Today's Top Supply Chain and Logistics News From WSJ

September 14 2016 - 7:12AM

Dow Jones News

By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

The beginning of the end may be underway at Hanjin Shipping Co.

The fire sale of the shipping line's fleet has started with the

sale of three bulk carriers, the WSJ's Costas Paris reports, as the

South Korean government is signaling strongly that it won't bail

out the troubled company. Hanjin had been chartering the three

ships, one a cape-size dry bulk vessel and the others smaller

commodities carriers, and the operator's recent bankruptcy left the

ship owners with a troubling prospect that now confronts other

charter companies. An analyst says the companies can either try to

place the vessels on the spot market at lower rates or dump them at

a discount. With more than two-thirds of Hanjin's fleet chartered,

ship owners including Danaos Corp., Navios Maritime Partners LP

will face similar questions. South Korea's president, Park

Geun-hye, dismissed suggestions that the government may offer

Hanjin a financial lifeline, saying that's just "lazy thinking."

That means Hanjin will have to raise money from its existing

investors or by selling the ships that it owns to get through the

coming weeks.

The global shipping industry rout is taking a heavy toll on

German investors. The country's banks and individuals are such big

backers of shipping that they now own about 29% of the world's

container ship capacity, more than the investors of any other

country. The weakness in the industry, highlighted by the ongoing

collapse of Hanjin Shipping, has left many of those investments

underwater, the WSJ's Friederich Geiger reports. The research firm

Deutsche Fondsresearch estimates that almost one-fifth of the 2,200

ships owned by the funds are insolvent, and the group says no fresh

money from bankers or investors is in sight. One fund established

in 2007 with a forecast that it could double the value of

investments within 20 years has instead plummeted 95%, with no

payouts to participants. The impact may be felt across the shipping

industry as some funds collapse and some seek emergency sales of

vessels to raise cash, actions that will undermine the values of

fleets and some more ships to scrapyards.

The fate of national rules requiring electronic logging devices

on trucks may rest with a federal appeals court. The largest

independent truckers group in the U.S. is asking an appellate panel

to throw out the Department of Transportation requirement, due to

take effect at the end of next year, that drivers install devices

that log their hours behind the wheel. Lawyers for the Owner

Operator Independent Drivers Association told judges in Chicago

that the devices known as e-logs would violate the privacy of

millions of drivers, the WSJ's Kelsey Gee reports, and make

highways less safe by giving employers data to push drivers to stay

on the road longer. Trucking customers are watching the outcome

closely because of widespread belief that shining a light on

driving hours will cut shipping capacity by sidelining drivers who

reach their work limits.

SUPPLY CHAIN STRATEGIES

The world's largest furniture retailer is thinking outside the

big box. IKEA says it has opened more click-and-collect locations

this year than traditional stores, a big shift in the company's

strategy and a stark sign of the impact e-commerce is having on the

retail business. Chief Executive Peter Agnefjäll tells the WSJ's

Saabira Chaudhuri that IKEA is undertaking a "total conversion"

from a brick-and-mortar retailer to a multichannel seller "with the

stores at the heart." The shift is especially significant because

IKEA pioneered the concept of big-box retailing, combining

sprawling stores that act as showrooms and warehouses --

distribution centers, effectively, where customers provide the

last-mile delivery and final assembly. But as e-commerce has become

a bigger growth driver, IKEA has rolled out smaller, centrally

located click-and-collect points that allow customers to collect

online orders and carry a limited range of products for immediate

purchase. The company is still adjusting the model: Mr. Agnefjäll

says IKEA is using its 22 click-and-collect locations to test which

products the company should stock and which should be pushed its

budding delivery network.

QUOTABLE

IN OTHER NEWS

Incomes in the U.S. surged 5.2% in 2015, the first increase for

family households in eight years. (WSJ)

The Obama administration filed a World Trade Organization

complaint alleging that China is illegally subsidizing its domestic

wheat, rice and corn growers. (WSJ)

Samsung Electronics Co. is racing to contain damage from a

recall of its Galaxy Note 7 phone that has hit confidence in the

world's biggest smartphone maker. (WSJ)

Arch Coal Inc. won bankruptcy-court approval for a plan to cull

nearly $5 billion in debt from its books and emerge from chapter 11

protection. (WSJ)

Target Corp. plans to hire 7,500 distribution center workers

during the holidays this year, up from 6,500 last year. (Internet

Retailer)

Business groups are urging Congress to restore full financing

authority to the Export-Import Bank. (The Hill)

An alliance of three Asian container shipping lines will start

trans-Pacific service to the ports of Long Beach and Oakland.

(Logistics Management)

Russia plans to halt exports of oil products from foreign ports

on the Baltic Sea by 2018. (Reuters)

The four largest ports in the north of England agreed to a

partnership aimed at consolidating investment and drawing shipping

trade. (city a.m.)

Drone maker IFM is running pilot programs with several companies

to test the use of drones in warehouses for inventory management.

(TechCrunch)

Freight brokers want U.S. regulators to crack down on cargo

terminal operators they say are charging them unfairly for failing

to pick up shipments. (American Shipper)

Cargolux and CAL Cargo Airlines are adding weekly freighter

flights to Puerto Rico this fall. (Air Cargo News)

General Electric plans to shut its turbine manufacturing

operations in East Houston amid falling energy industry demand.

(Fuel Fix)

Boeing Co. lifted its forecast for aircraft demand in China in

the next two decades, saying a rising middle class would spur

travel. (Industry Week)

General Motors Corp. says its auto sales in China jumped 8.1% in

the first eight months of the year as U.S. sales dropped 4.2%.

(Agence France-Presse)

South Carolina Ports Authority Chief Executive Jim Newsome

expects the largest 20 container shipping lines will consolidate

down to 12 in two years. (Charleston Post and Courier)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @lorettachao, @RWhelanWSJ and @EEPhillips_WSJ, and

follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

September 14, 2016 06:57 ET (10:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

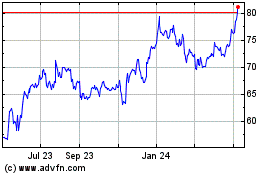

Danaos (NYSE:DAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

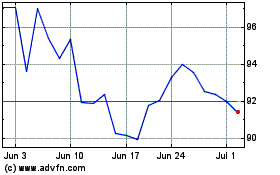

Danaos (NYSE:DAC)

Historical Stock Chart

From Apr 2023 to Apr 2024