Moody’s Analytics Launches the MARQ™ Portal and Credit Score for High Efficiency Small Business Lending

September 12 2016 - 10:00AM

Business Wire

The MARQ portal and score are key components of Moody’s

Analytics small business lending solution, an integrated set of

tools designed to improve the lending experience for banks and

businesses.

Moody’s Analytics, the leading provider of lending and risk

management solutions, today announced the launch of the MARQ

portal, an innovative tool that automates the exchange of financial

information between borrowers and lenders and generates the MARQ

small business credit score.

“The difficulty of accessing small business financial

information makes lending to this segment inefficient,

inconsistent, and expensive,” said Nancy Michael, Senior Director

at Moody’s Analytics. “Our new MARQ portal and score will speed up

the lending process by replacing weeks of back-and-forth emails and

phone calls with the click of a button to instantly get financial

and credit information to lenders.”

By creating a one-time, secure link to their accounting

information, small businesses can instantly get their MARQ score

and gain insight into how banks view their creditworthiness. The

score is generated by Moody’s Analytics award-winning RiskCalc™

models for analyzing private company credit risk. Banks can

immediately access the MARQ score and underlying financial

information through Lending Cloud,

Moody’s Analytics’ cloud-based loan origination platform, for

automated analysis and faster credit decisions.

“We believe the combination of the new MARQ tools with our

Lending Cloud origination platform provides the best, most complete

solution for small business lending on the market,” said Steve

Tulenko, Executive Director at Moody’s Analytics. “We are working

to help lenders make better decisions, much faster than they can

today.”

The MARQ portal is built with technology developed by Finagraph,

a pioneering provider of automated financial data collection and

business intelligence solutions.

Learn more about small business lending in a one-hour webinar,

“Master the Challenges of Small Business Lending,” hosted by

Moody’s Analytics on September 29, 2016. Register here: Master the

Challenges of Small Business Lending

Further information about Moody’s Analytics small business

lending solution can be found on our dedicated website:

www.moodysanalytics.com/small-business-lending

Small business owners can get their free MARQ score at

www.MARQscore.com.

About Moody’s Analytics

Moody’s Analytics helps capital markets and risk management

professionals worldwide respond to an evolving marketplace with

confidence. The company offers unique tools and best practices for

measuring and managing risk through expertise and experience in

credit analysis, economic research and financial risk management.

By providing leading-edge software, advisory services, and

research, including the proprietary analysis of Moody’s Investors

Service, Moody’s Analytics integrates and customizes its offerings

to address specific business challenges. Moody's Analytics is a

subsidiary of Moody's Corporation (NYSE:MCO), which reported

revenue of $3.5 billion in 2015, employs approximately 10,800

people worldwide and maintains a presence in 36 countries. Further

information is available at www.moodysanalytics.com.

About Finagraph

Seattle-based Finagraph is a best-in-class financial data

collection and business intelligence company. Finagraph's

pioneering technology gathers and organizes financials directly

from accounting systems, providing financial professionals and

business owners with clear and actionable information. Finagraph’s

streamlined workflow replaces the traditional paperwork process and

adds instant intelligence to best help lenders understand a

business' financial health and trends. To learn more, visit

www.finagraph.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160912005192/en/

Moody’s AnalyticsKATERINA SOUMILOVA, 212-553-1177Assistant

Vice-PresidentCorporate

Communicationskaterina.soumilova@moodys.com

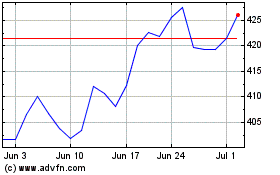

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024