BEIJING—China's leaders are forging what may soon be the world's

largest steelmaker, sticking to their conviction that big is good

and gigantic is better for state-owned firms.

The merger is the latest Chinese effort to create "national

champions" that can compete globally and trim excess production

capacity to adapt to falling demand. It comes as Beijing faces

growing international complaints over cheap steel exports.

But such efforts haven't aided efficiency in the past. And the

consolidation has entrenchedstate-owned enterprises in their

strategic positions of power in the economy, despite Beijing's vows

to develop a greater role for the private sector.

Through cheap loans and state support, Beijing has tried for two

decades to nurture industrial giants, creating the world's largest

rail-car maker and other behemoths. Yet, social and political

factors, such as keeping people employed to avoid social unrest,

have often trumped commercial ones such as shutting down production

to stem losses.

Meanwhile, the efficiency of China's heavy industry continues to

fall. In the oil-processing and steel sectors, for instance,

one-third of capacity remained unused by the start of this

year.

In the latest effort, China's two largest steelmakers, Baosteel

Group Corp. and Wuhan Iron and Steel Group Co., or Wisco, confirmed

on Tuesday their plans to merge. Baosteel's 130,000 workers are

nearly as many as in the entire U.S. steel industry.

If China adds one or two more mills into the mix, as officials

and analysts expect, the merged company's output would eclipse the

world's top producer, Luxembourg-based ArcelorMittal SA.

"This is the inevitable way to deal with falling demand, and it

will help the stable development of the global steel industry,"

said Dai Zhihao, president of Baosteel's listed subsidiary.

The companies declined to respond to requests for comment,

citing stock-exchange rules. Ma Guoqiang, a Baosteel veteran now

chairman of the heavily-indebted Wisco, told the official Xinhua

News Agency in July that "true restructuring" was needed to reduce

overcapacity.

"Megamergers don't necessarily lead to good restructuring," he

said.

Chinese mills, including Baosteel and Wisco, have committed to

cut 45 million metric tons of capacity this year and 150 million

tons over the next five years. But past attempts failed when

mothballed mills were reactivated as steel prices rose.

Instead, as China's economy slows and global demand for its

products shrinks, the government is again using consolidation to

assert control over unruly industries that haven't responded to

market forces.

Despite a global freight glut since 2011, two state-owned

shipping companies commissioned ever-larger ships, losing money

even as its global peers boast a 3.3% profit margin, according to

HSBC. The solution? Beijing merged them this year to create the

world's fourth-largest such company.

The government whittled its heavy-industry companies from 196 in

2003 to 112 last year. It aims for less than 100 by year-end.

The steel merger approach extends policies in place since 2004

and mirrors the last big round of megamergers at the height of the

financial crisis in 2009. To widen the reform process, Beijing has

recently also tried selling more of its noncore oil assets. Yet,

the twin goals of trimming excess and creating more competitive

global companies never came to pass.

Over the past decade, for example, China's largest steel mills

have become steadily less efficient than their peers in the U.S.,

Japan and South Korea. Return on assets fell to -3.6% in 2015 from

16% in 2004 at Wisco's listed subsidiary and only somewhat better

at Baosteel's listed arm. Nucor Corp., the largest U.S. mill,

showed return-on-assets of 4.7% last year.

China also lags behind in productivity. A worker at Baosteel

makes about 269 metric tons of steel a year, company data show. Its

largest global peers produce about 440 tons.

Global steel giants have laid off thousands of workers to cope

with recent downturns. Beijing says it prefers consolidation to

avoid mass retrenchments.

China struggles to close even the most obvious target in its

campaign—smaller and heavily polluting mills, leaving the sector

fragmented. China's top 10 steelmakers accounted for 34% of total

output in 2015, down from 53% in 2011 and well short of the

official target of 60%.

Turning these companies around would make a showpiece for

Beijing as it tries to rebut allegations from the U.S. and Europe

that it is overproducing and dumping cheap steel on world markets,

driving down prices. The trade brawl is clouding China's bid for

global stature and access to overseas markets.

Chinese officials say the country's steel is competitively

produced. They have also made a show of dismantling mothballed

furnaces, including one mammoth mill in Inner Mongolia last

month.

But gains in efficiency ultimately appear not to be a priority.

"State companies must be big, strong and good enough not to be

shaken" by global competition, President Xi Jinping said last

year.

Above the rutted roads of Muchangkou, a soot-blackened hamlet in

China's northern steel belt, smoke has begun wafting anew from the

red-and-white chimneys of the area's dozens of privately held mills

after more than a year of state-imposed suspension.

Local officials depend on these mills, usually the largest

employers, for revenue and kickbacks, workers and analysts say.

Local officials close the mills under pressure from Beijing but

often later let the factories reignite output.

"Lots of smaller mills in the area have revived production,"

said Liu Haibo, a 47-year-old steelworker who was laid off from one

Muchangkou mill early last year and re-employed by another this

month. "The local government won't let them fail."

Liyan Qi contributed to this article.

Write to Chuin-Wei Yap at chuin-wei.yap@wsj.com

(END) Dow Jones Newswires

September 20, 2016 23:05 ET (03:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

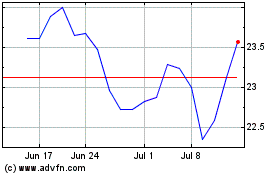

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

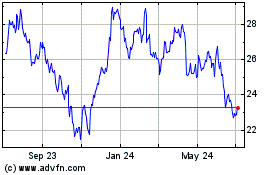

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024