RBC Capital Markets’ 2016 Corporate

Infrastructure & Pipeline Debt Conference Pat Murray Vice President, Treasury Max Chan Director, Treasury Filed by Enbridge Inc. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities

Exchange Act of 1934 Subject Company: Spectra Energy Corp (Commission File No. 1-33007)

Legal Disclaimer This presentation includes

certain forward looking statements and information (FLI) to provide Enbridge and Spectra Energy shareholders and potential investors with information about Enbridge, Spectra Energy and their respective subsidiaries and affiliates, including each

company’s management’s respective assessment of Enbridge, Spectra Energy and their respective subsidiaries’ future plans and operations, which FLI may not be appropriate for other purposes. FLI is typically identified by words such

as “anticipate”, “expect”, “project”, “estimate”, “forecast”, “plan”, “intend”, “target”, “believe”, “likely” and similar words

suggesting future outcomes or statements regarding an outlook. All statements other than statements of historical fact may be FLI. In particular, this news release contains FLI pertaining to, but not limited to, information with respect to the

following: the Transaction; the combined company’s scale, financial flexibility and growth program; future business prospects and performance; annual cost, revenue and financing benefits; the expectation that the Transaction will be neutral to

expected ACFFO per share growth guidance through 2019 and additive to the growth rate beyond that timeframe; future shareholder returns; annual dividend growth and anticipated dividend increases; payout of distributable cash flow; financial strength

and ability to fund capital program and compete for growth projects; run-rate and tax synergies; leadership and governance structure; and head office and business center locations. Although we believe that the FLI is reasonable based on the

information available today and processes used to prepare it, such statements are not guarantees of future performance and you are cautioned against placing undue reliance on FLI. By its nature, FLI involves a variety of assumptions, which are based

upon factors that may be difficult to predict and that may involve known and unknown risks and uncertainties and other factors which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied

by these FLI, including, but not limited to, the following: the timing and completion of the Transaction, including receipt of regulatory and shareholder approvals and the satisfaction of other conditions precedent; interloper risk; the realization

of anticipated benefits and synergies of the Transaction and the timing thereof; the success of integration plans; the focus of management time and attention on the Transaction and other disruptions arising from the Transaction; expected future

ACFFO; estimated future dividends; financial strength and flexibility; debt and equity market conditions, including the ability to access capital markets on favourable terms or at all; cost of debt and equity capital; potential changes in the

Enbridge share price which may negatively impact the value of consideration offered to Spectra Energy shareholders; expected supply and demand for crude oil, natural gas, natural gas liquids and renewable energy; prices of crude oil, natural gas,

natural gas liquids and renewable energy; economic and competitive conditions; expected exchange rates; inflation; interest rates; tax rates and changes; completion of growth projects; anticipated in-service dates; capital project funding; success

of hedging activities; the ability of management of Enbridge, its subsidiaries and affiliates to execute key priorities, including those in connection with the Transaction; availability and price of labour and construction materials; operational

performance and reliability; customer, shareholder, regulatory and other stakeholder approvals and support; regulatory and legislative decisions and actions; public opinion; and weather. We caution that the foregoing list of factors is not

exhaustive. Additional information about these and other assumptions, risks and uncertainties can be found in applicable filings with Canadian and U.S. securities regulators, including any proxy statement, prospectus or registration statement to be

filed in connection with the Transaction. Due to the interdependencies and correlation of these factors, as well as other factors, the impact of any one assumption, risk or uncertainty on FLI cannot be determined with certainty. Except to the extent

required by law, we assume no obligation to publicly update or revise any FLI, whether as a result of new information, future events or otherwise. All FLI in this news release is expressly qualified in its entirety by these cautionary statements.

This presentation makes reference to non-GAAP measures, including ACFFO and ACFFO per share. ACFFO is defined as cash flow provided by operating activities before changes in operating assets and liabilities (including changes in environmental

liabilities) less distributions to non-controlling interests and redeemable non-controlling interests, preference share dividends and maintenance capital expenditures, and further adjusted for unusual, non-recurring or non-operating factors.

Management of Enbridge believes the presentation of these measures gives useful information to investors and shareholders as they provide increased transparency and insight into the performance of Enbridge. Management of Enbridge uses ACFFO to

assess performance and to set its dividend payout target. These measures are not measures that have a standardized meaning prescribed by generally accepted accounting principles in the United States of America (U.S. GAAP) and may not be comparable

with similar measures presented by other issuers. Additional information on Enbridge’s use of non-GAAP measures can be found in Enbridge’s Management’s Discussion and Analysis (MD&A) available on Enbridge’s website and

www.sedar.com. Enbridge will file with the U.S. Securities and Exchange Commission (SEC) a registration statement on Form F-4, which will include a proxy statement of Spectra Energy that also constitutes a prospectus of Enbridge, and any other

documents in connection with the Transaction. The definitive proxy statement/prospectus will be sent to the shareholders of Spectra Energy. INVESTORS AND SHAREHOLDERS OF SPECTRA ENERGY ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, AND ANY OTHER

DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT Enbridge, Spectra Energy, THE TRANSACTION AND RELATED MATTERS. The registration statement and

proxy statement/prospectus and other documents filed by Enbridge and Spectra Energy with the SEC, when filed, will be available free of charge at the SEC's website at www.sec.gov. In addition, investors and shareholders will be able to obtain free

copies of the proxy statement/prospectus and other documents which will be filed with the SEC by Enbridge on Enbridge’s website at www.Enbridge.com or upon written request to Enbridge’s Investor Relations department, 200, 425 First St.

SW, Calgary, AB T2P 3L8 or by calling 800.481.2804 within North America and 403.231.5957 from outside North America, and will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC by Spectra Energy

upon written request to Spectra Energy, Investor Relations, 5400 Westheimer Ct. Houston, TX 77056 or by calling 713.627.4610. You may also read and copy any reports, statements and other information filed by Spectra Energy and Enbridge with the SEC

at the SEC public reference room at 100 F Street N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 800.732.0330 or visit the SEC's website for further information on its public reference room. This communication shall not constitute an

offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under

the securities laws of such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. This communication is not a solicitation of

proxies in connection with the Transaction. However, Enbridge, Spectra Energy, certain of their respective directors and executive officers and certain other members of management and employees, under SEC rules, may be deemed to be participants in

the solicitation of proxies in connection with the Transaction. Information about Enbridge’s directors and executive officers may be found in its Management Information Circular dated March 8, 2016 available on its website at www.Enbridge.com

and at www.sedar.com. Information about Spectra Energy's directors, executive officers and other members of management and employees may be found in its 2015 Annual Report on Form 10-K filed with the SEC on February 25, 2016, and definitive proxy

statement relating to its 2016 Annual Meeting of Shareholders filed with the SEC on March 16, 2016. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of such potential

participants in the solicitation of proxies in connection with the Transaction will be included in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available.

North America’s Premier Energy

Infrastructure Company Transaction Details Transaction Terms Based on Enbridge’s September 2, 2016 closing price of $53.25, total consideration for each Spectra share is 0.984 shares of Enbridge common stock Offer price represents a premium of

approximately 11.5% to Spectra’s closing price on September 2, 2016 Transaction Highlights Enbridge and Spectra shareholders will own 57% and 43% of the combined entity, respectively $37 billion total purchase price Approximately 694 million

new shares issued Enbridge will assume approximately $22 billion of existing Spectra debt Maintain robust sponsored investment vehicles and MLPs DCP will continue to operate as a 50/50 JV with Phillips 66 12% - 14% ACFFO1 per share CAGR guidance

maintained for the 2014-2019 period 15% dividend growth in 20172, 10-12% annual growth through 2024 The deal is expected to be neutral to Enbridge’s 12%-14% secured ACFFO/share CAGR guidance for the 2014-2019 plan horizon, and strongly

additive to growth beyond that timeframe Combined Entity Governance Head office in Calgary with natural gas business located in Houston Current Enbridge CEO, Al Monaco, will continue to serve as CEO of Enbridge Current Spectra CEO, Greg Ebel, will

serve as Chairman New Enbridge Board to be comprised of 13 total directors: 8 directors designated by Enbridge and 5 directors designated by Spectra Timing and Approvals Transaction is expected to close in Q1 2017, subject to shareholder vote at

both Enbridge and Spectra Regulatory approvals including HSR, Canada Competition Act and CFIUS (1)See appendix for definition of ACFFO which remains unchanged. (2)Contingent on deal closing.

Premier North American Combined Asset Base

Right Combination; Right Time Increasing

opportunities for large scale infrastructure investments Converging gas and liquids markets Changing global financial and commodity market conditions Acting proactively from positions of strength ü ü ü ü

Simplified Pro Forma Corporate Structure

Current Enbridge Inc. (BBB+/ Baa2/ BBBH) Enbridge Income Fund Holdings Inc. EEP (BBB/ Baa3/ BBB) Enbridge Gas Dist. (BBB+/ NR/ A) Enbridge U.S. Spectra* Spectra LP (BBB/ Baa2/ BBB*) Westcoast Energy Inc. (BBB/ NR/ AL) Union Gas Ltd. (BBB+/ NR/ A)

Transmission & Processing (Natural Gas) Enbridge Pipelines Inc. (BBB+/ NR/ A) Pro Forma Enbridge Income Fund (NR/ Baa2/ BBBH) Ratings (S&P / Moody’s / DBRS) * Fitch Rating Enbridge Inc. (BBB+/ Baa2/ BBBH) Enbridge Income Fund Holdings

Inc. EEP (BBB/ Baa3/ BBB) Enbridge Gas Dist. (BBB+/ NR/ A) Enbridge Pipelines Inc. (BBB+/ NR/ A) Enbridge Income Fund (NR/ Baa2/ BBBH) Spectra*

Combined Assets by Business Unit Enbridge

Inc. Gas Distribution Energy Services Power Gas Pipelines & Processing Liquids Pipelines Canadian Mainline Lakehead System Regional Oil Sands System Mid-Continental & Gulf Coast Southern Lights Pipeline Bakken System Feeder Pipeline &

Other Express Platte Pipeline Alliance Pipeline Vector Pipeline Offshore Pipelines Canadian Midstream US Midstream Texas Eastern Pipeline Algonquin Pipeline East Tennessee Pipeline NG Pipeline M&N (US) Enbridge Gas Distribution Union Noverco Gas

Storage Canadian Wind US Wind Solar International Offshore Wind Transmission Energy Services Market Hub Storage Field Services Canadian Midstream M&N Canada Ozark Gas Transmission Big Sandy Gulfstream SESH BC Pipeline Aux Sable

Diversifies and De-risks Secured Growth

Programs Diversity of secured growth programs by Commodity type Expenditure profile Geography Size of project ~$26 billion in projects to come online between 2017 and 2019

Strong Investment Grade Credit Increased

size, scale and asset diversity significantly enhances the credit profile of the combined entity Debt/EBITDA naturally improves as high quality projects under construction are placed into service and begin generating cash flows Committed to

achieving targeted reduction in credit metrics and maintaining credit ratings across the family of companies as new projects are pursued Strong Credit Metrics Key Credit Metrics and Targets Credit Metric Target FFO / Debt ≥15% Debt / EBITDA

≤5.0x Significant Balance Sheet Strengthening by 2019 Projected Pro Forma Debt / EBITDA (1)Additional funding capacity post 2018 as metric significantly better than target. 5.0x 4.3x 1 5.1x 5.5x 6.2x 2016 2017E 2018E 2019E 6.2 5.5

5.0999999999999996 4.3 Total Debt / EBITDA

No Requirement for Follow-on Enbridge

Inc. Equity Enbridge Group Funding Requirements (2017E – 19E) Ample Sources of Alternative Equity Financing Joint Benefits ($ in billions) Secured Capital Program Immediate and strengthening financial flexibility Debt maturities Secured

Capital expenditures DRIP / Sponsored Investments/ Monetization Debt Issuances Internal Cash Flow, Net of Dividends (1)Cumulative free cash flow (net of dividends) generated between 2020E to 2024E from commercially secured growth. Cumulative $14 to

$18 billion1 free cash flow enables company to grow organically, acquire assets, and raise dividends without equity issuance at corporate level More competitive in capturing new organic opportunities JV Contributions Significant Free Cash Flow

Generation Beyond 2019 $8 billion of alternative sources of equity capital (2017-19): Spectra Energy Partners ATM Enbridge Income Fund Common Equity Enbridge Energy Partners PIK Enbridge Inc. DRIP Hybrids Planned monetization of ~$2 billion in

non-core assets over next 12 months to provide additional financing flexibility Other identified asset monetizations could provide an incremental $5 – 6 billion of capital

Maintaining Enbridge’s Low Risk

and Capital Discipline Low Risk Business Model Investment Grade Customers 96% of cash flow underpinned by long term commercial agreements (Take-or-pay or equivalent1 contracts) <5% of combined EBITDA is commodity price exposed 93%2 of revenue

from investment grade or equivalent customers Limited Commodity Price Risk Unparalleled resilience in all market cycles (1)Equivalent includes cost of service, Competitive Tolling Settlement and fee for service. (2)Excludes low risk regulated

distribution utility revenues.

Timeline to Transaction Closing Sep 2016

Q4 2016 Q1 2017 Prepare proxy circular and registration statement Prepare and submit regulatory filings (CFIUS, Canadian Competition Act, HSR) Announcement Shareholder Votes Mail proxy circulars to Enbridge and Spectra shareholders File final

documents with securities commissions Regulatory Approvals Respond to regulator information requests Transaction Closing Shareholder Votes

Positive Capital Market Reaction

Enbridge Inc. spreads have tightened roughly 15-20 bps since the announcement that Enbridge and Spectra Energy entered in to a definitive merger agreement *Source: Bloomberg *Source: Company

Positive CDS Reaction *Source:

Bloomberg

Q&A

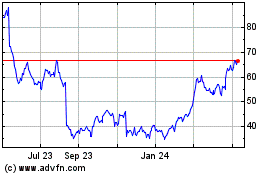

Sea (NYSE:SE)

Historical Stock Chart

From Mar 2024 to Apr 2024

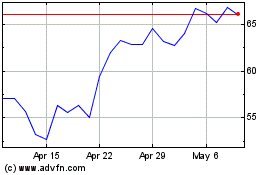

Sea (NYSE:SE)

Historical Stock Chart

From Apr 2023 to Apr 2024