MasterCard's Adoption to Chip Cards Accelerates, Though Merchants Lag

September 12 2016 - 10:33AM

Dow Jones News

By Austen Hufford

MasterCard Inc. said Monday that 88% of its U.S. consumer credit

cards now have fraud-reducing chips, even as the slower payment

method continues to frustrate users and merchants.

The company said 33% of its U.S. merchants now use chip

terminals, up multifold since last October but still far from being

universal.

The new chip cards, which are typically inserted into

credit-card machines instead of swiped, are meant to reduce credit

card fraud because they prevent cards from being counterfeited.

Since last October, retailers that didn't make the transition to

chip cards are on the hook for counterfeit transactions that used

to be covered by card-issuing banks. Consumers have also complained

that transactions now take longer to go through and they don't know

whether to swipe or insert their cards, as many merchants haven't

fully adopted the new technology.

Craig Vosburg, Mastercard's president of North America, said

things won't change overnight.

"With every additional chip transaction we move closer and

closer to our collective goal -- moving fraud out of the system,"

Mr. Vosburg said.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

September 12, 2016 10:18 ET (14:18 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

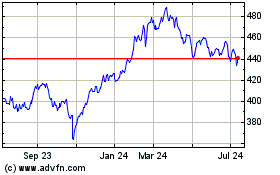

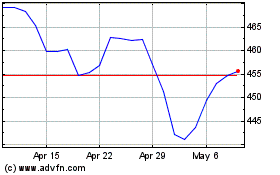

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024