SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

[Rule 13d-101]

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO § 24.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO § 240.13D-2(a)

(Amendment No. 1)*

Nivalis Therapeutics, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

(CUSIP Number)

|

|

David Clark

Deerfield Mgmt, L.P.

780 Third Avenue, 37

th

Floor

New York, New York 10017

(212) 551-1600

With a copy to:

Mark Wood

Jonathan D. Weiner

Katten Muchin Rosenman LLP

575 Madison Avenue

New York, New York 10022

(212) 940-8800

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box

o

.

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

(Continued on following pages)

(Page 1 of 15 Pages)

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

x

|

|

3

|

|

|

4

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

|

|

8

|

|

|

9

|

|

|

10

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

14

|

|

(1) Comprised of 1,124,740 shares held by Deerfield Special Situations Fund, L.P., 402,064 shares held by Deerfield Private Design, L.P., 647,152 shares held by Deerfield Private Design International, L.P., 726,242 shares held by Deerfield Private Design Fund II, L.P., and 832,216 shares held by Deerfield Private Design International II, L.P.

|

1

|

NAME OF REPORTING PERSON

Deerfield Special Situations Fund, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

x

|

|

3

|

|

|

4

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

|

|

8

|

|

|

9

|

|

|

10

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

14

|

|

|

1

|

NAME OF REPORTING PERSON

Deerfield Private Design International, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

x

|

|

3

|

|

|

4

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

|

|

8

|

|

|

9

|

|

|

10

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

14

|

|

|

1

|

NAME OF REPORTING PERSON

Deerfield Private Design Fund II, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

x

|

|

3

|

|

|

4

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

|

|

8

|

|

|

9

|

|

|

10

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

14

|

|

|

1

|

NAME OF REPORTING PERSON

Deerfield Private Design International II, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

x

|

|

3

|

|

|

4

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

|

|

8

|

|

|

9

|

|

|

10

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

14

|

|

|

1

|

NAME OF REPORTING PERSON

Deerfield Management Company, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

x

|

|

3

|

|

|

4

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

|

|

8

|

|

|

9

|

|

|

10

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

14

|

|

(2) Comprised of 1,124,740 shares held by Deerfield Special Situations Fund, L.P., 402,064 shares held by Deerfield Private Design, L.P., 647,152 shares held by Deerfield Private Design International, L.P., 726,242 shares held by Deerfield Private Design Fund II, L.P., 832,216 shares held by Deerfield Private Design International II, L.P.

and 2,050 shares of Common Stock underlying an option held by Howard P. Furst, a partner in Deerfield Management Company, L.P. and a director of the Issuer. Does not include 10,250 shares underlying such option, representing the portion thereof that is not vested and will not vest within 60 days from the date of this report.

|

1

|

NAME OF REPORTING PERSON

Deerfield Private Design Fund, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

x

|

|

3

|

|

|

4

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

|

|

8

|

|

|

9

|

|

|

10

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

14

|

|

|

1

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

o

(b)

x

|

|

3

|

|

|

4

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

|

|

8

|

|

|

9

|

|

|

10

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES*

|

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

14

|

|

(3) Comprised of 1,124,740 shares held by Deerfield Special Situations Fund, L.P., 402,064 shares held by Deerfield Private Design, L.P., 647,152 shares held by Deerfield Private Design International, L.P., 726,242 shares held by Deerfield Private Design Fund II, L.P., 832,216 shares held by Deerfield Private Design International II, L.P. and 2,050 shares of Common Stock underlying an option held by Howard P. Furst, a partner in Deerfield Management Company, L.P. and a director of the Issuer. Does not include 10,250 shares underlying such option, representing the portion thereof that is not vested and will not vest within 60 days from the date of this report.

This Amendment No. 1 (this “

Amendment

”) to Schedule 13D amends the Schedule 13D filed on June 26, 2015 by (i) Deerfield Mgmt, L.P. (“

Deerfield Mgmt

”), (ii) Deerfield Special Situations Fund, L.P. (“

Deerfield Special Situations Fund

”), (iii) Deerfield Management Company, L.P. (“

Deerfield Management

”), (iv) Deerfield Private Design Fund, L.P. (“

Deerfield Private Design”

), (v) Deerfield Private Design International, L.P. (“

Deerfield Private Design International

”), (vi) Deerfield Private Design Fund II, L.P. (“

Deerfield Private Design II

”), (vii) Deerfield Private Design International II, L.P. (“

Deerfield Private Design International II

”) and (viii) James E. Flynn, a natural person (“

Flynn

” and collectively with Deerfield Mgmt, Deerfield Special Situations Fund, Deerfield Management, Deerfield Private Design, Deerfield Private Design International, Deerfield Private Design II and Deerfield Private Design International II, the “

Reporting Persons

”), with respect to the securities of Nivalis Therapeutics, Inc. (the “

Issuer

”) Deerfield Special Situations Fund, Deerfield Private Design, Deerfield Private Design International, Deerfield Private Design II and Deerfield Private Design International II are collectively referred to herein as the “

Funds

”), with respect to the securities of Nivalis Therapeutics, Inc., (as amended, the “

Schedule 13D

”). The principal purpose of this Amendment is to report changes in the percentage of the Issuer’s outstanding common stock beneficially owned by the Reporting Persons as a result of changes in the number of outstanding shares of the Issuer’s Common Stock and the grant of an option to Howard P. Furst, a partner in Deerfield Management and a director of the Issuer.

Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to them in the Scheduled 13D.

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

Item 3 of the Schedule 13D is hereby amended by adding the following:

On September 12, 2016, the Issuer granted to Howard P. Furst (“

Furst

”), a partner in Deerfield Management and a director of the Issuer, an option to purchase 12,300 shares of Common Stock (the “

September 2016 Option

”) for an exercise price of $7.77 per share as compensation for his service as a director. The September 2016 Option vests in 12 equal monthly installments commencing on October 12, 2016. As an employee of Deerfield Management, all grants received by Mr. Furst as a director of the Issuer subsequent to November 2015 are for the benefit of Deerfield Management.

|

Item 4.

|

Purpose of Transaction.

|

Item 4 of the Schedule 13D is hereby amended by adding the following:

Jonathan Leff, a partner of Deerfield Management, resigned from the Company’s board of directors effective April 27, 2016.

|

Item 5.

|

Interest in Securities of the Issuer.

|

Items 5(a), (b) and (c) of the Schedule 13D are hereby amended and restated as follows:

(a)

(1)

Deerfield Mgmt

|

Number of shares:

|

3,732,414 (comprised of shares held by Deerfield Special Situations Fund, Deerfield Private Design, Deerfield Private Design International, Deerfield Private Design II and Deerfield Private Design International II and shares underlying the September 2016 Option, to the extent such option is vested or vests within 60 days from the date hereof)

|

Percentage of shares: 24.08%

(2)

Deerfield Management

|

Number of shares:

|

3,734,464 (comprised of shares held by Deerfield Special Situations International, Deerfield Special Situations Fund, Deerfield Private Design, Deerfield Private Design International, Deerfield Private Design II and Deerfield Private Design International II)

|

Percentage of shares: 24.09%

(3)

Deerfield Special Situations Fund

Number of shares: 1,124,740

Percentage of shares: 7.25%

(4)

Deerfield Private Design

Number of shares: 402,064

Percentage of shares: 2.59%

(5)

Deerfield Private Design International

Number of Shares: 647,152

Percentage of Shares: 4.17%

(6)

Deerfield Private Design II

Number of Shares: 726,242

Percentage of Shares: 4.68%

(7)

Deerfield Private Design International II

Number of Shares: 832,216

Percentage of Shares: 5.37%

(8)

Flynn

|

Number of shares:

|

3,734,464 (comprised of shares held by Deerfield Special Situations Fund, Deerfield Private Design, Deerfield Private Design International, Deerfield Private Design II and Deerfield Private Design International II and shares underlying the September 2016 Option, to the extent such option is vested or vests within 60 days from the date hereof)

|

Percentage of shares: 24.09%

(b)

(1)

Deerfield Mgmt

Sole power to vote or direct the vote: 0

Shared power to vote or direct the vote: 3,732,414

Sole power to dispose or to direct the disposition: 0

Shared power to dispose or direct the disposition: 3,732,414

(2)

Deerfield Management

Sole power to vote or direct the vote: 0

Shared power to vote or direct the vote: 3,734,464

Sole power to dispose or to direct the disposition: 0

Shared power to dispose or direct the disposition: 3,734,464

(3)

Deerfield Special Situations Fund

Sole power to vote or direct the vote: 0

Shared power to vote or direct the vote: 1,124,740

Sole power to dispose or to direct the disposition: 0

Shared power to dispose or direct the disposition: 1,124,740

(4)

Deerfield Private Design

Sole power to vote or direct the vote: 0

Shared power to vote or direct the vote: 402,064

Sole power to dispose or to direct the disposition: 0

Shared power to dispose or direct the disposition: 402,064

(5)

Deerfield Private Design International

Sole power to vote or direct the vote: 0

Shared power to vote or direct the vote: 647,152

Sole power to dispose or to direct the disposition: 0

Shared power to dispose or direct the disposition: 647,152

(6)

Deerfield Private Design II

Sole power to vote or direct the vote: 0

Shared power to vote or direct the vote: 726,242

Sole power to dispose or to direct the disposition: 0

Shared power to dispose or direct the disposition: 726,242

(7)

Deerfield Private Design International II

Sole power to vote or direct the vote: 0

Shared power to vote or direct the vote: 832,216

Sole power to dispose or to direct the disposition: 0

Shared power to dispose or direct the disposition: 832,216

(8)

Flynn

Sole power to vote or direct the vote: 0

Shared power to vote or direct the vote: 3,734,464

Sole power to dispose or to direct the disposition: 0

Shared power to dispose or direct the disposition: 3,734,464

Flynn is the sole member of the general partner of each of Deerfield Mgmt and Deerfield Management. Deerfield Mgmt is the general partner, and Deerfield Management is the investment advisor, of Deerfield Special Situations Fund, Deerfield Private Design, Deerfield Private Design International, Deerfield Private Design II and Deerfield Private Design International II. Pursuant to an arrangement between Deerfield Management and Furst, for so long as Furst is employed by Deerfield Management, any compensation that Furst receives from the Issuer is for the economic benefit of Deerfield Management and must be transferred to Deerfield Management, for no consideration, subject to applicable restrictions on transfer. See Item 6 for additional information regarding such arrangement.

(c) On September 12, 2016, the Issuer granted to Furst, a partner in Deerfield Management and a director of the Issuer, the September 2016 Option. The September 2016 Option vests in 12 equal installments, commencing on October 12, 2016, and is exercisable for $7.77 per share.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

|

Item 6 is hereby amended by adding the following:

The information set forth in Item 6 is incorporated by reference herein.

SIGNATURE

After reasonable inquiry and to the best of their knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete and correct.

Dated: September 20, 2016

|

|

DEERFIELD MGMT, L.P.

By: J.E. Flynn Capital, LLC, General Partner

By:

/s/ Jonathan Isler

Name: Jonathan Isler

Title: Attorney-in-Fact

DEERFIELD SPECIAL SITUATIONS FUND, L.P.

By: Deerfield Mgmt, L.P., General Partner

By: J.E. Flynn Capital, LLC, General Partner

By:

/s/ Jonathan Isler

Name: Jonathan Isler

Title: Attorney-in-Fact

DEERFIELD PRIVATE DESIGN FUND, L.P.

By: Deerfield Mgmt, L.P., General Partner

By: J.E. Flynn Capital, LLC, General Partner

By:

/s/ Jonathan Isler

Name: Jonathan Isler

Title: Attorney-in-Fact

DEERFIELD PRIVATE DESIGN INTERNATIONAL, L.P.

By: Deerfield Mgmt, L.P., General Partner

By: J.E. Flynn Capital, LLC, General Partner

By:

/s/ Jonathan Isler

Name: Jonathan Isler

Title: Attorney-in-Fact

|

|

|

DEERFIELD PRIVATE DESIGN FUND II, L.P.

By: Deerfield Mgmt, L.P., General Partner

By: J.E. Flynn Capital, LLC, General Partner

By:

/s/ Jonathan Isler

Name: Jonathan Isler

Title: Attorney-in-Fact

DEERFIELD PRIVATE DESIGN INTERNATIONAL II, L.P.

By: Deerfield Mgmt, L.P., General Partner

By: J.E. Flynn Capital, LLC, General Partner

By:

/s/ Jonathan Isler

Name: Jonathan Isler

Title: Attorney-in-Fact

DEERFIELD MANAGEMENT COMPANY, L.P.

By: Flynn Management LLC, General Partner

By:

/s/ Jonathan Isler

Name: Jonathan Isler

Title: Attorney-in-Fact

JAMES E. FLYNN

/s/ Jonathan Isler

Jonathan Isler, Attorney-in-Fact

|

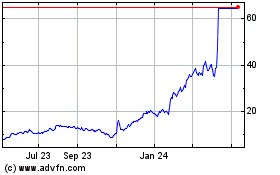

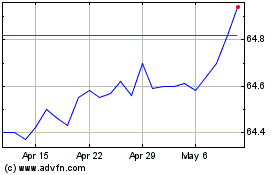

Alpine Immune Sciences (NASDAQ:ALPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alpine Immune Sciences (NASDAQ:ALPN)

Historical Stock Chart

From Apr 2023 to Apr 2024