AIG to Sell Lloyd's Insurance Operations to Canada Pension Fund

September 16 2016 - 9:48AM

Dow Jones News

By Anne Steele

American International Group Inc. agreed to sell insurance

operations connected with Lloyd's of London to Canada's biggest

pension fund, receiving about $240 million in cash.

The Canada Pension Plan Investment Board will acquire AIG's 20%

stake in specialty insurance underwriter Ascot Underwriting

Holdings Ltd., which manages a Lloyd's syndicate for which AIG

provides the capital, and a related reinsurance company based in

Bermuda. Ascot focuses on property insurance, marine insurance, and

reinsurance.

The Wall Street Journal had reported the groups were in talks in

August.

AIG valued the deal at $1.1 billion when factoring in CPPIB's

recapitalization of Syndicate 1414's Funds at Lloyd's capital

requirements. The syndicate provides insurance to cover marine

hulls and cargo, and fine art; and protects against shipping

liabilities, political risks, and terrorism, among other

specialties.

The deal is part of the New York insurer's efforts to improve

its results by narrowing its focus and returning more than $25

billion in capital to shareholders. It also marks the Canadian

fund's latest move to establish itself as a significant player in

the global insurance industry.

AIG will maintain a partnership with Ascot Underwriting Bermuda

Ltd., a wholly-owned subsidiary of Ascot. AIG, CPPIB, and Ascot

plan to "expand a collective commercial relationship in Bermuda,

and for AIG to be a preferred reinsurer to Syndicate 1414."

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

September 16, 2016 09:33 ET (13:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

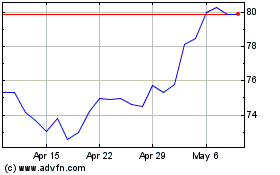

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

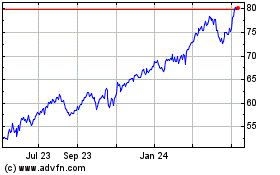

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024