CarMax Profit Falls

September 21 2016 - 9:00AM

Dow Jones News

CarMax Inc. on Wednesday reported a 5.7% decline in quarterly

profit, as sales fell short of expectations amid a continued weak

market for used cars.

Shares in the company, which have gained 3% so far this year,

fell 4.4% premarket to $53.30.

As new-car sales surge to record levels in the U.S. on robust

incentives and cheap fuel, the market for used cars has slowed. But

in its fiscal second quarter, CarMax reported that its used-vehicle

sales rose 7%, helped by store openings, while average selling

prices for used vehicles increased 2.3% to $19,530. Comparable

used-car sales, which factors out store openings, climbed 3.1%.

CarMax, which aims to open 15 stores over the current fiscal

year, opened three outlets during the quarter.

CarMax reported a quarterly profit of $162.4 million, down from

$172.2 million a year earlier. But per-share earnings rose to 84

cents from 82 cents a year earlier, helped by share repurchases.

Revenue rose 2.9% to $4 billion.

Analysts polled by Thomson Reuters had forecast earnings of 88

cents on $4.1 billion in revenue.

CarMax said earnings were dented by $6.8 million, or 4 cents a

share, by the modification of equity awards held by the company's

recently retired chief executive.

CarMax, which has been testing its own originations of subprime

loans, said total income in its auto-finance unit slipped 2.4% to

$96 million during the quarter.

The company bought back 2.4 million shares for $125.8 million

during the quarter.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

September 21, 2016 08:45 ET (12:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

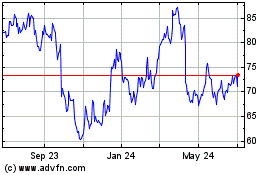

CarMax (NYSE:KMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CarMax (NYSE:KMX)

Historical Stock Chart

From Apr 2023 to Apr 2024