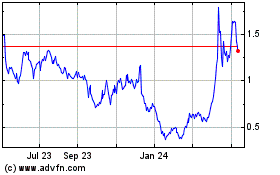

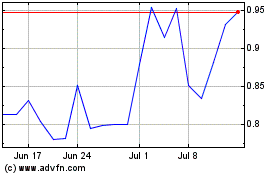

Veru (NASDAQ:VERU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Veru (NASDAQ:VERU)

Historical Stock Chart

From Apr 2023 to Apr 2024