By Cassandra Jaramillo

For decades, Telemundo churned out "telenovelas" -- soap operas

featuring tales of poor women pursuing wealthy men, forbidden

lovers in racy encounters, melodramatic fights and lots of

overacting.

Telenovelas for Hispanic audiences were long the staple for

prime-time television. But now, the Comcast Corp.-owned

Spanish-language network is overhauling its programming to appeal

to a U.S. Hispanic audience whose tastes are changing.

In July, Telemundo introduced three prime-time series -- a

romantic comedy and two edgy dramas -- with story lines and

characters that don't hew to telenovela stereotypes and clichés. In

fact, Telemundo calls them series, not telenovelas.

"Silvana Sin Lana" (Silvana Without Money) is a romantic comedy

about class differences, with a leading Colombian actress and

Puerto Rican actor. In "Sin Senos Sí Hay Paraíso" (Without Breasts,

There is Paradise) the female protagonist tries to succeed without

undergoing plastic surgery or falling into drug cartel life.

"Señora Acero: La Coyote" (Steel Woman: The Coyote) takes place

on the U.S.-Mexico border with a dark theme of a female smuggler,

known as a coyote, crossing immigrants into the U.S.

Premiering three hourlong series in the same week was a first

for Telemundo. Like the telenovelas, the shows air every night --

taking up the entire prime-time schedule -- but the content is far

different. Production quality is higher because the network has

increased its writing staff and moved filming locations to the U.S.

Meanwhile, the fairy-tale archetypes have started to disappear as

the company tries to reinvent the telenovela.

"We overturned our prime time from one day to the next," said

Cesar Conde, chairman of Comcast's NBCUniversal International Group

and NBCUniversal Telemundo Enterprises.

It is a makeover worth doing, executives say, given the stark

reality that telenovelas aren't resonating with a new generation of

young viewers. According to Census Bureau data from 2013, 32.7

million of U.S. Hispanics are under 34 years old, up from 25.6

million 10 years earlier. Meanwhile, there are a growing number of

Hispanics whose roots aren't in Mexico, which convinced the network

to update its programming to reach a more diverse Latino

population.

"We have our hand on the pulse on the evolution that's

occurring," Mr. Conde said. "We've been able to adapt our

content."

The Comcast-owned channel has stepped up its programming

spending to invest in the new genres, though it doesn't disclose

specific financials.

Telemundo executives credit the changes with helping to maintain

and even expand viewership, while English and Spanish-language

channels alike in the U.S. are suffering significant ratings

declines from so-called cord-cutting and the rising popularity of

streaming services.

Telemundo has grown modestly in recent years, from 1.1 million

average prime-time viewers in 2011 to 1.4 million this season,

according to Nielsen. Over the same span, main rival Univision fell

from 3.7 million average prime-time viewers to two million.

The gap between Telemundo and Univision among the coveted

demographic of 18-to-49 years old is now about 240,000, down from

more than one million three years ago. The recent changes have

given Telemundo a further bump -- lately it has been beating rival

Univision in weekday prime-time viewership, according to Nielsen

ratings provided by Telemundo.

At an investor conference this week, NBCUniversal Chief

Executive Steve Burke touted Telemundo's improved ratings position,

which he said eventually will translate into financial gains

through advertising and higher carriage fees from pay-TV providers.

"At some point, there is going to be a big monetization

opportunity," he said.

Univision is trying to move away from traditional telenovelas,

too, and has invested in digital media properties like Fusion and

Gawker Media to court younger audiences. But it is locked into a

long-term deal to buy programming from Mexico's Televisa SAB, which

churns out telenovelas, and that relationship has been rocky.

Univision parent Univision Communications Inc. in a statement

said it "continues to be the leading destination for U.S. Hispanics

by a significant margin" and said digital investments and gains at

its smaller networks have helped increase its "reach" to about 83

million average monthly unique consumers, up 24% year to year.

Univision has also said its relationship with Televisa is

strong.

Founded in 1987 with Puerto Rican roots, Telemundo for decades

sat as the second-rate Spanish language broadcaster in comparison

to Univision. It struggled financially until it faced bankruptcy in

1993, and was later acquired by NBCUniversal for $2.7 billion in

2002.

After venturing into original content in 2003, Telemundo spent

years trying unsuccessfully to outdo Univision's telenovelas.

Things began to change in 2011 when the network struck success with

the drug-themed drama "La Reina del Sur" (Queen of the South),

where the leading female character rises from poverty to wealth

running a powerful drug cartel. It was a contrast to the meek

female characters often portrayed in telenovelas, and attracted 2.4

million viewers for its premiere and 4.1 million in its finale.

"When you're not winning, you are also more willing to try more

to innovate," Perla Farías, senior vice president of scripted

programming development and writer at Telemundo. "When we moved

away from the traditional telenovela format, we saw growth."

Telemundo doesn't disclose financial results. Evercore ISI's

managing director of media research, David Joyce, said in an

interview that the network's "profitability has been accelerating"

as its adapted programming boosts the channel's ratings.

According to Evercore estimates, Telemundo and its local

stations are on track to generate $2.1 billion in revenue this year

with almost $260 million in operating income, more than double the

operating income the company booked in 2012.

Marla Skiko, executive vice president and director of digital

and data solutions for ad-buying agency group Publicis Media, said

Spanish-language channels rely on prime time to generate a larger

share of their ad dollars compared with English-language channels,

making Telemundo's gains especially important.

"Telemundo has been more in control of their destiny," Ms. Skiko

said, referring to programming decisions.

Write to Cassandra Jaramillo at cassandra.jaramillo@wsj.com

(END) Dow Jones Newswires

September 17, 2016 05:44 ET (09:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

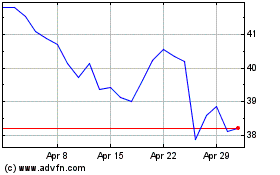

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024