Eldorado Resorts to Buy Isle of Capri Casinos

September 19 2016 - 8:30AM

Dow Jones News

Eldorado Resorts Inc. on Monday said it agreed to buy fellow

casino operator Isle of Capri Casinos Inc. for about $950 million

in cash and stock in a deal that more than doubles the number of

gaming locations Eldorado operates.

The deal values Isle of Capri at $23 a share, a 36% premium over

Friday's closing price. Eldorado said it would pay 58% of the

purchase price in cash and 42% in stock.

Isle of Capri shares rose 29% in premarket trading, while

Eldorado shares climbed 8.6%.

The combined company will have 20 properties in 10 states and

would have generated about $1.8 billion in revenue for the 12

months ended in June.

The deal is expected to close in the second quarter of 2017.

Certain large stockholders of Eldorado and Isle of Capri have

signed agreements to vote in favor of the transaction.

Eldorado shareholders will own 62% of the combined company,

while Isle of Capri shareholders will hold 38%.

Eldorado said it received committed financing for the

transaction totaling $2.1 billion from J.P. Morgan Chase &

Co.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

September 19, 2016 08:15 ET (12:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

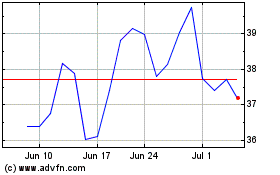

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Mar 2024 to Apr 2024

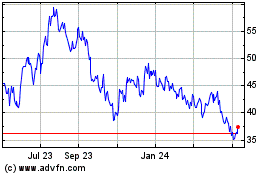

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Apr 2023 to Apr 2024