Freeport-McMoRan to Sell Deepwater Gulf Assets to Anadarko

September 12 2016 - 5:30PM

Dow Jones News

Mining giant Freeport-McMoRan Inc., which has been selling

assets to reduce debt, said Anadarko Petroleum Corp. will buy its

deepwater Gulf of Mexico properties for $2 billion.

Freeport has been under pressure to streamline since August

2015, when activist investor Carl Icahn disclosed a stake in the

company. Its cost-cutting moves have included suspending its

dividend.

Freeport said last year that it would evaluate alternative

courses for its oil-and-gas business. In May, it withdrew a plan to

take the oil-and-gas operations public. On Monday, Freeport said

the deal reflects its commitment to debt reduction and to its

copper business.

Meanwhile, Anadarko said the deal, expected to close later this

year, will immediately add to earnings and expand its

infrastructure throughout the Gulf of Mexico.

The deal includes up to $150 million of contingent payments.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

September 12, 2016 17:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

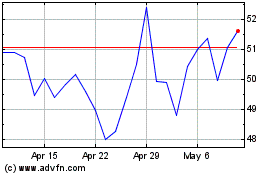

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Freeport McMoRan (NYSE:FCX)

Historical Stock Chart

From Apr 2023 to Apr 2024