Report of Foreign Issuer (6-k)

September 12 2016 - 9:25AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

Date of Report: September 12, 2016

COMMISSION FILE NUMBER: 001-33373

CAPITAL PRODUCT PARTNERS L.P.

(Translation of registrant’s name into English)

3 Iassonos Street

Piraeus, 18537 Greece

(Address of principal executive offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

¨

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes

¨

No

þ

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-

.)

Entry into A Material Definitive Agreement

On September 12, 2016, Capital Product Partners L.P. (the “

Partnership

”), and Capital GP L.L.C., a Marshall Islands

limited liability company, Capital Product Operating L.L.C., a Marshall Islands limited liability company, Crude Carriers Corp., a Marshall Islands corporation, and Crude Carriers Operating Corp., a Marshall Islands corporation (collectively, the

“

Capital Parties

”) entered into an Equity Distribution Agreement (the “

Agreement

”) with UBS Securities LLC (the “

Manager

”).

Pursuant to the terms of the Agreement, the Partnership may sell from time to time through the Manager, as the Partnership’s sales agent,

common units representing limited interests in the Partnership having an aggregate offering price of up to $50,000,000 (the “

Common Units

”). Sales of the Common Units, if any, will be made be made by means of ordinary brokers’

transactions through the facilities of the NASDAQ Global Select Market (“

NASDAQ

”), any other national securities exchange or facility thereof, a trading facility of a national securities association or an alternate trading system,

to or through a market maker or directly on or through an electronic communication network, a “dark pool” or any similar market venue, at market prices, in block transactions or as otherwise agreed between us and the Manager. The Agreement

provides that the Manager, when it is acting as the Partnership’s agent, will be entitled to compensation of up to 2% of the gross sales price of the Common Units sold through the Manager from time to time.

The Partnership intends to use the net proceeds from the sales of the Common Units, after deducting the sales agent’s commissions and our

offering expenses, for general partnership purposes, which may include, among other things, the acquisition of new vessels, the repayment or refinancing of all or a portion of the Partnership’s outstanding indebtedness and funding of working

capital requirements or capital expenditures.

Under the terms of the Agreement, the Partnership may also sell Common Units from time to

time to the Manager as principal for its own account at a price to be agreed upon at the time of sale. Any sale of Common Units to the Manager as principal would be pursuant to the terms of a separate terms agreement between the Partnership and the

Manager.

The Common Units will be issued pursuant to the Partnership’s Registration Statement on Form F-3 effective as of April 25,

2016 (Registration No. 333-210394). The Partnership filed a prospectus supplement, dated September 12, 2016, with the Securities and Exchange Commission in connection with the offer and sale of the Common Units.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of

the Agreement, a copy of which is filed herewith as Exhibit 1.1 and is incorporated by reference herein. Legal opinions relating to the Common Units are filed herewith as Exhibits 5.1 and 8.2.

Exhibits.

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

1.1

|

|

Equity Distribution Agreement by and among Capital Product Partners L.P., Capital GP L.L.C., Capital Product Operating L.L.C., Crude Carriers Corp., Crude Carriers Operating Corp., Capital Ship Management Corp., on the one hand, and

UBS Securities LLC, on the other hand, dated September 12, 2016

|

|

|

|

|

5.1

|

|

Opinion of Watson Farley and Williams LLP, Marshall Islands counsel to Capital Product Partners L.P., as to the validity of the securities being issued.

|

|

|

|

|

8.2

|

|

Opinion of Watson Farley and Williams LLP, Marshall Islands counsel to Capital Product Partners L.P., with respect to certain tax matters.

|

|

|

|

|

23.1

|

|

Consent of Watson Farley and Williams LLP, Marshall Islands counsel to Capital Product Partners L.P. (included in Exhibits 5.1 and 8.2)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CAPITAL PRODUCT PARTNERS L.P.

|

|

|

|

|

|

Dated: September 12, 2016

|

|

By:

|

|

Capital GP L.L.C., its general partner

|

|

|

|

|

|

|

|

|

|

/s/ Gerasimos (Jerry) Kalogiratos

|

|

|

|

|

|

Name:

|

|

Gerasimos (Jerry) Kalogiratos

|

|

|

|

|

|

Title:

|

|

Chief Executive Officer and

Chief Financial

Officer of Capital GP L.L.C.

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

1.1

|

|

Equity Distribution Agreement by and among Capital Product Partners L.P., Capital GP L.L.C., Capital Product Operating L.L.C., Crude Carriers Corp., Crude Carriers Operating Corp., Capital Ship Management Corp., on the one hand, and

UBS Securities LLC, on the other hand, dated September 12, 2016

|

|

|

|

|

5.1

|

|

Opinion of Watson Farley and Williams LLP, Marshall Islands counsel to Capital Product Partners L.P., as to the validity of the securities being issued.

|

|

|

|

|

8.2

|

|

Opinion of Watson Farley and Williams LLP, Marshall Islands counsel to Capital Product Partners L.P., with respect to certain tax matters.

|

|

|

|

|

23.1

|

|

Consent of Watson Farley and Williams LLP, Marshall Islands counsel to Capital Product Partners L.P. (included in Exhibits 5.1 and 8.2)

|

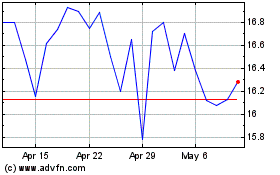

Capital Product Partners (NASDAQ:CPLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

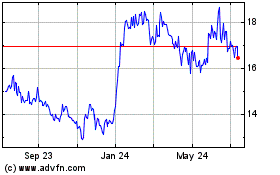

Capital Product Partners (NASDAQ:CPLP)

Historical Stock Chart

From Apr 2023 to Apr 2024