UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a - 101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the

registrant

x

Filed by a

party other than the registrant

¨

Check the appropriate box:

|

|

|

|

|

x

|

|

Preliminary Proxy Statement

|

|

¨

|

|

Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

|

Definitive proxy statement

|

|

¨

|

|

Definitive additional materials

|

|

¨

|

|

Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12.

|

COMSTOCK RESOURCES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (check the appropriate box):

|

|

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth amount on

which filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing

for which the offering fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of the filing.

|

|

|

|

|

|

|

|

1)

|

|

Amount previously paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3)

|

|

Filing party:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4)

|

|

Date filed:

|

|

|

|

|

|

|

|

|

|

|

COMSTOCK RESOURCES, INC.

Notice of Special Meeting of Stockholders

and Proxy Statement

|

|

|

Please Complete, Sign, Date

And Return Your Proxy Promptly

|

Tuesday, November 8, 2016

10:00 A.M.

Comstock

Resources, Inc.

Corporate Headquarters

5300 Town and Country Blvd.

Suite 500

Frisco,

Texas 75034

To the Stockholders of Comstock Resources, Inc.:

On September 6, 2016 we successfully completed an exchange offer with holders of approximately 98% of aggregate principal amount of our senior

notes who exchanged their senior notes for new first and second lien senior secured notes with equity conversion and pay-in-kind interest features. This transaction provided us enhanced liquidity which will allow us to continue and to

accelerate our successful Haynesville shale drilling program. The second lien notes issued in the exchange are convertible into shares of our common stock. We have called this special meeting of the stockholders in order to obtain

stockholder approval for the potential issuance of shares of common stock upon the conversion of the second lien notes in accordance with the rules of the New York Stock Exchange.

As a stockholder of Comstock Resources, Inc. you are invited to attend the Special Meeting of Stockholders. The meeting will be held at 10:00

a.m., local time, on Tuesday, November 8, 2016, at the Company’s headquarters at 5300 Town and Country Blvd., Suite 500, in Frisco, Texas.

At this Special Meeting, you will be asked to vote on three items more fully addressed in our Notice of Special Meeting of Stockholders,

including:

|

|

•

|

|

To authorize the issuances of up to a maximum of 46,444,212 shares of our common stock in the event of

conversion of our second lien convertible notes;

|

|

|

•

|

|

To approve an amendment and restatement of our 2009 Long-term Incentive Plan; and

|

|

|

•

|

|

To approve an amendment to our Restated Articles of Incorporation, to increase the number of authorized shares

of our common stock.

|

Our Board of Directors is soliciting proxies so that each stockholder has an opportunity to have

their shares represented at the Special Meeting.

If you do not plan to attend, please vote your shares by Internet, by telephone, or, if you received our proxy materials by mail, by returning the accompanying proxy card, as soon as possible so

that your shares will be voted at the meeting.

Instructions on how to vote can be found in our Proxy Statement.

On behalf of the

Board of Directors and management, thank you for your cooperation and continued support.

Sincerely,

M. Jay Allison

Chairman of the Board and

Chief Executive Officer

Preliminary Copy

COMSTOCK RESOURCES, INC.

Notice of Special Meeting of Stockholders

November

8, 2016

10:00 a.m. Central Time

|

|

|

|

|

Location:

|

|

Company Headquarters

5300 Town and Country Blvd.

Suite 500

Frisco, Texas 75034

|

ITEMS OF BUSINESS

|

1.

|

To authorize the issuance of up to a maximum of 46,444,212 shares of our common stock in the event of the

future conversion of our second lien convertible notes.

|

|

2.

|

To approve an amendment and restatement of our 2009 Long-term Incentive Plan.

|

|

3.

|

To approve an amendment to our Restated Articles of Incorporation to increase the number of authorized shares

of our common stock.

|

RECORD DATE

September 16, 2016

AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 8, 2016

This Notice of Special Meeting of Stockholders and the Proxy Statement are first being mailed to stockholders on or about September

29, 2016. This Notice of Special Meeting of Stockholders and the Proxy Statement are also available on our website at

www.comstockresources.com

.

PROXY VOTING

Stockholders of record may

vote in person at the meeting, but may also appoint proxies to vote their shares in one of three ways, by:

|

|

|

|

|

|

|

• Telephone

|

|

• Mail

|

|

• Internet

|

If your shares are held by a bank, broker or other holder of record, you may appoint proxies to vote your

shares on your behalf as instructed by that bank, broker or other holder of record. If your shares are held by any such person or entity, you may obtain a proxy from that entity and bring it with you to hand in with your ballot in order to be able

to vote your shares at the meeting.

Any proxy may be revoked at any time before it is exercised at the meeting.

By Order of the Board of Directors,

Roland O. Burns

Secretary

Table of Contents

Preliminary Copy

Proxy Summary

This summary is included to provide an introduction and overview of the information contained in the Proxy Statement. This is a summary only

and does not contain all of the information we have included in the Proxy Statement. You should refer to the entire Proxy Statement that follows for more information about us and the proposals you are being asked to consider.

Background For The Proposals to be Voted Upon

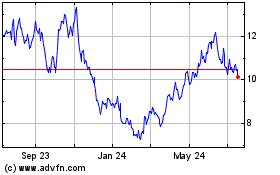

Oil and natural gas prices have declined substantially since mid 2014 and continued to decline into 2016. As a result, our operating cash flow

has not been sufficient to cover our fixed debt service costs and we have experienced reductions in our overall liquidity. During 2015 and the first six months of 2016, we took steps to mitigate the effects of these lower prices including: (1)

significantly reducing our drilling activity for 2016; (2) reducing our outstanding debt through open market purchases of our senior notes and completing debt for equity swaps; and (3) reducing our operating and personnel costs. In order to improve

our liquidity to allow us to continue our successful drilling program in the Haynesville shale, we completed an exchange offer with the holders of our senior notes on September 6, 2016. The new notes allow us to pay interest in-kind under

certain circumstances, which will free up our operating cash flow to fund our drilling operations.

Specifically, we exchanged $697.2

million of our 10% Senior Secured Notes due 2020 for $697.2 million of our 10% Senior Secured Toggle Notes due 2020 and warrants exercisable for 1,917,342 shares of our common stock, $270.6 million of our

7

3

⁄

4

% Senior Notes due 2019 for $270.6 million of 7

3

⁄

4

% Convertible

Second Lien PIK Notes due 2019 and $169.7 million of our 9

1

⁄

2

% Senior Notes due 2020 for $169.7 million of

9

1

⁄

2

% Convertible Second Lien PIK Notes due 2020 (collectively, the “Exchange Offer”).

The 7

3

⁄

4

% Convertible Second Lien PIK Notes due 2019

and the 9

1

⁄

2

% Convertible Second Lien PIK Notes due 2020 (together, the “Convertible Notes”) are convertible into 81.2 shares of our common stock

for each $1,000 of principal amount of notes. The conversion is subject to our obtaining stockholder approval for the issuance of the shares. An aggregate principal amount of $440.3 million of the Convertible Notes could convert into

35,752,685 shares of common stock. As interest on the Convertible Notes is only paid by the issuance of additional notes, up to an additional $131.7 million in principal could be outstanding by maturity, which could convert into an additional

10,691,527 shares of common stock. Accordingly, we are requesting that the stockholders authorize the issuance of up to 46,444,212 shares of common stock in connection with the potential conversion of the Convertible Notes.

Holders of the Convertible Notes can convert at any time after approval of the issuance of shares by the stockholders. In addition,

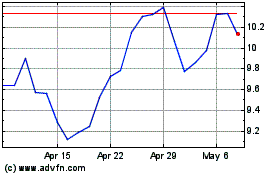

subject to stockholder approval, the Convertible Notes will be mandatorily converted following a 15 consecutive trading day period during which the daily volume weighted average price is equal to or greater than $12.32 per share.

The above summary of the Exchange Offer is provided as background information to the stockholders in connection with the proposals contained in

this Proxy Statement. The full terms and conditions of the Exchange Offer and the transactions consummated in connection therewith were disclosed in our publicly-filed documents with the Securities and Exchange Commission (“SEC”), which

are not a part of the proxy solicitation materials.

1

If stockholder approval is not obtained by December 31, 2016 and such failure to obtain

stockholder approval continues for a period of 90 days thereafter, the Convertible Notes will not be convertible into common stock and such failure to obtain stockholder approval will result in a default under such notes. Such default may in turn

result in a default under our debt agreements. Such defaults would likely require us to file for bankruptcy protection.

The following

table depicts the pro forma impact of the Exchange Offer on the ownership of our common stock (in thousands) as of September 16, 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma for the

Conversion

of the Notes and

Warrants

|

|

|

|

|

No. of

Shares

|

|

|

Percentage

of

Common

|

|

|

No. of

Shares

|

|

|

Percentage

of

Common

|

|

|

Existing Common Stockholders

(1)

|

|

|

11,521,162

|

|

|

|

92.1

|

%

|

|

|

11,521,162

|

|

|

|

22.9

|

%

|

|

Holders of the Convertible Notes

(2)

|

|

|

—

|

|

|

|

—

|

|

|

|

35,836,353

|

|

|

|

71.3

|

%

|

|

Warrants issued to 10% Senior Secured

Toggle Note Holders

|

|

|

—

|

|

|

|

—

|

|

|

|

1,917,342

|

|

|

|

3.8

|

%

|

|

Officers and Directors of the Company

|

|

|

984,828

|

|

|

|

7.9

|

%

|

|

|

984,828

|

|

|

|

2.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

12,505,990

|

|

|

|

100.0

|

%

|

|

|

50,259,685

|

|

|

|

100.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Excludes officers and directors.

|

|

|

(2)

|

Includes 83,668 shares representing PIK interest through September 16, 2016, but excludes up to 10,607,859

additional shares of common stock potentially issuable for future PIK interest.

|

Purpose of the Special

Meeting

Pursuant to New York Stock Exchange (the “NYSE”) rules, we may not issue shares of our common stock representing in

excess of 19.9% of our outstanding shares without the approval of our stockholders. Accordingly, we are calling a special meeting of stockholders pursuant to this Proxy Statement to consider (i) the authorization of the issuance of shares upon

conversion of the Convertible Notes, (ii) an amendment and restatement of our 2009 Long-term Incentive Plan to make additional shares available for awards under this plan, and (iii) an amendment to our Restated Articles of Incorporation to increase

the authorized shares of common stock to provide enough shares to be issued upon conversion of the Convertible Notes, for awards under our 2009 Long-term Incentive Plan, and for general corporate purposes.

If stockholder approval of the issuance of shares upon conversion of the Convertible Notes and the amendment to our Restated Articles of

Incorporation is not obtained by December 31, 2016 and such failure to obtain stockholder approval continues for a period of 90 days thereafter, the Convertible Notes will not be convertible into common stock and such failure to obtain stockholder

approval will result in a default under such notes. Such default may in turn result in a default under our other debt agreements, which defaults would likely force us to file for bankruptcy protection.

Proposals for Stockholder Action

Below is a summary of the proposals on which you are being asked to vote. Please review the complete information regarding these proposals

included in the Proxy Statement.

To authorize certain future issuances of our common stock upon conversion of the Convertible Notes

(Proposal 1 – Page 9)

We are recommending that, as required by the rules of the NYSE, our stockholders approve the issuance

of up to maximum of 46,444,212 shares of our common stock upon the conversion of the Convertible Notes.

2

To approve an Amendment and Restatement of our 2009 Long-term Incentive Plan (Proposal 2

– Page 10)

We are recommending that our stockholders approve an amendment and restatement of our 2009 Long-term Incentive

Plan to authorize an additional 2,500,000 shares for future equity-based incentive awards and to expand the performance measures upon which the payment or vesting of an award occurs.

To approve an Amendment to our Restated Articles of Incorporation to increase our authorized capital stock (Proposal 3 – Page 18)

We are recommending that our stockholders approve an amendment to our Restated Articles of Incorporation to increase the number of

authorized shares of common stock, par value $0.50 per share, to 75 million shares.

Recommendations of the Board of

Directors Regarding the Proposals

Our board of directors unanimously recommends that you vote:

|

1.

|

FOR

approval to issue up to a maximum of 46,444,212 shares of common stock upon conversion of the

Convertible Notes;

|

|

2.

|

FOR

amending and restating our 2009 Long-term Incentive Plan to increase the number of shares available

for future awards and to expand the performance measures upon which the payment or vesting of an award occurs; and

|

|

3.

|

FOR

amending our Restated Articles of Incorporation to increase the authorized capital stock of the

Company.

|

Communicating with the Board of Directors

Any interested party can communicate with our board of directors, any individual director or groups of directors by sending a letter addressed

to the board of directors as a whole, to the individual director or to a group of directors, c/o Corporate Secretary, 5300 Town and Country Blvd., Suite 500, Frisco, Texas 75034.

Governance Documents

Governance documents, such as the Corporate Governance Guidelines, the board committee charters, the Code of Ethics for Senior Financial

Officers, and the Code of Business Conduct and Ethics, can be found in the “Corporate Governance” section of our website:

www.comstockresources.com

. Please note that documents and information on our website are not incorporated

herein by reference. These documents may also be obtained in print at no cost by writing to the Corporate Secretary, 5300 Town and Country Blvd., Suite 500, Frisco, Texas 75034.

Information about the Electronic Availability of Proxy Materials

This Proxy Statement, the accompanying Notice of Special Meeting of Stockholders and the proxy card are available free of charge on our website

at:

www.comstockresources.com

.

3

COMSTOCK RESOURCES, INC.

Proxy Statement for the Special Meeting of Stockholders

to be Held November 8, 2016

In accordance with the rules of the SEC, we are furnishing our proxy materials (proxy statement for this Special Meeting and the proxy card)

by providing access to these materials on the Internet instead of mailing a printed copy of our proxy materials to each stockholder of record or beneficial owner.

A Notice of Meeting and Internet Availability of Proxy Materials will be mailed to stockholders on or about September 29, 2016. We are

providing this notice in lieu of mailing the printed proxy materials to instruct stockholders as to how they may: (1) access and review the proxy materials on the Internet; (2) submit their proxy; and (3) receive printed proxy

materials.

Stockholders may request to receive printed proxy materials by mail or electronically by e-mail on an ongoing basis at no

charge by following the instructions in the notice. A request to receive proxy materials in printed form by mail or by e-mail will remain in effect until such time as the submitting stockholder elects to terminate it.

Questions and Answers about the Special Meeting and Voting

Why am I receiving these materials?

A

Notice of Special Meeting of Stockholders or Notice Regarding the Availability of Proxy Materials has been provided to you because you are a Comstock stockholder and because the Board is soliciting your proxy to vote your shares at the Special

Meeting.

What is the purpose of the Special Meeting?

At the Special Meeting, our stockholders will act upon the matters outlined in the Notice of Special Meeting of Stockholders on the cover page

of this Proxy Statement. We will also transact any other business as may properly come before the Special Meeting or any adjournment thereof.

Where

can I find more information about proxy voting?

The SEC has created an educational website where you can learn more about proxy

voting:

www.sec.gov/spotlight/proxymatters.shtml.

Who is entitled to vote at the Special Meeting?

Owners of shares of common stock of the Company at the close of business on September 16, 2016 (the “Record Date”) are entitled to

vote at and participate in the Special Meeting.

What are the voting rights of holders of common stock?

Each outstanding share of common stock will be entitled to one vote on each matter to come before the Special Meeting.

4

What happens if additional matters are presented at the Special Meeting?

If another proposal is properly presented for consideration at the Special Meeting, the persons named in the Proxy Card will vote as

recommended by the Board or, if no recommendation is given, these persons will exercise their discretion in voting on the proposal.

How can shares be

voted?

Shares of common stock can be voted in person at the Special Meeting or they can be voted by proxy or voting instructions can

be given, in one of three ways, by:

|

|

|

|

|

|

|

• Telephone

|

|

• Mail

|

|

• Internet

|

The instructions for each are on the Proxy Card, in the Notice Regarding the Availability of Proxy Materials,

or on the voting form enclosed with the proxy from the bank, broker or other holder of record. If your shares are held by any such person or entity, you may obtain a proxy from that entity and bring it with you to hand in with your ballot in order

to be able to vote your shares at the Special Meeting.

What vote is required for approval?

The affirmative vote of the holders of at least a majority of the outstanding shares of common stock represented at the Special Meeting and

entitled to vote is required for approval of Proposals 1 and 2.

With regard to Proposal 3 (amending our Restated Articles of

Incorporation), the affirmative vote of the holders of at least a majority of the outstanding shares of common stock and entitled to vote on this proposal is required for approval.

How will votes be counted?

For shares

held in your own name, votes will be counted as directed, except when no choice for any particular matter is made. In that case, and only for the matter for which no choice is indicated, the shares will be voted as recommended by the Board.

For shares held indirectly through a bank, broker or other holder of record (i.e., in “street name”), unless you give your broker,

bank or other holder of record specific instructions, your shares will only be voted on Proposal 3. Under the NYSE rules that govern voting by brokers of shares held in street name, brokers have the discretion to vote these shares only on

routine matters, but not on non-routine matters, as defined by those rules.

What is a broker non-vote and what is the effect of a broker non-vote?

A “broker non-vote” occurs when a stockholder who holds shares indirectly does not give instructions to the holder of record

on how the stockholder wants his or her shares voted, but the holder of record exercises its discretionary authority under the rules of the NYSE to vote on one or more, but not all, of the proposals. In such a case, a “broker non-vote”

occurs with respect to the proposals not voted on. Shares represented by “broker non-votes” will, however, be counted in determining whether a quorum is present.

In the absence of instructions from the stockholder, the holder of record has the discretionary authority to vote them on the shares held by

it only on Proposal 3. Accordingly, if you hold your shares in “street name”, you must instruct your broker how to vote for each of Proposals 1 and 2 in order for your shares to be voted on such proposals at the Special Meeting.

5

What is an abstention and what is the effect of an abstention?

If you do not desire to vote on any proposal or have your shares voted as provided for in the preceding answer, you may abstain from voting by

marking the appropriate space on the Proxy Card or by following the telephone or Internet instructions. Shares voted as abstaining will be counted as present for the purpose of establishing a quorum and for the purpose of determining the number of

votes needed for approval of the Proposals before the Special Meeting.

Abstentions will have the effect of a negative vote for Proposals

1, 2 and 3.

What constitutes a quorum?

The presence at the Special Meeting of the holders of a majority of the shares of the common stock outstanding on the Record Date, in person or

by proxy, will constitute a quorum, permitting business to be conducted at the Special Meeting. As of the Record Date, 12,505,990 shares of common stock were outstanding. Therefore, the presence of the holders of common stock representing at least

6,252,996 votes will be required to establish a quorum.

What shares will be considered “present” at the Special Meeting?

The shares voted at the Special Meeting, shares properly voted by Internet or telephone, and shares for which properly signed Proxy Cards have

been returned will be counted as “present” for purposes of establishing a quorum. Proxies containing instructions to abstain on one or more matters, those voted on one or more matters and those containing broker non-votes will be included

in the calculation of the number of votes considered to be present at the Special Meeting.

How can a proxy be revoked?

You can revoke a proxy at any time prior to a vote at the Special Meeting by:

|

•

|

|

notifying the Corporate Secretary of the Company in writing;

|

|

•

|

|

delivering a subsequent proxy; or

|

|

•

|

|

subsequent vote by Internet or telephone.

|

Shares held indirectly in the name of a bank, broker or other holder of record may be revoked pursuant to the instructions provided by such

person or entity.

Who will count the votes?

We have hired a third party to determine whether or not a quorum is present at the Special Meeting and to tabulate votes cast.

Where can I find the results of the voting?

The voting results will be announced at the Special Meeting and filed on a Form 8-K with the SEC within four business days of the Special

Meeting.

6

Voting Securities and Principal Holders

Security Ownership of Certain Beneficial Owners

Ownership of our common stock is shown in terms of “beneficial ownership.” Generally, a person “beneficially owns” shares

if he or she has either the right to vote those shares or dispose of them. More than one person may be considered to beneficially own the same shares. The percentages shown in this Proxy Statement compare the stockholder’s beneficially owned

shares with the total number of shares of our common stock outstanding on September 16, 2016 (12,505,990 shares) plus the number of unissued shares as to which such owner has the right to acquire voting or dispositive power of on or before November

15, 2016. The following table lists the stockholders known to have been the beneficial owners of more than 5% of the common stock outstanding as of September 16, 2016:

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned

|

|

|

Name of Beneficial Owner

|

|

Number

|

|

|

Percent

|

|

|

Dimensional Fund Advisors LP

Palisades West, Building One, 6300 Bee Cave Road, Austin, Texas 78746

|

|

|

638,087

(1)

|

|

|

|

5.1

|

%

|

|

Galatyn Equity Holdings LP

47 Highland Park Village, Suite 200, Dallas, Texas 75205

|

|

|

664,587

(2)

|

|

|

|

5.3

|

%

|

|

Hodges Capital Holdings, Inc.

2905 Maple Avenue, Dallas, Texas 75201

|

|

|

1,204,504

(3)

|

|

|

|

9.9

|

%

|

|

Carl H. Westcott

100 Crescent Court, Suite 1620, Dallas, Texas 75201

|

|

|

959,740

(4)

|

|

|

|

7.7

|

%

|

|

|

(1)

|

Represents shares held on December 31, 2015, based on filing on Schedule 13G/A dated February 9,

2016.

|

|

|

(2)

|

Represents shares held on December 31, 2015, based on filing on Schedule 13G/A dated January 23,

2015.

|

|

|

(3)

|

Represents shares held on December 31, 2015, based on filing on Schedule 13G dated February 10,

2016.

|

|

|

(4)

|

Represents shares held on August 30, 2016, based on filing on Schedule 13D/A dated September 6, 2016.

|

7

Security Ownership of Management

The following table sets forth information as of September 16, 2016 concerning beneficial ownership information for our directors and

executive officers:

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned

|

|

|

Name of Beneficial Owner

(1)

|

|

Number

|

|

|

Percent

|

|

|

M. Jay Allison

Chairman of the Board of Directors and Chief Executive Officer

|

|

|

401,919

|

(2)

|

|

|

3.2

|

%

|

|

Roland O. Burns

Director Nominee, President, Chief Financial Officer and Secretary

|

|

|

218,828

|

(2)

|

|

|

1.7

|

%

|

|

Elizabeth B. Davis

Director

|

|

|

12,188

|

|

|

|

*

|

|

|

D. Dale Gillette

Vice President of Legal and General Counsel

|

|

|

29,431

|

|

|

|

*

|

|

|

Mack D. Good

Chief Operating Officer

|

|

|

78,181

|

|

|

|

*

|

|

|

David K. Lockett

Director Nominee

|

|

|

23,851

|

|

|

|

*

|

|

|

Cecil E. Martin

Director

|

|

|

31,024

|

|

|

|

*

|

|

|

Michael D. McBurney

Vice President of Marketing

|

|

|

14,377

|

|

|

|

*

|

|

|

Daniel K. Presley

Vice President of Accounting, Controller and Treasurer

|

|

|

29,844

|

|

|

|

*

|

|

|

Russell W. Romoser

Vice President of Reservoir Engineering

|

|

|

14,796

|

|

|

|

*

|

|

|

LaRae L. Sanders

Vice President of Land

|

|

|

16,988

|

(3)

|

|

|

*

|

|

|

Frederic D. Sewell

Director

|

|

|

17,244

|

|

|

|

*

|

|

|

Richard D. Singer

Vice President of Financial Reporting

|

|

|

16,949

|

|

|

|

*

|

|

|

David W. Sledge

Director

|

|

|

31,074

|

|

|

|

*

|

|

|

Blaine M. Stribling

Vice President of Corporate Development

|

|

|

18,674

|

|

|

|

*

|

|

|

Jim L. Turner

Director

|

|

|

31,460

|

|

|

|

*

|

|

|

|

|

|

|

All Executive Officers and Directors as a Group (16 Persons)

|

|

|

986,828

|

|

|

|

7.9

|

%

|

|

|

*

|

Indicates less than one percent

|

|

|

(1)

|

The address of each beneficial owner is c/o Comstock Resources, Inc., 5300 Town and Country Blvd, Suite

500, Frisco, Texas 75034.

|

|

|

(2)

|

269,683 shares owned by Mr. Allison and 152,508 shares owned by Mr. Burns are pledged as

security for lines of credit held in their respective names.

|

|

|

(3)

|

Includes 2,000 shares issuable pursuant to stock options which are presently exercisable or exercisable on

or before November 15, 2016 by Ms. Sanders.

|

8

|

PROPOSAL 1

|

PROPOSAL TO AUTHORIZE FUTURE ISSUANCES OF OUR COMMON STOCK UPON CONVERSION OF THE CONVERTIBLE NOTES

|

Prior to September 6, 2016, we retired $236.9 million of our outstanding 7

3

⁄

4

% Senior Notes due 2019 and 9

1

⁄

2

% Senior Notes due 2020 in open market purchases and through exchanges of our common

stock with holders of such notes. After these transactions, we had outstanding a total of $1.2 billion of long-term debt. In order to further restructure our outstanding debt, on September 6, 2016, we completed an exchange with the holders of

approximately 98% aggregate principal amount of our senior notes, which may require the future issuance of shares of our common stock in connection with the Convertible Notes issued in the Exchange Offer.

Our common stock is listed on the NYSE, and we are subject to rules and regulations set forth in the NYSE Listed Company Manual. Section

312.03(c) of the NYSE Listed Company Manual requires stockholder approval prior to the issuance of common stock (or securities convertible into or exercisable for common stock) equal to 20% or more of our outstanding common stock or 20% or more of

the voting power outstanding before the issuance of such securities. At the Special Meeting, we are seeking approval from our stockholders for the issuance of up to a maximum of 46,444,212 shares of common stock which would be issued upon conversion

of the Convertible Notes. The issuance of such shares will result in us issuing shares of our common stock that exceed, in the aggregate, the 20% threshold specified in Section 312.03(c) of the NYSE Listed Company Manual.

If stockholder approval is not obtained by December 31, 2016 and such failure to obtain stockholder approval continues for a period of 90 days

thereafter, the Convertible Notes will not be convertible into common stock and such failure to obtain stockholder approval will result in a default under such notes. Such default may in turn result in a default under our debt agreements. Such

defaults would likely require us to file for bankruptcy protection.

We intend to file with the NYSE one or more supplemental listing

applications to list the shares of common stock issued in connection with the potential conversion of the Convertible Notes. Holders of common stock are not entitled to preemptive rights in future offerings of our common stock. Under Nevada law,

stockholders are not entitled to appraisal rights in connection with this proposal.

The Board recommends that you vote “FOR”

the proposal to approve future issuances of up to a maximum of 46,444,212 shares of common stock upon the conversion of the Convertible Notes.

9

|

PROPOSAL 2

|

PROPOSAL TO APPROVE AN AMENDMENT AND RESTATEMENT OF OUR 2009 LONG-TERM INCENTIVE PLAN

|

In order to continue to provide long-term incentive opportunities under the Comstock Resources, Inc. 2009 Long-term Incentive Plan (the

“2009 Plan”), the board of directors has approved amending and restating the 2009 Plan to make an additional 2.5 million shares of common stock available for awards under the 2009 Plan.

The 2009 Plan was designed and is currently administered to support the achievement of the compensation program objectives, policies and plans,

which cover our executive officers. In particular, awards granted under the 2009 Plan:

|

•

|

|

Are administered by our compensation committee, which is made up entirely of independent directors;

|

|

•

|

|

Allow us to maintain a competitive compensation program to attract and retain executives and other key

employee talent;

|

|

•

|

|

Provide performance-based incentive compensation that aligns the interests of our executives and other key

employees with that of our stockholders; and

|

|

•

|

|

Facilitate the ownership of our common stock by our executives and other key employees.

|

Over the past several years, we have modified our long-term incentive equity compensation program in order to strengthen the alignment of pay

and performance and conform with prevailing market practices and stockholders’ expectations around corporate governance.

Since 2013,

we made the following changes related to equity compensation practices:

|

•

|

|

Adopted a pay philosophy that targets the median of our peer group, and adjusted our peer group to better

reflect our size and industry

|

|

•

|

|

Added performance share unit (“PSU”) awards, representing a significant portion of the total equity

award value for our executive officers

|

|

•

|

|

Required that our total shareholder return be positive in order to earn any above-target payouts from PSUs

|

|

•

|

|

Reduced the Chief Executive Officer’s maximum PSU award opportunity from 300% to 200% of target

|

|

•

|

|

Eliminated the Chief Executive Officer’s fixed Long-term Incentive (“LTI”) award guideline of

5x salary so that LTI awards can be made to reflect peer group market levels, as well as corporate and individual performance and other relevant factors

|

|

•

|

|

Added service-vesting requirements for PSUs that have one- and two-year performance periods so that all earned

awards vest after 3 years

|

|

•

|

|

Certain other compensation governance actions taken include:

|

|

|

•

|

|

Changed annual bonus award to be based on a formulaic structure

|

|

|

•

|

|

Eliminated excise tax gross-up provisions from employment agreements

|

10

|

|

•

|

|

Enhanced our anti-hedging policy

|

|

|

•

|

|

Enhanced proxy disclosures of our compensation program to provide more information about the program, the

Compensation Committee process and key decisions

|

|

|

•

|

|

Conducted discussions about our compensation program with stockholders representing a significant portion of

our outstanding shares

|

Since these actions related to equity compensation were taken, along with other adjustments to

our executive compensation program described in our proxy statements filed in 2014, 2015 and 2016, stockholder support for our say on pay proposals has increased from 33% in 2013 to 93% in 2014, 96% in 2015 and 90% in 2016.

As required under Section 422 of the Internal Revenue Code of 1986, as amended, and related regulations, our stockholders are being asked

to approve an amendment and restatemant of the 2009 Plan so that future awards of incentive stock options (if any) made by our compensation committee to employees and officers can qualify as incentive stock options.

Purpose of the 2009 Plan

The purpose of

the 2009 Plan is to attract, retain and motivate key participating employees and to attract and retain well-qualified members to the Board through the use of incentives based upon the value of common stock. Awards under the 2009 Plan are determined

by the compensation committee of the Board, and may be made to our key executives, managerial employees and non-employee directors.

As of

September 16, 2016, approximately ten executive officers, twenty-eight managerial employees and six non-employee directors are eligible to participate in the 2009 Plan.

Summary of the 2009 Plan, as Amended and Restated

Administration of Plan

The 2009 Plan is

administered by the compensation committee, each member of which must be a non-employee director, as defined by Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended. Subject to the provisions of the 2009 Plan, the

compensation committee has authority to select employees and non-employee directors to receive awards, to determine the time or times of receipt, to determine the types of awards and the number of shares covered by the awards, to establish the

terms, conditions, performance criteria, restrictions, and other provisions of such awards, to determine the number and value of performance units awarded and earned and to cancel or suspend awards. The compensation committee is authorized to

interpret the 2009 Plan, to establish, amend and rescind any rules and regulations relating to the 2009 Plan, to determine the terms and provisions of any agreements made pursuant to the 2009 Plan and to make all other determinations that may be

necessary or advisable for the administration of the 2009 Plan.

The compensation committee may not amend a stock option or stock

appreciation right to reduce the exercise or base price of the award. The compensation committee is prohibited from accelerating the vesting of any award, except in the event of death, disability, or a change in control.

Eligibility Under the 2009 Plan

Key

employees and non-employee members of the Board selected by the compensation committee are eligible for awards.

11

Duration of Plan

Assuming the amendment and restatement of the 2009 Plan is approved by the stockholders at the special meeting, the 2009 Plan will expire on

May 7, 2025. Following that date, no further awards may be made under the 2009 Plan.

Types of Awards

Awards under the 2009 Plan may be in the form of stock options (including incentive stock options that meet the requirements of

Section 422 of the Internal Revenue Code and non-qualified stock options), stock appreciation rights, restricted stock, restricted stock units and performance units.

Authorized Shares Available for Awards Under the 2009 Plan

The 2009 Plan currently authorizes awards to key employees and non-employee directors of up to 1,010,000 shares of common stock. In addition,

the shares of common stock that become available upon the lapse or expiration of prior grants under the 2009 Plan will be authorized for future grant under the 2009 Plan. As of September 16, 2016 only 5,256 shares are presently available for

future awards. Assuming the amendment and restatement of the 2009 Plan is approved by the stockholders at the Special Meeting, the number of shares authorized for awards will be increased by 2,500,000 shares.

Annual Limits on Awards to Employees

No

employee may be granted stock options or stock appreciation rights under the 2009 Plan in any single fiscal year, the total number of shares subject to which exceed 1,000,000 shares.

Performance Measures

The performance

goals, upon which the payment or vesting of an award occurs are limited to the following performance measures:

|

•

|

|

Increases in, or levels of, net asset value; net asset value per share; pretax earnings; earnings before

interest, taxes, depreciation, amortization, exploration and other non-cash expenses (“EBITDAX”); net income and/or earnings per share.

|

|

•

|

|

Return on equity, return on assets or net assets, return on capital (including return on total capital or

return on invested capital).

|

|

•

|

|

Share price or stockholder return performance (including, but not limited to, growth measures and total

stockholder return, which may be measured in absolute terms and/or in comparison to a group of peer companies or an index).

|

|

•

|

|

Oil and gas reserve replacement, oil and gas reserve growth, additions to our oil and gas drilling prospect

inventory and improvements to finding and development costs and/or operating costs.

|

|

•

|

|

Oil and/or gas production growth.

|

|

•

|

|

Cash flow measures (including, but not limited to, cash flows from operating activities, discretionary cash

flows, and cash flow return on investment, assets, equity or capital).

|

|

•

|

|

Improvements to our balance sheet including enhancing liquidity and maintaining or improving leverage as

measured by the ratio of total debt divided by EBITDAX.

|

|

•

|

|

Such other appropriate performance measures, including, but not limited to, leadership development and

execution of strategic initiatives, as established by the compensation committee for a performance period.

|

12

Terms of Awards

The 2009 Plan requires that awards vest over a minimum period of continued service with us. Awards that vest based on the achievement of

performance goals are subject to a minimum vesting period of one year after the date of grant. If vesting is not based on performance, the minimum vesting period is three years after the date of grant. Vesting over a three-year period includes

periodic graded vesting. Awards may provide for accelerated vesting in the event of death, disability, or a change in control. Notwithstanding these requirements, up to 5% of the shares available for awards under the 2009 Plan may be granted as

non-performance-based awards with a vesting term of less than three years.

Stock Options

Stock options may be awarded under the 2009 Plan with an exercise price of not less than one hundred percent of the market value of the common

stock on the date of the award or, if greater, the par value of the common stock. The 2009 Plan authorizes the award of both non-qualified stock options and incentive stock options. Only our employees are eligible to receive awards of incentive

stock options. The aggregate value (determined at the time of the award) of the common stock with respect to which incentive stock options are exercisable for the first time by any employee during any calendar year may not exceed $100,000. The term

of stock options cannot exceed ten years.

In addition to allowing an optionee to pay cash to exercise options, or deliver stock

certificates for previously-owned shares of common stock, the 2009 Plan will permit an optionee to use cashless exercise procedures. These include broker-assisted cashless exercises (selling a portion of the option shares to pay the exercise price

and withholding taxes), and an attestation procedure in a stock-for-stock cashless exercise, avoiding the delays in requiring physical delivery of stock certificates.

The 2009 Plan permits recipients of non-qualified stock options (including non-employee directors) to transfer their vested options by gift to

family members (or trusts or partnerships of family members). After transfer of an option, the optionee remains subject to tax upon the exercise of the option, and we retain the right to claim a deduction for compensation upon the exercise of the

option.

Stock Appreciation Rights

The 2009 Plan authorizes the compensation committee to award stock appreciation rights (“SARs”) payable in cash or shares of stock.

An SAR is an award that entitles the holder to receive an amount equal to the difference between (1) the fair market value of the shares of stock at the time of exercise of the SAR and (2) the fair market value of the shares of stock on

the date that the SAR was granted. Under the 2009 Plan, this amount is paid to the holder upon the exercise of a SAR in the form of shares of stock (valued at their fair market value at the time of exercise) or in cash, as specified in the award

agreement. The maximum term of SARs is ten years.

When an award of SARs is made, the total number of SARs covered by the award (and not

the “net” number of shares that would be issued in the future upon exercise of the SAR) is charged against the pool of shares authorized under the 2009 Plan.

Restricted Stock

The 2009 Plan

authorizes the compensation committee to grant to key employees and non-employee directors shares of restricted stock. The holder will become vested in shares of restricted stock free of all restrictions if he or she completes a required period of

employment or service following the award and satisfies any other conditions; otherwise, the shares will be forfeited. The restricted period may be no more than ten years, and must be at least one year. The holder will have the right to vote the

shares

13

of restricted stock and, unless the compensation committee determines otherwise, the right to receive dividends on the shares. The holder may not sell or otherwise dispose of restricted stock

until the conditions imposed by the compensation committee have been satisfied.

Restricted Stock Units and Performance Units

The 2009 Plan authorizes the compensation committee to award restricted stock units and performance units payable in cash or shares of stock. A

restricted stock unit is the grant of a right to receive shares of stock in the future, upon vesting of the award. Under the 2009 Plan, a number of performance units is initially assigned by the compensation committee and the number of units

actually earned will be contingent on future performance of the holder and/or us over the performance period in relation to the established performance measures. Although the performance measures and performance period will be determined by the

compensation committee at the time of the award of performance units, they may be subject to such later revision as the compensation committee deems appropriate to reflect significant events or changes. The maximum term of restricted stock units and

performance units is ten years.

Change in Control Events

In the event we have a change in control, as defined in the 2009 Plan, all outstanding stock options, stock appreciation rights and restricted

stock will automatically become fully exercisable and/or vested, and the compensation committee may, in its sole discretion and immediately prior to a change in control, take such action as necessary to modify the terms of or accelerate the vesting

of any outstanding performance units upon consummation of such change in control.

New Plan Benefits

Awards to be received by individual participants are not determinable because the compensation committee determines the amount and nature of

any award under the 2009 Plan in its sole discretion at the time of grant. As a result, the benefits that might be received by participants receiving discretionary grants under the 2009 Plan are not determinable.

Federal Income Tax Consequences

The

discussion below summarizes the expected federal income tax treatment of awards under the 2009 Plan, under currently applicable laws and regulations. It is only a summary of the effect of U.S. federal income taxation upon recipients of awards and us

with respect to the grant and exercise of awards under the 2009 Plan. It does not purport to be complete and does not discuss the tax consequences arising in the context of a recipient’s death or the income tax laws of any municipality, state

or foreign country in which the recipient’s income or gain may be taxable.

Non-Qualified Stock Options

The grant of a non-qualified stock option does not result in taxable income to the holder of such an option or in a deduction by us. The tax

consequences are determined generally at the time the optionee exercises the non-qualified stock option. Upon the exercise of a non-qualified stock option, the optionee generally recognizes ordinary income in an amount equal to the difference

between the fair market value of the common stock on the date of exercise and the exercise price of the option. We are entitled to a deduction for the year in which the optionee’s tax year ends in an amount equal to the amount that was

includable in the optionee’s gross income. Upon exercise of options, shares can be withheld (or delivered to us, in the case of previously-owned shares) to satisfy tax withholding obligations.

14

If an optionee surrenders or delivers shares of common stock in whole or partial payment of the

exercise price, the optionee will not recognize taxable income when the non-qualified stock option is exercised to the extent that the number of shares so surrendered or delivered equals the number of shares received upon the exercise of the option.

The optionee will, however, recognize ordinary income with respect to the shares received in excess of the number of shares so surrendered or delivered, in an amount equal to the excess of the fair market value of such excess shares on the date the

non-qualified stock option is exercised over the amount of any cash paid.

An optionee’s tax basis in the stock acquired pursuant to

the exercise of a non-qualified stock option for which the option price is paid solely in cash will be equal to the amount of cash paid plus the amount of ordinary income that the optionee recognizes upon exercise of the option. As to the stock

acquired pursuant to exercise of a non-qualified stock option for which an optionee surrenders stock in payment of all or part of the aggregate option price, the optionee’s tax basis in the number of shares acquired in the exchange which is

equal to the number of surrendered shares shall be the same as that of the surrendered shares. The holding period of these acquired shares shall be the same as that of the surrendered shares. The optionee’s tax basis in any excess shares

acquired in the exchange shall be zero, increased by the amount of cash, if any, paid upon the exercise of the non-qualified stock option and the amount of ordinary income that the optionee recognizes upon exercise of the option. The holding period

of these acquired shares shall begin as of the date such stock is transferred to the optionee.

Incentive Stock Options

Under current law, the holder of an option will not recognize taxable income on the grant or exercise of an incentive stock option. However,

the amount by which the fair market value of common stock on the date the incentive stock option is exercised exceeds the exercise price of such option will be treated as income for purposes of computing the optionee’s alternative minimum

taxable income in the year the incentive stock option is exercised.

If the shares of common stock acquired through the exercise of an

incentive stock option are held by an optionee through the later of (1) two years from the date of the grant of the option or (2) one year after the transfer of such shares to the optionee pursuant to the exercise, the amount received by

the optionee upon the sale or other disposition of such shares in excess of the optionee’s tax basis in such shares will be taxable to such optionee as a long-term capital gain in the year of such sale or disposition. An optionee’s tax

basis in the shares of common stock acquired pursuant to the exercise of an incentive stock option will be equal to the exercise price of such options.

If the shares of common stock acquired through the exercise of an incentive stock option are disposed of prior to the expiration of the

two-year or one-year holding periods, an amount equal to the difference between (1) the lesser of (a) the amount realized on the sale or exchange, and (b) the fair market value of the shares on the date the option was exercised, and

(2) the exercise price of the option relating to the shares sold or exchanged will be taxable to the optionee as ordinary income in the year of such disposition. In addition, if the amount realized from the sale or exchange is greater than the

fair market value of the shares on the date the incentive stock option was exercised, the optionee will also recognize gain in an amount equal to such difference. This gain will be characterized as long-term or short-term capital gain, depending

upon the holding period of such shares. If common stock is disposed of by gift prior to the expiration of the two-year or one-year holding periods, an amount equal to the fair market value of the shares on the date of exercise less the exercise

price of the option relating to the shares disposed of will be taxable to the optionee as ordinary income in the year of such disposition.

15

The grant or exercise of an incentive stock option will not result in any federal income tax

consequences to us. However, if common stock acquired through the exercise of an incentive stock option is disposed of by the optionee prior to the expiration of the two-year or one-year holding periods described above, we will be allowed a

deduction equal to the amount of income includable in the optionee’s gross income as a result of the disposition.

Stock Appreciation Rights

Under current federal tax law, upon the grant of an SAR, no taxable income will be realized by the holder and we will not be entitled

to any tax deduction. Upon exercise of an SAR, the holder will realize ordinary taxable income on the date of exercise. Such taxable income will equal the difference between the fair market value of the common stock on the date of grant of the SAR

and the cash received upon exercise, or, as applicable, the fair market value of the common stock received upon exercise on the date of exercise. We will be entitled to a corresponding tax deduction.

Restricted Shares

A participant normally

will not realize taxable income and we will not be entitled to a deduction upon the grant of restricted shares. When the shares are no longer subject to a substantial risk of forfeiture, the participant will realize taxable ordinary income in an

amount equal to the fair market value of such shares at such time, and we will be entitled to a deduction in the same amount. A participant may make a special tax election which affects the timing and measurement of income recognized in connection

with the grant of restricted shares, and our deduction.

Dividends received by a participant on restricted shares during the restricted

period are generally taxable to the participant as ordinary income and will be deductible by us.

Restricted Stock Units and Performance Units

A participant receiving an award of a restricted stock unit or a performance unit will not realize taxable income until the restricted stock

unit or performance unit is paid, in an amount equal to the fair market value of shares received in payment or the amount of cash received, as applicable, and we will be entitled to a corresponding deduction at such time.

Withholding

We will retain the right to

deduct or withhold, or require an employee to remit to us, an amount sufficient to satisfy federal, state and local taxes required by law or regulation to be withheld with respect to any taxable event as a result of awards under the 2009 Plan.

Change in Control and Excess Parachute Payments

The accelerated vesting of awards upon a change in control could result in a participant being considered to receive “excess parachute

payments” (as defined in Section 280G of the Code), which payments are subject to a 20% excise tax imposed on the participant. If so, we would not be able to deduct the excess parachute payments.

Section 162(m) Limitations

Section 162(m) of the Code generally places a $1 million annual limit on a company’s tax deduction for compensation paid to a

“covered employee.” A “covered employee” is an employee who is, on the last day of the company’s taxable year in which the deduction would otherwise be claimed, the

16

company’s chief executive officer or one of the other four highest paid officers named in its proxy statement except the chief financial officer. This limit does not apply to compensation

that satisfies the applicable requirements for performance-based compensation, one of which is that stockholders approve the material terms of the compensation.

The 2009 Plan incorporates the requirements for the performance-based compensation exception applicable to options, SARs, and performance units

so that all such awards should qualify for the exception. In addition, the compensation committee may grant other awards designed to qualify for this exception. However, the compensation committee reserves the right to grant awards that do not

qualify for this exception, and in some cases, including a change in control, the exception may cease to be available for some or all awards (including options, SARs, and performance units) that otherwise so qualify. Thus, it is possible that

Section 162(m) may disallow compensation deductions that would otherwise be available to us.

This summary is qualified in its

entirety by reference to the complete text of the amendment and restatement of the 2009 Plan, which has been filed with the SEC and which will be provided, at no charge, to any stockholder upon written request to our principal executive offices at

5300 Town and Country Blvd., Suite 500, Frisco, Texas 75034, Attention: Corporate Secretary.

A majority of the shares present in person or

by proxy at the meeting and entitled to vote on the proposal is required for approval of the amendment and restatement of the 2009 Plan. Brokers do not have discretion to vote on this proposal without instruction. If you do not instruct your broker

how to vote on this proposal, your broker will deliver a non-vote on this proposal. Abstentions will have the same effect as votes against the proposal, but broker non-votes will not affect the outcome of the voting on the proposal.

The Board recommends that you vote “FOR” the proposal to approve the amendment and restatement of our 2009 Long-term Incentive

Plan.

17

|

PROPOSAL 3

|

PROPOSAL TO AMEND OUR RESTATED ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED CAPITAL STOCK

|

The Board has determined that it is necessary to propose an amendment to our Restated Articles of Incorporation to increase the number of

authorized shares of common stock from 50 million to 75 million.

Under our Restated Articles of Incorporation, as amended, the total

number of shares of capital stock that we have the authority to issue is 55 million shares, of which 50 million are common stock and 5 million are preferred stock. As of September 16, 2016, the number of shares of common stock outstanding was

12,505,990, 11,730 shares of common stock were reserved for issuance upon exercise of outstanding stock options and 1,917,342 shares of common stock were reserved for issuance upon exercise of outstanding warrants. We also have outstanding

performance share unit awards equivalent to 269,253 shares that would be issuable upon achievement of the maximum awards under the terms of the performance share unit awards. As a result, as of September 16, 2016, we have a total of 35,295,685

shares of common stock available for future issuance. No shares of preferred stock are outstanding, and the proposed amendment would not increase the authorized number of shares of preferred stock.

The Board has determined that it is necessary to increase the number of authorized shares of common stock to allow for the conversion of the

Convertible Notes, to make available additional shares of common stock for issuance under the 2009 Plan and to provide a sufficient reserve of shares for our future business and financial needs. If stockholder approval for the amendment to increase

the authorized shares is not obtained by December 31, 2016 and such failure to obtain stockholder approval continues for a period of 90 days thereafter, the Convertible Notes will not be convertible into common stock and such failure to obtain

stockholder approval will result in a default under such notes. Such default may in turn result in a default under our other debt agreements. Such defaults would likely require us to file for bankruptcy protection.

Existing holders of shares of common stock would have no preemptive rights under our Restated Articles of Incorporation to purchase any

additional shares of common stock we may issue. Under Nevada law, stockholders are not entitled to appraisal rights with respect to this proposal.

The issuance of shares of common stock in connection with the conversion of the Convertible Notes will substantially dilute the voting power of

existing stockholders, decrease earnings per share and decrease the book value and market value per share of shares presently held. In addition, although the purpose of the proposed amendment is not as an anti-takeover measure, the increase in

the authorized number of shares of common stock and the subsequent issuance of a large number of those shares could have the effect of delaying or preventing a change of control without further action by our stockholders, and thus make it more

difficult to remove and replace our management. Shares of authorized and unissued common stock could (within the limits imposed by applicable law) be issued in one or more transactions that would make a change of control more difficult, and

therefore less likely. Although these potential anti-takeover effects are inherent in the proposed amendment, our

18

Board does not view the increase in the number of authorized shares of common stock as an

anti-takeover

measure, and the amendment is not being made in

response to any specific proposed or contemplated change-of-control transaction or effort by any third party.

The Board has unanimously

adopted a resolution approving, subject to stockholder approval, and declaring the advisability of an amendment to Article Fourth of our Restated Articles of Incorporation to increase the number of authorized shares of common stock from 50 million

to 75 million. The first paragraph of Article Fourth is proposed to be deleted in its entirety. This paragraph currently provides that:

Fourth: That the amount of the total of the authorized capital stock of the corporation is Fifty-Five Million

(55,000,000) shares of which Fifty Million (50,000,000) shares are Common Stock, Fifty Cents ($0.50) par value per share, and Five Million (5,000,000) shares are Preferred Stock, Ten Dollars ($10.00) par value per share. The shares of Common

Stock shall be identical in all respects and shall have one vote per share on all matters on which stockholders are entitled to vote. The Preferred Stock may be issued in one or more series; shares of each series shall be identical in all

respects and shall have such voting, dividend, conversion and other rights, and such preferences and privileges as may be determined by resolution of the Board of Directors of the corporation.

The following paragraph is proposed to be the new first paragraph of Article Fourth:

Fourth: That the amount of the total of the authorized capital stock of the corporation is Eighty Million

(80,000,000) shares of which Seventy-Five Million (75,000,000) shares are Common Stock, Fifty Cents ($0.50) par value per share, and Five Million (5,000,000) shares are Preferred Stock, Ten Dollars ($10.00) par value per share. The shares of

Common Stock shall be identical in all respects and shall have one vote per share on all matters on which stockholders are entitled to vote. The Preferred Stock may be issued in one or more series; shares of each series shall be identical in

all respects and shall have such voting, dividend, conversion and other rights, and such preferences and privileges as may be determined by resolution of the Board of Directors of the corporation.

If approved, this amendment will become effective upon the filing of a certificate of amendment to our Restated Articles of Incorporation with

the Secretary of State of the State of Nevada, which we would complete promptly after the Special Meeting. The full text of the proposed Certificate of Amendment to the Restated Articles of Incorporation is attached to this Proxy Statement as

Appendix A.

The Board recommends that you vote “FOR” the proposal to amend the Restated Articles of Incorporation to

increase the authorized shares of common stock.

19

Director Compensation

The compensation program for our non-employee directors has been developed by the compensation committee after consideration of the

recommendations and competitive market data provided by its independent compensation consultant. In setting non-employee director compensation, the compensation committee considers the significant amount of time that our directors spend satisfying

their duties to the Company and our stockholders, as well as the skill level required by our directors. The program has been approved by the Board. The following sets out the components of the compensation program for our non-employee directors

beginning in May 2016. Employee directors receive no additional compensation for serving on our Board:

|

|

|

|

|

|

|

Annual Board Retainer

|

|

$

|

83,000

|

|

|

Annual Equity Grant Value

|

|

$

|

125,000

|

|

|

Lead Director Retainer

|

|

$

|

37,000

|

|

|

Annual Committee Chair Retainer:

|

|

|

|

|

|

Audit Committee

|

|

$

|

31,500

|

|

|

Compensation Committee

|

|

$

|

20,750

|

|

|

Corporate Governance/Nominating Committee

|

|

$

|

12,500

|

|

The following table sets forth the compensation of our non-employee directors for services during 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees Earned

or Paid

in Cash

|

|

|

Equity Awards

|

|

|

Total

|

|

|

Name of Director

|

|

|

Grant Date

|

|

|

Number of

Restricted

Shares (#)

(1)

|

|

|

Grant

Date Fair

Value

(1)

|

|

|

|

Elizabeth B. Davis

|

|

$

|

83,000

|

|

|

|

May 7, 2015

|

|

|

|

5,483

|

|

|

$

|

125,000

|

|

|

$

|

208,000

|

|

|

David K. Lockett

|

|

$

|

103,750

|

|

|

|

May 7, 2015

|

|

|

|

5,483

|

|

|

$

|

125,000

|

|

|

$

|

228,750

|

|

|

Cecil E. Martin

|

|

$

|

151,500

|

|

|

|

May 7, 2015

|

|

|

|

5,483

|

|

|

$

|

125,000

|

|

|

$

|

276,500

|

|

|

Frederic D. Sewell

|

|

$

|

95,500

|

|

|

|

May 7, 2015

|

|

|

|

5,483

|

|

|

$

|

125,000

|

|

|

$

|

220,500

|

|

|

David W. Sledge

|

|

$

|

83,000

|

|

|

|

May 7, 2015

|

|

|

|

5,483

|

|

|

$

|

125,000

|

|

|

$

|

208,000

|

|

|

Jim L. Turner

|

|

$

|

83,000

|

|

|

|

May 7, 2015

|

|

|

|

5,483

|

|

|

$

|

125,000

|

|

|

$

|

208,000

|

|

|

(1)

|

Shares vest one year from grant date of May 7, 2015 and had a grant date value of $4.56 per share.

|

The compensation committee may award stock options, restricted stock, stock appreciation rights, restricted stock units

or performance units to non-employee directors at its discretion under our 2009 Long-term Incentive Plan.

In June, 2016 the directors

received 5,000 restricted shares each which vest in June, 2017. The value of the grants made to the directors in 2016 was 80% lower than the value of grants received in 2015.

Compensation Committee Interlocks and Insider Participation

Our compensation committee is

comprised entirely of independent directors. None of the members of the committee during 2015 or through the date of this Proxy Statement is or has been an officer or employee of the Company and no executive officer of the Company has served on the

compensation committee or board of directors of any company that employed any member of the Company’s compensation committee or Board.

20

Executive Compensation

Compensation Discussion and Analysis

Comstock’s executive compensation programs are intended to align pay outcomes with performance achievements, grow stockholder value,

attract and retain executive talent and support the Company’s business strategy. We believe that our executive compensation programs as currently designed align executive pay with Company performance, stockholder expectations and prevailing

market practices.

2015 was a very challenging year for the Company as oil and natural gas prices fell by 49% and 45%, respectively. Given