|

PROSPECTUS

|

Filed

Pursuant to Rule 424(b)(3)

|

|

|

Registration

No.: 333-213503

|

12,941,028

SHARES

NEONODE

INC.

Common

Stock

This

prospectus covers the sale, transfer or other disposition of up to 12,941,028 shares of our common stock, including 7,913,676

shares issuable upon exercise of warrants, by certain selling stockholders, which as used herein includes donees, pledgees, transferees

and other successors-in-interest selling shares of common stock or interests in shares of common stock received after the date

of this prospectus from a Selling Stockholder as a gift, pledge, partnership, distribution or other transfers, or the Selling

Stockholders. The Selling Stockholders may, from time to time, sell, transfer, or otherwise dispose of any or all of their shares

of common stock or interests in shares of common stock on any stock exchange, market, or trading facility on which the shares

are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale,

at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

Neonode

is not offering any shares of common stock for sale under this prospectus. We will not receive any of the proceeds from the sale

or other disposition of the shares of common stock by the Selling Stockholders, other than any proceeds from the cash exercise

of the warrants to purchase shares of common stock.

Our common stock is quoted on the NASDAQ Capital

Market under the symbol “NEON.” On September 12, 2016, the last reported sales price of our common stock, as

reported on the NASDAQ Capital Market, was $1.24 per share.

Investing

in our common stock involves certain risks. See the “Risk Factors” section herein and in our Annual Report on Form

10-K for the year ended December 31, 2015 as well as our subsequently filed periodic and current reports, which we file with

the Securities and Exchange Commission and are incorporated by reference into this prospectus. You should read the entire prospectus

carefully before you make your investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is September 13, 2016

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”)

using a “shelf” registration or continuous offering process.

You

should read this prospectus and the information and documents incorporated by reference carefully. Such documents contain important

information you should consider when making your investment decision. See “Where You Can Find More Information” and

“Incorporation of Certain Documents by Reference” in this prospectus.

You

should rely only on the information provided in this prospectus or documents incorporated by reference into this prospectus. We

have not, and each of the Selling Stockholders has not, authorized anyone to provide you with different information. This prospectus

covers offers and sales of common stock only in jurisdictions in which such offers and sales are permitted. The information contained

in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or

of any sale of our common stock. You should not assume that the information contained in this prospectus is accurate as of any

date other than the date on the front cover of this prospectus, or that the information contained in any document incorporated

by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time

of delivery of this prospectus or any sale of a security.

In

this prospectus, we refer to Neonode Inc. as “we,” “us,” “our,” the “Company”

or “Neonode.” References to “Selling Stockholders” refers to the stockholders listed herein under “Selling

Stockholders” and their donees, pledgees, transferees, or other successors-in-interest.

Neonode,

the Neonode logo, AirBar, MultiSensing, and zForce are trademarks of Neonode Inc. registered in the United States and other countries.

CAUTIONARY

STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

Information

in and incorporated by reference into this prospectus contains “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995 and the safe harbor provided by Section 27A of the Securities Act of

1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”). Statements that are not purely historical may be forward-looking. You can identify

some forward-looking statements by the use of words such as “believes,” “anticipates,” “expects,”

“intends” and similar expressions. Forward looking statements involve inherent risks and uncertainties

regarding events, conditions and financial trends that may affect our future plans of operation, business strategy, results of

operations, and financial position.

A

number of important factors could cause actual results to differ materially from those included within or contemplated by such

forward-looking statements, including, but not limited to risks relating to the uncertainty of growth in market acceptance for

our technology, our history of losses since inception, our ability to remain competitive in response to new technologies, the

costs to defend, as well as risks of losing, patents and intellectual property rights, a reliance on our future customers’

ability to develop and sell products that incorporate our technology, our customer concentration and dependence on a limited number

of customers, the uncertainty of demand for our technology in certain markets, the length of a product development and release

cycle, our ability to manage growth effectively, our dependence on key members of our management and development team, our limited

experience manufacturing hardware devices and our need and ability to obtain adequate capital to fund future operations. For a

discussion of these and other factors that could cause actual results to differ from those contemplated in the forward-looking

statements, please see the discussion under “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal

year ended December 31, 2015 and in our subsequent filings with the SEC.

Forward-looking

statements speak only as of the date made. Because actual results or outcomes could differ materially from those expressed in

any forward-looking statements made by us or on our behalf, you should not place undue reliance on any such forward-looking statements.

We do not undertake any responsibility to update or revise any of these factors or to announce publicly any revisions to forward-looking

statements, whether as a result of new information, future events or otherwise.

PROSPECTUS

SUMMARY

The

following is only a summary and therefore does not contain all of the information you should consider before investing in our

common stock. We urge you to read this entire prospectus, including the matters discussed under “Risk Factors” in

this prospectus and the more detailed consolidated financial statements, notes to the consolidated financial statements and other

information incorporated by reference from our other filings with the SEC.

Our

Company

We develop and license user interface and touch

technology. We also are developing, and intend to manufacture and sell, hardware sensor solutions as modules incorporating our

technology.

We

offer a patented family of optical touch solutions under the zForce and Multi-Sensing brands. Our optical touch technology is

capable of projecting a full plane of light beams in free air or over any flat touch surface. Our technology can also send light

into a fluid or a glass to achieve a flush design without a bezel. An object touching the touch surface obstructs a portion of

the projected light beams. This small variance of signal is detected with sensitive light sensors connected to touch controllers

that process the analog signals and produce touch object coordinates.

Licensing

Solutions

As

of June 30, 2016, we had forty-one technology license agreements with global Original Equipment Manufacturers (“OEMs”)

and Original Design Manufacturers (“ODMs”). During the six months ended June 30, 2016, we had fifteen customers using

our touch technology in products that were being shipped to customers. In addition, we are currently developing prototype products

and are engaged in product engineering design discussions with numerous global OEMs and ODMs who are in the process of qualifying

our touch technology for incorporation in various products. The development and release cycle for these products typically takes

six to thirty-six months.

We

also offer engineering consulting services to our OEM and ODM customers on a flat rate or hourly rate basis.

Hardware

Solutions

In

December 2015, we announced AirBar, our first product based on our embedded sensor module. Through a simple USB connection, the

AirBar hardware module can touch enable non-touch PCs. The AirBar “Plug-and-Touch” solution is based on our zForce

AIR sensing platform. We began manufacturing and selling AirBar for PCs in the third quarter of 2016 at our fully automated manufacturing

facility located in Gothenburg, Sweden. We currently have signed agreements with Ingram Micro for Europe, North America and Asia

to act as our direct customer and distribution channel.

In

2015, we entered into a joint development and cooperation agreement, with Autoliv Development AB (“Autoliv”) to develop

a new Human Machine Interface sensing product for vehicle steering wheel applications. We have licensed our zForce DRIVE technology

to Autoliv as part of the agreement.

Corporate

Information

Neonode Inc., formerly known as SBE, Inc., was

incorporated in the State of Delaware on September 4, 1997. SBE, Inc.’s name was changed to Neonode Inc. upon the completion

of a merger in August 2007 between SBE, Inc. and the parent company of Neonode AB, a company founded in February 2004 and incorporated

in Sweden. As a result of the merger, the business and operations of Neonode AB became the primary business and operations of

Neonode Inc. Our headquarters is located at Storgatan 23C, 114 55 Stockholm, Sweden and our phone number is +46 (0) 8 667 17 17.

We also maintain an office in the United States at 2880 Zanker Rd #362, San Jose, CA 95134 and the phone number there is (408)

496-6722. Our website address is www.neonode.com. Information on our website is not incorporated by reference into this prospectus

and does not constitute part of this prospectus.

Private

Placement

On

August 11, 2016, we entered into a purchase agreement (the “Securities Purchase Agreement”) with institutional and

accredited investors as part of a private placement pursuant to which we agreed to issue a total of 8,627,352 shares of Neonode

common stock, including certain Pre-Funded Warrants as described below, and warrants for an aggregate purchase price of $8.7 million

in gross proceeds. Closing of the private placement pursuant to the Securities Purchase Agreement occurred on August 17, 2016.

The

total number of shares includes (i) an aggregate of 427,352 shares to Thomas Eriksson, Chief Executive Officer of Neonode, and

Remo Behdasht, SVP AirBar Devices at Neonode (the “Employee Investor Shares”), (ii) an aggregate of 4,600,000 shares

to outside investors (the “Outside Investor Shares” and, together with the Employee Investor Shares, the “Initial

Shares”) for gross proceeds of $4,600,000, and (iii) up to 3,600,000 shares (the “Pre-Funded Warrant Shares”)

issuable upon exercise of warrants (the “Pre-Funded Warrants” and, together with the Initial Shares, the “Investor

Shares”). The Pre-Funded Warrants were issued to certain outside investors whose purchase of shares of Neonode common stock

would make them the beneficial owners of more than 9.99% of the outstanding common stock of Neonode. Each of the Pre-Funded Warrants

was pre-funded upon closing of the private placement at $0.99 per Pre-Funded Warrant Share and has an exercise price of $0.01

per Pre-Funded Warrant Share. The Pre-Funded Warrants were immediately exercisable upon closing of the private placement and will

not expire prior to exercise.

In

addition, under the terms of the Securities Purchase Agreement, we issued warrants (the “Purchase Warrants”) to all

investors in the private placement to purchase up to a total of 4,313,676 shares of Neonode common stock (the “Purchase

Warrant Shares”) at an exercise price of $1.12 per share. The total number of Purchase Warrant Shares represents a ratio

of 50% warrant coverage to the Investor Shares such that investors will be entitled to receive one Purchase Warrant Share upon

cash exercise for every two Initial Shares or Pre-Funded Warrants purchased. The Purchase Warrants will expire February 17, 2022,

which is five and one-half years from the date of closing of the private placement, and are non-exercisable for the first six

months or until February 17, 2017. The terms of the Purchase Warrants require that exercise may only be for cash and not on a

cashless basis unless, after a period of six months from closing of the private placement, the Purchase Warrant Shares are not

subject to a registration statement or there has been a failure to maintain the effective registration of the Purchase Warrant

Shares by Neonode as described below.

The

exercise price of the Pre-Funded Warrants and the Purchase Warrants is subject to adjustment for stock splits, stock dividends,

recapitalizations, and similar transactions or a “Fundamental Transaction” as provided for in the terms of the Pre-Funded

Warrants and the Purchase Warrants. The holders may exercise the Pre-Funded Warrants or the Purchase Warrants in whole or in part.

In

connection with the Securities Purchase Agreement, we also entered into a Registration Rights Agreement (the

“Registration Rights Agreement”) pursuant to which we have filed with the SEC the registration statement of which

this prospectus forms a part, relating to the offer and sale or other disposition by the holders of the Initial Shares, the

Pre-Funded Warrant Shares, and the Purchase Warrant Shares. Pursuant to the Registration Rights Agreement, we are obligated

to file the registration statement by September 10, 2016 and to use best efforts to cause the registration statement to be

declared effective by November 9, 2016, which is 90 days from the date of the Securities Purchase Agreement. Failure to meet

those and related obligations, or failure to maintain the effective registration of the Initial Shares, the Pre-Funded

Warrant Shares, and Purchase Warrant Shares will subject Neonode to payment for liquidated damages.

Copies

of the Securities Purchase Agreement, the Registration Rights Agreement, the form of Purchase Warrant, and the form of Pre-Funded

Warrant are incorporated by reference as exhibits to the registration statement of which this prospectus forms a part. The foregoing

summaries of each of the transaction documents, including the warrants, are qualified in their entirety by reference to such documents.

The

Offering

|

Common

stock outstanding:

|

|

48,844,503 shares

(1)

|

|

|

|

|

Common

stock that may be sold or otherwise disposed of by the Selling Stockholders:

|

|

12,941,028

shares

(2)

|

|

|

|

|

NASDAQ

Capital Market symbol for common stock:

|

|

NEON

|

|

|

|

|

Use

of proceeds:

|

|

We

will not receive any of the proceeds from the sale or other disposition of the shares covered by this prospectus. We will

receive proceeds from the cash exercise of the warrants held by the Selling Stockholders, and we intend to use any such proceeds

for working capital and general corporate purposes.

|

|

|

|

|

Risk

factors:

|

|

See

“Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2015 as well as our subsequently

filed periodic and current reports, for a discussion of factors to consider before investing in shares of our common stock.

|

|

(1)

|

The

number of shares shown to be outstanding is based on the number of shares of our common stock outstanding as of August 31,

2016, and does not include shares issuable upon exercise of warrants (including the shares of common stock being registered

hereunder underlying the warrants held by the Selling Stockholders), conversion of outstanding preferred stock, or reserved

for issuance upon the exercise of options granted or available under our equity compensation plans.

|

|

(2)

|

The

number of shares being registered hereunder includes 5,027,352 shares of our common stock outstanding, 4,313,676 shares issuable

upon exercise of the Purchase Warrants, and 3,600,000 shares issuable upon exercise of the Pre-Funded Warrants.

|

RISK

FACTORS

An

investment in our common stock involves risks. Prior to making a decision about investing in our common stock, you should consider

carefully the risks together with all of the other information contained or incorporated by reference in this prospectus, including

any risks described in the section entitled “Risk Factors” contained in any supplements to this prospectus and in

our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and in our subsequent filings with the SEC.

USE

OF PROCEEDS

We

will not receive any of the proceeds from any sale or other disposition of the shares of common stock covered by this prospectus.

We will receive proceeds upon the cash exercise of the warrants for which underlying shares of common stock are being registered

hereunder. Assuming full cash exercise of the Purchase Warrants at the exercise price of $1.12 per underlying share of common

stock, we will receive proceeds of $4,831,317.12. Assuming full exercise of the Pre-Funded Warrants, for which $3,564,000 already

has been received by us, at the remaining exercise price of $0.01 per underlying share of common stock, we will receive additional

proceeds of $36,000. We currently intend to use the cash proceeds from any warrant exercise for working capital and general corporate

purposes. We may also use a portion of the cash proceeds to acquire or invest in complementary businesses, technologies, product

candidates, or other intellectual property, although we have no present commitments or agreements to do so. The amount and timing

of our actual use of proceeds may vary significantly depending upon numerous factors, including the actual amount of proceeds

we receive and the timing of when we receive such proceeds. In addition, the terms of the Purchase Warrants provide that it may

be exercised on a cashless basis at any time and the terms of if, after February 7, 2017, the shares of common stock underlying

the Purchase Warrants are not subject to a registration statement or there has been a failure to maintain the effective registration

of such shares. The terms of the Pre-Funded Warrants provide that it may be exercised on a cashless basis at any time. We will

not receive any cash proceeds as a result of warrant that are exercised on a cashless basis pursuant to such terms of the warrant.

PLAN

OF DISTRIBUTION

The Selling Stockholders, which as used herein

includes donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares of

common stock received after the date of this prospectus from a Selling Stockholder as a gift, pledge, partnership distribution

or other transfer, may from time to time sell, transfer or otherwise dispose of any or all of their shares of common stock or

interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private

transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to

the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. The Selling Stockholders

may use any one or more of the following methods when selling securities:

|

|

●

|

ordinary brokerage transactions and transactions in

which the broker-dealer solicits purchasers;

|

|

|

|

|

|

|

●

|

block

trades in which the broker-dealer will attempt to sell the securities as agent but may

position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

|

|

|

|

●

|

purchases by a broker-dealer as principal and resale

by the broker-dealer for its account;

|

|

|

|

|

|

|

●

|

an exchange distribution in accordance with the rules

of the applicable exchange;

|

|

|

|

|

|

|

●

|

privately negotiated transactions;

|

|

|

|

|

|

|

●

|

settlement of short sales;

|

|

|

|

|

|

|

●

|

in

transactions through broker-dealers that agree with the Selling Stockholders to sell

a specified number of such securities at a stipulated price per security;

|

|

|

|

|

|

|

●

|

through

the writing or settlement of options or other hedging transactions, whether through an

options exchange or otherwise;

|

|

|

|

|

|

|

●

|

a combination of any such methods of sale; or

|

|

|

|

|

|

|

●

|

any other method permitted pursuant to applicable law.

|

The

Selling Stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities, if

available, rather than under this prospectus.

Broker-dealers

engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive

commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities,

from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an

agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a

principal transaction a markup or markdown in compliance with FINRA IM-2440.

In

connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions

with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of

hedging the positions they assume. The Selling Stockholders may also sell securities short and deliver these securities to close

out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling

Stockholders may also enter into options or other transactions with broker-dealers or other financial institutions or create one

or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities covered

by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus

(as supplemented or amended to reflect such transaction).

The

Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. The Selling Stockholders have informed us that they do not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the securities. We agreed to indemnify

the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We

agreed to keep this prospectus effective until the earlier of (i) the date that such securities become eligible for resale without

volume or manner-of-sale restrictions and without current public information pursuant to Rule 144 and certain other conditions

have been satisfied, or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities

Act or any other rule of similar effect.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not

simultaneously engage in market making activities with respect to our common stock for the applicable restricted period, as defined

in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable

provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of

purchases and sales of common stock by the Selling Stockholders or any other person.

SELLING

STOCKHOLDERS

The shares of common stock covered by this prospectus

are those previously issued in the private placement described above and those issuable upon exercise of the Purchase Warrants

and the Pre-Funded Warrants. For additional information regarding the issuances of those securities, see “Private Placement”

above.

The

table below lists the Selling Stockholders and other information regarding the beneficial ownership of the shares of our common

stock by each of the Selling Stockholders. The second column lists the number of shares of our common stock beneficially owned

by each of the Selling Stockholders, based on ownership of shares of common stock, the Purchase Warrants and the Pre-Funded Warrants,

as of August 31, 2016, assuming exercise of the Purchase Warrants and the Pre-Funded Warrants held by the Selling Stockholders

on that date, without regard to any limitations on exercises. The third column lists the shares of common stock covered by this

prospectus. The fourth column assumes the sale of all of the shares covered by this prospectus.

Under

the terms of the Purchase Warrants and the Pre-Funded Warrants, a Selling Stockholder may not exercise the Purchase Warrants or

the Pre-Funded Warrants to the extent such exercise would cause such Selling Stockholder, together with its affiliates and attribution

parties, to beneficially own a number of shares of common stock which would exceed a specified maximum amount. The number of shares

in the second column does not reflect this limitation. The Selling Stockholders may sell all, some or none of their shares in

this offering. See “Plan of Distribution.”

Mr.

Eriksson is the President and Chief Executive Officer, and a member of the Board of Directors, of Neonode. Mr. Behdasht is the

SVP AirBar Devices at Neonode. Other than Mr. Eriksson and Mr. Behdasht, none of the Selling Stockholders has had a material relationship

with us within the last three years.

To our knowledge, none of the Selling Stockholders

is a broker-dealer. Other than CVI Investments, Inc. and Messrs. Baker, Harris, Hartfiel, and Lipman, none of the Selling Stockholders

is an affiliate of a broker-dealer. Each of CVI Investments, Inc. and Messrs. Baker, Harris, Hartfiel, and Lipman have certified

to us that it or he bought the shares of common stock being registered for its or his own account and at the time of purchase,

it or he had no agreements or understandings, directly or indirectly, with any person to distribute the shares being registered.

|

|

|

Number of Shares of Common Stock Owned Prior to

|

|

|

Maximum Number of Shares of Common Stock to be Sold Pursuant to this

|

|

|

Number of Shares of

Common Stock Owned

After Offering

(1)

|

|

|

Name of Selling Stockholder

|

|

Offering

|

|

|

Prospectus

|

|

|

Numbers

|

|

|

Percentage

|

|

|

Special Situations Technology Fund II L.P.

(2)

|

|

|

8,613,482

|

|

|

|

5,160,000

|

|

|

|

3,453,482

|

|

|

|

6.08

|

%

|

|

Special Situations Technology Fund L.P.

(2)

|

|

|

1,397,057

|

|

|

|

840,000

|

|

|

|

557,057

|

|

|

|

*

|

|

|

ABE Brazil Investment Company Limited

|

|

|

1,125,000

|

|

|

|

1,125,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Dolphin Offshore Partners, L.P.

|

|

|

900,000

|

|

|

|

900,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Ronald L. Chez

|

|

|

1,500,346

|

|

|

|

750,000

|

|

|

|

750,346

|

|

|

|

1.32

|

%

|

|

CVI Investments, Inc.

|

|

|

712,500

|

|

|

|

712,500

|

|

|

|

0

|

|

|

|

*

|

|

|

Gregory Weaver

|

|

|

565,000

|

|

|

|

525,000

|

|

|

|

40,000

|

|

|

|

*

|

|

|

Pennington Capital Management

|

|

|

375,000

|

|

|

|

375,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Thomas Eriksson

(3)

|

|

|

2,506,900

|

|

|

|

320,514

|

|

|

|

2,186,386

|

|

|

|

3.85

|

%

|

|

Remo Behdasht

(4)

|

|

|

555,514

|

|

|

|

320,514

|

|

|

|

235,000

|

|

|

|

*

|

|

|

Iroquois Master Fund Ltd.

|

|

|

625,250

|

|

|

|

375,000

|

|

|

|

250,250

|

|

|

|

*

|

|

|

Iroquois Capital Investment Group LLC

|

|

|

300,000

|

|

|

|

300,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Blue Clay Capital Master Fund Ltd

(5)

|

|

|

300,000

|

|

|

|

300,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Verbier Investments

|

|

|

150,000

|

|

|

|

150,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Verbier SP Partnership, L.P.

|

|

|

150,000

|

|

|

|

150,000

|

|

|

|

0

|

|

|

|

*

|

|

|

MAZ Partners LP

|

|

|

150,000

|

|

|

|

150,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Bradley Baker

|

|

|

150,000

|

|

|

|

150,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Kevin Harris

|

|

|

150,000

|

|

|

|

150,000

|

|

|

|

0

|

|

|

|

*

|

|

|

William F. Hartfiel III

|

|

|

75,000

|

|

|

|

75,000

|

|

|

|

0

|

|

|

|

*

|

|

|

John C. Lipman

|

|

|

75,000

|

|

|

|

75,000

|

|

|

|

0

|

|

|

|

*

|

|

|

Black Brook Capital Management LLC

|

|

|

37,500

|

|

|

|

37,500

|

|

|

|

0

|

|

|

|

*

|

|

|

(1)

|

Assumes 56,758,179 shares of our common stock are outstanding after the offering, which reflects 48,844,503 shares presently outstanding and 7,913,676 shares issuable upon exercise of the Purchase Warrants and the Pre-Funded Warrants.

|

|

|

|

|

(2)

|

AWM Investment Company, Inc. (“AWM”) is the investment adviser to Special Situations Technology Fund II, L.P. and Special Situations Technology Fund, L.P. Austin W. Marxe, David M. Greenhouse and Adam C. Stettner are the principal owners of AWM. Through their control of AWM, Messrs. Marxe, Greenhouse and Stettner share voting and investment control over the portfolio securities of both funds listed above.

|

|

|

|

|

(3)

|

Includes 2,227,900 shares of common stock (including the 320,514 shares covered by this prospectus) held indirectly through Wirelesstoys Sweden AB, an entity beneficially owned by Mr. Eriksson, and also includes 279,000 shares underlying outstanding stock options held directly by Mr. Eriksson.

|

|

|

|

|

(4)

|

Includes 164,000 shares underlying outstanding stock options held directly by Mr. Behdasht.

|

|

|

|

|

(5)

|

The

securities are held directly by Blue Clay Capital Master Fund Ltd (the “Fund”) for the benefit of the Fund’s

investors. Such securities may be deemed to be beneficially owned by Blue Clay Capital Management, LLC, as the investment

manager of the Fund and Gary Kohler as principal and Chief Investment Officer of the investment manager who exercises voting

and investment power with regard to the securities held by the Fund. Blue Clay Capital Management, LLC and Mr. Kohler each

disclaim beneficial ownership of the shares owned by Blue Clay Capital Master Fund Ltd except to the extent of any pecuniary

interest therein.

|

EXPERTS

The consolidated financial statements incorporated

in this prospectus by reference from our Annual Report on Form 10-K for the year ended December 31, 2015, and the effectiveness

of our internal control over financial reporting, have been audited by KMJ Corbin & Company LLP, an independent registered

public accounting firm as stated in their reports, which are incorporated herein by reference, and have been so incorporated in

reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

LEGAL

MATTERS

The

validity of the shares of our common stock covered hereby will be passed upon for us by Reed Smith LLP, San Francisco, California.

WHERE

YOU CAN FIND MORE INFORMATION

This

prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain

all the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts,

agreements, or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the

registration statement or the exhibits to the reports or other documents incorporated by reference in this prospectus supplement

and the accompanying prospectus for a copy of such contract, agreement, or other document. Because we are subject to

the information and reporting requirements of the Exchange Act, we file annual, quarterly, and current reports, proxy statements,

and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s

website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference

Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on

the operation of the Public Reference Room. Our website address is www.neonode.com. Information contained in, or accessible

through, our website is not a part of this prospectus.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that

we can disclose important information to you by referring you to those documents. The information incorporated by reference

is considered to be part of this prospectus. Information contained in any supplement to this prospectus and information that we

file with the SEC in the future and incorporate by reference in this prospectus will automatically update and supersede the information

contained in this prospectus. We incorporate by reference the documents listed below and any future filings (other than current

reports on Form 8-K furnished under Item 2.02 or Item 7.01 and exhibits filed on such form that are related to such items) we

make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the initial filing date of the registration

statement of which this prospectus forms a part and prior to the termination of this offering covered by this prospectus:

|

|

●

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 filed on March 11, 2016;

|

|

|

|

|

|

|

●

|

Our Quarterly Reports on Form 10-Q for the fiscal periods ended March 31, 2016 and June 30, 2016 filed on May 10, 2016 and August 9, 2016 respectively;

|

|

|

|

|

|

|

●

|

Our Current Reports on Form 8-K filed on June 8, 2016 and August 16, 2016; and

|

|

|

|

|

|

|

●

|

The description of our common stock included in our registration statement on Form 8-A filed on April 26, 2012.

|

We

will provide without charge upon written or oral request, to each person, including any beneficial owner, to whom a prospectus

is delivered, a copy of any or all of the documents incorporated by reference, including exhibits to these documents. You should

direct any requests for documents to:

Neonode Inc.

Storgatan 23C, 114 55

Stockholm, Sweden

+46 (0) 8 667 17 17

info@neonode.com

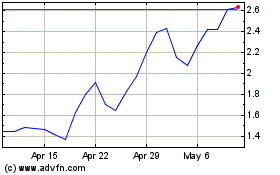

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Apr 2023 to Apr 2024