SÃ O PAULO—Legal woes dogging the head of Brazil's JBS SA could

delay plans by the world's largest meatpacker to list its shares on

the New York Stock Exchange, many analysts and investors say, a

potential blow for the company at a time when investors are

increasingly skittish about any bad news out of Brazil.

JBS Chief Executive Wesley Batista has been absent from the firm

since last week, barred by a court order from managing any business

while police investigate suspected corruption at a paper pulp

company owned by the Batista family's investment company J&F

Investimentos SA. The order also applies to Mr. Batista's brother,

Joesley Batista, who is chairman of JBS. The two brothers are

suspended from managing their companies until the end of the

investigation, unless the current order is overturned by the

court.

JBS has said little about Mr. Batista's whereabouts or potential

plans for replacing him. That is raising fears among investors and

analysts that his close ties to Brazil's government, which has been

upended by a series of graft scandals, could weigh on the meat

company and postpone JBS's plans for a global reorganization that

many analysts say would boost the firm's sagging value.

A JBS spokeswoman said Monday that the company hasn't changed

its plans regarding its reorganization. A spokesman for J&F has

denied wrongdoing by the Batistas and by the pulp company, Eldorado

Brasil SA. Through their company spokespeople, Wesley and Joesley

Batista declined to comment.

JBS, a major player in the U.S. market through its ownership of

chicken producer Pilgrim's Pride and meat processor Swift &

Company, announced in May it would spin off its international

businesses into a new company called JBS Foods International.

The new firm would be based in Ireland, with its shares listed

on the New York Stock Exchange. JBS SA shareholders would initially

receive one share in the new company for every share they already

own in the parent company. JBS SA shareholders would then be

offered the chance to trade in their JBS SA shares for more shares

of Foods International, and if 50% or more of JBS SA shares are

traded in, Foods International will become the controlling company

of JBS SA.

"Our feeling is that the new (corruption probe) will at least

delay" the NYSE listing, said Guilherme Figueiredo, a fund manager

at Sã o Paulo-based investment firm M. Safra.

Analysts at Brazil's Banco Bradesco BBI and Itaú BBA investment

banks have also expressed concerns that the Batista brothers' legal

problems could delay the reorganization, as have several

investors.

Mr. Figueiredo said JBS, which posted $163 billion reais ($50.3

billion) in global net sales in 2015, is a solid operator. Even so,

he said M. Safra dumped JBS shares from its portfolio a year ago

over fears that its deep Brazilian government connections could

prove a liability as the nation's graft probes have expanded.

Brazilian government entities own more than one-quarter of JBS

shares, part of a state strategy to turn the meatpacker into a

globally competitive player.

The Batista's legal troubles stem from a massive police

operation launched last week targeting more than 100 individuals

and businesses across Brazil. Dubbed Operation Greenfield, the

probe is aimed at uncovering alleged malfeasance at four state

pension funds that allegedly overpaid for stakes in Brazilian-owned

companies, including Eldorado.

Other recent investigations into alleged overbilling linked to

government contracting have turned up evidence that some of the

funds were used to pay bribes and kickbacks to politicians.

JBS's share price dropped 10% on Sept. 5, the day police raided

the offices Eldorado and brought in Wesley Batista for questioning.

Joesley Batista, who is CEO of J&F, was out of the country the

day of the raid and is scheduled to be questioned by police this

week. The company's shares closed at 11.62 reais on Monday in Sã o

Paulo, down 6.7% from when the probe was made public.

There is no indication that JBS was a target of Operation

Greenfield. But on the day of the raids, the judge overseeing the

probe ordered that the Batista brothers and another 38 people under

investigation halt all their management activities at any companies

where they work.

That order has led some analysts to question whether Wesley

Batista will be able to stay on as JBS's chief executive. The

company declined to say if Mr. Batista would stay on as CEO.

If top management at a company is under investigation, it could

scare away investors, even if the investigation is focused on a

different business, said Jonathan Macey, a professor at Yale Law

School who teaches a course on ethics in capital markets.

If a CEO and a chairman "are seen as untrustworthy, that is a

problem," said Mr. Macey.

Analysts say JBS was already undervalued compared with its peers

even before Mr. Batista was suspended from the company, due in part

to its location in Brazil, where borrowing costs are sky-high. The

reorganization was expected to give JBS access to much cheaper

financing and boost its standing with foreign investors.

It would have given JBS "a different kind of cachet," said Jason

DeVito, senior analyst and portfolio manager at Federated Investors

Inc.

JBS is the focus of a separate probe into Brazil's national

economic development bank, known as BNDES. Authorities are

investigating whether the meatpacker received favorable treatment

from the taxpayer-funded lender, which bankrolled an acquisition

spree that turned JBS into the world's biggest protein

producer.

BNDES didn't immediately respond to request for comment.

BNDES invested a total of 10.6 billion reais in JBS from 2005 to

2014, leaving it with 20.4% of the company's shares, the

second-biggest stake after J&F's 42.4%. State-owned lender

Caixa Economica Federal owns another 6.5% of JBS shares.

Several investors and analysts interviewed by The Wall Street

Journal praised the company's management and success in effectively

integrating the acquisitions into JBS. Several also said the

company has a deep bench of management talent capable of stepping

in to take over for Wesley Batista, should he need to step

aside.

"Chinese consumers aren't going to stop eating beef," said Paul

Lukaszewski, head of emerging-market credit research at fund

manager Aberdeen Asset Management PLC.

Write to Jeffrey T. Lewis at jeffrey.lewis@wsj.com and Luciana

Magalhaes at Luciana.Magalhaes@wsj.com

(END) Dow Jones Newswires

September 12, 2016 20:35 ET (00:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

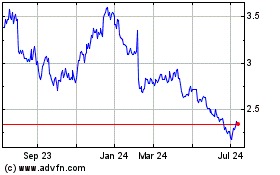

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Apr 2023 to Apr 2024