Report of Foreign Issuer (6-k)

September 21 2016 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2016

Commission File Number 001-32535

Bancolombia S.A.

(Translation of registrant’s name

into English)

Cra. 48 # 26-85

Medellín, Colombia

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

þ

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):___

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(2):___

Indicate by check mark whether the registrant by furnishing

the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

o

No

þ

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-

.

BANCOLOMBIA AND LEASING

BANCOLOMBIA ANNOUNCE THE APPROVAL OF THE MERGER COMMITMENT BETWEEN BOTH COMPANIES

Medellin,

Colombia, September 20, 2016

Today,

the General Shareholders Meetings’ of Bancolombia S.A and Leasing Bancolombia S.A Compañia de Financiamiento approved

the merger commitment pursuant to which Bancolombia will absorb its subsidiary Leasing Bancolombia.

Starting

today, the companies will have a period of 45 days to notarize the merger and to register the document in the Chamber of Commerce

of Medellin.

The

acquisition of the leasing company by the bank unit has the following objectives:

|

|

·

|

Take

advantage of the synergies and complementarities between both companies to allow for a more efficient operation of the leasing

business, a better value proposal and better profitability for the shareholders.

|

|

|

·

|

Consolidation

of an institution able to respond to the requirements of the local and international financial market, through a capital support

that allows, among others, funding for larger projects, and

|

|

|

·

|

The

creation of a services portfolio with bigger geographical coverage in order to offer Leasing Bancolombia’s products to new

markets

|

As

a result of the merger approval and after such merger takes effect:

|

|

·

|

Bancolombia

will absorb Leasing Bancolombia, which means Leasing Bancolombia will dissolve without liquidation and will transfer to Bancolombia

all of its assets, liabilities and equity.

|

|

|

·

|

Bancolombia

will hold the rights and obligations of Leasing Bancolombia

|

|

|

·

|

Bancolombia

will continue offering to its clients the products and services portfolio of Leasing Bancolombia. Those products and services

will be offered under the brand

“Leasing Bancolombia, una marca Bancolombia”

|

|

|

·

|

Bancolombia

will continue to be located in the city of Medellin, Colombia and will maintain its recent bylaws.

|

|

Contacts

|

|

|

|

Jaime A. Velásquez

|

Jose Humberto Acosta

|

Alejandro Mejía

|

|

Strategy and Finance VP

|

Financial VP

|

IR Manager

|

|

Tel.: (574) 4042199

|

Tel: (571) 4885934

|

Tel.: (574) 4041837

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

|

|

|

|

|

|

BANCOLOMBIA S.A.

(Registrant)

|

|

|

Date: September 20, 2016

|

By:

|

/s/ JAIME

ALBERTO VELÁSQUEZ B.

|

|

|

|

|

Name:

|

Jaime Alberto Velásquez B.

|

|

|

|

|

Title:

|

Vice President of Strategy and Finance

|

|

|

|

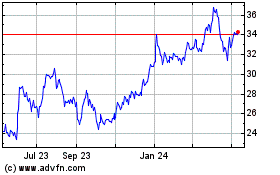

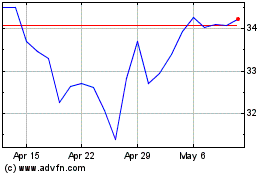

Bancolombia (NYSE:CIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bancolombia (NYSE:CIB)

Historical Stock Chart

From Apr 2023 to Apr 2024