FORM 6-K

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16

or 15d-16

of the Securities Exchange

Act of 1934

Date: September 15,

2016

Commission File Number 001-31528

IAMGOLD

Corporation

(Translation of registrant's name into English) |

| |

| 401 Bay Street Suite 3200, PO Box 153 |

| Toronto, Ontario, Canada M5H 2Y4 |

|

Tel: (416) 360-4710

(Address of principal executive offices) |

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

| |

Note: Regulation

S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders. |

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

| |

Note: Regulation

S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant

is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of

the home country exchange on which the registrant’s securities are traded, as long as the report or other document is

not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if

discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR. |

Indicate by check mark whether

by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If

"Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

Description of Exhibit

| Exhibit |

|

Description of Exhibit |

| |

|

|

| 99.1 |

|

News Release Dated September 15, 2016 - IAMGOLD Provides Further Diamond Drilling Results on the Boto Project Senegal |

Signatures

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

|

| |

IAMGOLD CORPORATION |

| |

|

|

| Date:

September 15, 2016 |

By: |

/s/ Tim Bradburn |

| |

Tim Bradburn |

| |

Vice President, Legal and Corporate Secretary |

Exhibit 99.1

IAMGOLD Provides Further Diamond Drilling Results on the Boto

Project Senegal

TSX:IMG NYSE:IAG

TORONTO, Sept. 15, 2016 /CNW/ - IAMGOLD Corporation

("IAMGOLD" or the "Company") today announced additional drilling results from its 100% owned Boto Gold Project

in eastern Senegal, West Africa. The Company is reporting assay results from twenty-three diamond drill holes at the Malikoundi

deposit totaling 2,217 metres, completed prior to the commencement of the rainy season, including five diamond drill holes that

were deepened to target footwall mineralization and provide additional geotechnical information.

The assay results are provided in Tables 1 and 2 and include

the following highlights:

| Malikoundi Deposit: |

| |

• Drill hole 2300: |

9 metres grading 4.76 g/t gold |

| |

• Drill Hole 2302: |

12 metres grading 6.39 g/t gold |

| |

|

Includes: 3 metres grading 20.77 g/t gold |

| |

• Drill hole 2303: |

22 metres grading 4.04 g/t gold |

| Malikoundi Deposit (Deepened Holes): |

| |

• Drill hole 2122: |

32 metres grading 5.19 g/t gold |

| |

• Drill Hole 2218: |

42 metres grading 3.60 g/t gold |

Craig MacDougall, Senior Vice President, Exploration for IAMGOLD,

stated, "The drilling program has successfully delineated near surface, shallow mineralization extending 500 metres

along strike, north of the Malikoundi deposit; and has confirmed the presence of wide intervals of high grade mineralization located

in the footwall to the main deposit which was not fully tested in previous drilling programs. Further drilling is planned

at the end of the rainy season to follow up these encouraging results."

BOTO PROJECT, SENEGAL

The Boto project comprises 236 square kilometres of exploration

licenses located in eastern Senegal along the Senegal-Mali border. The geological setting of the project area is similar

to the prolific Sadiola and Loulo gold districts in adjacent Mali, being underlain by highly prospective, Birimian-aged metasedimentary,

volcanic and intrusive rocks along a seven-kilometre strike length of the Senegal-Mali Shear Zone.

The project hosts an indicated resource of 27.7 million tonnes

averaging 1.8 g/t gold for 1.56 million ounces and an inferred resource of 2.9 million tonnes averaging 1.3 g/t gold for 125,000

ounces (see news release regarding reserves and resources dated February 17, 2016).

Next Steps

To date, the Company has completed 5,176 metres of diamond

drilling at the Malikoundi deposit to test for extensions of mineralization at depth and along strike beyond the current resource

model as well as the re-entry and deepening of selected drill holes which previously stopped in footwall mineralization.

The drilling program includes 765 metres completed to provide geotechnical information to help define potential pit wall slopes.

The assay results will be incorporated into an updated resource model for use in ongoing project evaluation studies. Diamond

drilling is expected to resume in the fourth quarter upon completion of the rainy season.

Technical Information and Quality Control Notes

Boto Project, Senegal:

The Boto drilling results contained in this news release have

been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects. The sampling of, and

assay data from, drill core is monitored through the implementation of a quality assurance - quality control (QA-QC) program designed

to follow industry best practice. Drill core (HQ and NQ size) samples are selected by the IAMGOLD geologists and sawn in half with

a diamond saw at the project site. Half of the core is retained at the site for reference purposes. Sample intervals are generally

one metre in length. Samples are prepared at the Veritas Preparation Laboratory in Bamako, Mali and analyzed using a standard fire

assay with a 50 gram charge with an Atomic Absorption (AA) finish at the Veritas Analytical Laboratory in Abidjan, Ivory Coast.

Qualified Persons

The information in this news release was prepared under the

supervision of, and reviewed and verified by, Craig MacDougall, P.Geo., Senior Vice President, Exploration for IAMGOLD. Mr. MacDougall

is a Qualified Person as defined by National Instrument 43-101.

Forward Looking Statement

This news release contains forward-looking statements.

All statements, other than of historical fact, that address activities, events or developments that the Company believes, expects

or anticipates will or may occur in the future (including, without limitation, statements regarding expected, estimated or planned

gold production, cash costs, margin expansion, capital expenditures and exploration expenditures and statements regarding the estimation

of mineral resources, exploration results, potential mineralization, potential mineral resources and mineral reserves) are forward-looking

statements. Forward-looking statements are generally identifiable by use of the words "will", "continue", "expect",

"estimate", "intend", "to have', "plan" or "project" or the negative of these

words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks

and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the

Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results

or events to differ materially from current expectations include, among other things, without limitation, failure to meet expected,

estimated or planned gold production, cash costs, margin expansion, capital expenditures and exploration expenditures and failure

to establish estimated mineral resources, the possibility that future exploration results will not be consistent with the Company's

expectations, changes in world gold markets and other risks disclosed in IAMGOLD's most recent Form 40-F/Annual Information Form

on file with the United States Securities and Exchange Commission and Canadian provincial securities regulatory authorities. Any

forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities

laws, the Company disclaims any intent or obligation to update any forward-looking statement.

About IAMGOLD

IAMGOLD (www.iamgold.com) is a mid-tier mining company with

four operating gold mines on three continents. A solid base of strategic assets in North and South America and West Africa is complemented

by development and exploration projects and continued assessment of accretive acquisition opportunities. IAMGOLD is in a strong

financial position with extensive management and operational expertise.

Please note:

This entire news release may be accessed via fax, e-mail,

IAMGOLD's website at www.iamgold.com and through CNW Group's website at www.newswire.ca. All material information on IAMGOLD can

be found at www.sedar.com or at www.sec.gov.

Si vous désirez obtenir la version française

de ce communiqué, veuillez consulter le http://www.iamgold.com/French/accueil/default.aspx.

| Table 1: Boto Project Drilling Results – Malikoundi Deposit |

| Hole No. |

UTM (WGS84Zone29N) |

AZ |

DIP |

EOH |

From |

To |

Length |

Grade |

| |

Easting |

Northing |

Elevation |

(degrees) |

(degrees) |

(m) |

(m) |

(m) |

(m) |

(g/t Au) |

| 2298 |

241959 |

1380551 |

158 |

113 |

-60 |

105 |

69 |

74 |

5 |

3.31 |

| 2299 |

241956 |

1380498 |

159 |

115 |

-60 |

110 |

80 |

82 |

2 |

1.88 |

| 2300 |

241999 |

1380478 |

160 |

115 |

-60 |

60 |

16 |

25 |

9 |

4.76 |

| 2301 |

241953 |

1380445 |

160 |

115 |

-60 |

115 |

65 |

73 |

8 |

1.93 |

| 2302 |

241998 |

1380424 |

161 |

115 |

-60 |

65 |

13 |

25 |

12 |

6.39 |

| includes |

|

|

|

|

|

|

17 |

20 |

3 |

20.77 |

| 2303 |

241951 |

1380390 |

161 |

115 |

-60 |

115 |

65 |

87 |

22 |

4.04 |

| includes |

|

|

|

|

|

|

83 |

85 |

2 |

21.50 |

| 2304 |

241996 |

1380370 |

161 |

115 |

-60 |

65 |

20 |

31 |

11 |

2.71 |

| 2305 |

241947 |

1380281 |

162 |

115 |

-60 |

115 |

22 |

26 |

4 |

1.15 |

| |

|

|

|

|

|

|

75 |

88 |

13 |

3.29 |

| 2306 |

241992 |

1380261 |

162 |

121 |

-60 |

65 |

19 |

27 |

8 |

2.12 |

| 2307 |

241945 |

1380227 |

162 |

115 |

-60 |

115 |

69 |

83 |

14 |

1.25 |

| 2308 |

241991 |

1380206 |

162 |

115 |

-60 |

67 |

27 |

31 |

4 |

1.89 |

| 2309 |

241943 |

1380175 |

162 |

120 |

-60 |

110 |

69 |

91 |

22 |

0.69 |

| 2310 |

241988 |

1380154 |

163 |

115 |

-60 |

60 |

12 |

20 |

8 |

1.74 |

| 2311 |

241941 |

1380123 |

163 |

115 |

-60 |

105 |

80 |

88 |

8 |

1.34 |

| 2312 |

241986 |

1380102 |

163 |

115 |

-60 |

55 |

25 |

36 |

11 |

4.03 |

| 2317 |

242076 |

1378829 |

158 |

103 |

-60 |

200 |

131 |

134 |

3 |

1.05 |

| 2318 |

242122 |

1378808 |

158 |

111 |

-60 |

200 |

64 |

72 |

8 |

1.12 |

| |

|

|

|

|

|

|

89 |

92 |

3 |

1.49 |

| 2319 |

242167 |

1378787 |

154 |

124 |

-60 |

180 |

15 |

33 |

18 |

0.69 |

| |

|

|

|

|

Total |

1907 |

|

|

|

|

Notes:

| 1. | Drill hole intercepts are calculated using a minimum

down-hole length of 2 metres, a cut-off grade of 0.5 g/t gold, a global assay cap of 25 g/t gold and may include up to 5 metres

of internal dilution. |

| 2. | The true widths of intersections are interpreted to

approximate the reported downhole lengths. |

| Table 2: Boto Project Drilling Results – Deepened Drill Holes (EXT), Malikoundi Deposit |

| Hole No. |

UTM (WGS84Zone29N) |

AZ |

DIP |

EOH |

From |

To |

Length |

Grade |

| |

Easting |

Northing |

Elevation |

(degrees) |

(degrees) |

(m) |

(m) |

(m) |

(m) |

(g/t Au) |

| 2117 Ext |

241865 |

1379093 |

165 |

115 |

-60 |

380 |

372 |

374 |

2 |

1.20 |

| 2122* |

241866 |

1379204 |

165 |

115 |

-60 |

275 |

259 |

272 |

13 |

7.94 |

| 2122 EXT |

241866 |

1379204 |

165 |

115 |

-60 |

325 |

259 |

291 |

32 |

5.19 |

| includes |

|

|

|

|

|

|

289 |

291 |

2 |

10.65 |

| 2125* |

241815 |

1379338 |

166 |

115 |

-60 |

300 |

274 |

299 |

25 |

1.64 |

| 2125 Ext |

241815 |

1379338 |

166 |

115 |

-60 |

335 |

274 |

324 |

50 |

1.57 |

| 2218* |

241774 |

1379187 |

166 |

116 |

-60 |

365 |

335 |

365 |

30 |

3.82 |

| 2218 Ext |

241774 |

1379187 |

166 |

116 |

-60 |

431 |

335 |

377 |

42 |

3.60 |

| |

|

|

|

|

|

|

413 |

431 |

18 |

2.44 |

| 2220* |

241867 |

1379149 |

165 |

116 |

-60 |

350 |

294 |

300 |

6 |

4.18 |

| 2220 Ext |

241867 |

1379149 |

165 |

116 |

-60 |

350 |

294 |

321 |

27 |

2.03 |

| |

|

|

|

|

Total Ext |

310 |

|

|

|

|

Notes:

| 1. | Drill hole intercepts are calculated using a minimum

down-hole length of 2 metres, a cut-off grade of 0.5 g/t gold, a global assay cap of 25 g/t gold and may include up to 5 metres

of internal dilution. |

| 2. | The true widths of intersections are interpreted to

approximate the reported downhole lengths. |

| 3. | * - previously reported footwall intercept (see news

releases dated November 5, 2012; May 21, 2013 and February 3, 2015) |

SOURCE IAMGOLD Corporation

PDF available at: http://stream1.newswire.ca/media/2016/09/15/20160915_C3746_PDF_EN_774762.pdf

%CIK: 0001203464

For further information: Bob Tait, VP Investor Relations,

IAMGOLD Corporation, Tel: (416) 360-4743, Mobile: (647) 403-5520; Laura Young, Director, Investor Relations, IAMGOLD Corporation,

Tel: (416) 933-4952, Mobile: (416) 670-3815; Shae Frosst, Investor Relations Associate, IAMGOLD Corporation, Tel: (416) 933-4738,

Mobile: (647) 967-9942, Toll-free: 1-888-464-9999, info@iamgold.com

CO: IAMGOLD Corporation

CNW 17:31e 15-SEP-16

This regulatory filing also includes additional resources:

ex991.pdf

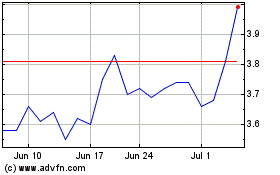

Iamgold (NYSE:IAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iamgold (NYSE:IAG)

Historical Stock Chart

From Apr 2023 to Apr 2024